TIDMAEMC

RNS Number : 8227C

Aberdeen Emerging Markets Inv Co Ld

13 February 2020

Aberdeen Emerging Markets Investment Company Limited

LEI: 213800RIA1NX8DP4P938

Looking for the best-of-breed emerging market funds

Annual Report and Accounts

For the year ended 31 October 2019

Financial Highlights

Aberdeen Emerging Markets Investment Company Limited ("AEMC" or

the "Company") is a closed-end investment company with its Ordinary

shares listed on the Premium Segment of the London Stock Exchange.

It offers investors exposure to some of the best investment talent

within the global emerging markets of Asia, Eastern Europe, Africa

and Latin America.

The Company is governed by a board of independent directors, and

has no employees. Like most other investment companies, it

outsources its investment management and administration to an

investment management group, the Standard Life Aberdeen Group, and

other third party providers.

Net asset value ("NAV") per Ordinary NAV per Ordinary share(2)

share total return(1, 4)

+14.1% 663.3p

2018 -12.4% 2018 600.6p

-------------------- -------------------- ----------- ------------------------

Ordinary share price total return(1, Ordinary share price - mid market

4)

+13.2% 561.0p

2018 -15.7% 2018 515.0p

-------------------- -------------------- ----------- ------------------------

MSCI Emerging Markets Net Total Return Net Assets

Index in

sterling terms

+10.3% GBP304.9 million

2018 -9.0% 2018 GBP276.6 million

-------------------- -------------------- ----------- ------------------------

Net gearing(4) Ongoing charges ratio ("OCR")(4)

+8.0% 1.07%

2018 +7.0% 2018 1.02%

-------------------- -------------------- ----------- ------------------------

Dividends per Ordinary share(4) Revenue return per Ordinary share

21.0p 2.41p

2018 21.0p 2018 2.03p

-------------------- -------------------- ----------- ------------------------

(1) Performance figures stated above include reinvestment of

dividends on the ex-date

2 See note 14 in the Notes to the Financial Statements for basis

of calculation

3 Dividends declared for the year in which they were earned

4 Definitions of these Alternative Performance Measures ('APMs')

together with how these have been calculated can be found

below.

Investment Objective

The Company's investment objective is to achieve consistent

returns for shareholders in excess of the MSCI Emerging Markets Net

Total Return Index in sterling terms (the "Benchmark").

Investment Policy

The Company's investment policy is included in the Annual Report

and Accounts.

Benchmark

MSCI Emerging Markets Net Total Return Index in sterling

terms.

Management

The Company's Manager is Aberdeen Standard Fund Managers Limited

("ASFML", the "AIFM" or the "Manager") which has delegated the

investment management of the Company to Aberdeen Asset Managers

Limited ("AAML" or the "Investment Manager"). Both companies are

wholly owned subsidiaries of Standard Life Aberdeen plc.

The Company's portfolio is managed by Aberdeen Standard

Investments' highly experienced Closed End Fund Strategies ("CEFS")

team, which is amongst the most experienced of any operating

globally with a similar strategy. Further details of the team and

the investment strategy and process are included in the Annual

Report and Accounts.

Financial Calendar

27 March 2020 First interim dividend payable for year ending 31

October 2020

================= ==============================================================

21 April 2020 Annual General Meeting (Guernsey)

================= ==============================================================

June 2020 Second interim dividend payable for year ending 31

October 2020

================= ==============================================================

June 2020 Announcement of Half-Yearly Financial Report for the

six months ending 30 April 2020

================= ==============================================================

September 2020 Third interim dividend payable for year ending 31

October 2020

================= ==============================================================

December 2020 Fourth interim dividend payable for year ending 31

October 2020

================= ==============================================================

January/February Announcement of Annual Report and Accounts for the

2021 year ending 31 October 2020

================= ==============================================================

Chairman's Statement

Overview

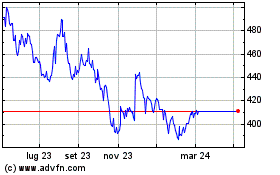

I am pleased to report that over the year to 31 October 2019,

the Company's net asset value ("NAV") total return per ordinary

share was 14.1%. This compares favourably with a total return of

10.3% from the Company's benchmark, the MSCI Emerging Markets Net

Total Return Index (in sterling terms). The ordinary share price

total return was 13.2%, as the discount to NAV at which the

Company's shares trade widened slightly, to 15.4% from 14.3% at the

start of the financial year. As at 7 February 2020, the discount to

NAV is now 12.9%.

Despite periods of volatility, the period under review was

positive for investors in emerging market equities with the asset

class recovering from a poor 2018. While developments around the

US-China trade dispute remained a cause for concern for most of the

year, a backdrop of easier monetary policy globally provided

support for equity markets. It is pleasing that the Company

outperformed the benchmark in both net asset value and share price

total return terms.

Asia was the best performing region during the year, with China,

India and Taiwan all performing strongly. Chinese equities

returned 11.4%, with the market direction unsurprisingly

correlating closely with developments in the trade dispute with the

US. The best performing country during the year was Russia, which

returned over 32%, benefitting from depressed equity valuations and

the country's relative immunity from trade war concerns. On the

other hand, within the Latin American region, the Argentinian

market fell by more than 35% mainly due to opposition leader

Alberto Fernandez's victory in October's presidential election,

which led investors to fear that a return to left wing populist

policies may be imminent.

Fund selection, asset allocation and discount narrowing all made

positive contributions to the performance for the year. Fund

selection was particularly strong in China where a number of

investments performed strongly. Within asset allocation, the

Company benefited from its overweight exposure to Russia and

underweight positioning in South Africa. The Company also benefited

from the discount narrowing of a number of investment trusts, as

well as the impact of fully utilising the Company's loan facility

during a time of rising markets.

A more detailed explanation of the year's performance and

portfolio activity during the year is provided in the

Investment

Manager's Report.

Dividends

The Board believes that one of the attractions of the Company is

its policy of making quarterly distributions by way of dividends to

be funded from a combination of income and capital. This policy has

been adopted by the Board in the belief that the level of dividends

paid by emerging market companies over the long term is an

increasingly important attraction for investors seeking to invest

in the emerging market asset class.

Three interim dividends, each of 5.25p per share, were paid on

29 March, 28 June and 27 September 2019 and, since the year end, a

fourth and final interim dividend in respect of the year of 5.25p

per share was paid on 20 December 2019. This brings the total

dividends for the year to 21p per share.

For future years, the Board intends to continue to pay interim

dividends on a quarterly basis, in March, June, September and

December and it is anticipated that the total dividends for the

year ending 31 October 2020 will be no less than 22.0p per share, a

5% increase on the level of dividends paid last year, representing

a yield of 3.47% based on the share price of 606.0p as at 7

February 2020. Accordingly, the Board declares a first interim

dividend for the current financial year, of 5.5p per share, which

will be paid on 27 March 2020 to shareholders on the register on 28

February 2020.

