U.S. Dollar Climbs On Trade Optimism

13 Gennaio 2020 - 8:51AM

RTTF2

The U.S. dollar strengthened against its major counterparts in

the European session on Monday, as investors awaited the signing of

the Phase 1 trade deal between the U.S. and China due this

week.

The deal due to be signed at the White House on Wednesday is

likely to include a commitment from China to increase agricultural

products and implement economic reforms as well as some relief to

China's aquatic exports to the U.S.

Chinese delegation headed by Vice Premier Liu He will visit

Washington from today to sign the deal.

The interim deal signals a de-escalation in a trade war that

threatens to dampen global economic growth.

The looming U.S. corporate earnings season also remained on

investors' radar, with the big banks scheduled to report results on

Tuesday.

The currency showed mixed trading against its major counterparts

in the Asian session. While it rose against the yen and the pound,

it held steady against the franc. Versus the franc, it

declined.

The greenback rose to 0.6895 against the aussie and 0.6622

against the kiwi, from its early 6-day low of 0.6920 and a 4-day

low of 0.6653, respectively. The next possible resistance for the

greenback is seen around 0.67 against the aussie and 0.64 against

the kiwi.

The greenback bounced off to 1.3065 against the loonie, from an

early low of 1.3045. If the currency rises further, it may locate

resistance around the 1.33 level.

The U.S. currency appreciated to 1.2961 against the pound, its

biggest since December 26. On the upside, 1.27 is possibly seen as

the next resistance for the greenback.

Data from the Office for National Statistics showed that the UK

economy shrank in November due to the weakness in services and

industrial output.

Gross domestic product contracted 0.3 percent on month driven by

the falls in services and production. GDP had advanced 0.1 percent

in both September and October. Economists had forecast GDP to

remain flat.

Nearing the key 110 level, the greenback touched 109.92 against

the yen, which was its strongest since May 27, 2019. The greenback

is likely to locate resistance around the 112.00 level.

The greenback reversed from an early 5-day low of 1.1136 against

the euro, recovering to 1.1113. The greenback may locate resistance

around the 1.10 area.

Data from Destatis showed that Germany's wholesale prices

continued to decline in December.

Wholesale prices decreased 1.3 percent year-on-year in December

but slower than the 2.5 percent decline seen in November. This was

the sixth consecutive fall in wholesale prices.

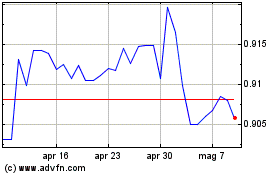

In contrast, the greenback declined to a 4-day low of 0.9718

against the franc from Friday's closing value of 0.9723. Further

decline may lead it to a support around the 0.96 level.

Looking ahead, the U.S. monthly budget statement for December

will be released in the New York session.

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Mar 2024 a Apr 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Apr 2023 a Apr 2024