TIDMAGL

RNS Number : 3610B

Angle PLC

30 January 2020

For Immediate Release 30 January 2020

ANGLE plc

("ANGLE" or "the Company")

Interim Results for the six months ended 31 October 2019

SUCCESSFUL COMPLETION OF CLINICAL AND ANALYTICAL STUDIES IN

SUPPORT OF FDA CLEARANCE OF PARSORTIX SYSTEM

OVARIAN CANCER CLINICAL VERIFICATION STUDY IN PROGRESS

ANGLE plc (AIM: AGL OTCQX: ANPCY), a world leading liquid biopsy

company, today announces its unaudited interim financial results

for the six months ended 31 October 2019.

Operational Highlights

-- Multi-year comprehensive clinical and analytical studies

successfully completed in support of FDA clearance of the

Parsortix(R) system for capturing and harvesting circulating tumour

cells from metastatic breast cancer patients

- Q-Submission process completed and full De Novo FDA submission

in preparation, targeting Q1 CY20 submission

-- Ovarian cancer clinical verification study established with

leading US cancer centre. Pre-study phase completed successfully

and 200 subject study initiated patient enrolment

-- Over 16,000 samples processed during the period (H1 2019:

13,000) and a further six peer reviewed publications from

internationally recognised cancer centres (H1 2019: two) with key

developments in breast, lung, prostate, melanoma and head and neck

cancers

Financial Highlights

-- Revenue GBP0.4 million (H1 2019: GBP0.3 million)

-- Loss for the half-year GBP5.3 million (H1 2019: loss GBP4.2

million) reflecting planned investment

-- Successful fundraising from institutional investors,

including significant new US institutional investors, raising gross

proceeds of GBP18.0 million (GBP16.9 million net of expenses)

-- Cash balance at 31 October 2019 of GBP20.4 million (30 April 2019: GBP11.0 million)

-- As also announced today, ANGLE's accounting reference date to be changed to 31 December

Garth Selvey, Non-Executive Chairman of ANGLE plc,

commented:

"Major progress was made during the period in the completion of

the clinical and analytical studies to support FDA clearance of the

Company's Parsortix system in metastatic breast cancer. Following

the Q-Submission meeting earlier this month with FDA, we are now

progressing a full De Novo FDA Submission in Q1 CY20 with the

prospect of FDA clearance in Q3 CY20, albeit the outcome and timing

of the FDA regulatory decision is entirely dependent on the FDA's

review and response to the Company's submission.

We continue to make progress in other indications with the

Company's ovarian cancer clinical verification study in progress

and patient enrolment expected to be completed by the end of Q1

CY20. The aim is to have a clinically verified assay to detect

ovarian cancer available for deployment as a laboratory developed

test (LDT) in a clinical laboratory in CY20.

During the period, we successfully raised further growth

capital, expanding our existing UK shareholder base and adding key

new US investors. We have a strong platform of support to drive

value and grow the business substantially in the future."

Details of webcast

Please see

https://angleplc.com/investor-relations/regulatory-news/ for

details.

For further information:

ANGLE plc +44 (0) 1483 343434

Andrew Newland, Chief Executive

Ian Griffiths, Finance Director

finnCap Ltd (NOMAD and Joint Broker)

Corporate Finance - Carl Holmes, Simon Hicks,

Max Bullen-Smith +44 (0)20 7220

ECM - Alice Lane, Sunila de Silva 0500

WG Partners (Joint Broker)

Nigel Barnes, Nigel Birks, Andrew Craig, Chris +44 (0) 203 705

Lee 9330

FTI Consulting +44 (0) 203 727

Simon Conway, Ciara Martin 1000

Matthew Ventimiglia (US) +1 212 850 5624

For Frequently Used Terms, please see the Company's website on

http://www.angleplc.com/the-parsortix-system/glossary/

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the EU Market Abuse Regulation (596/2014). Upon the publication of

this announcement via a regulatory information service, this

information is considered to be in the public domain.

These Interim Results may contain forward-looking statements.

