TIDMRECI

RNS Number : 3546B

Real Estate Credit Investments Ltd

30 January 2020

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, TO ANY "US PERSONS" (WITHIN THE

MEANING GIVEN TO IT IN REGULATION S UNDER THE US SECURITIES ACT OF

1933, AS AMED) OR INTO THE UNITED STATES, AUSTRALIA, CANADA, SOUTH

AFRICA OR JAPAN, OR ANY OTHER JURISDICTION, OR TO ANY PERSON, WHERE

DOING SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

Investors should not purchase or subscribe for any transferrable

securities referred to in this announcement except on the basis of

publicly available information published by the Company and not by

any other person.

This announcement does not constitute or form a part of any

offer to sell or issue, or a solicitation of any offer to purchase

or otherwise acquire, securities by any US Persons or in the United

States or in any other jurisdiction in which such offer or

solicitation would be unlawful. This announcement does not

constitute or form part of any offer or invitation to sell or

issue, or the solicitation of an offer to purchase, subscribe for

or otherwise acquire, any securities other than the securities to

which it relates or any offer or invitation to sell or issue, or

any solicitation of any offer to purchase, subscribe for or

otherwise acquire, such securities by any person in any

circumstances in which such offer or solicitation would be

unlawful.

30 January 2020

Real Estate Credit Investments Limited

Proposed Issue of New Ordinary Shares

Real Estate Credit Investments Limited (the "Company") is

pleased to announce that it intends to issue up to 19,920,363 new

ordinary shares ("New Ordinary Shares") in the Company to new and

existing investors pursuant to the authority granted to the

Directors by Shareholders at the Company's annual general meeting

held on 17 September 2019 (the "Issue").

The price at which each New Ordinary Share will be issued

pursuant to the Issue will be 168 pence (the "Issue Price").

The Company's board of directors (the "Directors" or "Board"),

as advised by Cheyne Capital Management (UK) LLP (the "Investment

Manager"), continues to be positive about the investment

opportunities available within real estate credit markets. It is

the Investment Manager's view that whilst economic and Brexit

related uncertainty exists, the UK and Western European real estate

markets continue to offer an attractive combination of underlying

tenant demand, relatively liquid investment markets and a shortage

of debt capital. In light of this, and present investment

opportunities in which the Company wishes to participate following

the Issue, the Board believes that the Issue is in the best

interests of the Company and its shareholders as a whole.

The net proceeds of the Issue are intended primarily to be

invested in debt secured by commercial or residential properties in

the United Kingdom and Western Europe, which might take the form

of: (i) secured senior real estate loans; and (ii) securitised

tranches of secured real estate related debt securities such as

commercial mortgage-backed securities.

Liberum Capital Limited ("Liberum") has been appointed as sole

bookrunner to procure placees to participate in the Issue and

Cheyne Capital Management (UK) LLP ("Cheyne") has been appointed to

provide introducing services, as the Company seeks to broaden its

investor base, for which Cheyne will be entitled to receive a

commission from Liberum.

Details of the Issue

The New Ordinary Shares to be issued pursuant to the Issue will

be issued under the Company's general authority to allot and issue

equity securities contained in Article 5 of the Company's articles

of incorporation (the "Articles"). The Issue will be conducted by

the Company on a non-pre-emptive basis pursuant to the authority

granted to the Directors by an extraordinary resolution of the

shareholders passed at the Company's annual general meeting held on

17 September 2019. The Company currently has capacity to issue up

to 19,920,363 New Ordinary Shares under this authority. The Issue

is being conducted by the Company pursuant to Article 1(5)(a) of

Regulation (EU) 2017/1129 such that the Company is not required to

publish a prospectus in connection with the Issue.

The Issue is being conducted through a bookbuild process which

will be launched immediately following this announcement (the

"Bookbuild"), in accordance with the terms and conditions set out

in the Appendix to this announcement.

The size and timing of the closing of the book and allocation is

at the discretion of Liberum. The number of New Ordinary Shares and

allocation are to be determined by Liberum (in consultation with

the Company) at the close of the Bookbuild. Details of the number

of New Ordinary Shares will be announced as soon as practicable

after the close of the Bookbuild.

The New Ordinary Shares will, when issued, be credited as fully

paid and will rank pari passu in all respects with the existing

ordinary shares of the Company, including the right to receive all

dividends and other distributions declared, made or paid on or in

respect of such shares after the date of issue of the New Ordinary

Shares.

Applications will be made to the Financial Conduct Authority

("FCA") and the London Stock Exchange ("LSE") for the New Ordinary

Shares issued pursuant to the Issue to be admitted to the premium

segment of the FCA's Official List and to trading on the premium

segment of the LSE's Main Market for listed securities

("Admission"). It is expected that Admission will become effective

and dealings in New Ordinary Shares will commence on or around 6

February 2020.

The Issue is conditional upon, amongst other things, Admission

becoming effective and Liberum's obligations in connection with the

Issue becoming unconditional and not being terminated.

The appendix to this announcement (which forms part of this

announcement) sets out the terms and conditions of the Issue (the

"Issue Terms and Conditions"). By choosing to participate in the

Issue and by making an oral and legally binding offer to acquire

New Ordinary Shares, investors will be deemed to have read and

understood this announcement in its entirety (including the

appendix) and to be making such offer on the terms and subject to

the Issue Terms and Conditions, and to be providing the

representations, warranties and acknowledgements contained in the

Issue Terms and Conditions.

This announcement has been prepared by, and is the sole

responsibility of, Real Estate Credit Investments Limited. This

announcement has been released by Chris Copperwaite of Aztec

Financial Services (Guernsey) Limited, Secretary of the

Company.

Enquiries

Cheyne Capital Management (UK) LLP +44 (0) 20 7968 7328

Richard Lang

Liberum Capital Limited (Sole Bookrunner) +44 20 3100 2222

Shane Le Prevost

Richard Crawley

Richard Bootle

Laura Hamilton

Important notice

Article 1(5)(a) of Regulation (EU) 2017/1129 provides that the

obligation to publish a prospectus shall not apply to the admission

to trading on a regulated market of any securities fungible with

securities already admitted to trading on the same regulated

market, provided that they represent, over a period of 12 months,

less than 20 per cent. of the number of securities already admitted

to trading on the same regulated market. The number of New Ordinary

Shares to be issued by the Company pursuant to the Issue is less

than 20 per cent. of the number of Ordinary Shares admitted to

trading on the London Stock Exchange and the Company has therefore

not issued a prospectus in connection with the Issue. Accordingly,

investors should not purchase or subscribe for any transferrable

securities pursuant to the Issue except on the basis of publicly

available information published by the Company.

