TIDMZIN

RNS Number : 9028A

Zinc Media Group PLC

24 January 2020

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, THE REPUBLIC OF IRELAND, AUSTRALIA, CANADA, JAPAN,

THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE TO DO

SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS

OF THAT JURISDICTION.

Zinc Media Group plc

("Zinc Media" or the "Company")

PUBLICATION OF CIRCULAR

Further to its announcements of 17 January 2020, Zinc Media

Group plc, (AIM: ZIN), a leading TV and multimedia content

producer, confirms that it has today published a Circular relating

to its proposed placing of GBP3.5 million (gross), preference share

conversion, debt conversion, debt variation, share consolidation,

article amendments and share consolidation. The circular is

available to download from the Company's website,

www.zincmedia.com, and will today be posted to Shareholders who

have so elected.

Participation by Herald in the Placing and Preference Share

Conversion and by the John Booth Parties (as appropriate) in the

Placing and Debt Conversion gives rise to certain considerations

under the Code. Brief details of the Code and the protection this

affords Shareholders are in set out in the Circular.

Following completion of the Proposals, Herald's shareholding in

the Company will increase to 3,187,830 New Ordinary Shares,

equivalent to 40.30 per cent. of the Enlarged Share Capital and the

holding of the John Booth Parties will increase to 346,439 New

Ordinary Shares, equivalent to 4.38 per cent. of the Enlarged Share

Capital. In aggregate, the holding of the Concert Party will

increase to 3,534,269 New Ordinary Shares, equivalent to a total of

44.68 per cent. of the Enlarged Share Capital. Without a waiver of

the obligations under Rule 9 of the Code, these acquisitions would

require the Concert Party to make a general offer for the entire

issued and to be issued share capital of the Company not already

held by the Concert Party. The Panel has agreed with the Company to

grant such a waiver, subject to the passing at the General Meeting

by Independent Shareholders (being Shareholders other than the

members of the Concert Party) of the Whitewash Resolution, to be

taken on a poll.

Accompanying the Circular is a notice convening the General

Meeting, which is to be held at the offices of N+1 Singer, 1

Bartholomew Lane, London EC2N 2AX at 10.00 a.m. on 12 February

2020, at which the Resolutions, including the Whitewash Resolution,

will be proposed.

Application will be made to the London Stock Exchange for the

Placing Shares and the Conversion Shares to be admitted to trading

on AIM. It is expected that Admission will become effective at 8.00

a.m. on 13 February 2020. Following completion of the Share

Consolidation, the Company's New Ordinary Shares will continue to

be eligible for CREST settlement but will trade under a new ISIN,

GB00BJVLR251.

Capitalised terms used but not defined in this announcement have

the meanings set out in the announcement of 17 January 2020

released at 7.00 a.m. entitled 'Launch of Placing via Accelerated

Bookbuild'.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2020

Publication of the Circular 24 January

Latest time and date for receipt of Proxy

Votes 10.00 a.m. on 10 February

Record Date in respect of the Share Consolidation 6.00 p.m. on 12 February

General Meeting 10.00 a.m. on 12 February

Admission and dealings in the New Ordinary

Shares expected to commence on AIM 8.00 a.m. on 13 February

Where applicable, expected date for CREST

accounts to be credited in respect of the

New Ordinary Shares in uncertificated form 13 February

Where applicable, expected date for despatch

of definitive share certificates for New by no later than 27

Ordinary Shares in certificated form February

Expected date of initial directions hearing

of the Court (in respect of Capital Reduction)* 18 February

Record date in respect of the Capital Reduction* 6.00 p.m. on 16 March

Expected date of Court Hearing to confirm

the Capital Reduction* 17 March

Expected effective date for the Capital Reduction* 19 March

Notes:

1. Each of the times and dates above are indicative only and are

subject to change (including, in respect of those items marked '*',

any changes imposed by the Court). If any of the above times and/or

dates change, the revised times and/or dates will be notified by

the Company to Shareholders by announcement through a regulatory

information service.

2. All of the above times refer to London time unless otherwise stated.

3. The admission of the Placing Shares on AIM is conditional on,

inter alia, the passing of the Whitewash Resolution at the General

Meeting.

For further information, please contact:

Zinc Media Group plc +44 (0) 20 7878 2311

Mark Browning, CEO / Will Sawyer CFO

www.zincmedia.com

N+1 Singer (NOMAD and Joint Broker to Zinc

Media) +44 (0) 20 7496 3000

Mark Taylor / Lauren Kettle

Peterhouse Capital Limited (Joint Broker

to Zinc Media) +44 (0) 20 7469 0932

Martin Lampshire / Duncan Vasey / Eran Zucker

About Zinc

Zinc Media Group plc is a leading British based TV and content

creation company and operates 6 TV labels and a non-TV content

division called Zinc Communicate.

The six award winning and critically acclaimed television

production labels include: Blakeway, Brook Lapping, Films of

Record, Blakeway North, Reef Television and Tern Television, whose

brands produce television and radio programmes for both UK and

international broadcasters.

Zinc Communicate specialises in creating B2B communications

strategies and behaviour change programmes, campaigns and resources

for partners, businesses and government departments.

For further information on Zinc Media please visit:

http://www.zincmedia.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCSEEFLLESSEFF

(END) Dow Jones Newswires

January 24, 2020 09:17 ET (14:17 GMT)

Grafico Azioni Zinc Media (LSE:ZIN)

Storico

Da Mar 2024 a Apr 2024

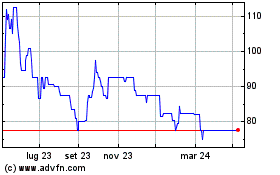

Grafico Azioni Zinc Media (LSE:ZIN)

Storico

Da Apr 2023 a Apr 2024