The Board will put a resolution to shareholders at the AGM in

respect of its policy to declare four interim dividends each year,

and will include this as a resolution at future AGMs. The payment

of any dividends will be subject to compliance with all necessary

regulatory obligations of the Company, including the Guernsey Law

solvency test, compliance with its loan covenants, and will also be

subject to the Company retaining sufficient cash for its working

capital requirements.

Loan Facility and Gearing

During the year, the Board announced the renewal of the

Company's GBP25 million multicurrency revolving loan facility for a

further year to 29 March 2020. The Board believes that the use of

gearing, which is one of the advantages of a closed ended

structure, within pre-determined ranges and at times when the

Investment Manager sees attractive investment opportunities, will

be beneficial to the longer term performance of the Company. At the

end of the year, the full GBP25 million available under the

facility was drawn down, representing gearing, net of cash, of

8.0%.

The Company has commenced discussions with its bankers and the

Board expects to renew the facility on similar terms when it

matures in March this year.

Share Buy Backs

During the year, in accordance with its stated discount

management policy, the Company bought back 81,937 shares

which are in treasury. Shares held in treasury may only be

resold at a price that represents a premium to the prevailing NAV

per share.

The Board's policy in relation to discount control is that it

considers it desirable that the Company's shares do not trade at a

price which, on average, represents a discount that is out of line

with the Company's direct peer group. To assist the Board in taking

action to deal with a material and sustained deviation in the

Company's discount from its peer group it seeks authority from

Shareholders annually to buy back shares. Shares may be repurchased

when, in the opinion of the Board and taking into account factors

such as market conditions and the discounts of comparable

companies, the Company's discount is higher than desired and shares

are available to purchase in the market. The Board is of the view

that the principal purpose of share repurchases is to enhance net

asset value for remaining shareholders, although it may also assist

in addressing the imbalance between the supply of and demand for

the Company's shares and thereby reduce the scale and volatility of

the discount at which the shares trade in relation to the

underlying net asset value.

Shares in Public Hands

During the year, the Board announced that the number of ordinary

shares which are deemed by the Listing Rules to be held in public

hands was below the minimum 25% threshold. The Listing Rules

provide that shares are not considered to be held in public hands

if they are held by persons (or persons in the same group or

persons acting in concert) who have an interest in 5% or more of a

listed company's share capital, as well as shares held by directors

of a listed company.

As at 31 October 2019, the shares in public hands was estimated

to be approximately 17% and is broadly unchanged as at the date of

this Report.

The FCA agreed to modify temporarily the relevant listing rule

to permit this decreased level of shares in public hands for a

period up until 21 August 2020, during which time the Company will

continue to monitor its share register and keep the FCA informed of

any relevant developments as well as working towards restoring the

number of shares in public hands.

The Board is pleased to recognise the increased effort that the

Manager is putting into broadening the Company's shareholder base

and continues to work closely with the Manager in this regard.

Annual General Meeting ("AGM")

The AGM will be held at 12 noon on 21 April 2020 at 11 New

Street, St Peter Port, Guernsey, GY1 2PF.

For those shareholders unable to attend, we would encourage you

to complete and return the proxy form enclosed with the Annual

Report and Accounts so as to ensure that your votes are represented

at the meeting. If you hold your shares in the Company via a share

plan or a platform and would like to attend and/or vote at the AGM,

then you will need to make arrangements with the administrator of

your share plan or platform. For this purpose, investors who hold

their shares in the Company via the Aberdeen Standard Investments

Plan for Children, Share Plan or ISA will find a Letter of

Direction enclosed. Shareholders are encouraged to complete and

return the Letter of Direction in accordance with the instructions

printed thereon.

The Notice of the Meeting is contained in the Annual Report and

Accounts.

Board Composition

In the light of relatively recent changes to the Board, and

having served as a Director since the Company's reconstruction, the

Directors have asked John Hawkins to continue to serve on the Board

until the AGM in 2021. I am delighted that John has accepted this

offer and will therefore stand for re-election at the AGM.

Outlook

Despite concerns over the outlook for global growth, corporate

earnings, tensions in the Middle East, and trade-war uncertainties,

your Investment Manager remains positive about the prospects for

emerging markets. Although there are signs of the global economy

weakening, growth forecasts remain respectable, and should be

supported by the continued accommodative stance of central banks

and progress in the trade dispute between the US and China. At the

time of writing, the spread of the Coronavirus is causing same

volatility in markets. How long this continues is uncertain, as is

the quantum of its potential knock-on impact.

Your Investment Manager continues to refine the Company's

portfolio towards those markets with the most compelling

fundamentals in terms of value, growth and quality. The Board

believes that this, together with the Company's approach of

investing through a portfolio of specialist funds run by talented

managers with strong investment propositions, provides an

attractive means for investors to benefit from the longer term

investment opportunity in emerging markets.

Mark Hadsley-Chaplin

Chairman

12 February 2020

Investment Manager's Report

During the financial year, the Company's NAV total return per

Ordinary share was 14.1% while the MSCI Emerging Markets Net Total

Return Index (the "Benchmark") rose by 10.3%. The Ordinary share

price total return was 13.2%, as the discount to NAV at which the

Company's Ordinary shares trade widened to 15.4% from 14.3% at the

start of the financial year.

Relative performance over the period was good, with the

Company's NAV outperforming the benchmark index by 3.8%. Fund

selection, asset allocation and discount narrowing all made a

positive contribution, as outlined in the table below. Fund

selection was particularly strong in China, where the Company's

investments in Neuberger Berman China Equity Fund and Aberdeen

Standard China A Share Equity Fund performed strongly, benefitting

in both instances from a high conviction, research intensive stock

picking strategy. Investment trusts with a global emerging markets

or Asian remit also added value (Genesis Emerging Markets Fund, JP

Morgan Emerging Markets Investment Trust, Schroder AsiaPacific

Fund, Asia Dragon Trust). QIC GCC Equity Fund, which invests

primarily in Saudi Arabia, Qatar and the United Arab Emirates, was

purchased in January and delivered healthy gains over the remainder

of the period. It was also pleasing to see a strong year in both

absolute and relative terms from Schroder Taiwanese Equity Fund.

Outside of Asia, the portfolio's investments in Eastern Europe

fared less well in relative terms, largely as a consequence of

investments in Russia failing to match the market's 32.5%

rally.

The primary driver of outperformance from asset allocation was

positioning in the Europe, Middle East and Africa region, with the

overweight in Russia and underweight in South Africa both proving

beneficial. During the period the Company's revolving credit

facility was fully drawn the majority of the time, enhancing

overall performance.

The contribution from narrowing discounts on closed end fund

investments was led by BlackRock Emerging Europe plc, which was

trading on a 5.3% discount at the start of the period but returned

capital at NAV less costs in December 2018, enabling the Company to

fully exit its holding. Other significant contributions were made

by holdings in BlackRock Latin American Investment Trust and

JPMorgan Emerging Markets Investment Trust whose discounts narrowed

alongside strong NAV performance.