The merits or suitability of any securities must be

independently determined by the recipient on the basis of its own

investigation and evaluation of the Company. Any such determination

should involve, among other things, an assessment of the legal,

tax, accounting, regulatory, financial, credit and other related

aspects of the securities.

This announcement does not constitute a recommendation regarding

the possible offering or the provision of investment advice by any

party. No information in this announcement should be construed as

providing financial, investment or other professional advice and

each prospective investor should consult its own legal, business,

tax and other advisers in evaluating the investment

opportunity.

Nothing in this announcement constitutes investment advice and

any recommendations that may be contained herein have not been

based upon a consideration of the investment objectives, financial

situation or particular needs of any specific recipient.

All investments are subject to risk, including the loss of the

principal amount invested. Past performance is not a reliable

indicator of future results. Potential investors should be aware

that any investment in the Company is speculative, involves a high

degree of risk, and could result in the loss of all or

substantially all of their investment. Results can be positively or

negatively affected by market conditions beyond the control of the

Company or any other person.

This announcement is only addressed to or directed at persons in

the United Kingdom who: (i) have professional experience in matters

relating to investments and fall within the definition of

"investment professionals" in Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (the

"Order"); or (ii) high net worth companies, unincorporated

associations and partnerships and trustees of high value trusts as

described in Article 49(2) of the Order; or (iii) are other persons

to whom it may otherwise lawfully be communicated (all such persons

referred to in (i), (ii) and (iii) together being "Relevant

Persons"). Any investment or investment activity to which this

announcement relates is available only to and will only be engaged

in with the persons referred to in (i), (ii) and (iii).

Neither this announcement nor any part or copy of it may be

taken or transmitted into the United States, Australia, Canada,

South Africa or Japan, or distributed, in whole or in part,

directly or indirectly, to any US Persons or in or into the United

States, Australia, Canada, South Africa, Japan or any other

jurisdiction where, or to any other person to whom, to do so would

constitute a violation of applicable law. Any failure to comply

with this restriction may constitute a violation of applicable law.

This announcement does not constitute or form a part of any offer

to sell or issue, or a solicitation of any offer to purchase or

otherwise acquire, securities by any US Persons or in the United

States or in any other jurisdiction in which such offer or

solicitation would be unlawful. Persons into whose possession this

announcement comes should observe all relevant restrictions.

The Company has not been and will not be registered under the US

Investment Company Act of 1940, as amended (the "US Investment

Company Act") and as such investors are not and will not be

entitled to the benefits of the US Investment Company Act. The

Ordinary Shares have not been and will not be registered under the

US Securities Act of 1933, as amended (the "US Securities Act") or

with any securities regulatory authority of any state or other

jurisdiction of the United States, and may not be offered, sold,

resold, pledged, taken up, exercised, renounced, delivered,

distributed or transferred, directly or indirectly, into or within

the United States or to, or for the account or benefit of, US

Persons, except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the US Securities

Act and in compliance with any applicable securities laws of any

state or other jurisdiction of the United States and in a manner

which would not result in the Company being required to register as

an "investment company" under the US Investment Company Act. In

connection with the Issue, subject to certain exceptions, offers

and sales of Ordinary Shares will be made only outside the United

States in "offshore transactions" to non-US Persons pursuant to

Regulation S under the US Securities Act. There has been and will

be no public offering of the Ordinary Shares in the United

States.

Neither the US Securities and Exchange Commission, nor any

securities regulatory authority of any state or other jurisdiction

of the United States, has approved or disapproved of the securities

of the Company or passed upon or endorsed the merits of any

offering of such securities.

Prospective investors should take note that any securities may

not be acquired by (i) investors using assets of (A) an "employee

benefit plan" as defined in Section 3(3) of the US Employee

Retirement Income Security Act of 1974, as amended ("ERISA") that

is subject to Title I of ERISA; (B) a "plan" as defined in Section

4975 of the US Internal Revenue Code of 1986, as amended (the "US

Tax Code"), including an individual retirement account or other

arrangement that is subject to Section 4975 of the US Tax Code; or

(C) an entity which is deemed to hold the assets of any of the

foregoing types of plans, accounts or arrangements that is subject

to Title I of ERISA or Section 4975 of the US Tax Code or (ii) a

governmental, church, non-US or other employee benefit plan that is

subject to any federal, state, local or non-US law that is

substantially similar to the provisions of Title I of ERISA or

Section 4975 of the US Tax Code.

Liberum is authorised and regulated in the United Kingdom by the

Financial Conduct Authority. Liberum is acting solely for the

Company and no one else in connection with the Issue and will not

be responsible to anyone other than the Company for providing the

protections afforded to clients of Liberum or for affording advice

in relation to any transaction or arrangement referred to in this

announcement. This announcement does not constitute any form of

financial opinion or recommendation on the part of Liberum or any

of its affiliates and is not intended to be an offer, or the

solicitation of any offer, to buy or sell any securities.

Target Market Assessment

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended or supplemented from time to time

("MiFID II"); (b) Articles 9 and 10 of Commission Delegated

Directive (EU) 2017/593 supplementing MiFID II; and (c) local

implementing measures (together, the "MiFID II Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any manufacturer (for

the purposes of the MiFID II Product Governance Requirements) may

otherwise have with respect thereto, the New Ordinary Shares have

been subject to a product approval process, which has determined

that the New Ordinary Shares are: (i) compatible with an end target

market of retail investors and investors who meet the criteria of

professional clients and eligible counterparties, each as defined

in MiFID II; and (ii) eligible for distribution through all

distribution channels as are permitted by MiFID II (the "Target

Market Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: the market price of the New Ordinary Shares may

decline and investors could lose all or part of their investment;

the New Ordinary Shares offer no guaranteed income and no capital

protection; and an investment in the New Ordinary Shares is

compatible only with investors who do not need a guaranteed income

or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating

the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result therefrom.

The Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Issue. Furthermore, it is noted

that, notwithstanding the Target Market Assessment, Liberum will

only procure investors who meet the criteria of professional

clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the New Ordinary

Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels.

