TIDMAJOT

RNS Number : 8308C

AVI Japan Opportunity Trust PLC

13 February 2020

AVI JAPAN OPPORTUNITY TRUST

ANNUAL REPORT 2019

The Directors present the audited Annual Report for the period

ended 31 December 2019.

Copies of the Annual Report can be obtained from the Company's

website ("AJOT" or the "Company") www.ajot.co.uk or by contacting

the Company Secretary by telephone on 01392 477500.

AVI Japan Opportunity Trust plc ("AJOT" or "the Company")

invests in a focussed portfolio of quality small and mid cap listed

companies in Japan that have a large portion of their market

capitalisation in cash or realisable assets.

Portfolio Statistics as at 31 December 2019(*)

Net cash/Market Cap 45.1%

Net financial value/Market

Cap 81.0%

FCF Yield 5.8%

EV/ FCF Yield 22.3%

EV/ EBIT 3.8

Portfolio discount -36.1%

Portfolio Yield 2.0%

ROE 7.5%

ROE ex non-core financial

assets 18.0%

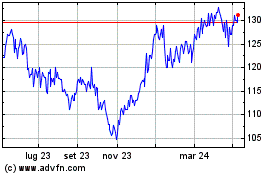

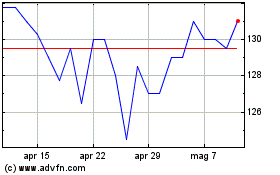

Performance Summary

Net asset value per share at 31 December

2019 112.00p

Share price at 31 December 2019 114.25p

Premium as at 31 December 2019

(difference between share price and

net asset value) 2.01%

Financial Highlights - Period from 23 October

2018 to 31 December 2019

NAV* +14.3%

Share Price* +14.3%

Benchmark +7.9%

(*) For all Alternative Performance Measures, please refer to

the definitions in the Glossary below.

MSCI Japan Small Cap Total Return Index (GBP adjusted total

return)

Overview

Company Objective & Strategy

AJOT aims to provide Shareholders with total returns in excess

of the MSCI Japan Small Cap Total Return Index in GBP ("MSCI Japan

Small Cap Total Return"), through the active management of a

focused portfolio of equity investments listed or quoted in Japan

which have been identified by Asset Value Investors Limited as

undervalued and having a significant proportion of their market

capitalisation held in cash, listed securities and/or other

realisable assets.

AVI will seek to unlock this value through proactive engagement

with management and taking advantage of the increased focus on

corporate governance, balance sheet e ciency, and returns to

shareholders in Japan.

Benchmark

The MSCI Japan Small Cap Total Return Index.

Capital Structure

As at 31 December 2019, the Company's issued share capital

comprised 113,939,742 Ordinary Shares of 1p each and as at 7

February 2020 it comprised 114,889,742 Ordinary Shares. No shares

were held in Treasury.

Annual General Meeting

The Company's first Annual General Meeting ("AGM") will be held

at 10.30 am on Thursday, 26 March 2020 at the o ces of N+1 Singer,

1 Bartholomew Lane, London EC2N 2AX. Please refer to the Notice of

AGM for further information and the resolutions which will be

proposed at this meeting.

Investment Manager

The Company has appointed Asset Value Investors Limited ("AVI"

or the "Investment Manager") as its Alternative Investment Fund

Manager.

Financial Conduct Authority ("FCA") regulation of

'non-mainstream pooled investments' and MiFID II 'complex

instruments'

The Company currently conducts its a airs so that its shares can

be recommended by Independent Financial Advisers in the UK to

ordinary retail investors in accordance with the Financial Conduct

Authority ("FCA")'s rules in relation to non-mainstream investment

products and intends to continue to do so. The shares are excluded

from the FCA's restrictions which apply to non-mainstream

investment products because they are shares in an authorised

investment trust.

The Company's ordinary shares are not classified as 'complex

instruments' under the FCA's revised appropriateness criteria

adopted in the implementation of MiFID II.

