U.S. Dollar Appreciates As Geopolitical Worries Fade

07 Gennaio 2020 - 9:03AM

RTTF2

The U.S. dollar strengthened against its major counterparts in

the European session on Tuesday, as investor sentiment lifted up on

optimism over the U.S.-China trade deal and easing tensions in the

Middle East.

Geopolitical tensions reduced amid lack of fresh developments in

the conflict between the U.S. and Iran.

Investors also shifted their focus to the monthly U.S. jobs

report due on Friday, which could offer some clues on the world's

largest economy and the Federal Reserve's monetary policy path into

2020.

On the trade front, it is expected that the Chinese trade

delegation will sign the first phase of its trade deal with the

U.S. in Washington on Jan. 15.

Investors became optimistic about global economic outlook after

surveys of service sectors out overnight showed an improvement in

the United States, U.K. and EU.

Investors await reports on the U.S. trade deficit, service

sector activity and factory orders due in the American session.

The currency has been trading in a positive note in the previous

session.

The greenback climbed to a session's high of 0.9717 against the

franc, from a low of 0.9676 seen at 5:00 pm ET. The greenback may

locate resistance around the 0.99 level.

Having dropped to a 5-day low of 1.3212 against the pound at

3:30 am ET, the greenback reversed direction, trading as high as

1.3123. The greenback is poised to challenge resistance around the

1.30 level.

The greenback appreciated to 1.1165 against the euro from

Monday's closing value of 1.1197. If the greenback rallies further,

1.10 is likely seen as its next resistance level.

Survey data from IHS Markit showed that Germany's construction

sector expanded at the fastest pace in nine months in December.

The construction Purchasing Managers' Index rose to 53.8 in

December from 52.5 in November. This was the highest score since

March.

Extending early gains, the greenback spiked up to near a 3-week

high of 0.6870 against the aussie and near a 2-week high of 0.6640

against the kiwi, off its early lows of 0.6942 and 0.6679,

respectively. The greenback is seen finding resistance around 0.67

against the aussie and 0.65 against the kiwi.

Reversing from a 1-week low of 1.2957 seen at 3:45 am ET, the

greenback rose to 1.2987 against the loonie. The next possible

resistance for the greenback is seen around the 1.33 level.

The greenback recovered to 108.50 against the yen, from a low of

108.26 hit at 2:30 am ET. Further rally may see the greenback

facing resistance around the 111.00 level.

Looking ahead, U.S. and Canadian trade data for November, ISM

services PMI for December, factory orders for November and Canada

Ivey PMI for December will be featured in the New York session.

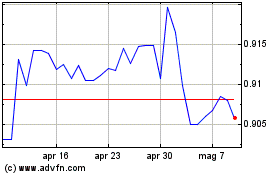

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Mar 2024 a Apr 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Apr 2023 a Apr 2024