Forward-looking statements

This announcement may contain forward-looking statements

regarding the financial condition, results of operations, cash

flows, dividends, financing plans, business strategies, operating

efficiencies, budgets, capital and other expenditures, competitive

positions, growth opportunities, plans and objectives of management

and other matters relating to the Company. Statements in this

announcement that are not statements of historical facts are hereby

identified as forward-looking statements. In some instances,

forward-looking statements can be identified by the use of

forward-looking terminology, including terms such as "projects",

"forecasts", "anticipates", "expects", "believes", "intends",

"may", "will" or "should" or, in each case, their negative or other

variations or comparable terminology.

By their nature, forward-looking statements involve risk and

uncertainty as they relate to future events and circumstances.

Forward-looking statements are not guarantees of future

performance, and the actual results, performance or achievements of

the Company, and development of the markets and the industries in

which it operates or is likely to operate, may differ materially

from those described in, or suggested by, any forward-looking

statements contained in this announcement. In addition, even if

actual results, performance, achievements or developments are

consistent with any forward-looking statements contained in this

announcement in a given period, those results, performance,

achievements or developments may not be indicative of results,

performance, achievements or developments in subsequent periods. A

number of factors could cause results, performance, achievements

and developments to differ materially from those expressed or

implied by any forward-looking statements including, without

limitation, general economic and business conditions, industry

trends, competition, changes in regulation and currency

fluctuations.

Any forward-looking statements in this announcement reflect the

Company's current view with respect to future events, speak only as

of their date and are subject to change without notice. Save as

required by applicable law or regulation, the Company and the other

parties named in this announcement expressly disclaim any

obligation or undertaking to update, review or revise any

forward-looking statement contained in this announcement whether as

a result of new information, future developments or otherwise.

APPIX

TERMS AND CONDITIONS OF THE ISSUE

1. INTRODUCTION

1.1 Defined terms used in these Issue Terms and Conditions and

not otherwise defined shall have the meanings ascribed to them in

the announcement of the Company with respect to the Issue released

today (the "Announcement").

1.2 Each placee which confirms its agreement (whether orally or

in writing) to the Company and Liberum to subscribe for the New

Ordinary Shares under the Issue (a "Placee") will be bound by these

terms and conditions and will be deemed to have accepted them.

1.3 The Company and/or Liberum may require any Placee to agree

to such further terms and/or conditions and/or give such additional

warranties and/or representations as it/they (in its/their absolute

discretion) see fit and may require any such Placee to execute a

separate placing letter.

2. AGREEMENT TO SUBSCRIBE FOR NEW ORDINARY SHARES

2.1 Liberum's obligations in respect of the Issue of the New

Ordinary Shares are conditional on, inter alia:

2.1.1 the representations and warranties given by the Company

and the Investment Manager to Liberum being true and accurate in

all material respects and not misleading on and as of the date of

the Announcement and immediately before Admission and the release

of any public or press announcement by the Company in connection

with the Issue, including an announcement of the results of the

Issue;

2.1.2 Admission taking place not later than 8:00 am on 6

February 2020, or such later date as is agreed in writing between

the Company and Liberum, but in any event not later than 8:00 am on

20 February 2020; and

2.1.3 Liberum's obligations in relation to the Issue becoming

otherwise unconditional in all respects in respect of the Issue and

not having been terminated before Admission.

2.2 Any commitment to acquire New Ordinary Shares under the

Issue agreed orally with Liberum, as agent for the Company, will

constitute an irrevocable, legally binding commitment upon that

person (who at that point will become a Placee) in favour of the

Company and Liberum, to subscribe for the number of the New

Ordinary Shares allocated to it and comprising its placing

confirmation on the terms and subject to the conditions set out in

the Announcement and in these Issue Terms and Conditions and in the

contract note (the "Contract Note") and in accordance with the

Articles. Except with the consent of Liberum, such oral commitment

will not be capable of variation, revocation or rescission after

the time at which it is made.

2.3 Each Placee's allocation of New Ordinary Shares under the

Issue will be evidenced by a Contract Note confirming: (i) the

Issue Price, (ii) the number of the New Ordinary Shares that such

Placee has agreed to acquire; (iii) the aggregate amount that such

Placee will be required to pay for such New Ordinary Shares; and

(iv) settlement instructions to pay Liberum, as agent for the

Company. The provisions as set out in the Announcement and in these

Issue Terms and Conditions will be deemed to be incorporated into

that Contract Note.

3. PAYMENT FOR NEW ORDINARY SHARES

3.1 Each Placee undertakes to pay the Issue Price for the New

Ordinary Shares issued to the Placee in the manner and by the time

directed by Liberum. In the event of any failure by any Placee to

pay as so directed and/or by the time required by Liberum, the

relevant Placee shall be deemed hereby to have appointed Liberum or

any nominee of Liberum as its agent to use its reasonable

endeavours to sell (in one or more transactions) any or all of the

New Ordinary Shares in respect of which payment shall not have been

made as directed, and to indemnify Liberum and its respective

affiliates (being (i) an affiliate of, or person affiliated with, a

specified person; or (ii) a person that directly, or indirectly

through one or more intermediaries, controls or is controlled by,

or is under common control with, the person specified

("Affiliate")) on demand in respect of any liability for stamp duty

and/or stamp duty reserve tax or any other liability whatsoever

arising in respect of any such sale or sales. A sale of all or any

of such New Ordinary Shares shall not release the relevant Placee

from the obligation to make such payment for the relevant New

Ordinary Shares to the extent that Liberum or its nominee has

failed to sell such New Ordinary Shares at a consideration which,

after deduction of the expenses of such sale and payment of stamp

duty and/or stamp duty reserve tax as aforementioned, exceeds the

Issue Price per New Ordinary Share.

3.2 Settlement of transactions in the New Ordinary Shares

following Admission will take place in CREST (as defined in clause

3.6) but Liberum reserves the right in its absolute discretion to

require settlement in certificated form if, in its opinion,

delivery or settlement is not possible or practicable within the

CREST system within the timescales previously notified to the

Placee (whether orally, in the Contract Note or otherwise) or would

not be consistent with the regulatory requirements in any Placee's

jurisdiction.

3.3 The Company will procure the delivery of the New Ordinary

Shares to the CREST accounts set out in the Contract Note. The

input to CREST by a Placee of a matching or acceptance instruction

will then allow delivery of the relevant New Ordinary Shares to

that Placee against payment.

3.4 Interest is chargeable daily on payments not received from

Placees on the due date in accordance with the arrangements set out

above at the rate of two percentage points above London Interbank

Offered Rate (LIBOR) as determined by Liberum.