NAV performance attribution for the year ended 31 October

2019

Fund Selection 0.8%

========================= ======

Asia 1.7%

EMEA (0.9%)

Latin America (0.0%)

========================= ======

Asset Allocation 1.6%

========================= ======

Asia 0.0%

EMEA 1.1%

Latin America 0.0%

Cash/Gearing (direct and

underlying) 0.5%

========================= ======

Discount Narrowing 2.4%

========================= ======

Fees and Expenses (1.0%)

========================= ======

NAV outperformance* 3.8%

========================= ======

* The above analysis has been prepared on a total return

basis.

Market Environment

The year under review was a positive one for investors in

emerging market equities, with the MSCI Emerging Markets Index

gaining 10.3% in total return terms. Volatility was a regular

feature, with three significant market retractions over the year as

investors reacted to developments in the US-China trade war,

weakening global economic data and the direction of monetary

policy. While emerging markets outperformed developed markets for

much of the year, the overall return was very similar, with the

MSCI World Index up 11.2% over the period.

Asia was the best performing region, gaining 11.2% as China,

India and Taiwan all delivered double digit returns. Chinese

equities gained 11.4%, with market direction correlating closely

with developments in the trade dispute with the US. After several

false dawns, the outline of a "Phase One" deal was agreed in

October 2019. China also benefitted from index provider MSCI's

decision to increase the weighting of domestically traded A-Shares

in local and regional indices during the period. Indian equities

rose by 15.9%. The key event in that market was the general

election, which saw the incumbent BJP deliver a resounding victory

in May that helped the market shrug off a somewhat lacklustre

economic outlook. Taiwan was a prime beneficiary of the improved

news flow on the trade war in the final weeks of the period and a

more optimistic demand outlook for the technology components sector

which dominates that market.

The Europe, Middle East and Africa regional index rose by 9.7%.

Russia was responsible for a significant part of that gain as its

market appreciated by 32.5%, benefitting from its relative immunity

from trade war concerns, depressed valuations and a sharp rally in

Gazprom's share price after a surprise doubling of its dividend in

May. Turkey endured a volatile year with domestic politics and

concerns about the direction of monetary policy impacting the value

of the Turkish Lira. The market declined sharply in the final month

of the period following Turkey's incursion into Syria and the US

imposition of sanctions in response, although it still posted a

gain of 7.9% for the overall period. South African equities rose by

6.9% despite a weak economic picture amidst ongoing electricity

outages and financial uncertainty at power utility Eskom.

Latin America was the weakest region, gaining just 6.3% despite

a strong recovery in Brazil, the largest regional market, which

rose by 11.7%. This was largely a consequence of a change in

political direction as President Bolsonaro took office in January

with a policy agenda pledging to tackle political corruption, clamp

down on crime and deliver social security and tax reform. A

significant pension reform bill was approved by the senate in

October. Mexico delivered a return of 5.7% despite concerns about

the policy direction under President López Obrador's administration

and a somewhat testing relationship with the US over migration.

Elsewhere in the region, Chile fell sharply in the final weeks of

the year to post a return of -16.8% amidst a wave of

anti-government protests over equality, pensions, healthcare and

education. Argentina had an eventful year, rejoining the emerging

markets index at the end of May (alongside Saudi Arabia) but

falling sharply as opposition leader Alberto Fernandez's victory in

October's presidential election led investors to fear that a return

to left wing populist policies may be imminent. Over the year as a

whole the Argentinian market declined 35.2%.

Portfolio

Our portfolio construction process seeks to deliver a focused

list of actively managed holdings run by talented investment teams.

We continually review the list of funds to which we have entrusted

the Company's capital and changes are made when we identify what we

consider to be superior managers, our asset allocation views change

or a discount opportunity in a closed end fund presents itself or

has played out. The period under review was one in which there was

a reasonable amount of activity in the portfolio consistent with

the above themes.

New positions were initiated in several open ended funds to

provide actively managed exposure to Middle Eastern equities (QIC

GCC Equity Fund), the China A Share market (Aberdeen Standard China

A Share Equity Fund) and frontier market debt (Aberdeen Standard

Frontier Markets Bond Fund). QIC GCC Equity Fund is a best in class

gulf-focused vehicle managed by an experienced investment team

based in Qatar which provides significant exposure to Saudi Arabia,

Kuwait and the United Arab Emirates. We believe markets in the

region are attractively valued and are currently largely overlooked

by international investors despite growing relevance within the

Benchmark following recent index inclusions.

The investment in Aberdeen Standard China A Share Equity Fund

was initiated in February, when concerns around US-China trade

tensions were rife and valuations had declined to extreme levels.

This proved a well-timed entry point. The fund invests in a

concentrated portfolio of high quality, reasonably valued A Share

companies with a focus on strong governance.

Frontier markets bonds have many attractions in the current

environment given the uncertainty around global growth and the

potential ongoing "easy" monetary policy in the US and much of the

emerging world. The Aberdeen Standard Frontier Markets Bond Fund is

one of a small number of dedicated vehicles globally and adds to

portfolio diversification at the country level, while potentially

offering equity like returns with bond like volatility. The fund

invests over half its assets in hard currency sovereign bonds with

the remainder allocated to hard currency corporate and local

currency sovereign bonds. The fund's 8.4% yield represents a

significant spread over emerging market debt. While the portfolio

is highly diversified, key country exposures include Egypt,

Nigeria, Ecuador, El Salvador and the Ivory Coast. As with all

investments into "in-house" managed funds, there is no double

charging of fees on the China A Share or Frontier Markets Bond

Fund.

There were also several new additions within the closed end fund

portion of the portfolio. As discussed in the Company's half yearly

report, positions in Aberdeen New India Investment Trust and

JPMorgan Indian Investment Trust were initiated at attractive

discounts following significant underperformance of the Indian

market relative to other emerging markets as pre-election nerves

weighed on sentiment in early 2019. The JPMorgan managed vehicle

had in place a performance driven tender offer for 25% of

outstanding shares that was triggered at the end of September and

we expect the tender to be completed in February.

In July, we initiated a new position in Gulf Investment Fund, a

closed end Middle Eastern equity fund trading in London at a double

digit discount to net asset value. In addition to being supported

by the same top-down case as the QIC GCC Equity Fund investment,

Gulf Investment Fund offers the potential upside of a full exit

opportunity in 2020. We also accumulated a holding in Aberdeen

Asian Income Fund over the year at an average discount of close to

8.0%. We view this as anomalous relative to its peers. Elsewhere,

we made a significant addition to the existing position in Fondul

Proprietatea, a deeply discounted Romanian closed end fund.

Corporate actions in a number of underlying holdings were a

valuable source of funds for these purchases. These included a full

exit from BlackRock Emerging Europe plc and tender offers at China

Fund Inc and Edinburgh Dragon Trust (later renamed Asia Dragon

Trust). In the latter two cases we were able to exit over 40% of

the Company's holdings at a material uplift to the prevailing

price.