These statements reflect the Board's current view, are subject to a

number of material risks and uncertainties and could change in the

future. Factors that could cause or contribute to such changes

include, but are not limited to, the general economic climate and

market conditions, as well as specific factors including the

success of the Group's research and development and

commercialisation strategies, the uncertainties related to

regulatory clearance and the acceptance of the Group's products by

customers.

CHAIRMAN'S STATEMENT

Introduction

During the period ANGLE completed clinical and analytical

studies to support a De Novo FDA submission for its Parsortix(R)

system for capturing and harvesting circulating tumour cells from

metastatic breast cancer patients.

Strong progress was also made with the Company's ovarian cancer

assay and a clinical verification study initiated patient enrolment

during the period.

Meanwhile ANGLE's collaborators and customers continued to

demonstrate Parsortix's versatility in cancer translational

research developing important new applications. This work generated

six new publications during the period increasing the body of

peer-reviewed evidence supporting the platform.

Overview of Financial Results

Revenue of GBP0.4 million (H1 2019: GBP0.3 million) came mainly

from research use of the Parsortix system. Planned investment in

studies to develop and validate the clinical application and

commercial use of the Parsortix system increased, resulting in

operating costs of GBP6.7 million (H1 2019: GBP5.3 million). Thus,

the loss for the period increased, in line with expectations, to

GBP5.3 million (H1 2019: GBP4.2 million).

The cash balance was GBP20.4 million at 31 October 2019 (30

April 2019: GBP11.0 million) and there was an R&D Tax Credit

due to the Company at 31 October 2019 of GBP3.0 million (30 April

2019: GBP1.9 million). The cash position was strengthened during

the period with a successful placing of new shares with

institutional investors including significant new US investors in

July 2019, which raised gross proceeds of GBP18.0 million. Proceeds

net of expenses were GBP16.9 million.

Strategy

ANGLE has continued with its sustained focus on its four-pronged

strategy for achieving widespread adoption of its Parsortix system

in the emerging multi-billion dollar liquid biopsy market:

1) Completion of rigorous large-scale clinical studies run by

leading cancer centres, demonstrating the effectiveness of

different applications of the system in cancer patient care

2) Securing regulatory approval of the system with the emphasis

on FDA clearance as the de facto global gold standard. ANGLE is

seeking to be the first company ever to gain FDA clearance for a

system which harvests circulating tumour cells (CTCs) from the

blood of patients (initially metastatic breast cancer patients) for

subsequent analysis

3) Establishing a body of published evidence from leading cancer

centres showing the utility of the system through peer reviewed

publications, scientific data and clinical research evidence,

highlighting a wide range of potential applications

4) Establishing partnerships with large healthcare companies for

market deployment and development of multiple other clinical

applications incorporating the Parsortix system.

Following the successful fundraise during the period, ANGLE

intends to establish an independent accredited clinical laboratory

that will have the capability of offering validated clinical tests.

This clinical laboratory will be used as an accelerator and

demonstrator in support of the Company's established plan for

product sales of Parsortix instruments and cassettes.

Progress towards FDA clearance

ANGLE is seeking to become the first ever company to receive FDA

clearance for a medical device that harvests intact circulating

tumour cells from the blood of metastatic breast cancer patients

for subsequent analysis.

During the period, clinical and analytical studies demonstrating

the performance of the Parsortix system for the capture and

harvesting of circulating tumour cells in metastatic breast cancer

were completed. These studies have been technically and

logistically extremely challenging, requiring over 10,000 samples

to be processed with Parsortix.

The FDA clinical studies were undertaken by four of the leading

US cancer centres (University of Texas MD Anderson Cancer Center,

University of Rochester Wilmot Cancer Center, University of

Southern California Norris Comprehensive Cancer Center, and Robert

H Lurie Comprehensive Cancer Center Northwestern University).

The analytical studies demonstrated the performance of the

Parsortix system in key aspects including precision and

reproducibility, limits of quantification and detection, accuracy

and linearity, and interferents and carryover. These studies have

required resolution of numerous technical challenges to meet FDA

requirements, giving ANGLE a thoroughly characterised platform and

consequent competitive advantage.

