TIDMVAST

Vast Resources plc / Ticker: VAST / Index: AIM / Sector: Mining

17 01 2020

Vast Resources plc

("Vast" or the "Company")

Interim Results: 1 May 2019 - 31 October 2019

Vast Resources plc, the AIM-listed mining company, is pleased to

announce that it has released its unaudited interim report and financial

results for period of 1 May 2019 to 31 October 2019.

The report can be found on the Company's website at the following

address:

https://www.globenewswire.com/Tracker?data=qh2kkEvKDmdu9k6eFxZe_Zvlc4wE98IkQnUy22RMA3W28Rt7ZiU3xV4kTN6c9J_xHLUKl2g4emUTcYnbfW1ZKw==

www.vastplc.com

**S**

For further information, visit www.vastplc.com or please contact:

Vast Resources plc www.vastplc.com

Andrew Prelea (Chief Executive +44 (0) 1491 615 232

Officer)

Andrew Hall

Beaumont Cornish - Financial & www.beaumontcornish.com

Nominated Adviser +44 (0) 020 7628 3396

Roland Cornish

James Biddle

SP Angel Corporate Finance LLP www.spangel.co.uk

-- Broker +44 (0) 20 3470 0470

Richard Morrison

Caroline Rowe

Blytheweigh www.blytheweigh.com

Tim Blythe +44 (0) 20 7138 3204

Megan Ray

The information contained within this announcement is deemed by the

Company to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014 ("MAR").

ABOUT VAST RESOURCES PLC

Vast Resources plc, is an AIM listed mining company with mines in

Romania and Zimbabwe focused on the rapid advancement of high quality

brownfield projects by recommencing production at previously producing

mines in Romania and commencement of the joint venture mining agreement

on the Chiadzwa Community Concession Block of the Chiadzwa Diamond

Fields in Zimbabwe.

The Company's portfolio includes an 80% interest in the Baita Plai

Polymetallic Mine in Romania, where work is now currently underway

towards developing and recommissioning the mine and the Community

Concession Block in Chiadzwa, Zimbabwe.

Vast Resources owns the Manaila Polymetallic Mine in Romania, which was

commissioned in 2015, currently on care and maintenance.

Overview of the Interim Results for the six months to 31 October 2019

The Company has arranged financing which it has prioritised for the

Baita Plai Polymetallic Mine ("BPPM") in Romania and the Chiadzwa

Community Concession in Zimbabwe. The Company is in the process of

drawing down on the first tranche of the Atlas Capital Markets facility

($7.1 million gross) and expects to receive funds shortly. The first

tranche will be applied to placing BPPM into production and to the

repayment of financial creditors. The Manaila Polymetallic Mine ("MPM")

continues on care and maintenance with the expectation of a second

funding round at a later stage. Prior to the receipt of the first

tranche of funding, the Company has diverted resources from MPM to

upgrade, develop, and maintain BPPM in order to accelerate the project

to production and in December 2019 conducted a cold commissioning as

well as a drilling campaign. Finally, discussions continue regarding the

conclusion of the Company's diamond joint venture with its Zimbabwe

stakeholders. These discussions are in line with previous expectations,

save on timing.

Financial

-- Interim period follows change of accounting reference date from 31 March

to 30 April as announced on 8 April 2019. Six month comparatives for 31

October 2018 have been included.

-- 19% decrease in administrative and overhead expenses for the six month

period ended 31 October 2019 ($2.0 million) compared to the six month

period ended 31 October 2018 ($2.4 million).

-- Foreign exchange losses of $0.8 million for the period compared to $1.4

million for the six month period ended 31 October 2018. Included within

the $0.8 million of foreign exchange losses is $0.6 million in respect of

the Company's operations in Zimbabwe.

-- 36% decrease in losses after taxation from continuing operations in the

period ($3.5 million) compared to the six month period ended 31 October

2018 ($5.5 million).

-- $15 million (net $13.5 million before costs) binding conditional bond

facility signed.

-- Cash balances at the end of the period $1.216 million compared to $0.775

million as at 31 October 2018.

Operational Development

-- Concluded a joint venture with Chiadzwa Mining Resources (Pvt) Ltd, a

company designated to represent Chiadzwa Community interests in the

Chiadzwa Community Diamond Concession (the "Concession").

-- Continued discussions to finalise the joint venture agreement with

Zimbabwe Consolidated Diamond Company (Pvt) Ltd ("ZCDC") which will

enable the Concession to procure a special grant for the mining of

diamonds. Discussions are in line with expectations, save on timing.