Sales of market access products (such as exchanged traded funds)

in Turkey, Saudi Arabia, South Korea and emerging markets debt

provided additional sources of liquidity, the net result being that

more of the portfolio is now managed on an active basis. The most

significant open ended fund sale was the redemption of Steyn

Capital South Africa Equity Fund, based on a deteriorating outlook

for that market combined with a disappointing spell of

performance.

The Company's geographic allocation is shown in the Annual

Report and Accounts. The activity described above resulted in a

meaningful increase in the Chinese and Indian allocations (to 29.6%

and 7.4% respectively) while those of South Korea and Taiwan

declined by several percentage points to 10.7% and 8.8%

respectively. The corporate action in BlackRock Emerging Europe plc

contributed to a decline in Russia's weighting to 6.5%. South

Africa saw a meaningful decrease to just 0.6% while the Middle

Eastern markets of Saudi Arabia, United Arab Emirates and Qatar

rose to 2.4%, 1.2% and 1.0% respectively. In Latin America,

Brazil's allocation increased to 6.6% largely as a consequence of a

rotation in underlying exposure within the portfolio's core Latin

American holding. We continue to believe that many frontier markets

offer compelling valuations as they remain overlooked by mainstream

emerging market investors. At the end of the period 11.8% of NAV

was allocated to frontier markets, including Romania, Nigeria and

Kenya.

The weighted average discount to NAV of the Company's closed end

holdings stood at 10.3% at the end of the period, a level that was

virtually unchanged on the prior period. This reflects the

reinvestment of corporate action proceeds into new ideas at

attractive discounts.

The allocation to funds managed by Aberdeen Standard Investments

increased from 2.9% to 11.9% of net assets over the year. This is a

trend we expect to continue, subject to us identifying in-house

managed strategies that we believe can help us deliver the

Company's investment objective. The lack of double-charging on

in-house managed funds is a potentially valuable tool in making the

Company as cost-effective as possible in an environment where this

is increasingly a concern for investors. All investments in

"in-house" products are subject to the same in-depth diligence as

external funds and a rigorous conflicts of interest procedure.

The overall composition of the portfolio by type of vehicle is

shown below. The allocations to both open and closed ended funds

increased modestly as we exited a number of market access products.

The Company's revolving credit facility was fully drawn at the end

of the period, representing net gearing of 8.0%.

October 2019 October 2018

================================ ============

Closed ended investment

funds 50.1% 48.6%

======================== ====== ============

Open ended investment

funds 56.3% 53.1%

======================== ====== ============

Market access products 1.4% 5.3%

======================== ====== ============

Cash plus other net

current assets (7.8%) (7.0%)

======================== ====== ============

Market Outlook

Despite the emerging markets index posting a gain of 10.3%, the

investment backdrop became more challenging over the course of the

year with investors increasingly focused on concerns about the

outlook for global growth and trade war uncertainties. Corporate

earnings and economic growth forecasts across the emerging world

were generally revised down as the period progressed.

While the global economy is weaker than historical averages,

growth remains respectable, with the IMF, OECD and World Bank

forecasting real growth in 2020 in the range of 2.8% to 3.4% and a

generally improving trend through 2021. Although there are risks to

these forecasts we feel they are reasonable given the accommodative

stance of central banks and signs of a truce in the trade war

between the US and China following the recent signing of the "Phase

one" trade deal and, as a result, the US suspending previously

announced tariff increases. China will significantly increase its

purchase of US agricultural products over the next two years. China

has also indicated that it will accelerate the opening of its

financial sector. Nonetheless, we will need to watch the tone of

further negotiations closely, particularly as the US presidential

election campaign develops and candidates potentially vie to be

"tough on China".

While 2019 was undoubtedly a poor year for corporate earnings in

emerging markets, with persistent downward revisions throughout the

period, the coming year may well offer a better environment.

Consensus expectations of 15.1% growth for 2020 appear somewhat

high but double digit growth may well be achievable if the economic

outlook and trade war truce can be sustained. As for valuations,

while emerging markets are not outstandingly cheap compared with

their history, they are trading on undemanding multiples (12.2

times forward earnings at the time of writing) relative to

developed markets as a whole.

Emerging market equity is an unloved asset class at present,

held back by negative sentiment and low expectations. The average

global investor remains significantly underweight and over the

course of 2019 global and regional emerging market equity funds saw

only modest inflows of US$4.1 billion, much of which came in the

final weeks of the year. Anecdotally, we see a withdrawal by

investors from single country funds and those regions now deemed to

be marginal when compared with Asia, which is perceived as the most

defensive emerging market region. This has been to the detriment of

frontier markets, Latin America and Eastern Europe. We believe the

long term prospects in many of these markets are as good, if not

better, than those of Asia. This is reflected in the Company's

current asset allocation.

A prerequisite for emerging markets to begin delivering relative

outperformance of developed markets again is a weakening, or at

least a consolidation, of the US dollar. The last year has shown

tentative signs that this is possible, although these signs have

not been sufficiently strong to prompt any meaningful rotation in

investor allocations.

At the time of writing, investors remain focused on the

developing Coronavirus situation to the exclusion of other factors.

While the situation is still evolving, our expectation is that it

will be short-lived and the effects of this unfortunate event will

have no lasting impact on either economic activity or stock

markets. We will of course continue to assess the situation as it

develops and remain ready to act as necessary.

As for the portfolio, we continue to refine the Company's

focused list of holdings with a bias towards those markets with the

most compelling fundamentals in terms of value, growth and quality.

The current portfolio provides exposure to some of the most

talented managers operating in emerging markets. Amongst the closed

ended investments we increasingly focus on defined catalysts to

unlock additional value from discounts to net asset value.

Underlying fee levels continue to be an area of focus and we have

endeavoured to lower those where possible in recent years while

maintaining the quality of the portfolio. That focus on costs will

continue. We believe the Company is well placed to benefit from any

recovery in interest in the asset class and its portfolio offers

differentiated and diversified exposure to emerging markets that is

not easily replicated.

Aberdeen Asset Managers Limited

12 February 2020

Principal Risks and Uncertainties

Together with the issues discussed in the Chairman's Statement

and the Investment Manager's Report, the Board considers that the

main risks and uncertainties faced by the Company fall into the

following categories:

(i) General Market Risks Associated with the Company's

Investments

Changes in economic conditions, interest rates, foreign exchange

rates and inflationary pressures, industry conditions, competition,

political and diplomatic events, tax, environmental and other laws

and other factors can substantially and either adversely or

favourably affect the value of the securities in which the Company

invests and, therefore, the Company's performance and

prospects.

The Company's investments are subject to normal market

fluctuations and the risks inherent in the purchase, holding or

selling of securities, and there can be no assurance that

appreciation in the value of those investments will occur. There

can be no guarantee that any realisation of an investment will be

on a basis which necessarily reflects the Company's valuation of

that investment for the purposes of calculating the NAV.

The Company's investments, although not made into developed

economies, are not entirely sheltered from the negative impact of

economic slowdowns, decreasing consumer demands and credit

shortages in such developed economies which, amongst other things,

affects the demand for the products and services offered by the

companies in which the Company directly or indirectly invests.