On 29 October 2019, ANGLE made a substantial Q-Submission (a

"pre-submission" used to request formal comment from FDA on key

questions) to FDA. The Q-Submission responded to a number of

questions and suggestions previously made by FDA on ANGLE's study

plans and set out headline data from both the clinical and

analytical studies. ANGLE also requested FDA formally respond to a

series of questions, including whether our responses to specific

questions which FDA had previously raised, were acceptable. ANGLE's

intention in making this Q-Submission was to reduce the risk that

the full FDA De Novo Submission might be rejected.

FDA provided a written response to the Q-Submission and held a

formal face-to-face meeting with ANGLE in January to discuss their

response, as announced on 22 January 2020. As a result of this

meeting, ANGLE will prepare and submit a full De Novo Submission to

FDA requesting clearance for the Parsortix PC1 system for capturing

and harvesting circulating tumour cells from metastatic breast

cancer patients.

The intention is to file with FDA in Q1 CY20 with the prospect

of FDA clearance in Q3 CY20 (unchanged). The outcome and timing of

the FDA regulatory decision is entirely dependent on the FDA's

review and response to the Company's submission. US regulatory

clearance by FDA is considered the global standard for approval of

medical devices and diagnostics.

Large scale clinical studies

Ovarian cancer clinical application: triaging abnormal pelvic

mass

During the period, following further successful optimisation of

the combination of ANGLE's Parsortix CTC system with its

proprietary HyCEAD(TM) Ziplex(R) downstream molecular analysis

process, an ovarian cancer clinical verification study was

established with University of Rochester Wilmot Cancer Center.

Following the successful completion of the initial testing

phase, the blinded, independently controlled 200 subject

verification study of the targeted population of pelvic mass

patients prior to surgery initiated patient enrolment on 29 August

2019. The study has been designed to evaluate performance of the

predictive ovarian cancer detection assay developed using the

results from the previous 200 subject study in a new patient cohort

and is expected to complete patient enrolment in Q1 CY20 with

reporting mid-year CY20.

Once the new performance data is available and, assuming

comparable results to the previous study, ANGLE intends to

establish this test as a laboratory developed test (LDT) in an

accredited clinical laboratory setting. The test has the potential

to significantly improve patient outcomes whilst at the same time

reducing overall healthcare costs.

Establishing a body of published evidence

The Company's strategy to secure research use adoption of the

Parsortix system by leading cancer research centres, in order to

get independent third parties driving development of new clinical

applications, is working very well.

Over 90,000 samples have now been processed using the Parsortix

system, with over 16,000 samples in the period (H1 2019: 13,000).

There are now 26 peer-reviewed publications with six new

publications announced during the period (see

https://angleplc.com/library/publications/) including:

-- the University Medical Centre Hamburg-Eppendorf (UKE),

demonstrating the use of Parsortix as a liquid biopsy to

investigate a key immunotherapy target in lung cancer

-- the Disseminated Cancer Cell Network (DCCNet), Duesseldorf,

developing a single cell analysis workflow for breast cancer

-- the Medical University of Vienna demonstrating the use of

Parsortix for neuroendocrine analysis (corresponding to poor

overall survival) in small cell lung cancer

-- Queen Mary University of London's Barts Cancer Institute

demonstrating the potential for Parsortix to be used to avoid

unnecessary biopsies in prostate cancer without missing clinically

significant prostate cancer

-- the University of Birmingham publishing a review showing key

benefits of Parsortix in head and neck cancer

-- the University Medical Centre Hamburg-Eppendorf (UKE),

demonstrating Parsortix use in prediction and monitoring of therapy

responses for melanoma patients

To date, 23 separate cancer centres from around the world have

published uniformly positive reports on their use of the Parsortix

system. Leading independent cancer centres throughout Europe and

North America using ANGLE's Parsortix system are working on

developments in 23 different cancer types.

Progressing partnerships with large healthcare companies

Large scale deployment of the Parsortix system across numerous

cancer types and application areas requires ANGLE to partner with

large, global healthcare companies to take advantage of their

distribution and sales channels and economic resources. Discussions

are ongoing with companies in relevant fields: medtech companies,

pharma companies, contract research organisations and reference

laboratories (laboratories offering clinical tests). We expect to

see our partnership programme accelerate once FDA clearance for the

system has been achieved.

