TIDMSVT

RNS Number : 0681B

Severn Trent PLC

28 January 2020

28 January 2020

Severn Trent Plc

Q3 Trading Update and AMP7 Dividend Policy

Severn Trent Plc today announces its Q3 trading update and a new

dividend policy for the next five years:

-- There have been no material changes to performance or outlook for the year 2019/20.

-- Severn Trent Water accepts its Final Determination for the period 2020-2025.

-- An AMP7 dividend policy with a growth rate of at least CPIH.

Trading update for the period 1 October 2019 to 28 January

2020

We continue to benefit from the efficiencies we have delivered

in AMP6, putting us on the right cost run rates for AMP7. Our

capital programme is now in its final stages with the Birmingham

Resilience Programme due to complete construction in March.

Overall, we remain on track to deliver at least GBP25 million in

customer ODI net outperformance payments for the year. This will

take the total amount deferred to AMP7 revenue to at least GBP177

million in nominal prices.

We continue to deliver improvements in our operational water

measures and the work we are doing to enhance our local environment

through the Water Framework Directive is progressing well. As

anticipated, the significantly more stretching targets we agreed

with Ofwat for our flooding measures have been challenging and we

expect penalties on some of these to partially offset

outperformance in other areas.

PR19 Final Determination

Following a detailed review, the Board of Severn Trent Water

Limited has decided to accept the Final Determination for the

period 2020-2025, published by Ofwat on 16 December 2019.

This decision has been made taking into consideration:

-- The 'in the round' approach taken by Ofwat;

-- A totex allowance for the next five years of GBP6.8 billion -

in line with our PR19 business plan;

-- Our stretching but achievable suite of customer ODIs, such as

a 15% reduction in leakage, 5% reduction in blockages, and helping

200,000 customers a year to pay their bill by 2025; and

-- An expected RCV real growth rate of 3.8%, creating long-term value for our shareholders.

AMP7 dividend policy

The Severn Trent Plc Board has reviewed the Final Determination

alongside current performance and, taken together with other market

considerations, is pleased to announce that the dividend policy for

AMP7 will be growth of at least CPIH. Based on the FY19/20 dividend

of 100.08p, the dividend for FY20/21 is therefore expected to be

101.58p, using CPIH of 1.50%(1) .

Webcast

We will be holding a short presentation and Q&A at 13:00 GMT

today, with Liv Garfield, Chief Executive, James Bowling, Chief

Financial Officer, and Shane Anderson, Head of Economic

Regulation.

To access the webcast online, please follow the link:

https://edge.media-server.com/mmc/p/mvujwi5f

If you are unable to access the webcast, you will find the

presentation on our website (severntrent.com) and conference call

details are as follows:

-- UK Dial-In: 08003767425

-- International Dial-In: +44 (0) 203 0095710

-- Conference ID: 5483307

(1) Based on November 2019 CPIH as reported by the Office of

National Statistics.

Financial calendar

Q3 Trading Update - This announcement is in place of the Q3

trading update scheduled on 5 February 2020. There will no longer

be a scheduled announcement on this day.

Capital Markets Day - Centred on delivering a sustainable

future, this Capital Markets Day will be held at Severn Trent

Centre, Coventry, on 4 March 2020. Please RSVP to

investorrelations@severntrent.co.uk.

Full year results - The Severn Trent annual results presentation

will take place on 20 May 2020 at the earlier time of 8.30am. Full

details will be circulated in due course.

Enquiries

Investors & Analysts

Rich Eadie Severn Trent Plc +44 (0) 7889 806578

Head of Investor Relations

Rachel Martin Severn Trent Plc +44 (0) 7824 624011

Investor Relations Manager

Media

Jonathan Sibun Tulchan Communications +44 (0) 207 353 4200

Press Office Severn Trent Plc +44 (0) 247 771 5640

Cautionary statement regarding forward-looking statements

This document contains statements that are, or may be deemed to

be, 'forward-looking statements' with respect to Severn Trent's

financial condition, results of operations and business and certain

of Severn Trent's plans and objectives with respect to these

items.

Forward-looking statements are sometimes, but not always,

identified by their use of a date in the future or such words as

'anticipates', 'aims', 'due', 'could', 'may', 'will', 'would',

'should', 'expects', 'believes', 'intends', 'plans', 'projects',

'potential', 'reasonably possible', 'targets', 'goal', 'estimates'

or words with a similar meaning, and, in each case, their negative

or other variations or comparable terminology. Any forward-looking

statements in this document are based on Severn Trent's current

expectations and, by their very nature, forward-looking statements

are inherently unpredictable, speculative and involve risk and

uncertainty because they relate to events and depend on

circumstances that may or may not occur in the future.

Forward-looking statements are not guarantees of future

performance and no assurances can be given that the forward-looking

statements in this document will be realised. There are a number of

factors, many of which are beyond Severn Trent's control that could

cause actual results, performance and developments to differ

materially from those expressed or implied by these forward-looking

statements. These factors include, but are not limited to: the

Principal Risks disclosed in our latest Annual Report and Accounts

(which have not been updated since the date of its publication);

changes in the economies and markets in which the group operates;

changes in the regulatory and competition frameworks in which the

group operates; the impact of legal or other proceedings against or

which affect the group; and changes in interest and exchange

rates.

All written or verbal forward-looking statements, made in this

document or made subsequently, which are attributable to Severn

Trent or any other member of the group or persons acting on their

behalf are expressly qualified in their entirety by the factors

referred to above. No assurances can be given that the

forward-looking statements in this document will be realised. This

document speaks as at the date of publication. Save as required by

applicable laws and regulations, Severn Trent does not intend to

update any forward-looking statements and does not undertake any

obligation to do so. Past performance of securities of Severn Trent

Plc cannot be relied upon as a guide to the future performance of

securities of Severn Trent Plc.

Nothing in this document should be regarded as a profits

forecast.

This document is not an offer to sell, exchange or transfer any

securities of Severn Trent Plc or any of its subsidiaries and is

not soliciting an offer to purchase, exchange or transfer such

securities in any jurisdiction. Securities may not be offered, sold

or transferred in the United States absent registration or an

applicable exemption from the registration requirements of the US

Securities Act of 1933 (as amended).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTPPUAPGUPUGMM

(END) Dow Jones Newswires

January 28, 2020 02:00 ET (07:00 GMT)

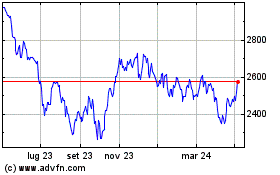

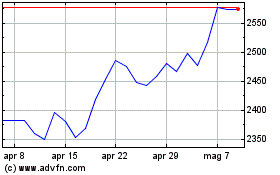

Grafico Azioni Severn Trent (LSE:SVT)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Severn Trent (LSE:SVT)

Storico

Da Apr 2023 a Apr 2024