TIDM88E

RNS Number : 2152A

88 Energy Limited

20 January 2020

20 January 2020

88 Energy Limited

QUARTERLY REPORT

Report on Activities for the Quarter ended 31 December 2019

The Directors of 88 Energy Limited ("88 Energy" or the

"Company", ASX & AIM:88E) provide the following report for the

quarter ended 31 December 2019.

Highlights

Project Icewine

-- Farm-out with Premier Oil Plc ("Premier") finalised and

completion documents executed in the quarter;

-- The Alaska Department of Natural Resources approved the Plan

of Operations for the Charlie-1 appraisal well in November

2019;

-- Permit to Drill submitted - approval expected in January 2020; and

-- All other contracting and logistical work is proceeding as

planned ahead of the scheduled February 2020 spud date.

Yukon Acreage

-- Discussions continue with nearby resource owners to optimise

the monetisation strategy of the acreage; and

-- Permitting underway ahead of potential drilling in 2021 - subject to farm-out.

Western Blocks

-- Assessment of strategy for future of leases underway.

Project Icewine

-- Project Icewine Conventional

Farm-out Update

All conditions precedent to the farm-out agreement between 88

Energy, Premier and Burgundy Xploration, signed in August 2019,

have been satisfied. Consequently, execution of the final

agreements took place on 26(th) November 2019.

Operations Update

88 Energy, via its 100% owned subsidiary Accumulate Energy

Alaska, Inc ("Accumulate"), executed a rig contract with

Nordic-Callista Services just prior to the beginning of the

quarter, to utilise Rig-3 for the upcoming drilling of the

Charlie-1 appraisal well. 88 Energy utilised Rig-3 for the drilling

of the Winx-1 well in March 2019 and was extremely pleased with its

safe and efficient performance throughout the course of

operations.

The Alaska Department of Natural Resources approved the Plan of

Operations for the Charlie-1 appraisal well on 22(nd) November. The

Plan of Operations is one of the key major permits required for

drilling.

The Permit to Drill was submitted prior to the end of 2019, as

planned, and approval is expected towards the end of January. This

is the last major permit required prior to spud of the Charlie-1

well.

As per the farm-out agreement, initial cash call was receipted

into the Joint Venture account in December 2019.

All other contracting and logistical work is proceeding as

planned ahead of the scheduled February 2020 spud date.

About the Charlie-1 Appraisal Well

The Charlie-1 appraisal well has been designed as a step out

appraisal of a well drilled in 1991 by BP Exploration (Alaska) Inc

called Malguk-1. Malguk-1 encountered oil shows with elevated

resistivity and mud gas readings over multiple horizons during

drilling but was not tested due to complications towards the end of

operations, which resulted in lack of time before the close of the

winter drilling season. It was also drilled using vintage 2D

seismic, which was insufficient to adequately determine the extent

of any of the prospective targets encountered.

88 Energy subsequently undertook revised petrophysical analysis,

which identified what is interpreted as bypassed pay in the

Malguk-1 well. 88E also completed acquisition of modern 3D seismic

in 2018, in order to determine the extent of the discovered oil

accumulations. Charlie-1 will intersect seven stacked prospects,

four of which are interpreted as oil bearing in Malguk--1 and are

therefore considered appraisal targets. 88 Energy will operate

Charlie-1, via its 100% owned subsidiary Accumulate Energy Alaska,

Inc, with cost of the well to be funded by Premier Oil Plc up to

US$23m under the recent farm-out agreement. Drilling is scheduled

to commence in February 2020 with flow testing anticipated to

conclude in April 2020. The total Gross Mean Prospective Resource

across the seven stacked targets to be intersected by Charlie-1 is

1.6 billion barrels of oil (480 million barrels net to 88E). Refer

announcement dated 23(rd) August.

Cautionary Statement: The estimated quantities of petroleum that

may be potentially recovered by the application of a future

development project relate to undiscovered accumulations. These

estimates have both an associated risk of discovery and a risk of

development. Further exploration, appraisal and evaluation are

required to determine the existence of a significant quantity of

potentially movable hydrocarbons.