During the period, ANGLE has progressed its three key

partnerships with the large healthcare companies Abbott, QIAGEN and

Philips, and is continuing to seek a corporate partner to progress

the use of Parsortix in non-invasive prenatal testing (NIPT).

Outlook

Major progress was made during the period in the completion of

the clinical and analytical studies to support FDA clearance of the

Company's Parsortix system in metastatic breast cancer. Following

the Q-Submission meeting earlier this month with FDA, we are now

progressing a full De Novo FDA Submission with the prospect of FDA

clearance in Q3 CY20, albeit the outcome and timing of the FDA

regulatory decision is entirely dependent on the FDA's review and

response to the Company's submission.

We continue to make progress in other indications with the

Company's ovarian cancer clinical verification study in progress

and patient enrolment expected to be completed by the end of Q1

CY20. The aim is to have a clinically verified assay to detect

ovarian cancer available for deployment as a laboratory developed

test (LDT) in a clinical laboratory in CY20.

During the period, we successfully raised further growth

capital, expanding our existing UK shareholder base and adding new

US investors. We have a strong platform of support to drive value

and grow the business substantially in the future.

Garth Selvey

Chairman

29 January 2020

ANGLE plc

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 31 OCTOBER 2019

Six months Six months

Note ended ended Year ended

31 October 31 October 30 April

2019 2018 2019

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Revenue 401 273 678

Cost of sales (101) (69) (155)

Gross profit 300 204 523

Other operating income 37 97 175

Operating costs (6,727) (5,340) (11,597)

__ ______ ________ ________

Operating profit/(loss) (6,390) (5,039) (10,899)

Net finance income/(costs) 14 10 28

Profit/(loss) before tax (6,376) (5,029) (10,871)

Tax (charge)/credit 3 1,033 781 1,939

Profit/(loss) for the

period (5,343) (4,248) (8,932)

Other comprehensive income/(loss)

Items that may be subsequently

reclassified to profit

or loss

Exchange differences on

translating foreign operations - 104 72

Other comprehensive income/(loss) - 104 72

Total comprehensive income/(loss)

for the period (5,343) (4,144) (8,860)

======== ======== ========

Profit/(loss) for the period

attributable to:

Owners of the parent (5,343) (4,258) (8,942)

Non-controlling interests - 10 10

________ ________ ________

Profit/(loss) for the

period (5,343) (4,248) (8,932)

======== ======== ========

Total comprehensive income/(loss) for the

period attributable to:

Owners of the parent (5,343) (4,068) (8,822)

Non-controlling interests - (76) (38)

________ ________ ________

Total comprehensive income/(loss)

for the period (5,343) (4,144) (8,860)

======== ======== ========

Earnings/(loss) per share attributable to owners of the parent

Basic and Diluted (pence

per share) 4 (3.33) (3.29) (6.56)

All activity arose from continuing operations

ANGLE plc

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 OCTOBER 2019

Note 31 October 31 October 30 April

2019 2018 2019

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Assets

Intangible assets 5 6,765 5,797 6,833

Property, plant and equipment 3,101 1,403 1,347

Inventories 847 880 988

Trade and other receivables 657 673 942

Taxation 2,961 1,918 1,900

Cash and cash equivalents 20,408 14,874 11,010

_________ _________ _________

Total assets 34,739 25,545 23,020

_________ _________ _________

Liabilities

Lease liabilities 1 (1,497) - -

Trade and other payables (2,088) (1,684) (3,684)

_________ _________ _________

Total liabilities (3,585) (1,684) (3,684)

_________ _________ _________

Net assets 31,154 23,861 19,336

============ ============ ============

Equity

Share capital 6 17,276 14,249 14,349

Share premium 67,267 52,905 53,273

Share-based payments reserve 1,495 1,182 1,266

Other reserve 2,553 2,553 2,553

Translation reserve 106 176 106

Retained earnings (57,441) (46,372) (52,109)

ESOT shares (102) (102) (102)

