TIDMROSE

RNS Number : 4108C

Rose Petroleum PLC

10 February 2020

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 ("MAR"). With the publication of this announcement,

this information is now considered to be in the public domain.

Rose Petroleum plc

("Rose" or the "Company")

Update on restructuring of the Paradox project

Rose Petroleum plc (AIM: ROSE), the Rocky Mountain-focused oil

and gas company, is pleased to provide an update on the

restructuring of its project in the Paradox Basin, Utah, U.S. (the

"project") further to its announcement on 14 October 2019.

Highlights:

-- Rose has been granted regulatory approval by the U.S. Bureau

of Land Management (the "BLM") for two year lease extensions on

circa 11,300 acres within the core of its project area.

-- The Company now holds a focused and contiguous land position

of circa 19,900 acres with extended lease terms (as set out in note

1 below)(1) , the majority of which is covered by Rose's

proprietary 3D seismic survey which was completed in 2018.

-- Rose gains an immediate 75% working interest in and

operatorship of the extended acreage, rather than the earn-in

structure through which the leases were formerly held.

-- There are no acquisition costs related to the extended

acreage, and Rose will continue to make lease payments on the

extended acreage. Overall lease payments have been substantially

reduced via the restructuring now that non-core acreage has been

relinquished.

-- The restructured project has estimated net 2C Contingent

Recoverable Resources of circa 9 million barrels of oil equivalent

("mmboe") solely within the Cane Creek reservoir(2) with further

exploration potential to be found in 5 shallower reservoir

intervals.

Colin Harrington, Chief Executive Officer, stated:

"With the project JV agreement successfully renegotiated, the

project land position now restructured and an increase in term now

secured, we are in a strong position to recommence our farm-in

process.

"The restructured project, combined with the increased focus

that partners like the U.S. Department of Energy are bringing to

the Paradox Basin, will make the project more attractive to

potential funding partners.

"While the Company's immediate focus is to acquire near-term

production in more mature Rocky Mountain Basins, the upside that

can be delivered from our Paradox project makes it a highly

attractive investment opportunity and ensures the project will

remain a central part of Company's future focus and activity.

"I would like to thank our JV partner Rockies Standard Oil

Company and the BLM for their continued commitment to Rose and the

development of the project."

Restructuring update

Since its update to the market on 14 October 2019, Rose has

worked with Rockies Standard Oil Company ("RSOC") and the

appropriate regulatory bodies to complete the restructuring of the

project.

In the October 2019 announcement, Rose outlined that it would

focus its efforts on the most valuable project acreage. As part of

this process, Rose and RSOC agreed to voluntarily terminate the

original Federal Unit Agreement (the Gunnison Valley Unit ("GVU")).

Subsequently, with the GVU Agreement terminated and pursuant to

U.S. Federal Oil and Gas Regulation 43 CFR 3107.4, Rose can

announce that a subset of leases, located within the project core

have been extended for a further two years and added back into the

Company's portfolio of leases.

The extension of these leases enables Rose to refocus on a core

acreage position of circa 19,900 acres which contains an estimated

net 2C Contingent Recoverable Resources of circa 9 million barrels

of oil equivalent ("mmboe") associated with 22 drilling targets in

the Cane Creek reservoir. The development of solely this reservoir

could generate an estimated post-tax net present value to Rose of

US$64m (at a 10% discount rate) ("NVP10")(3) , a significant

premium to the Company's current market capitalisation and which

demonstrates the considerable potential of the project. The Company

also recognizes further exploration potential in 5 shallower

reservoir targets which could add further value to the project over

time.

With the project restructuring completed and the land position

now clarified, the Company will recommence the farm-out

process.

Additionally, while the lease extensions are for an initial

period of two years, they can be extended further through the

creation of a new federal unit, the drilling of a new well on the

new unit and establishing production of paying quantities of oil

and gas.

Contacts:

Rose Petroleum plc Tel: +44 (0)20 7225 4599

Colin Harrington (CEO) Tel: +44 (0)20 7225 4599

Chris Eadie (CFO)

Allenby Capital Limited - AIM Nominated

Adviser Tel: +44 (0)20 3328 5656

Jeremy Porter / James Reeve / Liz Kirchner

Turner Pope Investments - Joint Broker Tel: +44 (0)20 3657 0050

Andy Thacker / Zoe Alexander

Cantor Fitzgerald Europe - Financial Tel: +44 (0)20 7894 7686

Adviser and Joint Broker

David Porter

Media enquiries: Tel: +44 (0) 20 3633 1730

Allerton Communications peter.curtain@allertoncomms.co.uk

Peter Curtain

Dr Gregor Maxwell, BSc Hons. Geology and Petroleum Geology, PhD,

Technical Adviser to the board of Rose Petroleum plc, who meets the

criteria of a qualified person under the AIM Note for Mining and

Oil & Gas Companies - June 2009, has reviewed and approved the

technical information contained within this announcement.

Notes

1. This notification confirms Rose's lease position is as follows:

a. A 5,240 gross acre lease position with an 9 year lease term remaining.

b. A 6,120 gross acre lease position with a 2 year extension, valid to October 2021.

c. Potential for the addition of a further 6,511 gross acres

also with a 2 year extension, subject to expected partner

approval.

d. A 1,920 acre lease which is currently suspended but which is

expected to be extended in due course.

2. The 2C Contingent Resource assessment is based upon a

proportional assessment of well count from the original 2C

assessment, has been undertaken by Rose and has not been

independently verified.

3. Oil and Gas Prices for Competent Persons Review ("CPR")

Gaffney Cline & Associates's 2Q 2018 WTI and Henry Hub price

scenario (Table 1) was used for Rose's economic analysis of the

project and included in the project CPR. Based on information

provided to GCA by the Company realised prices are expected to

include a US$10 per barrel discount for crude and a US$0.50/Mscf

discount for natural gas.

Table 1: GCA 2Q 2018 WTI and Henry Hub Price Scenario

Year WTI Price Henry Hub

(US$/Bbl) Price

(US$/Mscf)

2019 59.21 2.79

----------- ------------

2020 62.50 3.12

----------- ------------

2021 63.75 3.39

----------- ------------

2022 65.03 3.62

----------- ------------

2023 66.33 3.81

----------- ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDVKLFBBLLZBBF

(END) Dow Jones Newswires

February 10, 2020 02:00 ET (07:00 GMT)

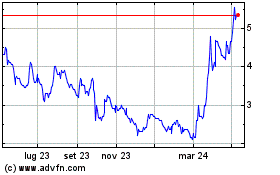

Grafico Azioni Zephyr Energy (LSE:ZPHR)

Storico

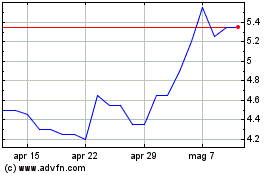

Da Mar 2024 a Apr 2024

Grafico Azioni Zephyr Energy (LSE:ZPHR)

Storico

Da Apr 2023 a Apr 2024