Pound Lower As U.K. Economy Contracts; BoE Vlieghe Hints At Rate Cut

13 Gennaio 2020 - 7:16AM

RTTF2

The pound slipped against its major counterparts in the early

European session on Monday, after the UK economy contracted

unexpectedly in November, opening door for a rate cut by the Bank

of England in the coming months.

Data from the Office for National Statistics showed that the UK

economy shrank in November due to the weakness in services and

industrial output.

Gross domestic product contracted 0.3 percent on month driven by

the falls in services and production. GDP had advanced 0.1 percent

in both September and October. Economists had forecast GDP to

remain flat.

In three months to November, the economy grew 0.1 percent

sequentially after rising by revised 0.2 percent in three months to

October.

Industrial production declined 1.2 percent month-on-month in

November after easing 0.4 percent in October. Manufacturing logged

a monthly fall of 1.7 percent due large falls in output of

transport equipment, food and chemicals.

Industrial output was forecast to remain flat and manufacturing

to fall 0.1 percent in November.

On a yearly basis, industrial production was down 1.6 percent,

faster than the 0.6 percent decrease a month ago. Likewise, the

decline in manufacturing output deepened to 2 percent from 0.3

percent.

Over the weekend, Bank of England policymaker Gertjan Vlieghe

joined other officials to back additional policy loosening, if

there are no indications of a rebound in economic activity after

the election.

Speaking to the Financial Times, Vlieghe said that he would vote

for a reduction in interest rates later this month, if the economic

growth remained sluggish.

"I really need to see an imminent and significant improvement in

the UK data to justify waiting a little bit longer," he added.

The pound depreciated to 1.2608 against the franc, a level

unseen since October 15, 2019. The next possible support for the

pound is seen around the 1.24 level.

Breaking the key 1.30 level, the pound slipped to near a 3-week

low of 1.2961 against the greenback. If the pound slides further,

1.27 is likely seen as its next support level.

The pound fell to a 5-day low of 142.36 against the yen, from

Friday's closing quote of 142.98. The pound is seen locating

support around the 140.00 level.

The U.K. currency declined to nearly a 3-week low of 0.8576

against the euro from last week's closing value of 0.8511. On the

downside, 0.87 is possibly seen as the next support level for the

pound.

Data from Destatis showed that Germany's wholesale prices

continued to decline in December.

Wholesale prices decreased 1.3 percent year-on-year in December

but slower than the 2.5 percent decline seen in November. This was

the sixth consecutive fall in wholesale prices.

Looking ahead, the U.S. monthly budget statement for December

will be released in the New York session.

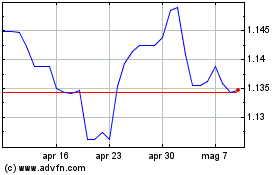

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Apr 2023 a Apr 2024