_________ _________ _________

Equity attributable to owners

of the parent 31,154 24,591 19,336

Non-controlling interests - (730) -

_________ _________ _________

Total equity 31,154 23,861 19,336

============ ============ ============

ANGLE plc

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 31 OCTOBER 2019

Six months Six months

ended ended Year ended

31 October 31 October 30 April

2019 2018 2019

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Operating activities

Profit/(loss) before tax from

continuing operations (6,376) (5,029) (10,871)

Adjustments for:

Depreciation of property, plant

and equipment 492 295 622

(Profit)/loss on disposal of

property, plant and equipment 13 8 8

Amortisation and impairment

of intangible assets 1,028 318 452

Share-based payments 240 125 332

Exchange differences (7) (2) (14)

Net finance (income)/costs (24) (10) (28)

Operating cash flows before

movements in working capital: (4,634) (4,295) (9,499)

(Increase)/decrease in inventories 31 (254) (583)

(Increase)/decrease in trade

and other receivables 269 160 (91)

Increase/(decrease) in trade

and other payables (1,285) (835) 608

Operating cash flows (5,619) (5,224) (9,565)

Research and development tax

credits received - 1,070 2,251

Overseas corporation tax payments (60) - -

Net cash from/(used in) operating

activities (5,679) (4,154) (7,314)

Investing activities

Purchase of property, plant

and equipment (410) (185) (219)

Purchase of intangible assets (1,293) (454) (1,133)

Interest received 24 10 28

Net cash from/(used in) investing

activities (1,679) (629) (1,324)

Financing activities

Net proceeds from issue of share

capital 16,921 11,996 11,996

Principal elements of lease

payments (180) - -

Interest elements of lease payments 10 - -

Net cash from/(used in) financing

activities 16,751 11,996 11,996

Net increase/(decrease) in cash

and cash equivalents 9,393 7,213 3,358

Cash and cash equivalents at

start of period 11,010 7,645 7,645

Effect of exchange rate fluctuations 5 16 7

Cash and cash equivalents at

end of period 20,408 14,874 11,010

======= ======= =======

ANGLE plc

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 31 OCTOBER 2019

---------------------------------------

Equity attributable to owners of the parent

-------------------------------------

Share-based

Share Share payments Other Translation

capital premium reserve reserve reserve

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May 2018

(Audited) 11,709 43,449 1,072 2,553 (14)

For the period

to 31 October

2018

--------------------------- ------------ ------------ ------------ ------------ ------------

Consolidated

profit/(loss)

Other comprehensive

income/(loss):

Exchange differences

in translating

foreign operations 190

--------------------------- ------------ ------------ ------------ ------------ ------------

Total comprehensive

income/(loss) 190

Issue of shares

(net of costs) 2,540 9,456

Share-based

payments 125

Released on

forfeiture (15)

___ ______ ___ _______ ___ ______ ___ ______ ___ ______

At 31 October

2018 (Unaudited) 14,249 52,905 1,182 2,553 176

For the period

to 30 April

2019

--------------------------- ------------ ------------ ------------ ------------ ------------

Consolidated

profit/(loss)

Other comprehensive

income/(loss):

Exchange differences

in translating

foreign operations (70)

--------------------------- ------------ ------------ ------------ ------------ ------------

Total comprehensive

income/(loss) (70)

Share-based

payments 207

Released on

forfeiture (123)

Acquisition

of non-controlling

interest 100 368

___ _______ ___ _______ ___ _______ ___ _______ ___ _______

At 30 April

2019 (Audited) 14,349 53,273 1,266 2,553 106

For the period

to 31 October

2019

------------

Consolidated

profit/(loss)

Other comprehensive

income/(loss):

Exchange differences

in translating

foreign operations -

--------------------------- ------------ ------------ ------------ ------------ ------------

Total comprehensive

income/(loss) -

Issue of shares

(net of costs) 2,927 13,994

Share-based

payments 240

Released on

forfeiture (11)

___ ______ ___ _______ ___ ______ ___ ______ ___ ______

At 31 October

2019 (Unaudited) 17,276 67,267 1,495 2,553 106

========== ========== ========== ========== =========

--------------Equity attributable

to owners of the parent -------------

Total Non-

Retained ESOT Shareholders' controlling Total

earnings shares equity interests equity

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May 2018

(Audited) (42,129) (102) 16,538 (654) 15,884

For the period

to 31 October

2018

--------------------------- ------------- ------------ -------------- ------------ ------------