A proportion of the Company's portfolio may be held in cash or

cash equivalent investments from time to time. Such proportion of

the Company's assets will be out of the market and will not benefit

from positive stock market movements, but may give some protection

against negative stock market movements.

(ii) Emerging Markets

The funds selected by the Investment Manager invest in emerging

markets. Investing in emerging markets involves certain risks and

special considerations not typically associated with investing in

other more established economies or securities markets. In

particular there may be: (a) the risk of nationalisation or

expropriation of assets or confiscatory taxation; (b) social,

economic and political uncertainty including war and revolution;

(c) dependence on exports and the corresponding importance of

international trade and commodities prices; (d) less liquidity of

securities markets; (e) currency exchange rate fluctuations; (f)

potentially higher rates of inflation (including hyper- inflation);

(g) controls on foreign investment and limitations on repatriation

of invested capital and a fund manager's ability to exchange local

currencies for pounds sterling; (h) a higher degree of governmental

involvement and control over the economies; (i) government

decisions to discontinue support for economic reform programmes and

imposition of centrally planned economies; (j) differences in

auditing and financial reporting standards which may result in the

unavailability of material information about economies and issuers;

(k) less extensive regulatory oversight of securities markets; (l)

longer settlement periods for securities transactions; (m) less

stringent laws regarding the fiduciary duties of officers and

directors and protection of investors; and (n) certain consequences

regarding the maintenance of portfolio securities and cash with

sub-custodians and securities depositories in developing

markets.

(iii) Other Portfolio Specific Risks

(a) Small cap stocks

The underlying investee funds selected by the Investment Manager

may have significant investments in smaller to medium sized

companies of a less seasoned nature whose securities are traded in

an "over-the-counter" market. These "secondary" securities often

involve significantly greater risks than the securities of larger,

better-known companies, due to shorter operating histories,

potentially lower credit ratings and, if they are not listed

companies, a potential lack of liquidity in their securities. As a

result of lower liquidity and greater share price volatility of

these "secondary" securities, there may be a disproportionate

effect on the value of the investee funds and, indirectly, on the

value of the Company's portfolio.

(b) Liquidity of the portfolio

The fact that a share is traded does not guarantee its liquidity

and the Company's investments may be less liquid than other listed

and publicly traded securities. The Company may invest in

securities that are not readily tradable or may accumulate

investment positions that represent a significant multiple of the

normal trading volumes of an investment, which may make it

difficult for the Company to sell its investments. Investors should

not expect that the Company will necessarily be able to realise its

investments within a period which they would otherwise regard as

reasonable, and any such realisations that may be achieved may be

at a considerably lower price than prevailing indicative market

prices. The Company has a borrowing facility in place which may be

utilised to assist in the management of liquidity. The borrowing

facility is described later in this Directors' Report.

Liquidity of the portfolio is further discussed in note 17 of

the Annual Report and Accounts.

(c) Foreign exchange risks

It is not the Company's present policy to engage in currency

hedging. Accordingly, the movement of exchange rates between

sterling and the other currencies in which the Company's

investments are denominated or its borrowings are drawn down may

have a material effect, unfavourable or favourable, on the returns

otherwise experienced on the investments made by the Company.

Movements in the foreign exchange rate between sterling and the

currency applicable to a particular shareholder may have an impact

upon that shareholder's returns in their own currency of

account.

Management or mitigation of the above risks

Risk Management or mitigation

of risk

General market risks associated These risks are largely a

with the Company's investments consequence of the Company's

investment strategy but the

Investment Manager attempts

to mitigate such risks by

maintaining an appropriately

diversified portfolio by

number of holdings, fund

structure, geographic focus,

investment style and market

capitalisation focus.

Liquidity, risk and exposure

measures are produced on

a monthly basis by the Investment

Manager and monitored against

internal limits.

-----------------------------------

Emerging markets

-----------------------------------

Other portfolio specific

risks

(a) Small cap stock

(b) Liquidity of the portfolio

(c) Foreign exchange

-----------------------------------

The investment management of the Company has been delegated to

the Company's Investment Manager. The Investment Manager's

investment process takes into account the material risks associated

with the Company's portfolio and the markets and holdings in which

the Company is invested. The Board monitors the portfolio and the

performance of the Investment Manager at regular Board

meetings.

(iv) Internal Risks

Poor allocation of the Company's assets to both markets and

investee funds by the Investment Manager, poor governance,

compliance or administration, including poor controls over cyber

security, could result in shareholders not making acceptable

returns on their investment in the Company.

Management or mitigation of internal risks

The Board monitors the performance of the Manager and the other

key service providers at regular Board meetings. The Manager

provides reports to the Board on compliance matters and the

Administrator provides reports to the Board on compliance and other

administrative matters. The Board has established various

committees to ensure that relevant governance matters are addressed

by the Board.

The management or mitigation of internal risks is described in

detail in the Corporate Governance Statement in the Annual Report

and Accounts.

Statement of Directors' Responsibilities in Respect of the

Annual Report and Accounts

The Directors are responsible for preparing the Annual Report

and Accounts in accordance with applicable law and regulations.

Guernsey company law requires the Directors to prepare financial

statements for each financial year. The Directors have elected to

prepare the financial statements in accordance with International

Financial Reporting Standards as issued by the IASB and applicable

law.

Under company law the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Company and of its profit or

loss for that period. In preparing these financial statements, the

directors are required to:

-- select suitable accounting policies and then apply them

consistently;

-- make judgements and estimates that are reasonable, relevant

and reliable;

-- state whether applicable accounting standards have been

followed, subject to any material departures disclosed and

explained in the financial statements;

-- assess the Company's ability to continue as a going concern,

disclosing, as applicable, matters related to going concern;

and

-- use the going concern basis of accounting unless they either

intend to liquidate the Company or to cease operations, or have no

realistic alternative but to do so.

The Directors are responsible for keeping proper accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

its financial statements comply with the Companies (Guernsey) Law,

2008. They are responsible for such internal control as they

determine is necessary to enable the preparation of financial

statements that are free from material misstatement, whether due to

fraud or error, and have general responsibility for taking such

steps as are reasonably open to them to safeguard the assets of the

Company and to prevent and detect fraud and other

irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website, but not for the content of any information

included on the website that has been prepared or issued by third

parties. Legislation in Guernsey governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

Disclosure of Information to the Auditor

The Directors who held office at the date of approval of this

Directors' Report confirm that, so far as they are each aware,

there is no relevant audit information of which the Company's

auditor is unaware; and each Director has taken all the steps that

they ought to have taken as a Director to make themselves aware of

any relevant audit information and to establish that the Company's

auditor is aware of that information.

Responsibility Statement of the Directors in Respect of the

Annual Financial Report

We confirm that to the best of our knowledge:

the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company; and the Management Report (comprising the

Chairman's Statement, the Investment Manager's Report and the

Directors' Report) includes a fair review of the development and

performance of the business and the position of the Company,

together with a description of the principal risks and

uncertainties that it faces.