-- Project Icewine Unconventional

Assessment of material from regional wells ongoing in order to

conduct additional FIB-SEM analysis to confirm improved effective

porosity and connectivity.

Additional analysis to be complimented by results from the

Charlie-1 well, with the well designed to penetrate HRZ and gather

additional data which will complement the ongoing additional

analysis being conducted.

The Joint Venture plans to conduct a formal farm-out process to

fund further appraisal.

Yukon Leases

Discussions are ongoing with nearby lease owners to optimise the

monetisation strategy for existing discovered resources located in

the vicinity of the Yukon Leases. The Yukon Leases contain the 86

million barrel Cascade Prospect(*) , which was intersected

peripherally by Yukon Gold-1, drilled in 1994, and classified as an

historic oil discovery. 88 Energy recently acquired 3D seismic

(2018) over Cascade and, on final processing and interpretation,

high-graded it from a lead to a drillable prospect. The Yukon

Leases are located adjacent to ANWR and in close proximity to

recently commissioned infrastructure.

Permitting underway ahead of possible drilling in 2021 - subject

to farm-out.

(*) Refer announcement 7th November 2018

Cautionary Statement: The estimated quantities of petroleum that

may be potentially recovered by the application of a future

development project relate to undiscovered accumulations. These

estimates have both an associated risk of discovery and a risk of

development. Further exploration, appraisal and evaluation are

required to determine the existence of a significant quantity of

potentially movable hydrocarbons.

Western Blocks

Assessment of strategy for future of leases underway, ahead of

lease expiry in May 2021.

Corporate

The ASX Appendix 5B attached to this report contains the

Company's cash flow statement for the quarter. The significant cash

flows for the period were:

-- Exploration and evaluation expenditure totalled A$4.0m

(gross), primarily associated with lease rentals and expenditure

associated with the upcoming Charlie-1 appraisal well;

-- Cash call proceeds received from Joint Venture partners totalled $12.4m;

-- Payments in relation to the debt facility interest totalled A$0.6m (US$0.4m); and

-- Administration and other operating costs A$0.9m (Sept'19 Quarter A$1.1m).

At the end of the quarter, the Company had cash reserves of

A$15.9m, including cash balances held in Joint Venture bank

accounts relating to Joint Venture Partner contributions totalling

A$10.7m.

Information required by ASX Listing Rule 5.4.3:

Project Name Location Area (acres)

-------------- ----------------

Interest at

beginning of Interest at

Quarter end of Quarter

----------------- ---------------------- ------------- -------------- ----------------

Onshore, North Slope

Project Icewine Alaska 482,000 64% 64%(1)

Onshore, North Slope

Yukon Gold Alaska 15,235 100% 100%

Onshore, North Slope

Western Blocks Alaska 22,711 36% 36%

(1) Assignment of interest to Premier in Project Icewine Area A

completed in Q4 2019.

Pursuant to the requirements of the ASX Listing Rules Chapter 5

and the AIM Rules for Companies, the technical information and

resource reporting contained in this announcement was prepared by,

or under the supervision of, Dr Stephen Staley, who is a

Non-Executive Director of the Company. Dr Staley has more than 35

years' experience in the petroleum industry, is a Fellow of the

Geological Society of London, and a qualified Geologist /

Geophysicist who has sufficient experience that is relevant to the

style and nature of the oil prospects under consideration and to

the activities discussed in this document. Dr Staley has reviewed

the information and supporting documentation referred to in this

announcement and considers the prospective resource estimates to be

fairly represented and consents to its release in the form and

context in which it appears. His academic qualifications and

industry memberships appear on the Company's website and both

comply with the criteria for "Competence" under clause 3.1 of the

Valmin Code 2015. Terminology and standards adopted by the Society

of Petroleum Engineers "Petroleum Resources Management System" have

been applied in producing this document.

