Wine and Liquor Makers Toast Excise-Tax Defeat for Treasury Department

29 Gennaio 2020 - 11:44PM

Dow Jones News

By Richard Rubin

WASHINGTON -- Makers of wines and spirits are celebrating a

federal-court decision that could save them billions of dollars in

excise taxes each year.

The ruling struck down Treasury Department regulations from 2018

that attempted to end what government officials saw as an unfair

benefit for imported products.

Judge Jane Restani of the Court of International Trade wrote

that the Treasury Department offered seemingly valid policy

arguments for its position, but she determined that the regulations

contradicted laws passed by Congress.

"The Final Rule is contrary to the clear intent of Congress as

expressed in the language and structure of the statute," Judge

Restani wrote last week in ruling for the National Association of

Manufacturers, which challenged the rules. "If the public fisc does

suffer ultimately from uncollected excise tax, then it is up to

Congress to decide whether to remedy the situation."

The dispute stemmed from a provision known as a drawback of

taxes. Under longstanding U.S. law, companies can get import taxes

refunded if they have a matching or similar export. That system

effectively lets them pay taxes only on their net imports for each

product category.

Since 2004, due to what Treasury officials say was an error,

wine companies have been able to engage in what the government sees

as tax avoidance. The companies produce bottles for export, never

paying excise taxes because the bottles weren't meant for domestic

consumption. Then, as the companies export those bottles and import

others, they seek and get refunds of the import taxes.

That benefit was set to expand to spirits makers and others

before Treasury issued its regulations. According to the Treasury

Department, that is a "double drawback" that puts domestic products

subject to excise taxes at a disadvantage and could cost the

government up to $3.3 billion a year in revenue.

"Excise taxes are intended to be paid on alcohol, tobacco, and

other goods that are sold and consumed in the U.S., whether

produced here or imported," said Adam Looney, a former Treasury

official who now teaches at the University of Utah. "The ruling now

means that those firms that both import and export alcohol no

longer will pay excise taxes on the alcohol they import and

sell."

The ruling is a victory for companies such as Diageo PLC, Pernod

Ricard SA and Altria Group Inc. that filed comments criticizing the

regulations.

"We were pleased with the ruling as we did not agree with

Treasury's decision on the regulations and it reversed a

longstanding policy that was widely accepted," Michael Kaiser, vice

president of WineAmerica, an industry trade group, said in an

email.

Industry officials say drawback encourages U.S. exports and

praised the judge's decision.

"We are pleased that the U.S. Court of International Trade

recognized that federal law clearly provides for the refund of

certain taxes when manufacturers export similar products," said

Peter Tolsdorf, deputy general counsel for the manufacturers

group.

The Treasury Department declined to comment.

(END) Dow Jones Newswires

January 29, 2020 17:29 ET (22:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

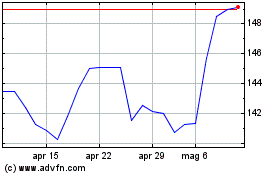

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Mar 2024 a Apr 2024

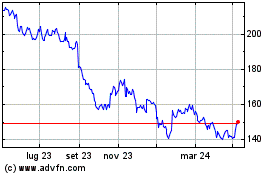

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Apr 2023 a Apr 2024