Consolidated

profit/(loss) (4,258) (4,258) 10 (4,248)

Other comprehensive

income/(loss):

Exchange differences

in translating

foreign operations 190 (86) 104

--------------------------- ------------- ------------ -------------- ------------ ------------

Total comprehensive

income/(loss) (4,258) (4,068) (76) (4,144)

Issue of shares

(net of costs) 11,996 11,996

Share-based

payments 125 125

Released on 15

forfeiture - -

___ ________ ___ ______ ___ _______ ___ _______ ___ _______

At 31 October

2018 (Unaudited) (46,372) (102) 24,591 (730) 23,861

For the period

to 30 April

2019

--------------------------- ------------- ------------ -------------- ------------ ------------

Consolidated

profit/(loss) (4,684) (4,684) - (4,684)

Other comprehensive

income/(loss):

Exchange differences

in translating

foreign operations (70) 38 (32)

--------------------------- ------------- ------------ -------------- ------------ ------------

Total comprehensive

income/(loss) (4,684) (4,754) 38 (4,716)

Share-based

payments 207 207

Released on

forfeiture 123 - -

Acquisition

of non-controlling

interest (1,176) (708) 692 (16)

___ _______ ___ _______ ___ _______ ___ _______ ___ _______

At 30 April

2019 (Audited) (52,109) (102) 19,336 - 19,336

For the period

to 31 October

2019

Consolidated

profit/(loss) (5,343) (5,343) - (5,343)

Other comprehensive

income/(loss):

Exchange differences

in translating

foreign operations - - -

--------------------------- ------------- ------------ -------------- ------------ ------------

Total comprehensive

income/(loss) (5,343) (5,343) - (5,343)

Issue of shares

(net of costs) 16,921 16,921

Share-based

payments 240 240

Released on 11

forfeiture - -

___ ________ ___ ______ ___ _______ ___ _______ ___ _______

At 31 October

2019 (Unaudited) (57,441) (102) 31,154 - 31,154

=========== ========== ========== ========== ==========

ANGLE plc

NOTES TO THE INTERIM FINANCIAL INFORMATION

FOR THE SIX MONTHSED 31 OCTOBER 2019

1 Basis of preparation and accounting policies

This Condensed Interim Financial Information is the unaudited

interim consolidated financial information (the "Condensed Interim

Financial Information") of ANGLE plc, a company incorporated in

Great Britain and registered in England and Wales, and its

subsidiaries (together referred to as the "Group") for the six

month period ended 31 October 2019 (the "interim period").

The Condensed Interim Financial Information should be read in

conjunction with the Financial Statements of the Group for the year

ended 30 April 2019, which have been prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the European Union (EU). New and revised IFRS and interpretations

recently adopted by the EU and that became effective in the period

did not have or are not expected to have a significant impact on

the Group, with the exception of IFRS 16 Leases, the impact of

which is described below. Where necessary, comparative information

has been reclassified or expanded from the previously reported

Condensed Interim Financial Information to take into account any

presentational changes which were made in the Annual Report and

Accounts to 30 April 2019 and which may be made in the Annual

Report and Accounts to 31 December 2019.

The accounting policies used in the preparation of the Condensed

Interim Financial Information for the six months ended 31 October

2019 are in accordance with the recognition and measurement

criteria of IFRS, as adopted by the EU, and are consistent with

those which will be adopted in the Financial Statements for the

period ended 31 December 2019. While the Condensed Interim

Financial Information has been prepared in accordance with the

recognition and measurement criteria of IFRS, as adopted by the EU,

these Financial Statements do not contain sufficient information to

comply with IFRS.

This Condensed Interim Financial Information does not constitute

statutory financial statements as defined in section 434 of the

Companies Act 2006 and is unaudited and has not been reviewed. The

comparative information for the six months ended 31 October 2018 is

also unaudited. The comparative figures for the year ended 30 April

2019 have been extracted from the Group Financial Statements as

filed with the Registrar of Companies. The report of the auditors

on those accounts was unqualified and did not contain statements

under sections 498(2) or (3) of the Companies Act 2006.

