TIDMACC

RNS Number : 1294C

Access Intelligence PLC

06 February 2020

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 ("MAR"). Upon the

publication of this announcement, the inside information is now

considered to be in the public domain for the purposes of MAR.

6(th) February 2020

ACCESS INTELLIGENCE PLC

Completion of Pulsar Accounting Review

Further to the announcement on 10 December 2019, the Board of

Access Intelligence provides the following update following the

completion of the review by an external firm of accountants of the

accounts of the Pulsar business at closing.

In October 2019, Access Intelligence acquired the Pulsar

business (comprising both Fenix Media Limited, which is

incorporated in the UK, and Face US, which is incorporated in the

US) from Cello Health plc ("Cello"). Following the identification

of certain accounting questions on some contracts within Pulsar

post acquisition, the Board of Access Intelligence commissioned an

accounting review to be undertaken by independent accountants

BDO.

Following completion of the BDO review, an adjustment of the

previously disclosed unaudited financial results for Pulsar is

required. Post this adjustment, for the year to 31 December 2018

Pulsar reported unaudited revenues of GBP6.8 million, gross profit

of GBP3.8 million and an Adjusted EBITDA loss of GBP0.7 million.

Upon acquisition by Access Intelligence, Pulsar's accounting

reference period was amended. For the 11 month period to 30

November 2019, Pulsar would have had reported unaudited revenue of

GBP5.2 million, gross profit of GBP2.3 million and an Adjusted

EBITDA loss of GBP1.7 million.

Pursuant to the terms of the sale and purchase agreement signed

on 2 October 2019 (the "Agreement"), and under the completion

accounts reconciliation process agreed by both sides, Cello Health

has agreed to pay Access Intelligence a net cash sum of GBP1.6m

reflecting the shortfall in net assets delivered at closing versus

the agreed target closing position.

In full and final settlement of any dispute under the Agreement

regarding the appropriate valuation of the business, Cello Health

has agreed that 4,076,238 of the consideration shares will be sold

back to Access Intelligence for GBP1. As Access Intelligence

currently does not have the requisite approvals to acquire these

shares, a shareholder's meeting will be convened to obtain the

necessary approval for the buy back. Upon completion of the buy

back the relevant shares will be cancelled.

The post-acquisition contribution of Pulsar to Access

Intelligence's consolidated financial results for the year to 30

November 2019 is expected to be revenue of GBP0.7 million, gross

profit of GBP0.2 million and an Adjusted EBITDA loss of GBP0.5

million, prior to any acquisition accounting adjustments. The

annual accounts may also be impacted by a potential non-cash write

down. This is currently being discussed with the accountants and an

update will be provided in due course.

This outcome of the financial analysis has no impact on the

rationale for the Pulsar acquisition which is in line with a

strategic ambition to strengthen capabilities in social media

analysis, audience segmentation and social media marketing

evaluation. Recurring revenues with Pulsar are around 70% of total

revenue.

Related Party Transaction

Cello is a related party of the Company for the purposes of the

AIM Rules by virtue of their status as substantial shareholders

holding 10% or more or more of the Company's existing ordinary

share capital.

The Board consider, having consulted with the Company's

nominated adviser, finnCap, that the settlement with Cello set out

above is fair and reasonable insofar as the Company's shareholders

are concerned.

Commenting on the resolution of this matter, Joanna Arnold, CEO,

said:

"Due to Cello Health's proactive engagement, we are pleased to

have reached a swift and satisfactory resolution. The rationale for

the acquisition remains unchanged and we look forward to growing

the business as part of the Access Intelligence portfolio."

For further information:

Access Intelligence plc

020 3426 4024

Joanna Arnold (CEO) / Mark Fautley (CFO)

finnCap Limited (Nominated Adviser and Broker) 020 7220 0500

Corporate Finance - Marc Milmo / Kate Bannatyne / Matthew Radley

/ Kate Washington

Corporate Broking - Alice Lane / Sunila de Silva

About Access Intelligence

Access Intelligence PLC is a tech innovator, delivering high

quality SaaS products that address the fundamental

business needs of more than 3,500 global brands in the PR,

communications and marketing industries. Listed on

AIM, Access Intelligence provides technology that helps

organisations understand what's important to their customers and

their brand as they navigate a constantly changing world of

politics, news and social media. This is alongside the practical

tools and information to ensure their communications are

relentlessly effective in

building awareness, reputation and engagement.

The expanding portfolio includes Vuelio, the platform that helps

organisations make their stories matter; ResponseSource, a network

that connects media and influencers to the resources they need,

fast; and Pulsar, an audience insights and social listening

platform.

- ENDS-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FURSSIEEIESSESE

(END) Dow Jones Newswires

February 06, 2020 02:00 ET (07:00 GMT)

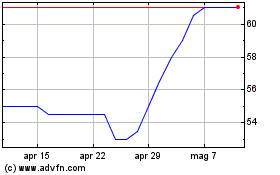

Grafico Azioni Access Intelligence (LSE:ACC)

Storico

Da Mar 2024 a Apr 2024

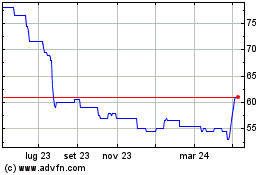

Grafico Azioni Access Intelligence (LSE:ACC)

Storico

Da Apr 2023 a Apr 2024