Riverstone Credit Opps. Inc PLC 4Q19 Quarterly Portfolio Valuations (3727A)

21 Gennaio 2020 - 8:01AM

UK Regulatory

TIDMRCOI

RNS Number : 3727A

Riverstone Credit Opps. Inc PLC

21 January 2020

Riverstone Credit Opportunities Income Announces 4Q19 Quarterly

Portfolio Valuations

London, UK (21 January 2020) - Riverstone Credit Opportunities

Income ("RCOI") announces its quarterly portfolio summary as of 31

December 2019, inclusive of updated quarterly unaudited fair market

valuations:

Current Portfolio

Gross

Realised

Capital

Gross Gross & 31 Dec

Committed Invested Realised Unrealised Unrealised 2019

Project Commitment Capital Capital Capital Value Value Gross

Name Subsector Date ($mm) ($mm) ($mm)[1] ($mm) ($mm) MOIC2

Yellowstone Midstream 13 June 2019 5.8 5.8 - 6.4 6.4 1.10x

18 June

Alp E&P 2019 13.3 5.7 0.5 5.9 6.4 1.13x

Mariners Services 11 July 2019 12.2 12.2 0.5 12.4 12.9 1.06x

Chase E&P 23 July 2019 12.3 1.6 0.4 1.7 2.1 1.35x

1 August

Remington Midstream 2019 3.4 3.4 0.1 3.5 3.6 1.07x

25 November

Ducks E&P 2019 13.8 6.8 0.2 6.9 7.1 1.04x

19 December

Knox Midstream 2019 14.8 4.0 0.2 4.0 4.2 1.06x

---------- ---------

$75.7 $39.4 $2.0 $40.8 $42.8 1.09x

Realisations

Gross

Gross Gross Realised

Committed Invested Realised Unrealised Capital 31 Dec

Project Commitment Capital Capital Capital Value & Unrealised 2019 Gross

Name Subsector Date ($mm) ($mm) ($mm)(1) ($mm) Value ($mm) MOIC(2)

Shiner E&P 13 June 2019 6.0 4.3 4.9 - 4.9 1.15x

--------- --------- ------------- ------------- ------------- ------------

$6.0 $4.3 $4.9 - $4.9 1.15x

Subsequent Activity in January 2020

Committed Invested

Commitment Capital Capital

Project Name Subsector Date ($mm) ($mm)

10 January

Beach II Services 2020 8.7 8.7

--------- ---------

$8.7 $8.7

Consolidated Portfolio Key Stats at Entry As of 31 December 20192

Weighted Avg. Structuring Fee/OID 97.8%

----------------------

Weighted Avg. All-in Coupon at Entry 10.4% p.a.

----------------------

Weighted Avg. Undrawn Spread at Entry 3.8% p.a.

----------------------

Weighted Avg. Tenor at Entry 2.8 years

----------------------

Weighted Avg. Call Premium at Entry 105.3

----------------------

Security 100% Secured

----------------------

Coupon Type 100% Floating Rate

----------------------

The Gross Realised Capital column includes interest, fee income,

and principal received. The Gross Unrealised Value column includes

the amortization of OID, accrued interest, fees and any unrealized

change in the value on the investment.

Manager Outlook

-- The Investment Manager continues to focus on originating and

underwriting transactions with strong risk-adjusted returns and has

committed over 75 per cent. of the proceeds raised in the IPO.

-- The current investment environment is highly attractive for

deal origination, as the capital markets and bank market have been

largely inaccessible for energy companies, especially those that

are in the small to middle market.

-- Despite the large number of investment opportunities that

have been reviewed, the Investment Manager has remained very

disciplined in deploying capital. The focus on asset-based lending

with structural protections and conservative loan-to-value ratios

provides the portfolio with resilience through commodity and

economic cycles.

About Riverstone Credit Opportunities Income Plc:

RCOI seeks to generate consistent Shareholder returns

predominantly in the form of income distributions, principally by

making senior secured loans to small and middle-market energy

companies. The investment strategy is predicated on asset-based

lending, with conservative loan-to-value ratios and structural

protective features to mitigate risk. The Company will invest

broadly across energy subsectors globally, with an initial focus on

North America. RCOI intends to create a diversified portfolio

across basins, commodities, and end-markets to provide natural

synergies and hedges that could enhance the overall stability of

the portfolio.

For further details, see www.RiverstoneCOI.com

Neither the contents of RCOI's website nor the contents of any

website accessible from hyperlinks on the websites (or any other

website) is incorporated into, or forms part of, this

announcement.

Media Contacts

For Riverstone Credit Opportunities Income Plc:

Daniel Lim

+1 212 271 6266

[1] Gross realised capital is total gross income realised on

invested capital.

[2] Metrics based on the current portfolio.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

PFUKKKBQABKDQDB

(END) Dow Jones Newswires

January 21, 2020 02:01 ET (07:01 GMT)

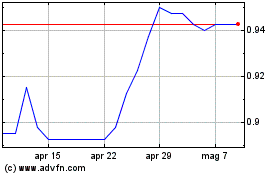

Grafico Azioni Riverstone Credit Opport... (LSE:RCOI)

Storico

Da Mar 2024 a Apr 2024

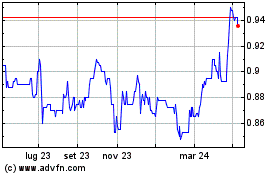

Grafico Azioni Riverstone Credit Opport... (LSE:RCOI)

Storico

Da Apr 2023 a Apr 2024