Yum China Shows Coronavirus Outbreak Is Curbing Chinese Consumption

06 Febbraio 2020 - 11:36AM

Dow Jones News

By Joanne Chiu

China's largest restaurant company is bracing for a financial

hit from the coronavirus, fresh evidence of how the outbreak is

denting corporate profits and depressing the consumer spending that

Beijing hopes will power its economic growth.

The gloomy short-term prognosis from Yum China Holdings Inc.

reflects how the epidemic has hurt China's hospitality industry,

with some cities locked down and many customers staying home to

minimize the risk of infection.

Yum China, which runs more than 9,000 KFCs, Pizza Huts and other

restaurants in China, has been forced to close more than three in

10 outlets. And in January, Starbucks Corp. said it temporarily

closed more than half its stores in China, while McDonald's Corp.

has closed several hundred locations in Hubei province, the

epicenter of the outbreak.

In a conference call on Wednesday, Chief Executive Joey Wat and

colleagues said while many customers were avoiding eating out,

demand for delivery was holding up well and Yum China had rolled

out "contactless" services requiring less interaction between

drivers and customers.

"This arrangement helps to reduce the risk of human-to-human

infection and protect our staff, riders and customers," Ms. Wat

said, according to a transcript. Managers also said all couriers

were wearing face masks, which Yum China took great pains to secure

as demand rose.

At restaurants that stayed open, same-store sales plummeted 40%

to 50% since the Lunar New Year holiday from a year earlier, due to

shorter opening hours, reduced traffic and other factors, Yum China

said.

Same-store sales is a way of tracking performance at a retailer

or dining group's more established outlets. Yum China calculates

the metric only considering stores that were already open at the

start of the previous financial year. This year's Lunar New Year

holiday began on Jan. 25.

Reporting full-year results on Wednesday, Yum China warned of

possible operating losses for the first quarter of 2020--or even

for this full year--if sales remained weak. It posted an operating

profit, which excludes interest and taxes, of $901 million in

2019.

The company said while it couldn't yet fully determine the

impact of the coronavirus disruption, it expected a "materially

adverse impact" on its results. Its shares fell nearly 3% in

after-hours trading, even after it reported better-than-expected

figures for the fourth quarter. Yum China said it was confident in

China's long-term market potential.

Some restaurant operators have temporarily closed all their

outlets on the mainland, including Hong Kong-listed Haidilao

International Holding Ltd. and Jiumaojiu International Holdings

Ltd, which both closed their doors on Jan. 26.

Haidilao runs a chain of hot pot restaurants, where diners

prepare their own dishes by dunking meat and vegetables into

bubbling cauldrons of spicy soup, while recently listed Jiumaojiu

is best known for pickled fish dishes.

Walter Woo, a consumer analyst at CMB International Securities

Ltd., said disruptions over the typically busy new year break would

have a disproportionately large impact on restaurants' full-year

profits. In some cases, he said landlords might help by offering

free rent for a period of time.

Choonshik Yi, head of Asia equities at UBP Asset Management Asia

Ltd., said he remained optimistic about Chinese consumption as

growth could rebound quickly once the coronavirus was brought under

control.

Speaking generally about companies focused on serving Chinese

consumers, he said: "It may sound scary to hear their gloomy

guidance but it's a matter of time for sales to recover."

Write to Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

February 06, 2020 05:21 ET (10:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

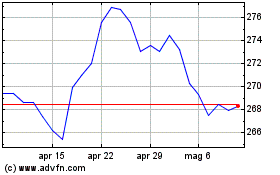

Grafico Azioni McDonalds (NYSE:MCD)

Storico

Da Mar 2024 a Apr 2024

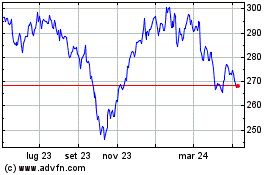

Grafico Azioni McDonalds (NYSE:MCD)

Storico

Da Apr 2023 a Apr 2024