Personal Group Holdings PLC PDMR purchase of shares (5751Y)

02 Gennaio 2020 - 1:17PM

UK Regulatory

TIDMPGH

RNS Number : 5751Y

Personal Group Holdings PLC

02 January 2020

Press Release 2 January 2020

Personal Group Holdings plc

("the Company")

PDMR purchase of shares

Personal Group Holdings Plc operates an Inland Revenue approved

Employee Share Ownership Plan which allows employees and directors

the opportunity to purchase ordinary shares of 5p each in the

Company ("Shares") currently held by Personal Group Trustees

Limited.

The latest allocation period ended on 31 December 2019 and the

following PDMRs have acquired Shares on 2 January 2020 as

follows:

Director Price paid Shares purchased Total number % of Company's

per Share of ordinary issued share

shares held capital

following transaction

Mr K Rooney 335.00p 362 3,060 0.010

----------- ----------------- ----------------------- ---------------

Mr M Dugdale 335.00p 100 41,453* 0.133

----------- ----------------- ----------------------- ---------------

Mrs D Frost 335.00p 27 300,069 0.961

----------- ----------------- ----------------------- ---------------

Mr A Doody 335.00p 30 905 0.003

----------- ----------------- ----------------------- ---------------

Mr A Lothian 335.00p 20 38,112** 0.122

----------- ----------------- ----------------------- ---------------

Mrs S Mace 335.00p 67 2,011 0.006

----------- ----------------- ----------------------- ---------------

Mrs M Darby-Walker 335.00p 268 268 0.001

----------- ----------------- ----------------------- ---------------

* This figure includes Mr Dugdale's wife's holding of 18,069

ordinary shares.

** This figure includes Mr Lothian's wife's holding of 17,570

ordinary shares.

Under the Rules of the plan, the share price at which the shares

are purchased is the lower of the mid-market value at the start and

end of the relevant accumulation period.

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name 1. Ken Rooney

2. Mike Dugdale

3. Deborah Frost

4. Ashley Doody

5. Andrew Lothian

6. Sarah Mace

7. Maria Darby-Walker

-------------------------- ---------------------------------------------

2 Reason for the notification

-------------------------------------------------------------------------

a) Position/status 1. Ken Rooney - Director / PDMR

2. Mike Dugdale - Director / PDMR

3. Deborah Frost - Director / PDMR

4. Ashley Doody - PDMR

5. Andrew Lothian - Director / PDMR

6. Sarah Mace - PDMR

7. Maria Darby-Walker - Director

/ PDMR

-------------------------- ---------------------------------------------

b) Initial notification Initial

/ Amendment

-------------------------- ---------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------

a) Name Personal Group Holdings Plc

-------------------------- ---------------------------------------------

b) LEI 213800TN8BH2YYWAH345

-------------------------- ---------------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------------

a) Description of the Ordinary shares of 5p each

financial instrument,

type of instrument

Identification code ISIN: GB0002760279

-------------------------- ---------------------------------------------

b) Nature of the transaction Purchase of shares pursuant to Personal

Group Share Investment Plan

-------------------------- ---------------------------------------------

c) Price(s) and volume(s) Director/PDMR Price(s) Volume(s)

1. K Rooney 335.00p 362

2. M Dugdale 335.00p 100

3. D Frost 335.00p 27

4. A Doody 335.00p 30

5. A Lothian 335.00p 20

6. S Mace 335.00p 67

7. M Darby-Walker 335.00p 268

--------- ----------

-------------------------- ---------------------------------------------

d) Aggregated information

- Aggregated volume 874 shares

- Price GBP3.35 per share

-------------------------- ---------------------------------------------

e) Date of the transaction 2 January 2020

-------------------------- ---------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------- ---------------------------------------------

-ENDS-

For more information please contact:

Personal Group Holdings Plc

Mike Dugdale - Chief Financial

Officer +44 (0)1908 605 000

Cenkos Securities Plc

Max Hartley / Stephen Keys

(Nomad) +44 (0)20 7397 8900

Russell Kerr (Sales)

Media enquiries:

Hudson Sandler

Nick Lyon / Lucy Wollam +44 (0)20 7796 4133

personalgroup@hudsonsandler.com

Notes to Editors

Personal Group Holdings Plc (AIM: PGH) is a technology enabled

employee services business, working with employers to drive

productivity though better employee engagement and a more motivated

workforce. With over 30 years' experience, the Company provides

employee benefits and services to a large number of employees

across the UK.

Personal Group's offer comprises in-house services, including

employee insurance products (hospital, convalescence plans and

death benefit), the provision of home technology via salary

sacrifice (iPads, computers, laptops, smart phones and smart TVs),

the provision of e-payslips, and pay and reward consulting via

Innecto, the leading independent UK consultancy acquired in 2019.

Third party services include retail discounts, employee assistance

programmes, wellbeing programmes and salary sacrifice cars and

bikes.

The product offer is provided via the Company's proprietary

technology platform, Hapi. The platform is intuitive, designed

primarily for app deployment and also accessible via web and

tablet, driving better engagement, communication and value

recognition. Hapi is flexible and can quickly integrate additional

services, such as existing employee services and partner platforms.

Hapi is a digital SaaS product.

Through technology and select acquisitions, the Company has

grown its addressable market to the majority of the working

population in the UK; including 15.6m SME employees targeted via

its partnership with Sage, the UK's largest software company.

Personal Group's innovative approach to using technology to

deliver its programmes, in combination with its face-to-face method

of communicating with employees, delivers a compelling offer to

blue-chip clients across the UK as a way of attracting, retaining

and motivating employees. The acquisition of Innecto in February

2019 allows Personal Group to engage with clients earlier in their

thinking around Pay and Reward, and to interact with a new base of

blue-chip and fast growth clients typically at HR Director and CEO

level.

Personal Group has a strong client base across a range of

sectors including passenger transport, healthcare, logistics and

food manufacturing. Clients include: Stagecoach, Four Seasons

Health Care, DHL, and 2 Sisters Food Group.

For further information, please see www.personalgroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DSHMZGGMZZKGGZM

(END) Dow Jones Newswires

January 02, 2020 07:17 ET (12:17 GMT)

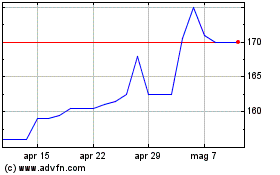

Grafico Azioni Personal (LSE:PGH)

Storico

Da Mar 2024 a Apr 2024

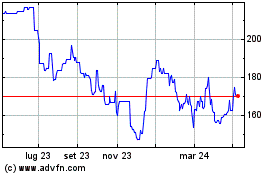

Grafico Azioni Personal (LSE:PGH)

Storico

Da Apr 2023 a Apr 2024