The Association of Investment Companies ("The AIC")

The Company is a member of The AIC.

Website

The Company's website, which can be found at www.ajot.co.uk,

includes useful information on the Company, such as price

performance, news, monthly and quarterly reports as well as the

half year report.

Chairman's Statement

Overview of the Period

It is with great pleasure that I present the first annual report

of AVI Japan Opportunity Trust plc ("the Company" or "AJOT"),

covering the period from incorporation on 27 July 2018 to 31

December 2019.

AJOT launched on 23 October 2018 with subscriptions for 80

million shares, and the Company was fully invested by the beginning

of 2019. Your Investment Manager, Asset Value Investors ("AVI"),

has a strong track record of investing in Japan, and has been

diligent in forging close working relationships with our investee

businesses. Since launch, the AVI team has further deepened those

ties with a program of regular communication and face to face

meetings with management boards. The engagement has been very

positive, and we are especially appreciative of the constructive

dialogue that has resulted.

Naturally, this level of engagement is resource intensive and it

is encouraging to see that AVI has continued to expand its

Japan-focussed staffing, both in London and in Tokyo. These

additions help to ensure that the Investment Manager's research

process to identify and work with our investments remains at an

industry leading standard.

Performance and Dividend

Your Company has generated strong positive returns since launch,

with a net asset value ("NAV") per share total return of 14.3%,

against a return of 7.9% from the benchmark, the MSCI Japan Small

Cap Total Return Index (as measured in GBP). Performance has been

driven by strong contributions from several stocks, as well as a

relative paucity of detractors. The top three contributors added

+8.7% to returns, compared to -1.1% from the worst three

detractors.

As at 7 February 2020 (the latest date prior to the publication

of this document) the NAV per share was 112.62p per share and the

share price 115.60p per share. Since 31 December 2020 the Company

has issued an addition 950,000 shares at an average premium of

3.4%.

The Board has elected to propose a final dividend of 0.9 pence

per share for the period, for approval by shareholders at the

General Meeting. As stated in the prospectus at the Initial Public

Offering ("IPO"), the Company intends to distribute substantially

all of the net revenue arising from the portfolio and is expected

to pay an annual dividend, but this may vary substantially from

year to year.

Investment Strategy

The original thesis behind AJOT is that corporate Japan is

undergoing a paradigmatic shift in governance. Board independence,

over-capitalised balance sheets, and returns on (and of)

shareholder capital, are under particular scrutiny. With pressure

from the government, regulators and investors both foreign and

domestic, Japanese companies feel increasingly compelled to improve

corporate governance and streamline their balance sheets. By

investing high quality, cashflow generative and compellingly valued

stocks, our portfolio stands to profit not only from the sound

underlying businesses but also disproportionately from this move

towards improved governance.

Your Company has benefitted directly from this trend. A good

example of this occurred when electronics maker Toshiba Corp bought

in its listed subsidiaries NuFlare Technology and Toshiba Plant

Systems & Services, both holdings in the portfolio, at

significant premiums to the prevailing share price. The

unsustainability of so-called parent-child subsidiary arrangements

have been a consistent pillar of our strategy since launch and both

companies were significant holdings in our portfolio. For further

details, please refer to the Investment Manager's Report below.

To date, ten of AJOT's portfolio companies have announced

buybacks, and three were subject to takeovers at substantial

premiums. Out of a total of twenty-eight holdings, this is an

impressive pace of change and further evidence in favour of the

investment thesis.

Share Premium and Issuance

As at 31 December 2019, your Company's shares were trading at a

premium of 2.01% to net asset value per share. The Board monitors

this premium carefully and manages it by periodically issuing

shares. Since May 2019, we have utilised both placings and the

Company's authorised block listing facility to increase our shares

in issue. As at 31 December 2019, 33,939,742 shares had been issued

at an average 2.1% premium to NAV, which has the beneficial effect

of modestly increasing NAV per share for existing Shareholders.

