Infrastrata PLC New Asset Backed Debt Facility (4113C)

10 Febbraio 2020 - 8:00AM

UK Regulatory

TIDMINFA

RNS Number : 4113C

Infrastrata PLC

10 February 2020

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). With the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

10 February 2020

InfraStrata plc

("InfraStrata" or the "Company")

NEW ASSET BACKED DEBT FACILITY FOR HARLAND AND WOLFF AND

RESTRUCTURING OF CURRENT LOAN FACILITY

InfraStrata (AIM: INFA), the UK quoted company focused on

strategic infrastructure projects and physical asset life-cycle

management, is pleased to announce that its subsidiary, Harland and

Wolff (Belfast) Limited ("Harland"), has secured a GBP2 million

asset backed term debt facility (the "Facility").

Under the terms of the Facility, Harland will drawdown the sum

of GBP2 million immediately and the proceeds will be utilised for

working capital purposes. The Facility is for a term of 24 months

with the principal amount repayable as a bullet payment at the end

of 24 months from the date of first drawdown. The Facility carries

a coupon of 13.2% per annum, payable in equal monthly instalments

in arrears. The Lender of the Facility has a first charge over all

the assets of Harland. At the end of the 24-month tenure of the

Facility, there will be an exit fee of 4% payable to the lender.

Belfast-based Whiterock Capital Partners LLP advised Harland on the

structuring of this Facility.

In addition, the Company is pleased to announce the

restructuring of the sum of GBP555,555.58 that remains outstanding,

and was drawn down as the second tranche, of the GBP2.2 million

loan facility with Riverfort Global Opportunities PCC Limited and

YA II PN Limited (the "Investors") (the "Loan"). Details of this

second drawdown under the Loan were announced on 14 November 2019.

Under the restructuring, the Company will no longer be required to

make a bullet repayment of GBP555,555.58 on 14 February 2020.

Instead, a sum of GBP55,555.58 of the principal plus fees and

accrued interest to date of, in aggregate, GBP110,624.98 will be

paid to the Investors immediately, and the remaining GBP500,000 of

principal ("Remaining Loan") will be amortised over a period of 10

months commencing 31 March 2020 and ending on 31 December 2020. The

amortised payment schedule will carry an interest rate of 12% per

annum from 14 February 2020, payable monthly in arrears. The

Remaining Loan is not convertible into shares, save in the event of

default.

Further, the final exercise dates for warrants issued to the

Investors pursuant to the terms of the Loan, as announced on 1

October 2019 and 14 November 2019, have been extended to 1 October

2023 and 14 November 2023 respectively.

Save for the above, all other terms of the Loan remain the

same.

John Wood, Interim Chairman and CEO of InfraStrata, said:

"We are pleased to have now put in place a debt facility for

Harland and restructured the second tranche of the loan facility

that we drew down in order to fund part of the costs of the Harland

acquisition. The introduction of this asset-backed debt facility

validates our thesis of leveraging physical assets and creating

cashflow sources. This has been possible due to the acquisition of

Harland's physical assets, something that we would not have been

able to achieve with the Company's portfolio of intangible

assets."

**ENDS**

For further information, please visit www.infrastrataplc.com or

contact:

InfraStrata plc c/o Newgate Communications

John Wood, Chief Executive & Interim Chairman +44 (0)20 3735

8825

Allenby Capital Limited (AIM Nominated

Adviser & Broker) +44 (0)20 3328

Jeremy Porter / Liz Kirchner 5656

Arden Partners plc (Joint Broker)

Paul Shackleton / Dan Gee-Summons (Corporate

Finance) +44 (0)20 7614

Simon Johnson (Corporate Broking) 5900

Newgate Communications (PR) +44 (0)20 3757

Elisabeth Cowell/ Ian Silvera 6880

Notes to editors:

InfraStrata is a London Stock Exchange-quoted group focused on

strategic infrastructure projects.

The rapid development of the 100% owned Islandmagee Gas Storage

Project is a core workstream for InfraStrata. It is expected to

provide 25% of the UK's natural gas storage capacity and to benefit

the Northern Ireland economy as a whole when complete. Given that

the Committee on Climate Change has advised that the UK will still

need a significant quantity of natural gas by 2050 - about 70% of

today's consumption - the market opportunity for this project is

compelling.

The Company also owns and operates the assets of Harland &

Wolff in Belfast, where it will undertake the fabrication work for

the Islandmagee project, as well as establish secondary revenue

streams through the provision of services to the energy, maritime

and defence sectors should such opportunities arise in future.

Mindful of the fact that safe, secure and flexible sources of

energy are needed for a sustainable future, InfraStrata is focused

on providing investors with exposure to a growing portfolio of UK,

European and international energy infrastructure projects. With

this in mind, the Company's highly experienced team is focused on

acquiring, developing and commercialising innovative infrastructure

projects around the world.

The Front-End Engineering & Design (FEED) and Insitu

Downhole Testing programme for the Islandmagee Gas Storage Project

is co-financed by the European Union's Connecting Europe

Facility.

Disclaimer releasing the European Union from any liability in

terms of the content of the dissemination materials:

"The sole responsibility of this publication lies with the

author. The European Union is not responsible for any use that may

be made of the information contained therein."

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IODZZGGZLLRGGZM

(END) Dow Jones Newswires

February 10, 2020 02:00 ET (07:00 GMT)

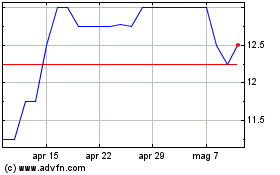

Grafico Azioni Harland & Wolff (LSE:HARL)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Harland & Wolff (LSE:HARL)

Storico

Da Apr 2023 a Apr 2024