-- Transitioned resources from MPM to BPPM in order to continue the upgrade

and development of BPPM.

Post period end:

-- Revised an existing agreement with Botswana Diamonds PLC ("BOD")

resulting in BOD acquiring a 2.5% interest in the cashflows generated

from Vast's share in the Concession. In consideration for this interest

BOD will provide know-how for all aspects of exploration, mining,

processing and marketing in relation to the Concession.

-- Cold commissioning of BPPM and commencement of drilling programme to

establish a JORC.

Funding

Share issues during the period: gross proceeds before cost of issue

Gross issue proceeds

No of shares

Date issued GBP $

28 May 775,862,068 900,000 1,142,010 Placing - new investor

Exercise of Open Offer

21 Jun 1,221 6 8 warrants

Exercise of Open Offer

7 Aug 244 1 1 warrants

13 Aug 595,454,545 655,000 789,799 Placing - new investor

30 Sep 902,592,977 1,805,186 2,225,975 Placing - new investor

24 Oct 34,000,000 47,600 61,471 Exercise of warrants

2,307,911,055 3,407,793 4,219,264

Post period end:

Gross issue proceeds

No of shares

Date issued GBP $

Exercise of Share Appreciation

7 Nov 20,000,000 50,000 64,110 Rights

Exercise of Open Offer

23 Dec 18,318 92 119 warrants

Exercise of Open Offer

31 Dec 260,629 1,303 1,721 warrants

Exercise of Open Offer

2 Jan 1,275 6 8 warrants

20,280,222 51,401 65,958

Debt Funding

-- Documentation was signed for a US$15 million binding conditional bond

issue deed for a facility up to US$ 15 million through an issuance of

secured convertible bonds to a UK based fund, Atlas Capital Markets Ltd

("Atlas").

Post period end

-- Issued a drawdown notice for the funding of the first tranche of the

Atlas facility. The Company expects to receive funds shortly.

Board and Management

Post period end

-- Appointment of Paul Fletcher as Finance Director on 11 November 2019; Roy

Tucker continues as Business Director.

CHAIRMAN'S STATEMENT

We had two key objectives for this reporting period. The first was to

secure financing for our Romanian and Zimbabwe operations, and the

second was to finalise the joint venture agreements in order to start

mining activities at the Chiadzwa Community Diamond Concession (the

"Concession").

The team made good progress in securing a US$15 million facility from

Atlas (net US$13.5 million before costs), and post period end we were

very pleased that we were in a position to drawn down on the first US$

7.1 million tranche of the facility. We anticipate that we will receive

these funds shortly. They will be applied to fund the capital

expenditure programme that will put BPPM into production, as well as

repay creditors. This clearly marks a significant turning point for the

Company and we look forward to reporting on progress in the months to

come.

While good progress was also made in concluding a joint venture

agreement with the Chiadzwa Community, to date we have been unable to

finalize the joint venture agreement with ZCDC, which, amongst other

matters, will enable the Company and our other Zimbabwean stakeholders

to procure a special grant for the exploration, development, and mining

of the Concession. As Andrew highlights in his report, we were concerned

in the unexpected delay in signing the ZCDC joint venture agreement but

we are pleased that discussions with the various Zimbabwe stakeholders

are in line with previous expectations, other than on timing, and we

remain confident that we will commence our mining operations in the near

future. The Company is well placed to move quickly to monetise this

opportunity with US$ 7.9 million binding and conditional funding

available in the form of tranches 2 to 4 of the Atlas facility.

As I mentioned in my report at the year end, the Company has been

through a testing period marked equally by great opportunities and

challenges. The Company and the management team has met these challenges

head-on and the effort and commitment has paid dividends in recent

months. The Company is now on a firm footing to realising the underlying

value of its key Romanian asset, BPPM, and is well positioned to

successfully execute on its Zimbabwe diamond opportunity upon

finalisation of the ZCDC joint venture agreement.

Brian Moritz

Chairman

CHIEF EXECUTIVE OFFICER'S REPORT

This has been a busy and critical period in the Company's development.

We were able to register some notable accomplishments in the half year

and after the period end that provide the necessary operational and

financial platform to allow the Company to begin to unlock the

underlying value of its key assets, the Baita Plai Polymetallic Mine

("BPPM") and the Chiadzwa Community Diamond Concession (the

"Concession").

