ONESAVINGS BANK PLC Directorate Changes

04 Febbraio 2020 - 5:09PM

UK Regulatory

TIDMOSB

LEI: 213800WTQKOQI8ELD692

OneSavings Bank plc ("OSB")

Directorate Changes

Resignation of Sir Malcolm Williamson

OneSavings Bank plc, the specialist lending and retail savings bank,

announces that Sir Malcolm Williamson has informed the OSB board of

directors (the "OSB Board") that he will step down from his role as

Non-Executive Chairman and from the OSB Board with immediate effect.

Sir Malcolm joined Charter Court Financial Services Group plc ("CCFSG")

as a Non-Executive director in June 2017, becoming Chairman of the CCFSG

board of directors in August 2017 and led CCFSG through its successful

initial public offering in October that year. Sir Malcolm became

Chairman of the OSB Board in October 2019, following the successful

combination of OSB and CCFSG (the "Combination"). Sir Malcolm worked

closely with the then Chairman of OSB (David Weymouth) during the

negotiations that led to the Combination, after which David Weymouth

assumed the role of Deputy Chairman of the OSB Board and continued to

work closely with Sir Malcolm as the integration of OSB and CCFSG

commenced.

Following Sir Malcolm's retirement, the OSB Board is very pleased to

announce the appointment of David Weymouth as Chairman of the OSB Board

and to the Group Nomination and Governance Committee, in each case

subject to regulatory approval.

Andy Golding, Chief Executive of OSB, said: "On behalf of the OSB Board

and executive team I would like to thank Sir Malcolm for his stewardship

and guidance of CCFSG and the subsequent combination with OSB. The

continuity provided by the appointment of David is valuable as we

execute on the strategy for the OSB Group, as enlarged by the

Combination with CCFSG."

Sir Malcolm Williamson said: "I am delighted that the combination of OSB

and CCFSG has gone well, and feel as I approach my 81(st) birthday that

it is a good time to reduce my work load and spend more time with my

family and on hobbies. I wish the OSB Board and Management Team my best

wishes for the future"

Appointment of Rod Duke

Sir Malcolm is also stepping down from his role as Chairman of Charter

Court Financial Services Limited ("CCFSL"), the regulated banking entity

which forms part of the CCFSG sub-group. In order to maintain the

independence of the board of directors of CCFSL (the "CCFSL Board"), Rod

Duke has agreed to step down from the OSB Board and will become Chairman

of the CCFSL Board subject to regulatory approval.

Resignation of Eric Anstee

Additionally, OSB announces that after four years as a Non-Executive

Director, Eric Anstee has tendered his resignation from the OSB Board

and will step down with immediate effect. Eric joined the OSB Board as a

Non-Executive Director shortly after the initial public offering of OSB,

and, as Chair of the Audit Committee from 1 January 2016 until 4 October

2019, has helped OSB grow and establish itself as a FTSE250 company.

Andy Golding, Chief Executive of OSB, said: "I would like to thank Eric

for the valuable contribution he has made to the success of OSB. Eric

will be missed and I wish him well in the future."

There are no additional matters that would require disclosure under LR

9.6.13R.

Enquiries:

OneSavings Bank plc

Alastair Pate t: 01634 838 973

Brunswick Group

Robin Wrench/Simone Selzer t: 020 7404 5959

About OneSavings Bank plc

OneSavings Bank plc ("OSB") began trading as a bank on 1 February 2011

and was admitted to the main market of the London Stock Exchange in June

2014 (OSB.L). OSB joined the FTSE 250 index in June 2015. On 4 October

2019, OSB acquired Charter Court Financial Services Group plc ("CCFSG")

and its subsidiary businesses. OSB is a specialist lending and retail

savings group authorised by the Prudential Regulation Authority, part of

the Bank of England, and regulated by the Financial Conduct Authority

and Prudential Regulation Authority.

Important disclaimer

This document should be read in conjunction with the documents

distributed by OneSavings Bank plc ("OSB") through the Regulatory News

Service ("RNS"). This document is not audited and contains certain

forward-looking statements, beliefs or opinions, including statements

with respect to the business, strategy and plans of OSB and its current

goals and expectations relating to its future financial condition,

performance and results. Such forward-looking statements include,

without limitation, those preceded by, followed by or that include the

words 'targets', 'believes', 'estimates', 'expects', 'aims', 'intends',

'will', 'may', 'anticipates', 'projects', 'plans', 'forecasts',

'outlook', 'likely', 'guidance', 'trends', 'future', 'would', 'could',

'should' or similar expressions or negatives thereof. Statements that

are not historical facts, including statements about OSB's, its

directors' and/or management's beliefs and expectations, are

forward-looking statements. By their nature, forward-looking statements

involve risk and uncertainty because they relate to events and depend

upon circumstances that may or may not occur in the future. Factors that

could cause actual business, strategy, plans and/or results (including

but not limited to the payment of dividends) to differ materially from

the plans, objectives, expectations, estimates and intentions expressed

in such forward-looking statements made by OSB or on its behalf include,

but are not limited to: general economic and business conditions in the

UK and internationally; market related trends and developments;