3.5 If New Ordinary Shares are to be delivered to a custodian or

settlement agent, Placees should ensure that the Contract Note is

copied and delivered immediately to the relevant person within that

organisation. Insofar as New Ordinary Shares are registered in a

Placee's name or that of its nominee or in the name of any person

for whom a Placee is contracting as agent or that of a nominee for

such person, such New Ordinary Shares should, subject as provided

below, be so registered free from any liability to UK stamp duty or

stamp duty reserve tax. If there are any circumstances in which any

other stamp duty or stamp duty reserve tax (together with interest

and penalties) is payable in respect of the issue of the New

Ordinary Shares neither Liberum nor the Company shall be

responsible for the payment thereof.

3.6 For the purposes of this clause 3, "CREST" means the

relevant system as defined in the Uncertificated Securities

Regulations 2001 (SI 2001 No. 2001/3755), as amended (the "CREST

Regulations") in respect of which Euroclear UK & Ireland

Limited is the operator (as defined in the CREST Regulations) in

accordance with which securities may be held in uncertificated

form.

4. REPRESENTATIONS AND WARRANTIES

By agreeing to subscribe for New Ordinary Shares under the

Issue, each Placee which enters into a commitment to subscribe for

New Ordinary Shares will be (for itself and for any person(s)

procured by it to subscribe for the New Ordinary Shares and any

nominee(s) for any such person(s)) deemed to represent, warrant,

undertake, agree and acknowledge to each of the Company and Liberum

that:

4.1 in agreeing to subscribe for the New Ordinary Shares under

the Issue, it is relying on publicly available information

published by the Company, of which the Announcement and these Issue

Terms and Conditions form part, and not on any other information

given, or representation or statement made at any time, by any

other person, concerning the Company, the New Ordinary Shares or

the Issue. It agrees that none of the Company, Liberum, the

Investment Manager, Link Market Services (Guernsey) Limited (the

"Registrar"), or any of their respective officers, agents,

employees or Affiliates, will have any liability for any other

information or representation. It irrevocably and unconditionally

waives any rights it may have in respect of any other information

or representation;

4.2 if the laws of any territory or jurisdiction outside the

United Kingdom are applicable to its agreement to subscribe for New

Ordinary Shares, it warrants that it has complied with all such

laws, obtained all governmental and other consents which may be

required, complied with all requisite formalities and paid any

issue, transfer or other taxes due in connection with its

application in any territory and that it has not taken any action

or omitted to take any action which will result in the Company,

Liberum, the Investment Manager or the Registrar or any of their

respective officers, agents, employees or Affiliates acting in

breach of the regulatory or legal requirements, directly or

indirectly, of any territory or jurisdiction outside the United

Kingdom in connection with the Issue;

4.3 it has carefully read and understands the publicly available

information published by the Company and acknowledges that it is

acquiring New Ordinary Shares on the terms and subject to the

conditions set out in the Announcement and these Issue Terms and

Conditions and in the Contract Note and the Articles as in force at

the date of Admission;

4.4 the price payable per New Ordinary Share is payable to

Liberum on behalf of the Company in accordance with the terms of

these Issue Terms and Conditions and in the Contract Note;

4.5 it has the funds available to pay in full for the New

Ordinary Shares for which it has agreed to subscribe and it will

pay the total subscription amount in accordance with the terms set

out in these Issue Terms and Conditions and incorporated into the

Contract Note on the due time and date;

4.6 it has not relied on Liberum or any person affiliated with Liberum in connection with any investigation of the accuracy of any publicly available information published by the Company;

4.7 it acknowledges that the content of publicly available

information published by the Company is exclusively the

responsibility of the Company and the Directors and neither Liberum

nor any person acting on its behalf nor any of its Affiliates are

responsible for or shall have any liability for any information

published by or on behalf of the Company and will not be liable for

any decision by a Placee to participate in the Issue based on any

such information;

4.8 it acknowledges that no person is authorised in connection

with the Issue to give any information or make any representation

other than as contained in the Announcement and these Issue Terms

and Conditions and, if given or made, any information or

representation must not be relied upon as having been authorised by

Liberum, the Company or the Investment Manager;

4.9 it is not applying as, nor is it applying as nominee or

agent for, a person who is or may be liable to notify and account

for tax under the Stamp Duty Reserve Tax Regulations 1986 at any of

the increased rates referred to in section 67, 70, 93 or 96

(depository receipts and clearance services) of the Finance Act

1986;

4.10 it accepts that none of the New Ordinary Shares have been

or will be registered under the securities laws, or with any

securities regulatory authority, of the United States, Australia,

Canada, South Africa or Japan (each a "Restricted Jurisdiction").

Accordingly, the New Ordinary Shares may not be offered, sold,

issued or delivered, directly or indirectly, within any Restricted

Jurisdiction unless an exemption from any registration requirement

is available;

4.11 if it is within the United Kingdom, it is (a) a person who

falls within (i) Articles 49(2)(A) to (D) or (ii) Article 19(5) of

the Financial Services and Markets Act 2000 (Financial Promotions)

Order 2005 (the "Order") or is a person to whom the New Ordinary

Shares may otherwise lawfully be offered under such Order, or, if

it is receiving the offer in circumstances under which the laws or

regulations of a jurisdiction other than the United Kingdom would

apply, that it is a person to whom the Shares may be lawfully

offered under that other jurisdiction's laws and regulations and

(b) a qualified investor (as such term is defined in section 86(7)

of the Financial Services and Markets Act 2000 ("FSMA"));

4.12 if it is a resident in the EEA (other than the United

Kingdom), it is (a) a qualified investor within the meaning of the

law in the relevant EEA State implementing Article 2(1)(e)(i) or

(ii) of Directive 2003/71/EC on the prospectus to be published when

securities are offered to the public or admitted to trading and

amending Directive 2001/34/EC (the "Prospectus Directive") and (b)

if the Relevant Member State (being any Member State of the EEA

which has implemented the Prospectus Directive) has implemented EU

Directive 2011/61/EU on Alternative Investment Fund Managers, that

it is a person to whom the New Ordinary Shares may lawfully be

marketed to under the applicable implementing legislation (if any)

of the Relevant Member State;