Debt Structure and Gearing

As described in the Prospectus, the Board supports the use of

gearing to enhance portfolio performance. In April 2019, we entered

into a one-year unsecured revolving credit facility for Yen1.465

billion with Scotiabank. In October 2019, following the issuance of

additional shares, this facility was increased by a further

Yen1.465 billion in order to maintain a broadly similar level of

gearing for the portfolio. In total the Company currently has a

total debt facility of Yen2.93 billion, equivalent to approximately

GBP20 million. The gearing has been provided at an interest rate of

LIBOR plus 0.75%.

As at 31 December 2019, Yen2.3 billion (GBP16 million) of the

facility has been drawn, with gross gearing standing at 13% of NAV.

Including cash, net gearing was negative at -2% (i.e. the Company

was in a net cash position). This was driven by the realisation of

two large positions at the end of the period, Nuflare and Toshiba

Plant, after they were subject to takeover offers at premia to

their prevailing share prices.

Outlook

Japan has a long and unenviable history of disappointing

investors. Over three 'lost decades' global capital has repeatedly

been deployed in the Japanese markets with the promise of

revaluations that were going to be inevitable once the attractive

valuations and opportunities were recognised. The performance of

our portfolio since launch has been highly satisfactory so at the

risk of sounding overly guarded, it is still worth injecting a word

of caution: it is early days and any Company's true accomplishments

can only be measured across the medium to long-term. Change in

Japan is arduous (as it is in any culture) and the timing of

inflection points, together with the consequent outsized returns,

is di cult to predict. However, it is our conviction that change -

meaningful change - is in the wind in Japan: with the political

will to apply pressure through the revised Stewardship and

Governance Codes, and the increasing presence of

shareholder-conscious institutional investors, a slow-but-sure

shift is coming about in Japan Inc.'s attitude to corporate

governance. Perhaps things really are di erent this time. The

companies we invest in continue to operate attractive businesses

and boast high and growing levels of cash and realisable

securities, all the while trading at valuations not available in

other developed markets today. The opportunity set remains rich and

continues to hold out the o er of highly attractive risk-adjusted

returns. Valuations in the portfolio remain compelling.

The Environmental, Social & Governance ("ESG") Context

There has rightly been a marked increase in the attention paid

to ESG factors in investments all over the world. As a UK based

investment trust, the regulatory stipulations that apply to us are

described and addressed on page 18. In my Chairman's Statement,

with input from Yoshi Nishio a AJOT director with deep knowledge of

Japan and its culture, I want to go a little further and give an

historical overview of how the ESG environment in Japan has

developed to di er from the western world. Some of our portfolio

companies are involved in activities that traditional ESG funds may

seek to avoid. AJOT is not an ESG fund; the basis for making

investment decisions is di erent. However, no responsible citizen,

whether private or corporate, can or should ignore the growing

calls for everyone to work together for the benefit of all. In this

sense, your Board feels that your Company finds itself in an

interesting position.

The history of caring for the environment in Japan is a long

one, having its foundations in a deep-rooted cultural connection to

nature. According to Shinto folklore, the islands that make up the

nation owe their very existence to the ocean surrounding them, when

the gods Izanami and Izanagi dipped their swords into the sea and

the salty water droplets turned into land. Thus, when the air and

water supplies su ered severe and tangible pollution during the

period of rapid industrialisation in the 1950s, the Japanese

people's response was visceral. The government was galvanised into

crafting what now seems a very forward-looking framework placing

heavy responsibilities on corporations not only to do no harm to

the environment, but to take steps to improve it. The recycling of

household waste has been commonplace for over twenty years, while

as early as 1990, the business group Keidanren published detailed

guidelines that required Japanese companies to review their

activities from the viewpoint of reducing the burden on the

environment and specifically integrating precautions and

protections into their operations. More recently, the response to

the nuclear accident in Fukushima in 2011 focussed the world's

attention on an e ective way to ensure that any damage to the

environment is rectified immediately and those responsible be dealt

with appropriately.