The Board considers that the Annual Report and Accounts, taken

as a whole, is fair, balanced and understandable and provides the

information necessary for shareholders to assess the Company's

position and performance, business model and strategy.

Helen Green

Director

William Collins

Director

12 February 2020

Statement of Comprehensive Income

Year ended 31 October Year ended 31 October

2019 2018

======================================= ================================ ================================

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

====================================== ======== ======== ============ ======== ========== ==========

Gains/(losses) on investments

at fair value

======== ======== ============ ======== ========== ==========

through profit or loss - 37,730 37,730 - (41,807) (41,807)

======================================= ======== ======== ============ ======== ========== ==========

Losses on currency movements - (392) (392) - (157) (157)

======================================= ======== ======== ============ ======== ========== ==========

Net investment gains/(losses) - 37,338 37,338 - (41,964) (41,964)

======================================= ======== ======== ============ ======== ========== ==========

Investment income 4,861 - 4,861 5,019 - 5,019

======================================= ======== ======== ============ ======== ========== ==========

4,861 37,338 42,199 5,019 (41,964) (36,945)

======================================= ======== ======== ============ ======== ========== ==========

Investment management fee (2,331) - (2,331) (2,515) - (2,515)

======================================= ======== ======== ============ ======== ========== ==========

Other expenses (883) - (883) (886) - (886)

======================================= ======== ======== ============ ======== ========== ==========

Operating profit/(losses) before

finance costs and taxation 1,647 37,338 38,985 1,618 (41,964) (40,346)

======================================= ======== ======== ============ ======== ========== ==========

Finance costs (315) - (315) (312) - (312)

======================================= ======== ======== ============ ======== ========== ==========

Operating profit/(losses) before

taxation 1,332 37,338 38,670 1,306 (41,964) (40,658)

======================================= ======== ======== ============ ======== ========== ==========

Withholding tax expense (223) - (223) (326) - (326)

======================================= ======== ======== ============ ======== ========== ==========

Profit/(loss) and total comprehensive

income for the year 1,109 37,338 38,447 980 (41,964) (40,984)

======================================= ======== ======== ============ ======== ========== ==========

Earnings per Ordinary share 2.41p 81.17p 83.58p 2.03p (86.83p) (84.80p)

======================================= ======== ======== ============ ======== ========== ==========

The total column of this statement represents the Company's

Statement of Comprehensive Income, prepared under IFRS. The revenue

and capital columns, including the revenue and capital earnings per

share data, are supplementary information prepared under guidance

published by the Association of Investment Companies.

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued

during the year.

The notes form part of these financial statements.

Statement of Financial Position

As at 31 As at 31

October October

2019 2018

GBP'000 GBP'000

======================================= ================ ================

Non-current assets

Investments at fair value through

profit or loss 328,713 295,601

======================================= ================ ================

Current assets

Cash and cash equivalents 1,190 1,037

Sales for future settlement 72 -

Other receivables 350 297

======================================= ================ ================

1,612 1,334

======================================= ================ ================

Total assets 330,325 296,935

======================================= ================ ================

Current liabilities

Purchases for future settlement (104) -

Other payables (344) (351)

Finance costs payable - (28)

Bank loan payable (25,000) (20,000)

======================================= ================ ================

Total liabilities (25,448) (20,379)

======================================= ================ ================

Net assets 304,877 276,556

======================================= ================ ================

Equity

Share capital 149,616 150,082

Capital reserve 161,204 132,546

Revenue reserve (5,943) (6,072)

======================================= ================ ================

Total equity 304,877 276,556

======================================= ================ ================

Net assets per Ordinary share 663.28p 600.59p

======================================= ================ ================

Approved by the Board of Directors and authorised for issue on

12 February 2020.

Helen Green - Director

William Collins - Director

The notes form part of these financial statements.

Statement of Changes in Equity

Revenue

Share capital Capital reserve reserve Total

For the year ended 31 October GBP'000 GBP'000 GBP'000 GBP'000

2019

================================ ================ ================= ======== =========

Balance at 1 November 2018 150,082 132,546 (6,072) 276,556

Profit for the year - 37,338 1,109 38,447

Dividends paid - (8,680) (980) (9,660)

Share buybacks (466) - - (466)

================================= ================ ================= ======== =========

Balance at 31 October 2019 149,616 161,204 (5,943) 304,877

================================= ================ ================= ======== =========

Revenue

Share capital Capital reserve reserve Total

For the year ended 31 October GBP'000 GBP'000 GBP'000 GBP'000

2018

================================ ================ ================= ======== =========

Balance at 1 November 2017 183,930 184,593 (7,052) 361,471

Loss for the year - (41,964) 980 (40,984)

Dividends paid - (10,083) - (10,083)

Tender offer (33,413) - - (33,413)

Tender offer costs (254) - - (254)

Share buybacks (181) - - (181)

================================== ================ ================= ======== =========

Balance at 31 October 2018 150,082 132,546 (6,072) 276,556

================================== ================ ================= ======== =========

The Company's distributable reserves comprise; the Capital

reserve attributable to realised profits and the Revenue

reserve.

The notes form part of these financial statements.

Statement of Cash Flow

Year ended Year ended

31 October 31 October

2019 2018

GBP'000 GBP'000

====================================================== =========== ===========

Operating activities cash flows

Cash inflow from investment income and other

income 4,830 4,908

Cash outflow from management expenses (3,243) (3,407)

Cash inflow from disposal of investments* 110,609 73,523

Cash outflow from purchase of investments* (105,959) (27,668)

Cash outflow from withholding tax (223) (326)

====================================================== =========== ===========

Net cash flow from operating activities 6,014 47,030

====================================================== =========== ===========

Financing activities cash flows

Proceeds from/(repayment of) bank borrowings 5,000 (5,000)

Borrowing commitment fee and interest

charges (343) (319)

Dividend paid (9,660) (10,083)

Tender offer and associated costs - (33,667)

Share buybacks (466) (181)

====================================================== =========== ===========

Net cash flow used in financing activities (5,469) (49,250)

====================================================== =========== ===========

Net increase/(decrease) in cash and cash equivalents 545 (2,220)

====================================================== =========== ===========

Effect of foreign exchange (392) (157)

Cash and cash equivalents at start of the

year 1,037 3,414

====================================================== =========== ===========

Cash and cash equivalents at end of the year 1,190 1,037

====================================================== =========== ===========

* Receipts from the disposal and purchase of investments have

been classified as components of cash flow from/(used in) operating

activities because they form part of the Company's operating

activities.

The notes form part of these financial statements.

Notes to the Financial Statements For the Year Ended 31 October

2019

1. Reporting entity

Aberdeen Emerging Markets Investment Company Limited (the

"Company") is a closed-ended investment company, registered in

Guernsey on 16 September 2009. The Company's registered office is

11 New Street, St Peter Port, Guernsey, GY1 2PF. The Company's

shares have a premium listing on the London Stock Exchange and

commenced trading on 10 November 2009. The Company changed its name

to Aberdeen Emerging Markets Investment Company Limited on 14 April

2016. The financial statements of the Company are presented for the

year ended 31 October 2019.

