By Maitane Sardon

Are robotics, 6G networks or autonomous vehicles powered by

renewable energy the next big thing? That is what many investors

are betting on.

An approach known as thematic investing, based on broad trends

such as automation and climate change, has grown in popularity over

the past few years. Funds that use a thematic strategy aren't bound

by sector or region, which usually involves higher risk. Instead,

the idea is to tap into companies that are part of -- and best

positioned to benefit from -- technological, demographic and

environmental changes sweeping the world.

"In a world littered with jargon and abstract financial theory,

thematic investing represents a pleasingly straightforward approach

to investing, " says Kenneth Lamont, senior analyst, manager

research, passive strategies at Morningstar. "Thematic strategies

tend to tap into powerful narratives that are often well-known to

investors, such as aging populations or the shift to a digital

economy, making them easy to relate to."

According to data provided by research firm Morningstar Inc.,

thematic investing on a global basis has tripled in size over the

past five years to some $40.76 billion. In addition to theme-based

funds that have popped up, some wealth advisers and brokerages have

also turned to thematic investing, using its focus on long-term and

easy-to-understand trends to help clients avoid making decisions

based on short-term market activity.

To be sure, thematic funds shouldn't replace core fund holdings.

Wealth advisers recommend holding them alongside other core funds.

For someone who has a long time frame, advisers say a good

portfolio could be built with a core-and-satellite approach, where

60% of the assets are split across two core equity funds and the

remaining 40% across equity funds using a theme-based strategy.

If an investor believes robots will become increasingly

important in the future, for example, he or she might want to

consider an ETF investing in robotics and artificial intelligence,

which are some of the fastest-growing segments within the tech

sector.

As with every investment vehicle, a skeptical approach is

needed, as some themes may be just temporary fashions that can

quickly swing out of favor. What follows is a look at some of the

themes that asset managers and wealth advisers think will be among

the biggest of the next few years.

'Peak Globalization'

The rise of political leaders with protectionist views, embodied

by the U.K.'s withdrawal from the European Union and trade tensions

between the U.S. and China, is a sign that the world has reached

the peak of globalization, according to Bank of America Merrill

Lynch's global investment strategy team.

Globalization, with its desired goals of free movement of goods,

people and capital around the world, is not coming to an end, but

it has reached its highest point, the team at Merrill says.

"There will be a time frame when investors have to ask

themselves these questions: How is the fact that companies are

reshoring their activities going to impact their profit and loss or

their cost structure? Will some of these extra costs be offset by

automation?" says Haim Israel, global strategist and managing

director of research at Merrill.

Barriers to international trade could present opportunities for

smaller firms, local markets and such unloved real assets as

commodities, farm land, real estate and precious metals. The

aerospace and defense, infrastructure, and energy and water sectors

may benefit from the growing focus on national security and

economic sovereignty, Mr. Israel says.

'Smart' everything

Many market participants agree that technology's impact on

industries, markets and people will be a key theme of the next

decade.

"We are seeing an unprecedented rate of innovation and changes;

what we call tech-celeration, the acceleration in growth that is

based on tech," says Mr. Israel.

By the end of 2030, close to 500 billion devices will be

connected to the internet, research by Cisco Systems Inc. shows.

Asset managers agree: Given the amount of time we currently spend

online -- 23.6 hours a week for the average American, according to

the think tank Center for the Digital Future -- smart and connected

devices will become ubiquitous.

"Smart meters, smart machinery, Internet-of-Things devices that

can sense everything from electricity consumption to water

consumption or carbon emissions; sensors and devices that can

monitor traffic or surveillance equipment that can be used for

future planning...all of that has a huge economic value added,"

says Mr. Israel.

Experts say investors should also consider how companies are

managing such related emerging risks as the increasing

vulnerability of users' personal information.

Defiance Quantum ETF (QTUM), which invests in companies that are

involved in the development of machine-learning technology and

quantum computing, was one of the top-performing thematic funds of

2019, up 48.2%.

Robotics

Technological advances are going to have huge impact on the job

market.

The McKinsey Global Institute estimates that up to 800 million

workers could be replaced by automation by the end of 2030. Experts

say algorithms, big data, data mining and analytics to solve

problems and perform tasks could affect not only blue-collar jobs

but also jobs in that require more skilled labor, architecture, law

and journalism.

This presents challenges and risks but also creates

opportunities that investment managers should be prepared to

leverage.

Entire companies will be at risk because they are going to be

replaced by something more technologically advanced, says Guillaume

Mascotto, vice president, head of ESG and investment stewardship at

American Century Investments, a Kansas City, Mo.-based investment

manager.

Climate

Many advisers expect companies and governments to address

climate change and rising global temperatures this decade, which

will be reflected in where they invest money.

"The move away from wood to coal and from coal to oil are energy

transitions that we see historically. Now, The cost advantage is

emerging for alternative clean energies, which presents investment

opportunities," says David Docherty, a director of thematic

investing at Schroders, a London-based asset manager that oversees

$575.06 billion.

Rising temperatures will have direct and indirect impacts, Mr.

Mascotto says. Direct impacts include short-term extreme weather

events like stronger hurricanes, heavier rainstorms and more severe

droughts. The indirect impacts are the long-term repercussions of

changing rainfall, heavy flooding and sea-level rises: migration,

altered crop life cycles and higher inequality.

Investors might consider investing in companies that can help

reduce fossil-fuel-based emissions, including renewable-power

generation or grid management. This could include investing in

countries with low renewable-energy production costs, Mr. Israel

says.

Some of the best-performing thematic ETFs of 2019 tap into this

theme. Invesco Solar ETF (TAN) and Invesco WilderHill Clean Energy

ETF (PBW) delivered annual returns of 65.7% and 61.9%,

respectively, Morningstar Research says.

Ms. Sardon is a reporter for The Wall Street Journal in

Barcelona. Email her at maitane.sardon@wsj.com.

(END) Dow Jones Newswires

January 05, 2020 22:18 ET (03:18 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

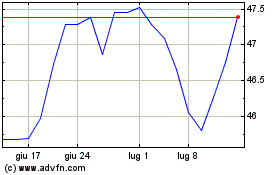

Grafico Azioni Cisco Systems (NASDAQ:CSCO)

Storico

Da Mar 2024 a Apr 2024

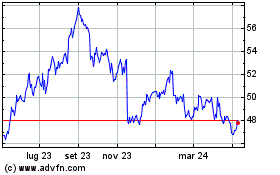

Grafico Azioni Cisco Systems (NASDAQ:CSCO)

Storico

Da Apr 2023 a Apr 2024