Media and Investor Relations:

88 Energy Ltd

Dave Wall, Managing Director Tel: +61 8 9485 0990

Email: admin@88energy.com

Finlay Thomson, Investor Relations Tel: +44 7976 248471

Hartleys Ltd

Dale Bryan Tel: + 61 8 9268 2829

Cenkos Securities

Neil McDonald/Derrick Lee Tel: +44 131 220 6939

This announcement contains inside information.

A pdf copy of this Quarterly Report, including the following

figures and graphics, is available at

http://www.rns-pdf.londonstockexchange.com/rns/2152A_1-2020-1-17.pdf

-- Graph Showing Charlie-1: Seven Stacked Horizons

-- Table Showing Charlie-1 Targets

Appendix 5B

Mining exploration entity and oil and gas exploration entity

quarterly report

Introduced 01/07/96 Origin Appendix 8 Amended 01/07/97,

01/07/98, 30/09/01, 01/06/10, 17/12/10, 01/05/13, 01/09/16

Name of entity

-----------------------------------------------------

88 Energy Limited

ABN Quarter ended ("current quarter")

--------------- ----------------------------------

80 072 964 179 31 December 2019

----------------------------------

Consolidated statement of cash Current quarter Year to date

flows $A'000 (12 months)

$A'000

1. Cash flows from operating

activities

1.1 Receipts from customers - -

1.2 Payments for

(a) exploration & evaluation (4,043) (30,711)

(b) development - -

(c) production - -

(d) staff costs (465) (1,710)

(e) administration and corporate

costs (466) (1,757)

1.3 Dividends received (see note - -

3)

1.4 Interest received 1 23

Interest and other costs of

1.5 finance paid (595) (2,396)

1.6 Income taxes paid - -

1.7 Research and development refunds - -

1.8 Other (JV Partner Contributions) 12,387 23,860

---------------- -------------

Net cash from / (used in)

1.9 operating activities 6,819 (12,691)

----- ------------------------------------- ---------------- -------------

2. Cash flows from investing

activities

2.1 Payments to acquire:

(a) property, plant and equipment - -

(b) tenements (see item 10) - (52)

(c) investments - -

(d) other non-current assets - -

2.2 Proceeds from the disposal

of:

(a) property, plant and equipment - -

(b) tenements (see item 10) - -

(c) investments - -

(d) other non-current assets - -

2.3 Cash flows from loans to - -

other entities

2.4 Dividends received (see note - -

3)

Other: a) Bond Returned -

2.5 State of Alaska - 4,251

b) JV Partner Contribution

- Bond - (2,549)

c) Bond Paid - State of

Alaska (659) (659)

---------------- -------------

Net cash from / (used in)

2.6 investing activities (659) 991

------- ----------------------------------- ---------------- -------------

3. Cash flows from financing

activities

3.1 Proceeds from issues of shares - 6,530

3.2 Proceeds from issue of convertible - -

notes

3.3 Proceeds from exercise of - -

share options

Transaction costs related

to issues of shares, convertible

3.4 notes or options (23) (461)

3.5 Proceeds from borrowings - -

3.6 Repayment of borrowings - -

3.7 Transaction costs related - -

to loans and borrowings

3.8 Dividends paid - -

3.9 Other (Fees for debt refinancing) - -

---------------- -------------

Net cash from / (used in)

3.10 financing activities (23) 6,069

------- ----------------------------------- ---------------- -------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 10,144 21,723

Net cash from / (used in)

operating activities (item

4.2 1.9 above) 6,819 (12,691)

Net cash from / (used in)

investing activities (item

4.3 2.6 above) (659) 991

Net cash from / (used in)

financing activities (item

4.4 3.10 above) (23) 6,069

Effect of movement in exchange

4.5 rates on cash held (378) (189)

---------------- -------------

Cash and cash equivalents

4.6 at end of period 15,903 15,903

------- ----------------------------------- ---------------- -------------

5. Reconciliation of cash and Current quarter Previous quarter

cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 15,903 10,144

5.2 Call deposits - -

5.3 Bank overdrafts - -

5.4 Other (provide details) - -

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 15,903 10,144

---- ----------------------------------- ---------------- -----------------

6. Payments to directors of the entity and Current quarter

their associates $A'000

Aggregate amount of payments to these parties

6.1 included in item 1.2 170

----------------

6.2 Aggregate amount of cash flow from loans -

to these parties included in item 2.3

----------------

6.3 Include below any explanation necessary to understand

the transactions included in items 6.1 and 6.2

----- -----------------------------------------------------------------

6.1 Payments relate to Director and consulting fees paid to

Directors. All transactions involving directors and associates

were on normal commercial terms.

