Richland Resources Ltd Completion of Disposal of Capricorn Sapphire (4678Y)

02 Gennaio 2020 - 8:00AM

UK Regulatory

TIDMRLD

RNS Number : 4678Y

Richland Resources Ltd

02 January 2020

2 January 2020

Richland Resources Ltd

("Richland" or the "Company")

Completion of Disposal of the Capricorn Sapphire Project

Richland (AIM: RLD) is pleased to announce that, further to its

announcements of 18 July, 22 July, 19 August, 31 October, 18

November, 2 December, 9 December, 16 December and 23 December 2019

in relation to the proposed disposal to Fura Gems Inc. ("Fura") of

its wholly owned subsidiary Richland Corporate Ltd, the holder of

the Capricorn Sapphire Project (and the Company's loans to Richland

Corporate Ltd) (the "Disposal"), the Disposal completed on 31

December 2019 (the "Completion Date").

Accordingly, Fura has paid the total cash consideration of

US$1,250,000 (approximately GBP952,125) due under the Disposal (the

"Consideration"), of which US$880,000 (approximately GBP670,296)

has been paid directly to the Lender in order to settle the total

amount outstanding under the Company's pre-existing Secured

Convertible Loan Facility (including all accrued interest). The

balance of the Consideration will be utilised by the Company to pay

transaction costs and certain other outstanding creditors and to

provide additional working capital as the Company seeks to identify

a suitable reverse takeover transaction in the mining sector.

AIM Rule 15 Cash Shell Status

Pursuant to the successful completion of the Disposal, the

Company has become an AIM Rule 15 cash shell and, as such, is

required to make an acquisition, or acquisitions, which constitutes

a reverse takeover under AIM Rule 14 (including seeking

re-admission under the AIM Rules for Companies) within six months

from the Completion Date. Alternatively, within such time period,

the Company can seek to become an investing company pursuant to AIM

Rule 8, which requires, inter alia, the raising of at least GBP6

million and publication of an admission document. In the event that

the Company does not complete a reverse takeover under AIM Rule 14

within such six month period or seek re-admission to trading on AIM

as an investing company pursuant to AIM Rule 8 (either being, a

"Re-admission Transaction"), the Company's common shares would be

suspended from trading pursuant to AIM Rule 40. Thereafter, if a

Re-admission Transaction has not been completed within a further

six month period, admission to trading on AIM of the Company's

common shares would be cancelled.

Capitalised terms used in this announcement, unless otherwise

defined herein, have the same meanings as set out in the Company's

announcement of 27 June 2019.

For further information, please contact:

Anthony Brooke Edward Nealon Mike Allardice

Chief Executive Officer Chairman Group Company Secretary

+66 81 854 1755 +61 409 969 955 +852 91 864 854

Nominated Adviser Broker

Strand Hanson Limited Peterhouse Capital Limited

James Harris Duncan Vasey / Lucy Williams

Matthew Chandler (Broking)

James Bellman Eran Zucker (Corporate

+44 (0) 20 7 409 3494 Finance)

+44 (0) 20 7 469 0930

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014.

Note to Editors:

Further information is available on the Company's website:

www.richlandresourcesltd.com. Neither the contents of the Company's

website nor the contents of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DISFLFEALSILIII

(END) Dow Jones Newswires

January 02, 2020 02:00 ET (07:00 GMT)

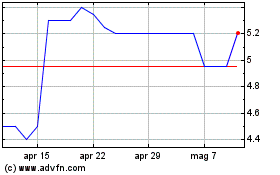

Grafico Azioni Lexington Gold (LSE:LEX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lexington Gold (LSE:LEX)

Storico

Da Apr 2023 a Apr 2024