SQN Asset Finance Income Fund Ltd Anaerobic Digestion Assets (2893A)

20 Gennaio 2020 - 9:26AM

UK Regulatory

TIDMSQN

RNS Number : 2893A

SQN Asset Finance Income Fund Ltd

20 January 2020

20 January 2020

SQN Asset Finance Income Fund Limited

Anaerobic Digestion Assets

SQN Asset Finance Income Fund Limited (the "Company") has

invested in a total of 15 Anaerobic Digestion ("AD") plants since

its launch. Four have subsequently been exited profitably and 11

remain in the ordinary share portfolio.

At the time of the publication of the Annual Report and Accounts

for the year ended 30 June 2019, which were released on 30

September 2019, the Company reported all of the AD plants had

completed construction and that six were in the ramp-up phase which

often involves continuous refinement until the plants reach optimum

output. As reported in the results, this process has proven to take

longer than anticipated and occasionally requires additional

capital which can affect the overall economics of the investments.

This led the Company to make an impairment at that time of GBP3.2

million across two of these AD plants.

In preparation for the review of the interim accounts for the

six months ended 31 December 2019, the Company is undertaking a

review of the models and projections supporting the carrying values

of the AD plants. Three of the AD plants have not yet reached

targeted operational capacity. A further three AD plants are

performing at or above the targeted operational capacity but

feedstock costs have been higher than originally anticipated.

As a result, the Investment Manager has undertaken an assessment

of the valuation of these assets. Given the large number of

variables and the high degree of sensitivity of each of those

variables when modelled over the more than 20 year lives of the

assets, the range of potential values is large. If the range of

values were to be accepted and deemed appropriate for purposes of

the interim accounts, a potential impairment of between 4.6 pence

to 13.2 pence per ordinary share would have to be recorded. Given

the wide range of potential values, and in the interests of prudent

risk management, the Board intends to appoint a third-party valuer

to provide an independent assessment of the valuation of these

assets, which will then be reflected in the 31 December 2019 net

asset value ("NAV"). The six assets, in aggregate, had a valuation

of GBP127.7 million, as at 30 November 2019.

The C share portfolio has no exposure to AD assets.

In light of this ongoing assessment, the publication of the 31

December 2019 NAV for the ordinary shares is expected to be delayed

and a further update will be released as soon as possible. The 31

December 2019 NAV for the C shares is expected to be announced

later this week.

The Investment Manager will continue to work with the asset

operators to achieve optimisation of each of the AD plants with the

intention of monetising these assets in due course, together with

the five AD plants operating in-line with expectations. It should

be noted that the four AD plants that have been exited to date have

achieved yields of between 11% and 20%, the highest return being on

an investment that went into default and required a complicated

workout.

The Company has a triennial continuation vote, with the next

vote to be held at its AGM this year and the Board intends to

consult with shareholders in due course.

This announcement contains Inside Information as defined under

the Market Abuse Regulation (EU) No. 596/2014.

LEI: 2138007S3YRY3IUU4W39

For further information please contact:

SQN Capital Management, LLC

Jeremiah Silkowski

Neil Roberts 01932 575 888

Winterflood Securities Limited 020 3100 0000

Neil Langford

Chris Mills

Buchanan

Charles Ryland

Henry Wilson 020 7466 5000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCZZGZMRGDGGZG

(END) Dow Jones Newswires

January 20, 2020 03:26 ET (08:26 GMT)

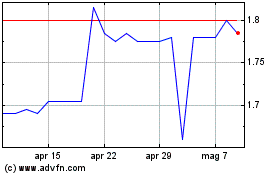

Grafico Azioni Slf Realisation (LSE:SLFR)

Storico

Da Mar 2024 a Apr 2024

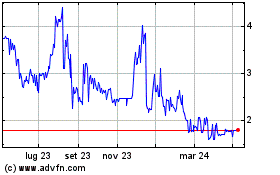

Grafico Azioni Slf Realisation (LSE:SLFR)

Storico

Da Apr 2023 a Apr 2024