Yen Drops Amid Rising Risk Appetite

22 Gennaio 2020 - 3:47AM

RTTF2

The Japanese yen declined against its major counterparts in the

Asian session on Wednesday, as most Asian shares rose following a

sell-off in the previous session amid concerns over an outbreak of

a coronavirus in China.

Health officials have already confirmed cases of the coronavirus

infection in Thailand, Japan, South Korea and Taiwan. The U.S. too

confirmed its first case of the coronavirus in a patient who

recently returned from Wuhan, China.

The World Health Organization will consider whether to designate

the outbreak an international public health emergency.

The yen declined to 122.02 against the euro, from a high of

121.72 seen at 5:00 pm ET. The next likely support for the yen is

seen around the 124.00 level.

Reversing from an 8-day high of 113.32 hit at 7:45 pm ET, the

yen fell to 113.50 against the franc. Next key support for the yen

is likely seen around the 116.00 level.

The yen dropped to 143.74 against the pound, after rising to

143.25 at 5:00 pm ET. If the yen continues its fall, 146.00 is

possibly seen as its next support level.

The yen retreated to 72.57 against the kiwi and 75.34 against

the aussie, from its previous near 2-week highs of 72.33 and 75.03,

respectively. The yen is poised to challenge support around 74.00

against the kiwi and 76.5 against the aussie.

Following a 9-day high of 83.92 set at 8:45 pm ET, the yen

reversed direction and weakened to 84.14 versus the loonie. The yen

is seen finding support around the 85.5 region.

The yen held steady against the greenback, after falling to

110.10 at 9:45 pm ET. The pair had ended yesterday's trading at

109.86.

Looking ahead, U.K. public sector finance data for December is

set for release at 4:30 am ET.

In the New York session, Canada wholesale sales for November,

CPI and new housing price index for December, U.S. FHFA's home

price index for November and existing home sales for December are

scheduled for release.

At 10:00 am ET, the Bank of Canada announces its decision on

interest rates. The BoC is widely expected to keep borrowing costs

unchanged at 1.75 percent.

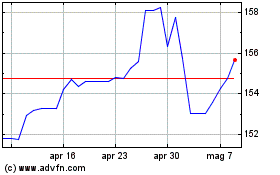

Grafico Cross US Dollar vs Yen (FX:USDJPY)

Da Mar 2024 a Apr 2024

Grafico Cross US Dollar vs Yen (FX:USDJPY)

Da Apr 2023 a Apr 2024