7. Payments to related entities of the entity Current quarter

and their associates $A'000

Aggregate amount of payments to these parties

7.1 included in item 1.2 24

----------------

7.2 Aggregate amount of cash flow from loans -

to these parties included in item 2.3

----------------

7.3 Include below any explanation necessary to understand

the transactions included in items 7.1 and 7.2

---- -------------------------------------------------------------------------

7.1 Payments relate to consulting fees paid to Director related

entities. Consultant fees paid to associated entities were

on normal commercial terms.

8. Financing facilities available Total facility Amount drawn

Add notes as necessary for amount at quarter at quarter end

an understanding of the position end $US'000

$US'000

------------------- ----------------

8.1 Loan facilities 15,884 15,884

------------------- ----------------

8.2 Credit standby arrangements - -

------------------- ----------------

8.3 Other (please specify) - -

------------------- ----------------

8.4 Include below a description of each facility above, including

the lender, interest rate and whether it is secured or

unsecured. If any additional facilities have been entered

into or are proposed to be entered into after quarter

end, include details of those facilities as well.

---- -------------------------------------------------------------------------

* On the 23rd of March 2018, 88 Energy Lt's 100%

controlled subsidiary Accumulate Energy Alaska Inc

entered into a US$ 16.5 million debt refinancing

agreement to replace the existing Bank of America

debt facility. The key terms to the facility are

noted in the ASX announcement released on 26th of

March 2018. The facility is secured by available

Production Tax Credits.

9. Estimated cash outflows for next $A'000

quarter

9.1 Exploration and evaluation* (565)

9.2 Development -

9.3 Production -

9.4 Staff costs (385)

9.5 Administration and corporate costs (300)

9.6 Other (provide details if material)** (595)

--------

9.7 Total estimated cash outflows (1,845)

---- -------------------------------------- --------

* Includes amounts relating to lease rentals, G&A, G&G,

which are net of anticipated JV partner contributions.

** Includes amounts relating to costs associated with the Brevet

debt interest costs.

10. Changes in tenements Tenement Nature of interest Interest Interest

(items 2.1(b) reference at beginning at end

and 2.2(b) above) and location of quarter of quarter

10.1 Interests in N/A 482,000 482,000

mining tenements Gross Gross

and petroleum acres acres

tenements lapsed,

relinquished

or reduced

----- --------------------- -------------- ------------------- -------------- ------------

10.2 Interests in N/A

mining tenements

and petroleum

tenements acquired

or increased

----- --------------------- -------------- ------------------- -------------- ------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Sign here: .......................................................... Date: ..........................................

(Company Secretary)

Print name: Ashley Gilbert

Notes

1. The quarterly report provides a basis for informing the

market how the entity's activities have been financed for the past

quarter and the effect on its cash position. An entity that wishes

to disclose additional information is encouraged to do so, in a

note or notes included in or attached to this report.

2. If this quarterly report has been prepared in accordance with

Australian Accounting Standards, the definitions in, and provisions

of, AASB 6: Exploration for and Evaluation of Mineral Resources and

AASB 107: Statement of Cash Flows apply to this report. If this

quarterly report has been prepared in accordance with other

accounting standards agreed by ASX pursuant to Listing Rule 19.11A,

the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFLFESLLIDLII

(END) Dow Jones Newswires

January 20, 2020 02:00 ET (07:00 GMT)

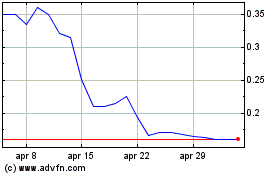

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Apr 2023 a Apr 2024