The Condensed Interim Financial Information was approved by the

Board and authorised for issue on 30 January 2020.

Adoption of new and revised standards

IFRS 16 Leases came into effect for accounting periods

commencing on or after 1 January 2019. The Group has adopted the

standard and included relevant transactions in these Interim

Financial Statements. The Group has not restated comparatives for

the previous reporting period, as permitted under the specific

transitional provisions in the standard.

The Group has recognised right-of-use assets representing its

occupation rights under various property leases, and the

corresponding lease liabilities representing its obligations to

make lease payments over the remaining lease terms.

The effect of IFRS 16 was to recognise right-of-use assets and

corresponding lease liabilities of GBP1.7 million at 1 May 2019

(the date of initial application). The right-of-use assets are

included in Property, plant and equipment and the corresponding

Lease liabilities are shown separately on the Statement of

Financial Position. There is no impact on reserves as at 1 May

2019.

The impact on the Consolidated Statement of Comprehensive Income

in the reporting period has been to increase the depreciation

charge and reduce the leasing cost by GBP0.2 million, both

presented within 'Operating costs'.

Going concern

The Financial Information has been prepared on a going concern

basis which assumes that the Group will be able to continue its

operations for the foreseeable future.

The Directors have prepared and reviewed financial projections

for the 12 month period from the date of approval of this Condensed

Interim Financial Information. Based on the level of existing cash

and the projected income and expenditure (the timing of some of

which is at the Group's discretion), the Directors have a

reasonable expectation that the Company and Group have adequate

resources to continue in business for the foreseeable future.

Accordingly the going concern basis has been used in preparing the

Condensed Interim Financial Information.

Critical accounting estimates and judgements

The preparation of the Condensed Interim Financial Information

requires the use of estimates, assumptions and judgements that

affect the reported amounts of assets and liabilities at the date

of the Financial Information and the reported amounts of revenues

and expenses during the reporting period. Although these estimates,

assumptions and judgements are based on the Directors' best

knowledge of the amounts, events or actions, and are believed to be

reasonable, actual results ultimately may differ from those

estimates.

The estimates, assumptions and judgements that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities relate to 1) the valuation and

amortisation of internally generated intangible assets 2)

impairment of intangible assets 3) share-based payments 4) research

and development tax credit and 5) IFRS 16 recognition of

right-of-use asset and lease liabilities.

2 Operating segment and revenue analysis

The Group's principal trading activity is undertaken in relation

to the commercialisation of its Parsortix cell separation system

and its HyCEAD Ziplex multiplex analysis system. There are separate

work streams on the Parsortix and HyCEAD Ziplex systems however the

HyCEAD Ziplex system is used primarily in combination with

Parsortix in the Ovarian cancer clinical application. There is

significant overlap of work between the teams involved in R&D

and commercial activities and as a result the Directors believe

that these activities are best shown as one operating segment. All

significant decisions are made by the Board of Directors with

implementation of those decisions on a Group-wide basis. The Group

manages all overseas R&D and commercial activities from the

UK.

3 Tax

The Group undertakes research and development activities. In the

UK these activities qualify for tax relief resulting in research

and development tax credits.

4 Earnings/(loss) per share

The basic and diluted earnings/(loss) per share is calculated by

dividing the after tax loss for the period attributable to the

owners of the parent of GBP5.3 million (six months to 31 October

2018: loss GBP4.3 million, year to 30 April 2019: loss GBP8.9

million) by the weighted average number of shares in the

period.

In accordance with IAS 33 Earnings per share 1) the "basic"

weighted average number of Ordinary shares calculation excludes

shares held by the Employee Share Ownership Trust (ESOT) as these

are treated as treasury shares and 2) the "diluted" weighted

average number of Ordinary shares calculation considers potentially

dilutive Ordinary shares from instruments that could be converted.

