TIDMADME

RNS Number : 7026A

ADM Energy PLC

23 January 2020

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED TO

CONSTITUTE INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF THE

MARKET ABUSE REGULATION (EU) NO. 596/2014. UPON THE PUBLICATION OF

THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE

IN THE PUBLIC DOMAIN.

23 January 2020

ADM Energy PLC

("ADM" or the "Company")

Strategy Update

ADM Energy PLC (AIM:ADME), an oil and gas investing company

quoted on AIM, provides a strategy update for 2020 and beyond.

In the second half of the year, the Company made significant

changes to the Board and strengthened the management team to take

advantage of the assets now being made available across Nigeria and

West Africa.

Specifically, it appointed Osamede ("Osa") Okhomina, a

specialist in the Nigerian Oil & Gas sector with deep-rooted

connections in the country and across West Africa, as its Chief

Executive Officer. It also appointed Peter Francis, a veteran of

the oil industry, as Non-Executive Chairman, and financier Manuel

Lamboley as Non-Executive Director.

As a result of the Board and management changes, the Company

will be progressing in a meaningful way its plans to build a larger

investment portfolio of projects. By leveraging its extensive

network across Africa, the new management team has identified a

number of investment opportunities and contines to evaluate new

potential investments in assets at varying stages of the production

cycle including appraisal, development and producing assets. It has

also actively engaged in conversations with a number of parties

including potential funding partners, off-takers and local project

partners to further support the Company in the development of its

asset portfolio.

Investment Approach

The Company's primary approach to investments will be to

"option" appraisal assets where oil and gas has already been

discovered, conduct a detailed evaluation, and then make a debt or

equity contribution to access future upside. The benefit of this

approach is that the Company raises equity only after the asset has

been secured.

The Board believes that in the upstream sector, the

international oil companies ("IOC") have divestment programmes

planned and management estimates that up to 500,000 barrels per day

could be sold to independent operators. For these deals to be

financed, they will require local expertise, close relationships

and experience of operating in the region. As a result, ADM plans

to acquire value investments by adopting the following methods:

International Trading Partners

In the Board's opinion, the major oil traders have become the

de-facto financiers for many acquisitions, however they often

struggle to find partners with the necessary credibility. It is the

intention of ADM to use the relationships of the senior management

team to partner with these trading companies, who can provide

capital for projects identified by ADM and whose strong balance

sheets will underpin ADM's potential asset purchases.

Debt Finance

Furthermore, the Company has mature, long-standing relationships

in place with key providers of debt within Africa which are

supportive of natural resource deals. These can potentially provide

the Company with funding to be deployed alongside its equity

investment.

Equity as Currency

In addition to the IOCs, there are several local companies

looking for financing. In this instance, ADM intends to use its

local experience and trusted relationships of its leadership team

to invest in such companies willing to do part-cash and part-equity

deals.

Corporate Update

The appointment of Osa as CEO in July 2019 significantly

expanded ADM's network of industry contacts and expertise in oil

and gas across West Africa. Osa, who was educated in Nigeria and

the UK before attending Cambridge University, has 18 years'

experience in the upstream oil & gas sector, originating and

completing multiple transactions in Nigeria as well as Equatorial

Guinea, Libya and Mauritania, including joint ventures with

ExxonMobil and Chevron. As a result, he has extensive industry

contacts within Nigeria and with IOCs. He also has considerable

familiarity with how the Nigerian government works through his

personal business dealings with several federal ministries.

Additionally, the Company has augmented the Board with the

appointment of Peter Francis as Non-Executive Chairman, bringing

over 35 years of experience working with major international oil

companies including ExxonMobil.

ADM has also appointed Manuel Lamboley, a financier with over 30

years' experience in international broking and investment banking,

predominantly in the natural resources sector, to the role of

Non-Executive Director. Manuel is based in Geneva and holds

extensive contacts with commodity trading houses and European

Investors. He has been instrumental in helping to bring fresh

capital into the Company.

Since August 2019, ADM has raised approximately GBP1.32 million

in two fundraises to help strengthen its balance sheet. In doing

so, it has brought in new long-term investors which have helped to

build up the Company's supportive shareholder base.

Meanwhile, the recent appointment of Fox-Davies Capital Limited

("Fox-Davies") as the Company's Lead Broker, and Fox-Davies Capital

DIFC as financial adviser, adds signficiant specialist knowledge of

the industry and African markets that will assist ADM in executing

its investment strategy. As a broker, Fox-Davies has extensive

relationships with dedicated oil investors and investors outside

the UK. The Company believes this to be a complementary appointment

to the work and assitance provided by Pello Capital.

The Company has also appointed a financial controller to

strengthen its accounting function. These measures are part of

ADM's commitment to add both technical expertise and financial

oversight as the Company seeks to expand its investment

portfolio.

Osamede Okhomina, CEO of ADM Energy, commented: "I joined ADM

because I have long recognised the value that could be created by

structuring oil and gas opportunities through public markets. The

Company has set out a clear strategy based on the strength of our

existing asset base and our team's ability to identify additional

undervalued investments. As a country, Nigeria represents a

compelling value proposition for investors. It is a buyer's market,

with many of the oil majors embarking on significant divestment

programmes. This opens up an opportunity for companies that have

the local contacts, experience and financing options to acquire

assets at very attractive prices. Consequently, we are very much

looking forward to an exciting 2020 for ADM and hope to have an

active deal flow to accelerate our growth."

For further information, please contact:

ADM Energy plc +44 20 7786 3555

Osamede Okhomina, CEO

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Fox-Davies Capital Ltd +44 20 3884 8450

(Lead Broker)

Daniel Fox-Davies, Lionel Therond

Pello Capital Limited +44 20 3700 2500

(Joint Broker)

Dan Gee

Luther Pendragon +44 20 7618 9100

(Financial PR)

Harry Chathli, Alexis Gore, Joe Quinlan

About ADM Energy PLC

ADM Energy (AIM:ADME) is a natural resources investment company

with an existing asset base in Nigeria. ADM Energy holds a 5%

equity investment in the Aje Field, part of OML 113, which covers

an area of 835 sq km offshore Nigeria. Aje has multiple oil, gas

and gas condensate reservoirs in the Turonian, Cenomanian and

Albian sandstones with five wells drilled to date.

ADM Energy is seeking to build on its existing asset base in

Nigeria and target other investment opportunities across the West

African region in the oil and gas sector with attractive risk

reward profiles such as proven nature of reserves, level of

historic investment, established infrastructure, route to early

cash flow and exploration upside.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDBJMRTMTJTMAM

(END) Dow Jones Newswires

January 23, 2020 03:00 ET (08:00 GMT)

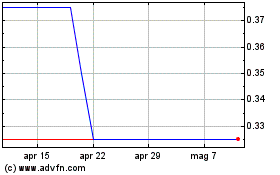

Grafico Azioni Adm Energy (LSE:ADME)

Storico

Da Mar 2024 a Apr 2024

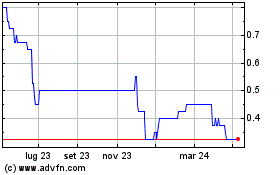

Grafico Azioni Adm Energy (LSE:ADME)

Storico

Da Apr 2023 a Apr 2024