On 26th September we concluded a joint venture with Chiadzwa Mining

Resources (Pvt) Ltd, a company designated to represent Chiadzwa

Community interests in the Concession. This resulted in the formation of

Katanga Mining (Pvt) Ltd ("Katanga"), a majority owned Vast company that

will invest in Chiadzwa Community Company (Pvt) Ltd ("CCC"), a company

with specific objectives to carry out exploration, resource development

and mining in the Chiadzwa Community Diamond Concession. A further joint

venture agreement between Katanga and the Zimbabwe Consolidated Diamond

Company (Pvt) Ltd ("ZCDC"), a government entity which represents the

Republic of Zimbabwe in the diamond sector is due to be signed, and

which will result in the procurement of a special grant from the

Zimbabwe authorities allowing the exploration and mining of diamonds

within the Concession and will establish the final interests of Vast,

the Community, and ZCDC in CCC. While we appreciate and share

shareholders' concern in the unexpected delay in signing this second

agreement with ZCDC, discussions with the various Zimbabwe stakeholders

are in line with previous expectations , save on timing, and we are

confident that we will commence our mining operations in the near

future. Full details of the Chiadzwa joint venture will be announced at

the same time as the conclusion and announcement of the ZCDC joint

venture to which it is linked.

On 24th October documentation was signed with Atlas Capital Markets Ltd

("Atlas") for a US$15 million binding conditional convertible bond

facility. The authorities necessary for the bond issue were approved by

shareholders on 8th November. The facility is divided into four

tranches, the first tranche of US$7.1 million being applied to bringing

BPPM into production and the repayment of two existing creditors,

Sub-Sahara Goldia Investments (US$ 1 million in full and final

settlement) and Mercuria (US$ 1 million in partial settlement). Mercuria

will continue to support the Company's Romanian operations under a

tripartite intercreditor agreement with Atlas and the Company. We are in

the process of drawing down the US7.1 million tranche from Atlas which

we anticipate receiving shortly and which will be applied immediately

to BPPM, enabling the commencement of production in H1 2020. This

represents a very significant and critical step for the Company, as was

also the announcement at the end of last year of the cold commissioning

of BPPM and the commencement of a drilling programme. The results of the

drilling programme will be used to further define the grades and

resource and will support the process of confirming a JORC resource.

On 28th November the Company revised an existing agreement with Botswana

Diamonds PLC ("BOD"). Upon finalising the Katanga / ZCDC agreement, BOD

will receive an interest of 2.5% in Vast Resources Enterprises Ltd

("VRE") with Vast retaining an interest of 97.5%. In consideration for

this interest BOD will provide know-how on all aspects of exploration,

mining, processing and marketing in relation to the Concession.

We enter 2020 in a far stronger position than at any time in the

Company's history. We are resourced to place BPPM into production in the

near future and we are well placed to execute our Zimbabwe diamond

strategy as soon as the agreement with ZCDC is concluded, a process that

we believe will be concluded shortly.

Andrew Prelea

Chief Executive Officer

For further information visit www.vastplc.com or please contact:

Vast Resources plc www.vastplc.com

Andrew Prelea (Chief Executive Officer) +44 (0) 1491 615232

Andrew Hall

------------------------------------------- -------------------------

Beaumont Cornish -- Financial & Nominated www.beaumontcornish.com

Adviser +44 (0) 020 7628 3396

Roland Cornish

James Biddle

------------------------------------------- -------------------------

SP Angel Corporate Finance LLP -- Broker www.spangel.co.uk

Richard Morrison +44 (0)20 3470 0470

Caroline Rowe

------------------------------------------- -------------------------

Blytheweigh www.blytheweigh.com

Tim Blythe +44 (0)20 7138 3204

Megan Ray

------------------------------------------- -------------------------

Condensed consolidated statement of comprehensive income

for the six months ended 31 October 2019

31 Oct 30 Apr 31 Oct

2019 2019 2018

13

6 Months Months 6 Months

Group Group Group

Unaudited Audited Unaudited

$'000 $'000 $'000

Revenue - 3,432 2,137

Cost of sales - (4,344) (2,882)

Gross loss - (912) (745)

Overhead expenses (3,179) (8,195) (4,588)

Depreciation of property, plant

and equipment (411) (1,206) (819)

Profit / (loss) on sale of property,

plant and equipment - 84 (2)

Share option and warrant expense (69) (264) (38)

Sundry income 33 311 136

Exchange loss (773) (2,798) (1,448)

Other administrative and overhead

expenses (1,959) (4,322) (2,417)

--------------------------------------------- ---------

Loss from operations (3,179) (9,107) (5,333)

Finance income - 1 -

Finance expense (345) (845) (191)

Loss before taxation from continuing

operations (3,524) (9,951) (5,524)

Taxation charge - - -

Total loss after taxation from continuing

operations (3,524) (9,951) (5,524)