4.13 in the case of any New Ordinary Shares acquired by a Placee

as a financial intermediary as that term is used in Article 3(2) of

the Prospectus Directive (i) the New Ordinary Shares acquired by it

in the Issue have not been acquired on behalf of, nor have they

been acquired with a view to their offer or resale to, persons in

any Relevant Member State other than qualified investors, as that

term is defined in the Prospectus Directive, or in circumstances in

which the prior consent of Liberum has been given to the offer or

resale; or (ii) where New Ordinary Shares have been acquired by it

on behalf of persons in any Relevant Member State other than

qualified investors, the offer of those New Ordinary Shares to it

is not treated under the Prospectus Directive as having been made

to such persons;

4.14 if it is outside the United Kingdom, neither the

Announcement and these Issue Terms and Conditions, nor any other

offering, marketing or other material in connection with the Issue

(for the purposes of these Issue Terms and Conditions, each an

"Issue Document") constitutes an invitation, offer or promotion to,

or arrangement with, it or any person whom it is procuring to

subscribe for New Ordinary Shares pursuant to the Issue unless, in

the relevant territory, such offer, invitation or other course of

conduct could lawfully be made to it or such person and such

documents or materials could lawfully be provided to it or such

person and New Ordinary Shares could lawfully be distributed to and

subscribed and held by it or such person without compliance with

any unfulfilled approval, registration or other regulatory or legal

requirements;

4.15 it does not have a registered address in, and is not a

citizen, resident or national of, Australia, Canada, South Africa

or Japan or any jurisdiction in which it is unlawful to make or

accept an offer of the New Ordinary Shares and it is not acting on

a non-discretionary basis for any such person;

4.16 if the investor is a natural person, such investor is not

under the age of majority (18 years of age in the United Kingdom)

on the date of such investor's agreement to subscribe for New

Ordinary Shares under the Issue;

4.17 it has only communicated or caused to be communicated and

will only communicate or cause to be communicated any invitation or

inducement to engage in investment activity (within the meaning of

section 21 of FSMA) relating to the New Ordinary Shares in

circumstances in which section 21(1) of FSMA does not require

approval of the communication by an authorised person and you

acknowledge and agree that no Issue Document is being issued by

Liberum in its capacity as an authorised person under section 21 of

FSMA and such documents may not therefore be subject to the

controls which would apply if they were made or approved as a

financial promotion by an authorised person;

4.18 it is aware of and acknowledges that it is required to

comply with all applicable provisions of FSMA with respect to

anything done by it in relation to the New Ordinary Shares in, from

or otherwise involving, the United Kingdom;

4.19 it is aware of the provisions of the Criminal Justice Act

1993 regarding insider dealing, the EU Market Abuse Regulation

(596/2014) and the Proceeds of Crime Act 2002 and confirms that it

has and will continue to comply with any obligations imposed by

such statutes and/or regulations;

4.20 unless it is expressly agreed otherwise with the Company

and Liberum, it has not, directly or indirectly, distributed,

forwarded, transferred or otherwise transmitted the Announcement,

these Issue Terms and Conditions, or any other Issue Document to

any persons within the United States or to any US Persons, nor will

it do any of the foregoing;

4.21 it represents, acknowledges and agrees to the

representations, warranties and agreements as set out under the

heading "United States Purchase and Transfer Restrictions" in

clause 5 below;

4.22 no action has been taken or will be taken in any

jurisdiction other than the United Kingdom that would permit a

public offering of the New Ordinary Shares in any country or

jurisdiction where action for that purpose is required;

4.23 it acknowledges that neither Liberum nor any of its

Affiliates nor any person acting on its or their behalf is making

any recommendations to it, advising it regarding the suitability of

any transactions it may enter into in connection with the Issue or

providing any advice in relation to the Issue and participation in

the Issue is on the basis that it is not and will not be a client

of Liberum and that Liberum does not have any duties or

responsibilities to it for providing protections afforded to its

clients or for providing advice in relation to the Issue;

4.24 that, save in the event of fraud on the part of Liberum,

none of Liberum, its ultimate holding companies nor any direct or

indirect subsidiary undertakings of such holding companies, nor any

of their respective directors, members, partners, officers and

employees, shall be responsible or liable to a Placee or any of its

clients for any matter arising out of Liberum's role as sole

bookrunner or otherwise in connection with the Issue and that where

any such responsibility or liability nevertheless arises as a

matter of law the Placee and, if relevant, its clients, will

immediately waive any claim against any of such persons which the

Placee or any of its clients may have in respect thereof;

4.25 it acknowledges that where it is subscribing for the New

Ordinary Shares for one or more managed, discretionary or advisory

accounts, it is authorised in writing for each such account: (i) to

subscribe for the New Ordinary Shares for each such account; (ii)

to make on each such account's behalf the representations,

warranties and agreements set out in the Announcement and these

Issue Terms and Conditions; and (iii) to receive on behalf of each

such account any documentation relating to the Issue in the form

provided by the Company and/or Liberum. It agrees that the

provisions of this clause shall survive any resale of the New

Ordinary Shares by or on behalf of any such account;

4.26 it irrevocably appoints any Director and any director of

Liberum to be its agent and on its behalf (without any obligation

or duty to do so), to sign, execute and deliver any documents and

do all acts, matters and things as may be necessary for, or

incidental to, its subscription for all or any of the New Ordinary

Shares for which it has given a commitment under the Issue, in the

event of its own failure to do so;

4.27 it accepts that if the Issue does not proceed or the New

Ordinary Shares for which valid applications are received and

accepted are not admitted to trading on the premium segment of the

Main Market, in each case for any reason whatsoever, then none of

Liberum or the Company or the Investment Manager, nor persons

controlling, controlled by or under common control with any of them

nor any of their respective employees, agents, officers, members,

stockholders, partners or representatives, shall have any liability

whatsoever to it or any other person;

4.28 in connection with its participation in the Issue it has

observed all relevant legislation and regulations, in particular

(but without limitation) those relating to money laundering and

that its application is only made on the basis that it accepts full

responsibility for any requirement to verify the identity of its

clients and other persons in respect of whom it has applied. In

addition, it warrants that it is a person: (i) subject to the Money

Laundering Regulations 2007 (SI 2007 No. 2157) in force in the

United Kingdom; or (ii) subject to the Money Laundering Directive

(2015/849/EC) of the European Parliament (the "Money Laundering

Directive") and of the EC Council of 20 May 2015 on the prevention

of the use of the financial system for the purpose of money

laundering and terrorist financing); or (iii) subject to the

Criminal Justice (Proceeds of Crime) (Bailiwick of Guernsey) Law,

1999 (as amended), ordinances, rules and regulations made

thereunder, and the Guernsey Financial Services Commission's

Handbook for Financial Services Businesses on Countering Financial

Crime and Terrorist Financing (as amended); or (iv) acting in the

course of a business in relation to which an overseas regulatory

authority exercises regulatory functions and is based or

incorporated in, or formed under the law of, a country in which

there are in force provisions at least equivalent to those required

by the Money Laundering Directive;

