ONESAVINGS BANK PLC Update To Stated Post-offer Intention Statements With Regard To Charter Court Financial Services Group Plc

30 Gennaio 2020 - 4:05PM

UK Regulatory

TIDMOSB

LEI: 213800WTQKOQI8ELD692

THE FOLLOWING ANNOUNCEMENT IS BEING MADE PURSUANT TO THE REQUIREMENTS OF

RULE 19.6(B) OF THE CITY CODE ON TAKEOVERS AND MERGERS (THE "CODE"),

WHICH, INTER ALIA, REQUIRE A PARTY TO AN OFFER, SAVE WITH THE CONSENT OF

THE PANEL ON TAKEOVERS AND MERGERS, TO PROMPTLY MAKE AN ANNOUNCEMENT

SHOULD IT DECIDE TO TAKE A COURSE OF ACTION DIFFERENT FROM ITS STATED

INTENTIONS DURING THE PERIOD OF 12 MONTHS OR SUCH LONGER STATED PERIOD

FROM THE END OF THE OFFER PERIOD EXPLAINING ITS REASONS FOR DOING SO.

OneSavings Bank plc ("OSB")

Update to stated post-offer intention statements with regard to

Charter Court Financial Services Group plc ("CCFS")

OSB announces that, further to the completion of its recommended

all-share combination with CCFS, which was effected by way of a scheme

of arrangement between CCFS and its shareholders under Part 26 of the

Companies Act 2006, on 4 October 2019 (the "Combination"), due to a

commercial opportunity, its Board of Directors has decided to take a

course of action which differs from the statements of intent made

pursuant to Rules 2.7(c)(iv) and 24.2 of the Takeover Code (the "Stated

Intentions"), as set out in its announcement of 14 March 2019 and the

scheme document published on 15 May 2019 (together, the "Offer

Documentation").

Reasons for the modification to the Stated Intentions and action to be

taken

As set out in the Offer Documentation, OSB expected to maintain all of

the current locations of the enlarged group comprising the OSB group and

the CCFS group following the completion of the Combination (together,

the "Combined Group"), besides consolidating the existing London

premises to a new premises in London, and to retain and operate the

lending brands of both OSB and CCFS (including OSB's second charge

residential brand, Prestige Finance ("Prestige")).

OSB has determined that a modification to the Stated Intentions is

required in relation to OSB's locations and the Prestige brand as a

result of a highly attractive and unsolicited commercial opportunity

that has arisen for OSB to sell Prestige House, Bushey, Hertfordshire

("Prestige House"), which is the principal place of business of

Prestige. The attractiveness of this opportunity means that OSB now

intends to sell Prestige House. As a result of this sale and the

operational capacity available (or which can be created) in other OSB

existing locations, OSB now intends to create a 'Centre of Excellence'

for second charge lending by migrating the existing business of Prestige

to Wolverhampton and to discontinue the Prestige brand for new lending.

The second charge loan book serviced under the Prestige brand was

broadly flat against the financial year ended 31 December 2018, with a

gross value of GBP372.8m as at 30 June 2019 (31 December 2018:

GBP368.0m).

Where possible, OSB will seek to review opportunities to reallocate

staff from discontinued roles arising from the disposal of Prestige

House and the operation of the Prestige brand to other appropriate roles,

including those being created from organic growth. However, the intended

actions outlined in this announcement are likely to have an impact for

those employed in Prestige House and by the Prestige brand. OSB confirms

that the employment rights, including pension rights, of all such

employees will be fully safeguarded.

Alan Cleary, Group Managing Director of Mortgages at OSB, said, "The

attractive offer for Prestige House has led us to consider this proposed

restructure which, we believe, would enhance the overall second charge

loan proposition."

Alan continued, "We are actively engaging with our key intermediary

partners on this proposal to ensure minimal disruption. We are also

consulting with our colleagues at Prestige Finance who are directly

impacted by this proposal to ensure they receive the support they need."

These modifications do not impact OSB's fundamental rationale for the

Combination, nor are they expected to impact on the business or

prospects of the Combined Group.

Following the successful completion of OSB's combination with CCFS on 4

October 2019, OSB is in the early stages of integrating the two

businesses and remains focused on delivering shareholder value as it

executes on the strategy for the enlarged Group.

- ENDS -

Contacts:

Robert Gurr Eleanor Ross Alastair Pate

OneSavings Bank plc Teamspirit PR OneSavings Bank plc

Public Relations T: 020 7861 3841 Investor Relations

T: 01634 821249 E: OneSavingsBank@teamspiritpr.com T: 01634 838 973

E: Robert.Gurr@osb.co.uk E. Alastair.Pate@osb.co.uk

------------------------- ----------------------------------- ---------------------------

Notes:

About Precise Mortgages

Our mission is to broaden the criteria for mortgage approval to support

home owning aspirations and buy to let entrepreneurialism. Our award

winning, technology driven underwriting and credit risk management

processes mean we can be more expansive in our mortgage approvals --

serving those underserved by mainstream lenders.

Precise Mortgages was established in 2010, free of the legacy of poor

decisions made pre-financial crisis, Precise Mortgages, delivers

innovative products for residential mortgages, buy to let mortgages,

bridging finance and second charge loans through a nationwide

intermediary base.

About OneSavings Bank plc

OneSavings Bank plc began trading as a bank on 1 February 2011 and was

admitted to the main market of the London Stock Exchange in June 2014

(OSB.L). OSB joined the FTSE 250 index in June 2015. OSB is a specialist

lending and retail savings group authorised by the Prudential Regulation

Authority, part of the Bank of England, and regulated by the Financial

Conduct Authority and the Prudential Regulation Authority (registered

number 530504). The Bank acquired Charter Court Financial Services Group

Plc (CCFS) and its subsidiary businesses on 4 October 2019.

OSB primarily targets underserved market sub-sectors that offer high

growth potential and attractive risk-adjusted returns in which it can

take a leading position and where it has established expertise,

platforms and capabilities. These include private rented sector

Buy-to-Let, commercial and semi-commercial mortgages, residential

development finance, bespoke and specialist residential lending, secured

funding lines and asset finance. OSB originates organically through

specialist brokers and independent financial advisers. It is

differentiated through its use of high skilled, bespoke underwriting and

efficient operating model.

OSB is predominantly funded by retail savings originated through the

long established Kent Reliance name, which includes online and postal

channels, as well as a network of branches in the South East of England,

and through its Charter Savings Bank brand. Diversification of funding

is currently provided by securitisation programmes, the Bank of England

Term Funding Scheme and Index Long-Term Repo operation.

(END) Dow Jones Newswires

January 30, 2020 10:05 ET (15:05 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

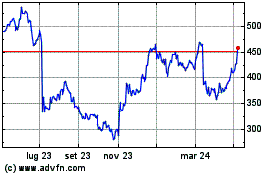

Grafico Azioni Osb (LSE:OSB)

Storico

Da Mar 2024 a Apr 2024

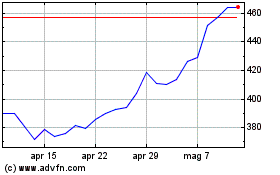

Grafico Azioni Osb (LSE:OSB)

Storico

Da Apr 2023 a Apr 2024