Adriatic Metals PLC Issue of Equity (5317C)

11 Febbraio 2020 - 9:00AM

UK Regulatory

TIDMADT1

RNS Number : 5317C

Adriatic Metals PLC

11 February 2020

11 February 2020

Adriatic Metals PLC

("Adriatic Metals" or the "Company")

ISSUE OF EQUITY AND TOTAL VOTING RIGHTS

Adriatic Metals plc (ASX: ADT/ LON: ADT1) ("Adriatic", or the

"Company") advises that on 10 February 2020 it completed the issue

and allotment of 100,000 new Ordinary Shares in the form of Chess

Depository Interests in the capital of the Company in connection

with the exercise of 100,000 unlisted options granted under the

Company's 2018 share option scheme at an exercise price of A$0.40

per share.

Application will be made for the new Ordinary Shares to be

admitted to the standard segment of the Official List of the UK

Financial Conduct Authority, and to trading on the main market of

the London Stock Exchange. Admission is expected on or around 17

February 2020.

Following the allotment of the abovementioned shares, the

Company now has a total of 179,640,987 fully paid Ordinary Shares

in issue.

An Appendix 2A statement has been issued to the Australian

Securities Exchange (ASX) and is available on the Company's

website:

https://www.adriaticmetals.com/investors/asx-announcements/

** ENDS **

Market Abuse Regulation Disclosure

The information contained within this announcement is deemed by

the Company (LEI: 549300OHAH2GL1DP0L61) to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014. The person responsible for arranging the release of

this announcement on behalf of the Company is Paul Cronin, Managing

Director and CEO.

For further information please visit www.adriaticmetals.com,

@AdriaticMetals on Twitter,

or contact:

Adriatic Metals Plc Tel: +44 (0)20 7993 0066

Paul Cronin / Emma Chetwynd Stapylton

Blytheweigh (IR/PR Contact) Tel: +44 (0)20 7138 3204

Camilla Horsfall / Megan Ray

ABOUT ADRIATIC METALS

Adriatic Metals PLC (ASX:ADT, LON:ADT1) ("Adriatic" or the

"Company") is a dual listed (ASX and LSE) precious and base metals

explorer and developer via its 100% interest in the world class

Vares Project (the "Project") in Bosnia & Herzegovina. The

Project comprises a historic open cut mine at Veovaca and

brownfield exploration at Rupice, an advanced proximal deposit

which exhibits exceptionally high grades of base and precious

metals.

The Company announced the results of a Scoping Study on 19

November 2019 which indicated an NPV(8) of US$917 million and IRR

of 107%, following the release of a Maiden Resource Estimate

earlier the year on 23 July 2019. There have been no material

adverse changes in the assumptions underpinning the forecast

financial information or material assumptions and technical

parameters underpinning the Maiden Resource Estimate since the

original relevant market announcements which continue to apply.

Adriatic has attracted a world class team to both expedite its

exploration efforts to expand the current JORC resource at the

high-grade Rupice deposit and to rapidly advance the Project into

the development phase utilising its first mover advantage and

strategic position in Bosnia.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOETMMATMTJBBFM

(END) Dow Jones Newswires

February 11, 2020 03:00 ET (08:00 GMT)

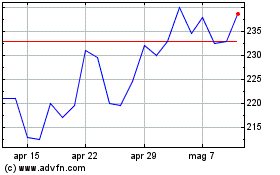

Grafico Azioni Adriatic Metals (LSE:ADT1)

Storico

Da Mar 2024 a Apr 2024

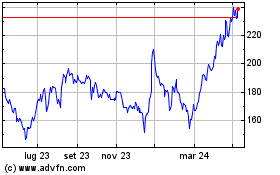

Grafico Azioni Adriatic Metals (LSE:ADT1)

Storico

Da Apr 2023 a Apr 2024