4.29 it acknowledges that due to anti-money laundering

requirements, Liberum, Aztec Financial Services (Guernsey) Limited

(the "Administrator"), the Registrar and the Company may require

proof of identity and verification of the source of the payment

before the application can be processed and that, in the event of

delay or failure by the applicant to produce any information

required for verification purposes, Liberum and the Company may

refuse to accept the application and the subscription monies

relating thereto. It holds harmless and will indemnify Liberum and

the Company against any liability, loss or cost ensuing due to the

failure to process such application, if such information as has

been requested has not been provided by it in a timely manner;

4.30 that it is aware of, has complied with and will at all

times comply with its obligations in connection with money

laundering under the Proceeds of Crime Act 2002;

4.31 it acknowledges and agrees that information provided by it

to the Company, the Administrator or the Registrar will be stored

on the Registrar's and the Administrator's computer system and

manually;

4.32 by submitting personal data to the Administrator (acting

for and on behalf of the Company), the Registrar or Liberum:

4.32.1 in the case of a Placee, where (a) the Placee is a

natural person or (b) where the Placee is not a natural person,

he/she/it (as the case may be) represents and warrants that

he/she/it (as applicable):

(A) has read and understood the terms of the privacy notice as

set out on the Company's website (the "Privacy Notice"); and/or

(B) has brought the Privacy Notice to the attention of any

underlying data subjects on whose behalf or account the Placee may

act or whose personal data will be disclosed to the Company,

Liberum, the Registrar and the Administrator as a result of the

Placee subscribing for New Ordinary Shares under the Issue; and

(C) the Placee has complied in all other respects with Data

Protection Laws (as defined in clause 4.32.3 below) in respect of

the disclosure and provision of personal data to the Company;

or

4.32.2 where the Placee acts for or on account of an underlying

data subject, he/she/it shall, in respect

of the personal data it processes in relation to or arising out of the Issue:

(A) comply with all applicable Data Protection Laws;

(B) take appropriate technical and organisational measures

against unauthorised or unlawful processing of the personal data

and against accidental loss or destruction of, or damage to the

personal data;

(C) if required, agree with Company, the Administrator, Liberum

or the Registrar (as appropriate), the responsibilities of each

such entity as regards relevant data subjects' rights and notice

requirements; and

(D) immediately on demand, fully indemnify the Company, the

Administrator, Liberum and the Registrar and keep them fully and

effectively indemnified against all costs, demands, claims,

expenses (including legal costs and disbursements on a full

indemnity basis), losses (including indirect losses and loss of

profits, business and reputation), actions, proceedings and

liabilities of whatsoever nature arising from or incurred by the

Company, the Administrator, Liberum and the Registrar in connection

with any failure by the Placee to comply with the provisions of

this clause 4.32.2; and

4.32.3 for the purposes of this clause 4.32, "Data Protection

Laws" means Regulation (EU) 2016/619 on the protection of natural

persons with regard to the processing of personal data and on the

free movement of such data (known as the "General Data Protection

Regulation") and any associated code, regulation or guidance (as

may be amended or replaced from time to time), the Data Protection

(Bailiwick of Guernsey) Law 2001, as such may be varied, amended or

replaced from time to time, any successor legislation thereto and

any related regulations and guidance;

4.33 Liberum and the Company are entitled to exercise any of

their rights in relation to the Issue in their absolute discretion

without any liability whatsoever to them;

4.34 the representations, undertakings and warranties contained

in the Announcement and these Issue Terms and Conditions are

irrevocable. It acknowledges that Liberum and the Company and their

respective Affiliates will rely upon the truth and accuracy of the

foregoing and following representations and warranties and it

agrees that if any of the representations or warranties made or

deemed to have been made by its subscription of the New Ordinary

Shares are no longer accurate, it shall promptly notify Liberum and

the Company;

4.35 where it or any person acting on behalf of it is dealing

with Liberum, any money held in an account with Liberum on behalf

of it and/or any person acting on behalf of it will not be treated

as client money within the meaning of the relevant rules and

regulations of the FCA which therefore will not require Liberum to

segregate such money, as that money will be held by Liberum under a

banking relationship and not as trustee;

4.36 any of its clients, whether or not identified to Liberum,

will remain its sole responsibility and will not become clients of

Liberum for the purposes of the rules of the FCA or for the

purposes of any other statutory or regulatory provision;

4.37 it accepts that the allocation of the New Ordinary Shares

shall be determined by Liberum, in its absolute discretion, and

that it may scale down any Issue commitments for this purpose on

such basis as it may determine;

4.38 time shall be of the essence as regards its obligations to

settle payment for the New Ordinary Shares and to comply with its

other obligations under the Issue;

4.39 it authorises Liberum to deduct from the total amount

subscribed under the Issue the aggregation commission (if any)

(calculated at the rate agreed with the Placee) payable on the

number of the New Ordinary Shares allocated under the Issue;

4.40 the commitment to subscribe for New Ordinary Shares on the

terms set out in these Issue Terms and Conditions will continue

notwithstanding any amendment that may in the future be made to the

terms of the Issue and that it will have no right to be consulted

or require that its consent be obtained with respect to the

Company's conduct of the Issue;

4.41 it is capable of being categorised as a person who is a

"professional client" or an "eligible counterparty" within the

meaning of Chapter 3 of the FCA's Conduct of Business Sourcebook;

and

4.42 if it is acting as a "distributor" (for the purposes of the

MiFID II Product Governance Requirements):

4.42.1 it acknowledges that the target market assessment

undertaken by the Investment Manager and Liberum does not

constitute: (a) an assessment of suitability or appropriateness for

the purposes of MiFID II; or (b) a recommendation to any investor

or group of investors to invest in, or purchase, or take any other

action whatsoever with respect to, the New Ordinary Shares, and

each distributor is responsible for undertaking its own target

market assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels;

4.42.2 notwithstanding any target market assessment undertaken

by the Investment Manager and Liberum, it confirms that it has

satisfied itself as to the appropriate knowledge, experience,

financial situation, risk tolerance and objectives and needs of the

investors to whom it plans to distribute the New Ordinary Shares

and that it has considered the compatibility of the risk/reward

profile of such Shares with the end target market; and

4.42.3 it acknowledges that the price of the New Ordinary Shares

may decline and investors could lose all or part of their

investment; the New Ordinary Shares offer no guaranteed income and

no capital protection; and an investment in the New Ordinary Shares

is compatible only with investors who do not need a guaranteed

income or capital protection, who (either alone or in conjunction

with an appropriate financial or other adviser) are capable of

evaluating the merits and risks of such an investment and who have

sufficient resources to be able to bear any losses that may result

therefrom.