The Company invests in a portfolio of funds and products which

give diversified exposure to developing and emerging markets

economies with the objective of achieving consistent returns for

shareholders in excess of the MSCI Emerging Markets Net Total

Return Index in sterling terms.

Manager

The investment activities of the Company were managed by

Aberdeen Standard Fund Managers Limited ("ASFML") during the year

ended 31 October 2019.

Non-mainstream pooled investments ("NMPIs")

The Company currently conducts its affairs so that the shares

issued by the Company can be recommended by Independent Financial

Advisers to ordinary retail investors in accordance with the

Financial Conduct Authority's rules in relation to NMPIs and

intends to continue to do so for the foreseeable future.

2. Basis of preparation

(a) Statement of compliance

The financial statements, which give a true and fair view, have

been prepared in accordance with International Financial Reporting

Standards ("IFRS") and are in compliance with the Companies

(Guernsey) Law, 2008. There were no changes in the accounting

policies of the Company in the year to 31 October 2019.

Where presentational guidance set out in the Statement of

Recommended Practice ("SORP") for Investment Companies issued by

the Association of Investment Companies ("AIC") in October 2019 is

consistent with the requirements of IFRS, the directors have sought

early adoption of the SORP and to prepare the financial statements

on a basis compliant with the recommendations of the SORP.

The total column of the Statement of Comprehensive Income is the

profits or loss account of the Company. The "Capital" and "Revenue"

columns provide supplementary information.

The financial statements were approved and authorised for issue

by the Board on 12 February 2020.

This report will be sent to shareholders and copies will be made

available to the public at the Company's registered office It will

also be made available on the Company's website:

aberdeenemergingmarkets.co.uk.

(b) Going concern

The Directors have adopted the going concern basis in preparing

the financial statements. The Board formally considered the

Company's going concern status at the time of the publication of

these financial statements and a summary of the assessment is

provided below.

At the AGM held in April 2018, a resolution was approved by

shareholders that the Company will continue in existence in its

current form until the AGM to be held in 2023.

The Directors believe that the Company has adequate resources to

continue in operational existence for at least 12 months from the

date of approval of this document. In reaching this conclusion, the

Directors have considered the liquidity of the Company's portfolio

of investments as well as its cash position, income and expense

flows.

As at 31 October 2019, the Company held GBP1.2 million in cash

and GBP328.7 million in investments. It is estimated that

approximately 75% of the investments held at the year end could be

realised in one month. The total operating expenses for

the year ended 31 October 2019 were GBP3.2 million, which

represented approximately 1.07% of average net assets during

the

year. The Company also incurred GBP0.3 million of finance costs.

At the date of approval of this report, based on the aggregate of

investments and cash held, the Company has substantial operating

expenses cover.

The Company has a GBP25 million revolving loan facility with

RBSI, maturing on 29 March 2020. The Company has commenced

discussions with RBSI and the Board expects to renew the facility

on similar terms when it matures. As at 31 October 2019, GBP25

million was drawn down from the RBSI facility. The liquidity of the

Company's portfolio, as mentioned above, sufficiently supports the

Company's ability to repay its borrowings at short notice.

The Directors are satisfied that it is appropriate to adopt the

going concern basis in preparing the financial statements and,

after due consideration, that the Company is able to continue in

operation for a period of at least 12 months from the date of

approval of these financial statements.

(c) Basis of measurement

The financial statements have been prepared on the historical

cost basis except for investments held at fair value through profit

or loss which are measured at fair value.

(d) Functional and presentation currency

The Company's investments are denominated in multiple

currencies. However, the Company's shares are issued in GBP

sterling and the majority of its investors are UK based. Therefore,

the financial statements are presented in sterling, which is the

Company's functional currency. All financial information presented

in sterling has been rounded to the nearest thousand pounds.

(e) Capital reserve

Profits achieved by selling investments and changes in fair

value arising upon the revaluation of investments that remain in

the portfolio are all charged to profits or loss in the capital

column of the Statement of Comprehensive Income and allocated to

the capital reserve. The Capital reserve is also used to fund

dividend distributions.

(f) Revenue reserve

The balance of all items allocated to the revenue column of the

Statement of Comprehensive Income in each year is transferred to

the Company's revenue reserve. The revenue reserve is also used to

fund dividend distributions.

(g) Use of estimates, assumptions and judgements

The preparation of the financial statements in conformity with

IFRS requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets, liabilities, income and expenses.

Actual results may differ from these estimates.

Use of estimates and assumptions

Estimates and underlying assumptions are reviewed on an on-going

basis. Revisions to accounting estimates are recognised in the

period in which the estimates are revised and in future periods

affected.

Information about significant areas of estimation uncertainty

and critical judgements in applying accounting policies that have

the most significant effect on the amounts recognised in the

financial statements are described below.

Classification and valuation of investments

Investments are designated as fair value through profit or loss

on initial recognition and are subsequently measured at fair value.

The valuation of such investments requires estimates and

assumptions made by the management of the Company depending on the

nature of the investments as described in note 3 (a) and fair value

may not represent actual realisable value for those

investments.

Allocation of investments to fair value hierarchy

IFRS requires the Company to measure fair value using the

following fair value hierarchy that reflects the significance of

the inputs used in making the measurements. IFRS establishes a fair

value hierarchy that prioritises the inputs to valuation techniques

used to measure fair value. The hierarchy gives the highest

priority to unadjusted quoted prices in active markets for

identical assets or liabilities (Level 1 measurements) and the

lowest priority to unobservable inputs (Level 3 measurements). The

three levels of fair value hierarchy under IFRS are as follows:

Level 1 - quoted prices (unadjusted) in active markets for

identical assets or liabilities;

Level 2 - inputs other than quoted prices included within level

1 that are observable for the asset or liability, either directly

(that is, as prices) or indirectly (that is, derived from prices);

and

Level 3 - inputs for the asset or liability that are not based

on observable market data (that is, unobservable inputs).

The level in the fair value hierarchy within which the fair

value measurement is categorised in its entirety is determined on

the basis of the lowest level input that is significant to the fair

value measurement in its entirety. For this purpose, the

significance of an input is assessed against the fair value

measurement in its entirety. If a fair value measurement uses

observable inputs that require significant adjustment based on

unobservable inputs, that measurement is a Level 3 measurement.

Assessing the significance of a particular input to the fair value

measurement in its entirety requires judgement, considering factors

specific to the asset or liability.

Use of judgements

The determination of what constitutes 'observable' requires

significant judgement by the Company. The Company considers

observable data to be that market data that is readily available,

regularly distributed or updated, reliable and verifiable not

proprietary and provided by independent sources that are actively

involved in the relevant market.

