IP Group PLC Oxford Nanopore completes £109.5m financing (5148Y)

02 Gennaio 2020 - 8:00AM

UK Regulatory

TIDMIPO

RNS Number : 5148Y

IP Group PLC

02 January 2020

FOR RELEASE ON 02 January 2020

THIS ANNOUNCEMENT CONSTITUTES INSIDE INFORMATION AS STIPULATED

UNDER THE MARKET ABUSE REGULATION (EU) NO.596/2014.

Portfolio company Oxford Nanopore Technologies announces

GBP109.5m of investment and secondary share sales

IP Group cash realisations in 2019 increased to more than GBP75m

across multiple portfolio holdings

IP Group plc (LSE: IPO) ("IP Group" or "the Group"), the

developer of intellectual property-based businesses, notes that its

portfolio company Oxford Nanopore Technologies Limited ("Oxford

Nanopore") has announced that it has raised GBP29.3 million of new

capital and facilitated the secondary sale of GBP80.2 million of

shares, an aggregate investment of GBP109.5 million.

Following completion of the transaction, IP Group will hold an

undiluted beneficial stake of 16.4% in Oxford Nanopore, the company

behind the only real-time DNA/RNA sequencer that can sequence any

read length and is fully scalable from smaller portable formats to

larger devices for population-scale sequencing. The directors

expect that this transaction will result in a fair value gain to

the Group of approximately GBP12 million compared with Oxford

Nanopore's last financing round in March 2018 and that the Group's

holding will be valued at approximately GBP264 million. IP Group

will realise GBP22.0 million cash from a partial sale of its

holding in Oxford Nanopore as part of the secondary element of the

transaction.

In addition, IP Group announces that cash realisations during

2019 totalled more than GBP75 million compared to the GBP30 million

achieved in 2018. This excludes the GBP22 million partial

realisation of Oxford Nanopore noted above. As a result, the Group

anticipates that gross cash resources at 31 December 2019 will be

significantly in excess of the GBP161 million reported at 30 June

2019.

Alan Aubrey, Chief Executive of IP Group plc, said: "We're

delighted to see another successful fundraising for Oxford Nanopore

which rounds off an impressive year of commercial success and

technical validation of nanopore sequencing. IP Group has continued

to focus attention this year on generating realisations from our

maturing portfolio and we're pleased to report that cash exits in

2019 were more than double the amount recorded in 2018, leaving the

business well-funded and well positioned for 2020."

Oxford Nanopore noted that funds were raised from both new

investors and existing shareholders from the US, Europe and Asia

Pacific. The fundraising brings the total primary investment in

Oxford Nanopore to approximately GBP480 million. Further

information on the fundraising will be made available in due

course.

Last month, Oxford Nanopore confirmed that its technology had

been selected for the population-scale 'Genome Program' launched by

Abu Dhabi's Department of Health. The project aims to be the first

of its kind worldwide to provide citizens with their own

high-quality genome as a baseline and aims to incorporate genomic

data into healthcare management. Among other developments during

2019, Oxford Nanopore users reported new methods for rapid cancer

and infectious disease characterisation, HLA tissue typing and food

safety.

The full announcement from Oxford Nanopore follows.

For more information, please contact:

IP Group plc www.ipgroupplc.com

+44 (0) 20 7444 0050

Alan Aubrey, Chief Executive Officer

Greg Smith, Chief Financial Officer +44 (0) 20 7444 0062/+44 (0)

Liz Vaughan-Adams, Communications 7979 853802

Charlotte Street Partners

Andrew Wilson +44 (0) 7810 636995

David Gaffney +44 (0) 7854 609998

Notes for editors

About IP Group

IP Group is a leading intellectual property commercialisation

company which focuses on evolving great ideas, mainly from its

partner universities, into world-changing businesses. The Group has

pioneered a unique approach to developing these ideas and the

resulting businesses by providing access to business building

expertise, capital (through its 100%-owned FCA-authorised

subsidiaries IP Capital and Parkwalk Advisors), networks,

recruitment and business support. IP Group has a strong track

record of success and its portfolio comprises holdings in early

stage to mature businesses across life sciences and technology. IP

Group is listed on the Main Market of the London Stock Exchange

under the code IPO.

Group holdings in portfolio companies reflect the undiluted

beneficial equity interest excluding debt, unless otherwise

explicitly stated.

For more information, please visit our website at

www.ipgroupplc.com.

ENDS

Oxford Nanopore announces GBP109.5M ($144.5M) in investment and

share sales

2 January 2020: Oxford Nanopore has raised GBP29.3M ($38.6M) in

new capital and additionally facilitated the sale of GBP80.2M

($105.9M) in secondary shares, resulting in total gross proceeds of

GBP109.5M ($144.5M).

These funds have been raised internationally and include both

new investors and existing shareholders, from the US, Europe and

Asia/Pacific.

This brings the total primary investment in Oxford Nanopore to

GBP480M to date.

Further information on Oxford Nanopore's fundraising will be

made available in due course.

The Company made substantial progress in 2019; from scaling up

to population-scale sequencing with PromethION, to accurate, rapid

testing in cancer and infectious disease. Read 19 highlights of

2019. https://nanoporetech.com/about-us/news/19-highlights-2019

Assumes exchange rate of 1.32 at 31st December 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCQLLBBBFLEBBZ

(END) Dow Jones Newswires

January 02, 2020 02:00 ET (07:00 GMT)

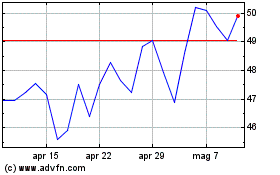

Grafico Azioni Ip (LSE:IPO)

Storico

Da Mar 2024 a Apr 2024

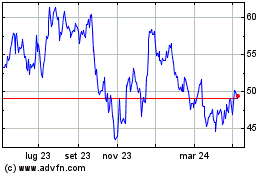

Grafico Azioni Ip (LSE:IPO)

Storico

Da Apr 2023 a Apr 2024