ADM Energy PLC Trading Update (6598A)

23 Gennaio 2020 - 8:00AM

UK Regulatory

TIDMADME

RNS Number : 6598A

ADM Energy PLC

23 January 2020

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED TO

CONSTITUTE INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF THE

MARKET ABUSE REGULATION (EU) NO. 596/2014. UPON THE PUBLICATION OF

THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE

IN THE PUBLIC DOMAIN.

23 January 2020

ADM Energy PLC

("ADM" or the "Company")

Trading Update

ADM Energy PLC (AIM:ADME), an oil and gas investing company

quoted on AIM, provides an update on trading for the year ended 31

December 2019.

The Company holds a 5% equity investment in the Aje Field, part

of the OML 113 licence offshore Nigeria. In 2019, the Aje Field

continued to produce oil from both the Aje-4 well in the Cenomanian

reservoir and Aje-5 well in the Turonian reservoir, with annual net

production of 890,203 barrels of oil (2018: 1,200,000 barrels). The

reduction was caused by both routine maintenance work on the

floating production storage and offloading facility ("FPSO") and

significant equipment upgrades on the gas lift modules in the

second half of the year. Average barrels of oil per day ("bopd")

was 2,967 (2018: 3,100 bopd), of which 148 bopd was net to ADM

(2018:155 bopd).

As previously stated, it had been anticipated that the project

debt would be repaid after the 12th lifting in January 2020. Whilst

the operating conditions and production costs have remained stable,

the lower than expected oil prices, combined with the slight delay

detailed above, has meant that the project debt is now expected to

be repaid on the 14th lifting scheduled in May 2020.

In addition, the Company is embarking on a strategy to expand

its portfolio of assets by investing in assets now being made

available across Nigeria and West Africa. This opportunity has

necessitated an incremental increase in costs of the new management

team and key personnel as the Company sets a platform to execute

its growth strategy. Consequently, the Company no longer expects to

be cash flow positive and profitable in 2020 as previously

anticipated on the current asset portfolio.

The OML 113 partners continue to assess the viability of the

next development stages, including funding to unlock the gas

reserves at Aje, and technical work is currently been carried

out.

Osamede Okhomina, Chief Executive Officer of ADM Energy, said:

"In recent months, we have been very busy behind the scenes laying

the groundwork to expand our investment portfolio. The Company's

existing stake in OML 113 provides a producing asset with a

long-term licence in place and potentially significant near-term

upside, subject to further investment, from which to build this

larger portfolio. PetroNor's recent buy-in to OML 113 brings

expertise that has only served to further de-risk operations and

accelerate plans for production growth.

"We already have several investment opportunities in

consideration and are now forming strategic alliances to best

structure and conclude them. With these elements in place, we are

well positioned for a period of aggressive growth. I am looking

forward to being able to annouce these deals in the near future and

delivering on the Company's vision."

For further information, please contact:

ADM Energy plc +44 20 7786 3555

Osamede Okhomina, CEO

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Fox-Davies Capital Ltd +44 20 3884 8450

(Lead Broker)

Daniel Fox-Davies, Lionel Therond

Pello Capital Limited +44 20 3700 2500

(Joint Broker)

Dan Gee

Luther Pendragon +44 20 7618 9100

(Financial PR)

Harry Chathli, Alexis Gore, Joe Quinlan

About ADM Energy PLC

ADM Energy (AIM:ADME) is a natural resources investment company

with an existing asset base in Nigeria. ADM Energy holds a 5%

equity investment in the Aje Field, part of OML 113, which covers

an area of 835 sq km offshore Nigeria. Aje has multiple oil, gas

and gas condensate reservoirs in the Turonian, Cenomanian and

Albian sandstones with five wells drilled to date.

ADM Energy is seeking to build on its existing asset base in

Nigeria and target other investment opportunities across the West

African region in the oil and gas sector with attractive risk

reward profiles such as proven nature of reserves, level of

historic investment, established infrastructure, route to early

cash flow and exploration upside.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTPPUACGUPUPWP

(END) Dow Jones Newswires

January 23, 2020 02:00 ET (07:00 GMT)

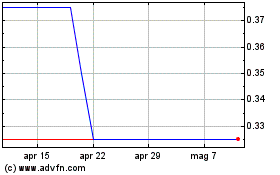

Grafico Azioni Adm Energy (LSE:ADME)

Storico

Da Mar 2024 a Apr 2024

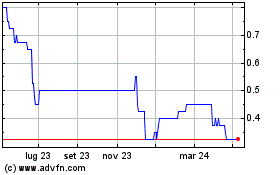

Grafico Azioni Adm Energy (LSE:ADME)

Storico

Da Apr 2023 a Apr 2024