3. Significant accounting policies

(a) Investments

As the Company's business is investing in financial assets with

a view to profit from their total return in the form of increases

in fair value, financial assets are designated as fair value

through profit or loss on initial recognition. These investments

are recognised on the trade date of their acquisition at which the

Company becomes a party to the contractual provisions of the

instrument. At this time, the best evidence of the fair value of

the financial assets is the transaction price. Transaction costs

that are directly attributable to the acquisition or issue of the

financial assets are charged to profit or loss in the Statement of

Comprehensive Income as a capital item. Subsequent to initial

recognition, investments designated as fair value through profit or

loss are measured at fair value with changes in their fair value

recognised in profit or loss in the Statement of Comprehensive

Income and determined by reference to:

i) investments quoted or dealt on recognised stock exchanges in

an active market are valued by reference to their market bid

prices;

ii) investments other than those in i) above which are dealt on

a trading facility in an active market are valued by reference to

broker bid price quotations, if available, for those

investments;

iii) investments in underlying funds, which are not quoted or

dealt on a recognised stock exchange or other trading facility or

in an active market, are valued at the net asset values provided by

such entities or their administrators. These values may be

unaudited or may themselves be estimates and may not be produced in

a timely manner. If such information is not provided, or is

insufficiently timely, the Investment Manager uses appropriate

valuation techniques to estimate the value of investments. In

determining fair value of such investments, the Investment Manager

takes into consideration the relevant issues, which may include the

impact of suspension, redemptions, liquidation proceedings and

other significant factors. Any such valuations are assessed and

approved by the Directors. The estimates may differ from actual

realisable values;

iv) investments which are in liquidation are valued at the

estimate of their remaining realisable value; and

v) any other investments are valued at the directors' best estimate of fair value.

Transfers between levels of the fair value hierarchy are

recognised as at the end of the reporting period during which the

change has occurred.

Investments are derecognised on the trade date of their

disposal, which is the point where the Company transfers

substantially all the risks and rewards of the ownership of the

financial asset. Gains or losses are recognised in profit or loss

in the capital column of the Statement of Comprehensive Income. The

Company uses the weighted average cost method to determine realised

gains and losses on disposal of investments.

(b) Foreign currency

Transactions in foreign currencies are translated into sterling

at the exchange rate at the date of the transaction. Monetary

assets and liabilities denominated in foreign currencies at the

reporting date are retranslated into sterling at the spot exchange

rate at that date. Non-monetary assets and liabilities denominated

in foreign currencies that are measured at fair value through

profit or loss are retranslated into sterling at the exchange rate

at the date that the fair value was determined. Non-monetary assets

and liabilities that are measured in terms of historical cost in a

foreign currency are translated into sterling using the exchange

rate at the date of the transaction.

Foreign currency differences arising on retranslation are

recognised in profit or loss and, depending on the nature of the

gain or loss, are allocated to the revenue or capital column of the

Statement of Comprehensive Income. Foreign currency differences on

retranslation of financial instruments designated as fair value

through profit or loss are shown in the "Losses on currency

movements" line.

(c) Income from investments

Dividend income is recognised when the right to receive it is

established and is reflected in the Statement of Comprehensive

Income as Investment Income in the revenue column. For quoted

equity securities this is usually on the basis of ex-dividend

dates. For unquoted investments this is usually on the entitlement

date confirmed by the relevant holding. Income from bonds is

accounted for using the effective interest rate method.

Special dividends and distributions described as capital

distributions are assessed on their individual merits and may be

credited to the capital reserve if considered to be closely linked

to reconstructions of the investee company or other capital

transactions. Bank interest receivable is accounted for on a time

apportionment basis and is based on the prevailing variable

interest rates for the Company's bank accounts.

(d) Treasury shares

Where the Company purchases its own share capital, the

consideration paid, which includes any directly attributable costs,

is recognised as a deduction from equity shareholders' funds

through the Company's reserves. When such shares are subsequently

sold or re-issued to the market any consideration received, net of

any directly attributable incremental transaction costs, is

recognised as an increase in equity shareholders' funds through the

share capital account. Shares held in treasury are excluded from

calculations when determining NAV per share.

(e) Cash and cash equivalents

Cash comprises cash and demand deposits. Cash equivalents, which

include bank overdrafts, are short term, highly liquid investments

that are readily convertible to known amounts of cash, are subject

to insignificant risks of changes in value, and are held for the

purpose of meeting short-term cash commitments rather than for

investment or other purposes.

(f) Investment management fees and finance costs

Investment management fees and finance costs are charged to the

Statement of Comprehensive Income as a revenue item and are accrued

monthly in arrears. Finance costs include interest payable and

direct loan costs. Performance-related fees, if any, are payable

directly by reference to the capital performance of the Company and

are therefore charged to profit or loss in the Statement of

Comprehensive Income as a capital item.

(g) Financial liabilities

Financial liabilities (including bank loans) are classified

according to the substance of the contractual arrangements entered

into. Financial liabilities held at fair value through profit or

loss are measured initially at fair value, with transaction costs

recognised in profit or loss in the Statement of Comprehensive

Income.

(h) Taxation

The Company has exempt status under the Income Tax (Exempt

Bodies) (Guernsey) Ordinance 1989 and is charged an annual

exemption fee of GBP1,200 (2018: GBP1,200).

Dividend and interest income received by the Company may be

subject to withholding tax imposed in the country of origin. The

tax charges shown in profit or loss in the Statement of

Comprehensive Income relate to overseas withholding tax on dividend

income.

(i) Operating segments

IFRS 8, 'Operating segments' requires a 'management approach',

under which segment information is presented on the same basis as

that used for internal reporting purposes. The Board, as a whole,

has been determined as constituting the chief operating decision

maker of the Company. The Board has considered the requirements of

the standard and is of the view that the Company is engaged in a

single segment of business, which is investing in a portfolio of

funds and products which give exposure to developing and emerging

market economies. The key measure of performance used by the Board

is the Net Asset Value of the Company (which is calculated under

IFRS). Therefore no reconciliation is required between the measure

of profit or loss used by the Board and that contained in the

financial statements.

Further information on the Company's operating segment is

provided in note 19 of the Annual Report and Accounts.

(j) Offsetting

Financial assets and liabilities are offset and the net amount

presented in the Statement of Financial Position when, and only

when, the Company has a legal right to set off the recognised

amounts and it intends to either settle on a net basis or to

realise the asset and settle the liability simultaneously.

Income and expenses are only presented on a net basis when

permitted under IFRS.

(k) Structured entities

A structured entity is an entity that has been designed so that

voting or similar rights are not the dominant factor in deciding

who controls the entity, such as when any voting rights relate to

administrative tasks only and the relevant activities are directed

by means of contractual arrangements. A structured entity often has

some or all of the following features or attributes; (a) restricted

activities, (b) a narrow and well-defined objective, such as to

provide investment opportunities for investors by passing on risks

and rewards associated with the assets of the structured entity to

investors, (c) insufficient equity to permit the structured entity

to finance its activities without subordinated financial support

and (d) financing in the form of multiple contractually linked

instruments to investors that create concentrations of credit or

other risks.

The Company holds shares, units or partnership interests in the

funds or investment products presented on the Company's portfolio.

The Company does not consider its investments in listed funds to be