Profit after taxation from discontinued

operations - 17,047 1,520

Total profit (loss) after taxation

for the period (3,524) 7,096 (4,004)

Other comprehensive income

Items that may be subsequently reclassified

to either profit or loss

(Loss) / gain on available for sale

financial assets - (3) 1

Exchange gain on translation of foreign

operations 34 1,941 625

Total comprehensive profit / (loss)

for the period (3,490) 9,034 (3,378)

========= ======= =========

Total profit / (loss) attributable

to:

- the equity holders of the parent

company (3,398) 243 (5,142)

- non-controlling interests (126) 6,853 1,138

(3,524) 7,096 (4,004)

========= ======= =========

Total comprehensive profit / (loss)

attributable to:

- the equity holders of the parent

company (3,364) 2,181 (4,516)

- non-controlling interests (126) 6,853 1,138

(3,490) 9,034 (3,378)

========= ======= =========

Loss per share -- basic and diluted (0.04) (0.00) (0.10)

Loss per share continuing operations

-- basic and diluted (0.04) (0.16) (0.10)

Condensed consolidated statement of changes in equity

for the six months ended 31 October 2019

Foreign

currency Available

Share Share Share option translation for sale EBT Retained Non-controlling

capital premium reserve reserve reserve reserve deficit Total interests Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

At 30 April 2018 20,052 77,284 1,664 (2,656) 3 (3,942) (95,934) (3,529) 23,683 20,154

Total comprehensive loss

for the period - - - 625 1 - (5,142) (4,516) 1,138 (3,378)

Share option and warrant

charges 38 38 38

Share options and warrants

lapsed - - (10) - - - 10 - - -

Acquired through business

combination:

- Delta Gold Zimbabwe (Pvt)

Ltd - - - - - - - - (1,694) (1,694)

Derecognition of EBT reserve - - - - - 3,942 (3,715) 227 - 227

Disposal of available for

sale investments - - - - (4) - - (4) - (4)

Shares issued for cash: 592 2,792 - - - - - 3,384 - 3,384

- to settle liabilities - - -

At 31 October 2018 20,644 80,076 1,692 (2,031) - - (104,781) (4,400) 23,127 18,727

Total comprehensive loss

for the period - - - 1,309 - - 3,625 4,934 5,079 10,013

Share option and warrant

charges - - 142 - - - - 142 - 142

Share options and warrants

lapsed - - (219) - - - 219 - - -

Derecognised on discontinued

operations:

- Dallaglio Investments (Private)

Limited - - - - - - - (28,247) (28,247)

Shares issued for cash 3,058 1,609 - - - - - 4,667 - 4,667

At 30 April 2019 23,702 81,685 1,615 (722) - - (100,937) 5,343 (41) 5,302

Total comprehensive loss

for the period - - - 34 - - (3,398) (3,364) (126) (3,490)

Share option and warrant

charges - - 69 - - - - 69 - 69

Share options and warrants

lapsed - - (387) - - - 387 - - -

Shares issued for cash 2,859 1,066 - - - - - 3,925 - 3,925

At 31 October 2019 26,561 82,751 1,297 (688) - - (103,948) 5,973 (167) 5,806

======== ======== ============= ============= ========== ======== ========= ======= ================ ========

Condensed consolidated statement of financial position

As at 31 October 2019

31 Oct 2019 30 Apr 2019 31 Oct 2018

Unaudited Audited Unaudited

Group Group Group

$'000 $'000 $'000

Assets Note

Non-current assets

Property, plant and equipment 3 11,998 11,261 52,242

Investment in joint ventures - - 548

Goodwill arising on consolidation - - 566

11,998 11,261 53,356

----------- ----------- -----------

Current assets

Inventory 5 472 413 5,033

Receivables 6 1,961 2,537 8,431

Available for sale investments - - 15

Cash and cash equivalents 1,216 569 775

Total current assets 3,649 3,519 14,254

----------- ----------- -----------

Total Assets 15,647 14,780 67,610

Equity and Liabilities

Capital and reserves

attributable to equity

holders of the Parent

Share capital 26,561 23,702 20,644

Share premium 82,751 81,685 80,076

Share option reserve 1,297 1,615 1,692

Foreign currency translation

reserve (688) (722) (2,031)

Retained deficit (103,948) (100,937) (104,781)

5,973 5,343 (4,400)