5. UNITED STATES PURCHASE AND TRANSFER RESTRICTIONS

5.1 Unless it is expressly agreed otherwise with the Company and

Liberum, by agreeing to subscribe for New Ordinary Shares, each

Placee which enters into a commitment with Liberum to subscribe for

New Ordinary Shares will (for itself and any person(s) procured by

it to subscribe for New Ordinary Shares and any nominee(s) for any

such person(s)) be deemed to represent, warrant, undertake, agree

and acknowledge to Liberum, the Company, the Registrar, the Board,

the Investment Manager and their respective Affiliates, that:

5.1.1 it is not a US Person, is not located within the United

States at the time it received the offer to subscribe for New

Ordinary Shares and is not acquiring the New Ordinary Shares for

the account or benefit of a US Person;

5.1.2 it is acquiring the New Ordinary Shares in a manner

qualifying as an "offshore transaction" meeting the requirements of

Regulation S under the US Securities Act;

5.1.3 the Ordinary Shares have not been and will not be

registered under the US Securities Act, or with any securities

regulatory authority of any state or other jurisdiction of the

United States, and may not be offered, sold, resold, pledged,

delivered, distributed or otherwise transferred, directly or

indirectly, into or within the United States or to, or for the

account or benefit of, US Persons, except pursuant to an exemption

from, or in a transaction not subject to, the registration

requirements of the US Securities Act and in compliance with any

applicable securities laws of any state or other jurisdiction of

the United States and in a manner which would not result in the

Company being required to register under the US Investment Company

Act;

5.1.4 the Company has not been and will not be registered under

the US Investment Company Act and as such investors are not and

will not be entitled to the benefits of the US Investment Company

Act, and that the Company has put in place restrictions on the

ability of investors to hold or transfer Ordinary Shares to ensure

that the Company is not and will not be required to register under

the US Investment Company Act;

5.1.5 no portion of the assets used to acquire, and no portion

of the assets used to hold, the New Ordinary Shares or any

beneficial interest therein constitutes or will constitute the

assets of (i) an "employee benefit plan" as defined in Section 3(3)

of ERISA that is subject to Title I of ERISA; (ii) a "plan" as

defined in Section 4975 of the US Tax Code, including an individual

retirement account or other arrangement that is subject to Section

4975 of the US Tax Code; or (iii) an entity which is deemed to hold

the assets of any of the foregoing types of plans, accounts or

arrangements that is subject to Title I of ERISA or Section 4975 of

the US Tax Code. In addition, if an investor is a governmental,

church, non-US or other employee benefit plan that is subject to

any federal, state, local or non-US law that is substantially

similar to the provisions of Title I of ERISA or Section 4975 of

the US Tax Code, its acquisition, holding, and disposition of the

New Ordinary Shares will not constitute or result in a non-exempt

violation of any such substantially similar law;

5.1.6 if any New Ordinary Shares are issued to it in

certificated form, then such certificates evidencing ownership will

contain a legend substantially to the following effect unless

otherwise determined by the Company in accordance with applicable

law:

REAL ESTATE CREDIT INVESTMENTS LIMITED (THE "COMPANY") HAS NOT

BEEN AND WILL NOT BE REGISTERED UNDER THE US INVESTMENT COMPANY ACT

OF 1940, AS AMED (THE "US INVESTMENT COMPANY ACT"). IN ADDITION,

THE SECURITIES OF THE COMPANY REPRESENTED BY THIS CERTIFICATE HAVE

NOT BEEN AND WILL NOT BE REGISTERED UNDER THE US SECURITIES ACT OF

1933, AS AMED (THE "US SECURITIES ACT"), OR WITH ANY SECURITIES

REGULATORY AUTHORITY OF ANY STATE OR OTHER JURISDICTION OF THE

UNITED STATES. ACCORDINGLY, THIS SECURITY MAY NOT BE OFFERED, SOLD,

PLEDGED OR OTHERWISE TRANSFERRED EXCEPT (I) IN AN OFFSHORE

TRANSACTION COMPLYING WITH THE PROVISIONS OF RULE 903 OR RULE 904

OF REGULATION S UNDER THE US SECURITIES ACT TO A PERSON OUTSIDE THE

UNITED STATES AND NOT KNOWN BY THE TRANSFEROR TO BE A "US PERSON"

AS DEFINED IN REGULATION S UNDER THE US SECURITIES ACT (A "US

PERSON") OR ACTING FOR THE ACCOUNT OR BENEFIT OF A US PERSON, BY

PRE-ARRANGEMENT OR OTHERWISE, (II) TO THE COMPANY OR A SUBSIDIARY

THEREOF, OR (III) PURSUANT TO ANOTHER EXEMPTION FROM THE

REGISTRATION REQUIREMENTS OF THE US SECURITIES ACT, IF ANY, IN EACH

CASE UNDER CIRCUMSTANCES WHICH WILL NOT REQUIRE THE COMPANY TO

REGISTER UNDER THE US INVESTMENT COMPANY ACT AND IN ACCORDANCE WITH

ALL APPLICABLE SECURITIES LAWS. IN ADDITION, THIS SECURITY MAY NOT

BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED TO ANY PERSON

USING THE ASSETS OF (I) (A) AN "EMPLOYEE BENEFIT PLAN" AS DEFINED

IN SECTION 3(3) OF THE US EMPLOYEE RETIREMENT INCOME SECURITY ACT

OF 1974, AS AMED ("ERISA"), THAT IS SUBJECT TO TITLE I OF ERISA;

