Tech Licensing Boosts Qualcomm's Revenue -- WSJ

06 Febbraio 2020 - 9:02AM

Dow Jones News

By Asa Fitch

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 6, 2020).

Qualcomm Inc. said revenue rose 5% in its first fiscal quarter,

as stronger sales of smartphones bolstered its technology-licensing

business, though the spread of the coronavirus could take some

shine away from a year that includes many high-end phone

launches.

The San Diego-based company, which designs and markets

semiconductors mostly for mobile-communications equipment, on

Wednesday said sales were $5.08 billion in the quarter ended in

December, up from $4.84 billion a year ago.

Profit fell 13% to $925 million, or 80 cents a share. The

previous year's first quarter included a more than

half-billion-dollar tax benefit recorded from U.S. tax law

changes.

On an adjusted basis, earnings fell to 99 cents, though that

figure came in higher than analysts surveyed by FactSet had

expected.

Like its peers in the cellphone supply chain, Qualcomm grappled

with lower global smartphone sales last year.

Many consumers are waiting to purchase new handsets to take

advantage of superfast fifth-generation cell networks that

operators are building out. But Chief Executive Steve Mollenkopf

said Qualcomm was reaping early gains from the rollout of 5G

networks.

Even though the company forecasts selling fewer cellphone chips

this quarter, partly as the result of seasonal fluctuations, it is

expecting to make more money per chip as the year progresses.

Finance chief Akash Palkhiwala said cellphone makers are

dedicating resources to introducing new high-end phones, including

5G smartphones for which Qualcomm makes more expensive chips.

Part of that upswing will likely come from Apple Inc., which

Qualcomm reached a chip-supply agreement with last year after

settling a long-running licensing dispute. Qualcomm chips are

widely expected to go into Apple's first 5G-capable phones when

they are introduced, likely in September.

Apple also provided a boost to Qualcomm during the last three

months of 2019, when it reported bumper sales of its latest

iPhones. Qualcomm collects royalties from patents it licenses to

Apple and other handset makers.

Qualcomm's licensing arm generated $1.4 billion in sales in the

quarter, up 38% from a year ago as Apple resumed royalty payments

following their legal settlement. Qualcomm's chip division's sales

fell 3%.

Risks lie on the horizon, however. Qualcomm has yet to resolve a

licensing dispute with Huawei Technologies Co., after it reached an

interim agreement with the Chinese telecom giant in late 2018 under

which Huawei made $150 million quarterly payments to Qualcomm. That

agreement has since expired, with no indication that it will be

renewed.

Qualcomm has also started to see a decrease in orders of chips

from customers in China as a result of the outbreak of coronavirus

there, Mr. Palkhiwala said in an interview. Manufacturers have been

bracing for supply-chain disruption as the virus spreads, with the

number of confirmed cases rising above 24,000 as of Tuesday.

China accounts for around a quarter of global smartphone demand,

UBS analysts estimate, and Qualcomm is a key supplier of chips to

many Chinese handset makers.

The company cut the low-end of its earnings guidance out of an

abundance of caution, Mr. Palkhiwala said, although there has only

been a small decline in its orders so far. Qualcomm expects

adjusted earnings to be between 80 cents and 95 cents a share in

the current quarter, with Wall Street analysts forecasting 86 cents

a share.

Qualcomm said chip shipments could fall to between 125 million

and 145 million in the second fiscal quarter, from 155 million in

the first quarter.

The company forecast sales of $4.9 billion to $5.7 billion,

compared with Wall Street expectations of $5.1 billion.

Qualcomm also disclosed it is under investigation in the

European Union over whether it engaged in anticompetitive behavior

related to its 5G radio-frequency technologies. The company

received a request for information from the European Commission on

Dec. 3, the company said in a regulatory filing. Qualcomm said it

didn't believe it was violating EU competition rules.

Qualcomm has been caught in a legal tangle for years over

allegations that it leveraged its dominance as a supplier of

cellphone chips that manage communications with cell towers to

extract unfair patent-licensing terms. While the company resolved

its licensing dispute with Apple, it is appealing antitrust

decisions against it in the U.S., where a court hearing is

scheduled this month. It also is appealing an EU fine, issued in

2018, of almost a billion euros.

Shares in the company fell slightly in after-hours trading. The

chip maker's stock has gained 79% over the past 12 months through

Wednesday's close.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

February 06, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

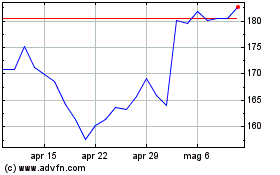

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Mar 2024 a Apr 2024

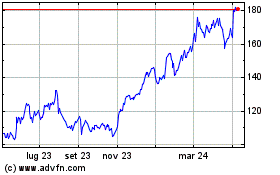

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Apr 2023 a Apr 2024