Non-controlling interests (167) (41) 23,127

Total equity 5,806 5,302 18,727

----------- ----------- -----------

Non-current liabilities

Loans and borrowings 7 3,073 4,043 23,607

Provisions 9 489 489 2,465

Deferred tax liability - - 3,330

3,562 4,532 29,402

----------- ----------- -----------

Current liabilities

Loans and borrowings 7 2,348 1,476 11,956

Trade and other payables 8 3,931 3,470 7,525

Total current liabilities 6,279 4,946 19,481

----------- ----------- -----------

Total liabilities 9,841 9,478 48,883

Total Equity and Liabilities 15,647 14,780 67,610

Condensed consolidated statement of cash flow

for the six months ended 31 October 2019

31 Oct

2019 30 Apr 2019 31 Oct 2018

Unaudited Audited Unaudited

Group Group Group

$'000 $'000 $'000

CASH FLOW FROM OPERATING ACTIVITIES

Profit (loss) before taxation for

the period

- from continuing operations (3,524) (9,951) (5,524)

- from discontinued operations - 17,047 1,520

Adjustments for:

Depreciation and impairment charges 411 4,554 2,138

(Profit) loss on sale of property,

plant and equipment - (76) 2

Gain on disposal of discontinued

operations - (8,649) -

Loss on disposal of available for

sale investments - 10 -

Share option expense 69 264 38

(3,044) 3,199 (1,826)

---------- ----------- -----------

Changes in working capital:

Decrease (increase) in receivables 613 2,140 (2,439)

Decrease (increase) in inventories (55) 1,290 (1,000)

Increase (decrease) in payables 490 (1,275) 2,639

1,048 2,155 (800)

---------- ----------- -----------

Taxation paid - - -

Cash generated by / (used in) operations (1,996) 5,354 (2,626)

Investing activities:

Payments to acquire property, plant

and equipment (1,184) (11,391) (4,443)

Payments to acquire new subsidiary - (4,480) (4,480)

Proceeds on disposal of property,

plant and equipment - 168 85

Net cash inflow on disposal of

discontinued operations - 1,592 -

Proceeds of derecognition of EBT

reserve - 221 221

Decrease (increase) in investment

in joint venture - 559 (54)

.

Total cash used in investing activities (1,184) (13,331) (8,671)

---------- ----------- -----------

Financing activities:

Net proceeds from the issue of

ordinary shares 3,925 8,110 4,667

Proceeds from loans and borrowings

granted 156 6,165 6,985

Repayment of loans and borrowings (254) (7,029) (53)

Total proceeds from financing activities 3,827 7,246 11,599

---------- ----------- -----------

Increase (decrease) in cash and

cash equivalents 647 (731) 302

Cash and cash equivalents at beginning

of period 569 1,300 473

Cash and cash equivalents at end

of period 1,216 569 775

========== =========== ===========

Interim report notes

1 Interim Report

These condensed interim financial statements, which are unaudited, are

for the six months ended 31 October 2019 and consolidate the financial

statements of the Company and all its subsidiaries. The statements are

presented in United States Dollars.

The financial information set out in these condensed interim financial

statements does not constitute statutory accounts as defined in Section

434(3) of the Companies Act 2006. The condensed interim financial

statements should be read in conjunction with the consolidated financial

statements of the Group for the period ended 30 April 2019 which have

been prepared in accordance with International Financial Reporting

Standards as adopted by the European Union ("IFRSs"). The Auditor's

report on those financial statements was unqualified and did not contain

a statement under s.498(2) or s.498(3) of the Companies Act 2006.

While the Auditors' report for the period ended 30 April 2019 was

unqualified, it did include a material uncertainty related to going

concern, to which the Auditors drew attention by way of emphasis without

qualifying their report. Full details of these comments are contained in

the report of the Auditors on Pages 23-27 of the annual financial

statements for the period ended 30 April 2019, released elsewhere on

this website on 30 September 2019.

The accounts for the period have been prepared in accordance with

International Accounting Standard 34 "Interim Financial Reporting" ("IAS

34") and the accounting policies are consistent with those of the annual

financial statements for the period ended 30 April 2019, unless

otherwise stated, and those envisaged for the financial statements for

the year ended 30 April 2020.

New IFRS accounting standards

IFRS 16 Leases became effective for the Group from 1 January 2019. The

principal impact of IFRS 16 will be to change the accounting treatment

by lessees of leases currently classified as operating leases. Lease

agreements will give rise to the recognition by the lessee of an asset,

representing the right to use the leased item, and a related liability

for future lease payments. Lease costs will be recognised in the income

statement in the form of depreciation of the right of use asset over the

lease term, and finance charges representing the unwind of the discount

on the lease liability. The adoption of IFRS 16 does not materially

impact the carrying value of lease liabilities given the Group's

negligible leasing exposure. As the effects of applying these standards

are considered immaterial to the Group, the Group has elected not to

demonstrate the impact of these standards on the current period's

results and not to restate prior periods on adoption of the new

standards in 2019.