(B) A "PLAN" AS DEFINED IN SECTION 4975 OF THE UNITED STATES

INTERNAL REVENUE CODE OF 1986, AS AMED (THE "US TAX CODE"),

INCLUDING AN INDIVIDUAL RETIREMENT ACCOUNT OR OTHER ARRANGEMENT

THAT IS SUBJECT TO SECTION 4975 OF THE US TAX CODE; OR (C) AN

ENTITY WHICH IS DEEMED TO HOLD THE ASSETS OF ANY OF THE FOREGOING

TYPES OF PLANS, ACCOUNTS OR ARRANGEMENTS THAT IS SUBJECT TO TITLE I

OF ERISA OR SECTION 4975 OF THE US TAX CODE OR (II) A GOVERNMENTAL,

CHURCH, NON-US OR OTHER EMPLOYEE BENEFIT PLAN THAT IS SUBJECT TO

ANY FEDERAL, STATE, LOCAL OR NON-US LAW THAT IS SUBSTANTIALLY

SIMILAR TO THE PROVISIONS OF TITLE I OF ERISA OR SECTION 4975 OF

THE US TAX CODE IF THE PURCHASE, HOLDING OR DISPOSITION OF THE

SECURITIES WOULD RESULT IN A VIOLATION OF APPLICABLE LAW AND/OR

CONSTITUTE A NON-EXEMPT PROHIBITED TRANSACTION UNDER SECTION 503 OF

THE US TAX CODE OR ANY SUBSTANTIALLY SIMILAR LAW.

NOTWITHSTANDING ANYTHING TO THE CONTRARY IN THE FOREGOING, THESE

SECURITIES MAY NOT BE DEPOSITED INTO ANY UNRESTRICTED DEPOSITARY

RECEIPT FACILITY IN RESPECT OF THE COMPANY'S SECURITIES,

ESTABLISHED OR MAINTAINED BY A DEPOSITARY BANK.

5.1.7 if in the future it decides to offer, resell, transfer,

assign, pledge or otherwise dispose of Ordinary Shares or any

beneficial interest therein, it will do so only (i) in an "offshore

transaction" complying with the provisions of Rule 903 or Rule 904

of Regulation S under the US Securities Act to a person outside the

United States and not known by the transferor to be a US Person, by

prearrangement or otherwise, (ii) to the Company or a subsidiary

thereof, or (iii) pursuant to another exemption from the

registration requirements of the US Securities Act, if any, and in

each case, in compliance with all applicable securities laws;

5.1.8 it is acquiring the New Ordinary Shares for its own

account or for one or more investment accounts for which it is

acting as a fiduciary or agent, in each case for investment only,

and not with a view to or for sale or other transfer in connection

with any distribution of Ordinary Shares in any manner that would

violate the US Securities Act, the US Investment Company Act or any

other applicable securities laws;

5.1.9 the Company reserves the right to make inquiries of any

holder of the Ordinary Shares or interests therein at any time as

to such person's status under US federal securities laws and to

require any such person that has not satisfied the Company that the

holding by such person will not violate or require registration

under US federal securities laws to transfer such Shares or

interests in accordance with the Articles;

5.1.10 the representations, warranties, undertakings, agreements

and acknowledgements contained herein are irrevocable and it

acknowledges that the Company, Liberum and their respective

directors, officers, agents, employees, advisers and others will

rely upon the truth and accuracy of the foregoing representations,

warranties, undertakings, agreements and acknowledgements;

5.1.11 if any of the foregoing representations, warranties,

undertakings, agreements or acknowledgements are no longer accurate

or have not been complied with, it will immediately notify the

Company; and

5.1.12 if it is acquiring any Shares as a fiduciary or agent for

one or more accounts, it has sole investment discretion with

respect to each such account and it has full power to make, and

does make, each of the foregoing representations, warranties,

undertakings, agreements and acknowledgements on behalf of each

such account.

6. SUPPLY OF INFORMATION

If Liberum, the Registrar or the Company or any of their agents

request any information about a Placee's agreement to subscribe for

the New Ordinary Shares under the Issue, such Placee must promptly

disclose it to them.

7. MISCELLANEOUS

7.1 The rights and remedies of the Company, the Registrar, the

Investment Manager and Liberum under these terms and conditions are

in addition to any rights and remedies which would otherwise be

available to each of them and the exercise or partial exercise of

one will not prevent the exercise of others.

7.2 On application, if a Placee is an individual, that Placee

may be asked to disclose in writing or orally, his nationality. If

a Placee is a discretionary fund manager, that Placee may be asked

to disclose in writing or orally the jurisdiction in which its

funds are managed or owned. All documents provided in connection

with the Issue will be sent at the Placee's risk. They may be

returned by post to such Placee at the address notified by such

Placee.

7.3 Each Placee agrees to be bound by the Articles once the New

Ordinary Shares, for which the Placee has agreed to subscribe

pursuant to the Issue, have been acquired by the Placee. The

contract to subscribe for the New Ordinary Shares under the Issue

and the appointments and authorities mentioned in the Announcement

and these Issue Terms and Conditions will be governed by, and

construed in accordance with, the laws of England and Wales. For

the exclusive benefit of Liberum, the Registrar and the Company,

each Placee irrevocably submits to the jurisdiction of the courts

of England and Wales and waives any objection to proceedings in any

such court on the ground of venue or on the ground that proceedings

have been brought in an inconvenient forum. This does not prevent

an action being taken against a Placee in any other

jurisdiction.

7.4 In the case of a joint agreement to subscribe for the New

Ordinary Shares under the Issue, references to a Placee in these

terms and conditions are to each of the Placees who are a party to

that joint agreement and their liability is joint and several.

7.5 Liberum and the Company expressly reserve the right to

modify the Issue (including, without limitation, the timetable) at

any time before allocations are determined. The Issue is subject to

the satisfaction of the conditions contained in the agreement

entered into between, inter alia, the Company and LIberum in

relation to the Issue and such agreement not having been

terminated.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEZZGZMRLVGGZM

(END) Dow Jones Newswires

January 30, 2020 02:00 ET (07:00 GMT)

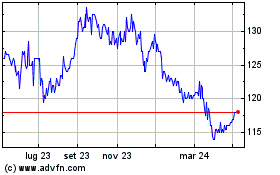

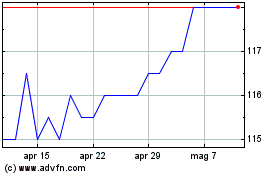

Grafico Azioni Real Estate Credit Inves... (LSE:RECI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Real Estate Credit Inves... (LSE:RECI)

Storico

Da Apr 2023 a Apr 2024