Share options are potentially dilutive where the exercise price is

less than the average market price during the period. Due to the

losses in the periods, share options are non-dilutive for the

respective periods as adding them would have the effect of reducing

the loss per share and therefore the diluted loss per share is

equal to the basic loss per share.

The basic and diluted earnings/(loss) per share are based on

160,552,479 weighted average Ordinary GBP0.10 shares (six months to

31 October 2018: 129,580,872; year to 30 April 2019:

136,398,468).

5 Intangible assets

Acquired

intangible Intellectual Product

Goodwill assets property development Total

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 May 2018 (Audited) 2,207 1,213 809 2,385 6,614

Additions - - 43 428 471

Exchange movements - 6 17 111 134

_________ _________ _________ _________ _________

At 31 October 2018 (Unaudited) 2,207 1,219 869 2,924 7,219

Additions - - 52 1,130 1,182

Disposals - - - (3) (3)

Exchange movements - (5) (5) (32) (42)

_________ _________ _________ _________ _________

At 30 April 2019 (Audited) 2,207 1,214 916 4,019 8,356

Additions - - 34 917 951

Exchange movements - 3 2 9 14

_________ _________ _________ _________ _________

At 31 October 2019 (Unaudited) 2,207 1,217 952 4,945 9,321

======= ======= ======= ======= =======

Amortisation and impairment

At 1 May 2018 (Audited) - 87 181 758 1,026

Charge for the period - 71 13 234 318

Exchange movements - 2 10 66 78

_________ _________ _________ _________ _________

At 31 October 2018 (Unaudited) - 160 204 1,058 1,422

Charge for the period - 72 29 (14) 87

Disposals - - - (3) (3)

Impairment - - 47 - 47

Exchange movements - (2) (4) (24) (30)

_________ _________ _________ _________ _________

At 30 April 2019 (Audited) - 230 276 1,017 1,523

Charge for the period - 72 19 101 192

Impairment - - - 836 836

Exchange movements - 1 1 3 5

_________ _________ _________ _________ _________

At 31 October 2019 (Unaudited) - 303 296 1,957 2,556

======= ======= ======= ======= =======

Net book value

At 31 October 2019 (Unaudited) 2,207 914 656 2,988 6,765

At 30 April 2019 (Audited) 2,207 984 640 3,002 6,833

At 31 October 2018 (Unaudited) 2,207 1,059 665 1,866 5,797

"Goodwill" relates to the acquisition of the assets of Axela

Inc. on 1 November 2017. Goodwill is deemed to have an indefinite

useful life, is carried at fair value and is reviewed for

impairment annually or more frequently if events or changes in

circumstances indicate a potential impairment.

6 Share capital

The Company has one class of Ordinary shares which carry no

right to fixed income and at 31 October 2019 had 172,754,816

Ordinary shares of GBP0.10 each allotted, called up and fully

paid.

During the period the Company issued 29,268,294 new Ordinary

shares with a nominal value of GBP0.10 at an issue price of

GBP0.615 per share in a subscription of shares realising gross

proceeds of GBP18.0 million. Shares were admitted to trading on AIM

in July 2019.

7 Post reporting date events

As explained in the Chairman's Statement, subsequent to the

reporting date the Company has made continued strong progress with

Parsortix and made further announcements in relation to FDA

clearance studies progress.

Shareholder communications

The announcement is being sent to all shareholders on the

register at 30 January 2020. Copies of this announcement are posted

on the Company's website www.ANGLEplc.com and are available from

the Company's registered office: 10 Nugent Road, Surrey Research

Park, Guildford, Surrey, GU2 7AF.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FFFELLFIAFII

(END) Dow Jones Newswires

January 30, 2020 02:01 ET (07:01 GMT)

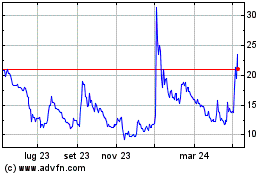

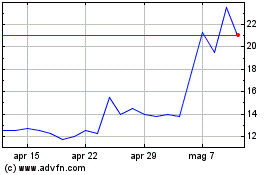

Grafico Azioni Angle (LSE:AGL)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Angle (LSE:AGL)

Storico

Da Apr 2023 a Apr 2024