Going concern

After review of the Group's operations and of the funding opportunities

open to the Group, the Directors have a reasonable expectation that the

Group has adequate resources to continue in operational existence for

the foreseeable future. Accordingly, the Directors continue to adopt the

going concern basis in preparing the unaudited condensed interim

financial statements.

This interim report was approved by the Directors on 17 January 2019.

2 Segmental analysis Continuing operations Discontinued operations

Mining, exploration Admin Mining, exploration Admin and

and development and corporate Total and development corporate Total

Europe Africa Europe Africa

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

Six months to 31 October 2019

Revenue - - - - - - - -

Production costs - - - - - - - -

Gross profit (loss) - - - - - - - -

Depreciation (409) - (2) (411) - - - -

Profit (loss) on sale of property,

plant and equipment - - - - - - - -

Share option and warrant expense - - (69) (69) - - - -

Sundry income 33 - - 33 - - - -

Exchange (loss) gain (156) - (617) (773) - - - -

Other administrative and overhead

expenses (722) - (1,237) (1,959) - - - -

Finance income - - - - - - - -

Finance expense (189) - (156) (345) - - - -

Profit on disposal of discontinued

operations - - - - - - - -

Taxation (charge) - - - - - - - -

Profit (loss) for the year from

continuing operations (1,443) - (2,081) (3,524) - - - -

31 October 2019

Total assets 14,516 - 1,131 15,647 - - - -

Total non-current assets 11,998 - - 11,998 - - - -

Additions to non-current assets 1,184 - - 1,184 - - - -

Total current assets 2,120 - 1,529 3,649 - - - -

Total liabilities 8,329 - 1,512 9,841 - - - -

2 Segmental analysis (continued)

Continuing operations Discontinued operations

Mining, exploration Admin Mining, exploration Admin

and development and corporate Total and development and corporate Total

Europe Africa Europe Africa

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

Thirteen months to 30 April 2019

Revenue 3,328 - 104 3,432 - 31,243 - 31,243

Production costs (4,344) - - (4,344) - (18,527) - (18,527)

Gross profit (loss) (1,016) - 104 (912) - 12,716 - 12,716

Depreciation and impairment (1,200) - (6) (1,206) - (3,348) - (3,348)

Profit (loss) on sale of property,

plant and equipment 86 - (2) 84 - (8) - (8)

Share option and warrant expense - - (264) (264) - - - -

Sundry income 311 - - 311 - 670 - 670

Exchange (loss) gain (2,283) - (515) (2,798) - 6,494 (779) 5,715

Other administrative and overhead

expenses (1,516) - (2,806) (4,322) - (4,894) (22) (4,916)

Finance income - - 1 1 - 2 - 2

Finance expense (413) - (432) (845) - (1,014) - (1,014)

Loss on disposal of subsidiary

company loans - - - - - 8,649 - 8,649

Taxation (charge) - - - - - (1,408) (11) (1,419)

Profit (loss) for the year from

continuing operations (6,031) - (3,920) (9,951) - 17,859 (812) 17,047

30 April 2019

Total assets 13,611 - 1,169 14,780 - - - -

Total non-current assets 11,220 - 41 11,261 - - - -

Additions to non-current assets 1,684 - 53 1,737 - 14,371 - 14,371

Total current assets 2,441 - 1,078 3,519 - - - -

Total liabilities 8,434 - 1,044 9,478 - - - -

2 Segmental analysis (continued)

Continuing operations Discontinued operations

Mining, exploration Admin Mining, exploration Admin

and development and corporate Total and development and corporate Total

Europe Africa Europe Africa

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

Six months to 31 October 2018

Revenue 2,137 - - 2,137 - 16,932 - 16,932

Production costs (2,882) - - (2,882) - (12,840) - (12,840)

Gross profit (loss) (745) - - (745) - 4,092 - 4,092

Depreciation (818) - (1) (819) - (1,319) - (1,319)

Profit (loss) on sale of property,

plant and equipment - - (2) (2) - - - -

Share option and warrant expense - - (38) (38) - - - -

Sundry income 136 - - 136 - 215 - 215

Exchange (loss) gain (1,047) - (401) (1,448) - 1 - 1

Other administrative and overhead

expenses (866) - (1,551) (2,417) - (839) (20) (859)

Finance income - - - - - 23 - 23

Finance expense (191) - - (191) - (685) 52 (633)