fluctuations in exchange rates, stock markets, inflation, deflation,

interest rates and currencies; policies of the Bank of England, the

European Central Bank and other G8 central banks; the ability to access

sufficient sources of capital, liquidity and funding when required;

changes to OSB's credit ratings; the ability to derive cost savings;

changing demographic developments, and changing customer behaviour,

including consumer spending, saving and borrowing habits; changes in

customer preferences; changes to borrower or counterparty credit

quality; instability in the global financial markets, including Eurozone

instability, the potential for countries to exit the European Union (the

EU) or the Eurozone, and the impact of any sovereign credit rating

downgrade or other sovereign financial issues; technological changes and

risks to cyber security; natural and other disasters, adverse weather

and similar contingencies outside OSB's control; inadequate or failed

internal or external processes, people and systems; terrorist acts and

other acts of war or hostility and responses to those acts; geopolitical,

pandemic or other such events; changes in laws, regulations, taxation,

accounting standards or practices, including as a result of an exit by

the UK from the EU; regulatory capital or liquidity requirements and

similar contingencies outside OSB's control; the policies and actions of

governmental or regulatory authorities in the UK, the EU or elsewhere

including the implementation and interpretation of key legislation and

regulation; the ability to attract and retain senior management and

other employees; the extent of any future impairment charges or

write-downs caused by, but not limited to, depressed asset valuations,

market disruptions and illiquid markets; market relating trends and

developments; exposure to regulatory scrutiny, legal proceedings,

regulatory investigations or complaints; changes in competition and

pricing environments; the inability to hedge certain risks economically;

the adequacy of loss reserves; the actions of competitors, including

non-bank financial services and lending companies; and the success of

OSB in managing the risks of the foregoing.

Accordingly, no reliance may be placed on any forward-looking statement

and no representation, warranty or assurance is made that any of these

statements or forecasts will come to pass or that any forecast results

will be achieved. Any forward-looking statements made in this document

speak only as of the date they are made and it should not be assumed

that they have been revised or updated in the light of new information

of future events. Except as required by the Prudential Regulation

Authority, the Financial Conduct Authority, the London Stock Exchange

PLC or applicable law, OSB expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained in this document to reflect any

change in OSB's expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based. For

additional information on possible risks to OSB's business, please see

the "Risk Review" section of the OSB 2018 Annual Report and Accounts.

Copies of this are available at www.osb.co.uk and on request from OSB.

Nothing in this document and any subsequent discussion constitutes or

forms part of a public offer under any applicable law or an offer to

purchase or sell any securities or financial instruments. Nor does it

constitute advice or a recommendation with respect to such securities or

financial instruments, or any invitation or inducement to engage in

investment activity under section 21 of the Financial Services and

Markets Act 2000. Past performance cannot be relied on as a guide to

future performance. Nothing in this document is intended to be, or

should be construed as, a profit forecast or estimate for any period.

Liability arising from anything in this document shall be governed by

English law, and neither the Company nor any of its affiliates, advisors

or representatives shall have any liability whatsoever (in negligence or

otherwise) for any loss howsoever arising from any use of this document

or its contents or otherwise arising in connection with this document.

Nothing in this document shall exclude any liability under applicable

laws that cannot be excluded in accordance with such laws.

Certain figures contained in this document, including financial

information, may have been subject to rounding adjustments and foreign

exchange conversions. Accordingly, in certain instances, the sum or

percentage change of the numbers contained in this document may not

conform exactly to the total figure given.

(END) Dow Jones Newswires

February 04, 2020 11:09 ET (16:09 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

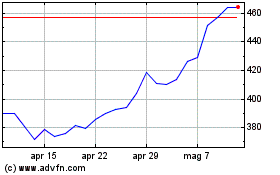

Grafico Azioni Osb (LSE:OSB)

Storico

Da Mar 2024 a Apr 2024

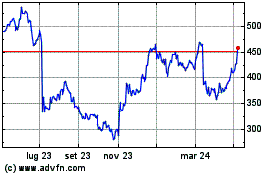

Grafico Azioni Osb (LSE:OSB)

Storico

Da Apr 2023 a Apr 2024