Loss on disposal of subsidiary

company loans - - - - - - - -

Taxation (charge) - - - - - - - -

Profit (loss) for the year from

continuing operations (3,531) - (1,993) (5,524) - 1,488 32 1,520

31 October 2018

Total assets 14,105 - 20 14,125 53,485 - 53,485

Total non-current assets 10,768 - - 10,768 42,588 - 42,588

Additions to non-current assets 421 - 1 422 4,021 - 4,021

Total current assets 2,849 - 388 3,237 10,749 268 11,017

Total liabilities 8,484 - 662 9,146 24,877 14,860 39,737

3 Property, Plant and equipment

Fixtures, Capital

Plant and fittings Computer Motor Buildings Mining Work in

Group machinery and equipment assets vehicles and Improvements assets progress Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

Cost at 1 May 2018 19,297 178 307 722 3,749 27,693 2,760 54,706

Revaluation - - - - - - - -

Additions during the

period 254 40 83 115 46 1,314 2,591 4,443

Acquired through business

combination 2,319 20 - 2 1,790 - - 4,131

Reclassification 260 - - - 5 - (265) -

Disposals during the

period - - - - (87) - - (87)

Foreign exchange

movements (189) (2) (6) (32) (171) (278) (62) (740)

Cost at 31 October 2018 21,941 236 384 807 5,332 28,729 5,024 62,453

----------- --------------- --------- --------- ------------------ -------- ---------- --------

Revaluation - 10 1 40 51

Additions during the

period 1,089 55 19 174 120 3,851 752 6,060

Acquired through business

combination 493 1 102 - - - - 596

Reclassification (14) - - - 129 - (115) -

Disposals during the

period (14) - - - 5 - - (9)

Discontinued operations (20,142) (243) (382) (707) (2,240) (26,188) (2,830) (52,732)

Foreign exchange

movements (150) (13) (6) (69) (134) (218) (47) (637)

Cost at 30 April 2019 3,203 46 118 245 3,212 6,174 2,784 15,782

----------- --------------- --------- --------- ------------------ -------- ---------- --------

Additions during the

period - 1 - 37 - - 1,146 1,184

Foreign exchange

movements (6) - - (5) (10) (16) (10) (47)

Cost at 31 October 2019 3,197 47 118 277 3,202 6,158 3,920 16,919

----------- --------------- --------- --------- ------------------ -------- ---------- --------

Depreciation at 1 May 2018 4,898 85 147 410 540 1,721 604 8,405

Charge for the period 1,548 16 42 28 76 428 - 2,138

Foreign exchange

movements (198) (4) (10) (31) (56) (33) - (332)

Depreciation at 31 October

2018 6,248 97 179 407 560 2,116 604 10,211

----------- --------------- --------- --------- ------------------ -------- ---------- --------

Charge for the period 1,162 28 120 72 134 794 106 2,416

Acquired through business

combination 52 - 9 - - - - 61

Disposals during the

period (4) - - - - - - (4)

Discontinued operations (5,402) (84) (238) (319) (68) (1,828) - (7,939)

Foreign exchange

movements (103) (6) (4) (28) (41) (42) - (224)

Depreciation at 30 April 2019 1,953 35 66 132 585 1,040 710 4,521

----------- --------------- --------- --------- ------------------ -------- ---------- --------

Charge for the period 184 6 4 14 57 146 - 411

Foreign exchange

movements (2) - - (2) (4) (3) - (11)

Depreciation at 31 October

2019 2,135 41 70 144 638 1,183 710 4,921

----------- --------------- --------- --------- ------------------ -------- ---------- --------

Net book value at 31 October

2018 15,693 139 205 400 4,772 26,613 4,420 52,242

Net book value at 30 April

2019 1,250 11 52 113 2,627 5,134 2,074 11,261

Net book value at 31 October

2019 1,062 6 48 133 2,564 4,975 3,210 11,998

4 Loss per share

31 Oct 2019 30 Apr 2019 31 Oct 2018

Unaudited Audited Unaudited

Group Group Group

Profit and loss per ordinary share

has been calculated using the weighted

average number of ordinary shares in

issue during the relevant financial

year.

The weighted average number of ordinary

shares in issue for the period is: 9,017,815,872 5,887,042,985 5,372,499,686

Profit / (loss) for the period: ($'000) (3,398) 243 (5,142)

Profit / (loss) per share basic and

diluted (cents) (0.04) 0.00 (0.10)

Profit / (loss) for the period from

continuing operations: ($'000) (3,398) (9,649) (5,356)

Profit / (loss) per share for the period

from continuing operations - basic

and diluted (0.04) (0.16) (0.10)

Profit / (loss) for the period from

discontinued operations: ($'000) - 9,892 214

Profit / (loss) per share for the period

from discontinued operations - basic

and diluted - 0.17 0.00

The effect of all potentially dilutive

share options is anti-dilutive.

5 Inventory

31 Oct 30 Apr 31 Oct

2019 2019 2018

Unaudited Audited Unaudited

Group Group Group

$'000 $'000 $'000

Minerals held for sale 61 61 1,145

Production stockpiles 48 48 1,711

Consumable stores 363 304 2,177

472 413 5,033

--------- ------- ---------

6 Receivables

31 Oct 30 Apr 31 Oct

2019 2019 2018

Unaudited Audited Unaudited

Group Group Group

$'000 $'000 $'000

Trade receivables - - 412

Other receivables 839 1,502 2,414

Short term loans 211 174 -

Prepayments 60 74 2,506

VAT 851 787 3,099

1,961 2,537 8,431

--------- ------- ---------

7 Loans and borrowings

31 Oct 30 Apr 31 Oct

2019 2019 2018

Unaudited Audited Unaudited

Group Group Group

$'000 $'000 $'000

Non current

Secured borrowings 5,035 4,043 9,120

Unsecured borrowings 206 - 14,838

less amounts payable in less than 12

months (2,168) - (351)

3,073 4,043 23,607

--------- ------- ---------

Current

Secured borrowings 2,018 978 3,802

Unsecured borrowings 330 498 4,269

Bank overdrafts - - 3,885

2,348 1,476 11,956

--------- ------- ---------

Total loans and borrowings 5,421 5,519 35,563

8 Payables

31 Oct 30 Apr 31 Oct

2019 2019 2018

Unaudited Audited Unaudited

Group Group Group

$'000 $'000 $'000

Trade payables 1,298 1,193 4,460

Other payables 1,293 1,033 2,380

Other taxes and social security taxes 1,340 1,027 538

Accrued expenses - 217 147

3,931 3,470 7,525

--------- ------- ---------

9 Provisions

31 Oct 30 Apr 31 Oct

2019 2019 2018

Unaudited Audited Unaudited

Group Group Group

$'000 $'000 $'000

Provision for rehabilitation of mining

properties

- Provision brought forward from previous

periods 489 1,397 1,397

- Liability recognised during period - - 1,068

- Derecognised on disposal of subsidiary - (908) -

489 489 2,465

--------- ------- ---------

10 Events after the reporting date

Shares issued

Gross issue proceeds

No of shares

Date issued GBP $ Reason for issue

Exercise of Share Appreciation

7 Nov 20,000,000 50,000 64,110 Rights

Exercise of Open Offer

23 Dec 18,318 92 119 warrants

Exercise of Open Offer

31 Dec 260,629 1,303 1,721 warrants

Exercise of Open Offer

2 Jan 1,275 6 8 warrants

20,280,222 51,401 65,958

On 28th November the Company revised an existing agreement with Botswana

Diamonds PLC (BOD), BOD will now be a consulting partner in the

development of the Chiadzwa Community Concession in Zimbabwe, providing

know-how on all aspects of exploration, mining, processing and

marketing. Upon finalising the Katanga / ZCDC agreement, BOD will

receive an interest of 2.5% in Vast Resources Enterprises Ltd ("VRE").

On 16(th) December the Company announced the cold commissioning of BPPM

and on 23(rd) December the commencement of a drilling programme, the

results of which will be used to further define the grades and resource

and will support the process of confirming a JORC resource.

On 2(nd) January the Company has submitted a drawdown request for the

First Tranche Issuance to Atlas Capital Markets Limited in accordance

with the terms and conditions of the Bond Issuance Deed.

Attachment

-- Interim Results

https://ml-eu.globenewswire.com/Resource/Download/8e4762c3-c334-45bc-99e0-fe73a58ad08a

(END) Dow Jones Newswires

January 17, 2020 10:00 ET (15:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

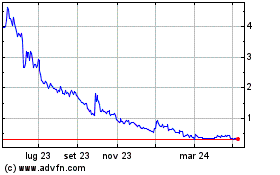

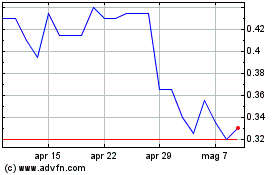

Grafico Azioni Vast Resources (LSE:VAST)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Vast Resources (LSE:VAST)

Storico

Da Apr 2023 a Apr 2024