There is therefore a case to be made that Japan Inc. already

benefits from high levels of corporate environmental awareness and

responsibility. This is likely to take on increasing relevance to

global investors as the interpretation of ESG develops over time.

Even dedicated ESG funds are now starting to take a more nuanced

approach - no longer just bluntly investing in businesses that are

sustainable and avoiding others that cause harm - but also seeking

out companies that perform traditionally harmful activities in

innovative and less harmful ways, thereby starving the less

responsible actors of investment. Under these criteria, the

universe of companies that AJOT looks at is likely to outperform

their non-Japanese counterparts.

In terms of benefits to society, Japan built its post-war

prosperity on a slightly di erent model to the west, one that

places a strong emphasis on societal advantage. Here again, history

has a lesson to teach. During the Edo period (1603-1868) when the

eponymous city, since renamed Tokyo, was the largest city in Asia

and its most prosperous commercial hub, the merchants and traders

coined a dictum: sanpo yoshi. Literally meaning "tripartite

contentment", every transaction was thought to have three parties:

the buyer, the seller and society. And only if all three parties

were satisfied should any deal be concluded. Implicitly or

explicitly, this is a dictum that has continued to be followed to

this day. Lifetime employment, the paucity of opportunities for

outsized personal enrichment, consensus-based decision making,

seniority based pay - many of the components of what western

commentators have seized on as the essence of what is considered

the 'Japanese way' owe their origins to sanpo yoshi. This does not

mean that Japan doesn't have more improvements to make - the slow

progress on gender equality is a very visible failing - but your

Board feels that relative to global peers, our investee companies

are in a better position to be of benefit to society.

So much for "E" and "S"; the focus for AJOT is "G," where we

believe that real change is due in Japan. Better corporate

governance and the consequent improvement in shareholder returns,

is precisely the opportunity that we are pursuing. As capital flows

become ever more international, Japan needs to evolve its

particular model of capitalism to reflect and incorporate some

aspects of globally accepted standards. AVI has been and always

will be respectful of cultural sensitivities while engaging as

shareholders. Looking forward, if we can be even a small part of

the catalyst that brings about a permanent change in the way

Japanese corporations work with their shareholders, AJOT may well

come to be looked upon as the exemplary investment vehicle for the

21st century.

Closing Remarks

I would like to thank AVI and all of our service providers whose

e orts come together every day to secure AJOT's success. I would

also like to thank you, our Shareholders, for your continued

support and for the trust that you have placed in us. We will

continue working to ensure that we deserve that trust. We hope and

believe that our relationship will be a long and rewarding one. If

you have any queries, please do not hesitate to contact me

personally (norman.crighton@ajot.co.uk), or alternatively speak to

our broker N+1 Singer to arrange a meeting.

Norman Crighton

Chairman

12 February 2020

Investment Manager's Report

AVI Japan Opportunity Trust (AJOT) was launched in October 2018.

This report covers the period from 23 October 2018 to 31 December

2019. Over this time, your Company has returned +14.3% (on a NAV

total return basis in GBP), ahead of the +7.9% total return

generated by the benchmark, the MSCI Japan Small Cap Index (in

GBP). This robust performance has been driven by a combination of

several standout performers and a lack of significant detractors.

The +8.6% contribution from the top three contributors, NuFlare

Technology (+4.1%), Digital Garage (+2.6%) and Fujitec (+1.9%) far

exceeded the combined -1.1% loss from the three largest detractors,

Hi-Lex (-0.5%), Konishi (-0.4%), and TBS (-0.2%).

It has been a difficult time for the Japanese market since AJOT

was launched. The TOPIX's +8.2% return has underperformed that of

the MSCI Europe (+15.6%) and S&P 500 (+17.4%) indices. Japan is

seen as a proxy for global trade and, with the US-China trade war

dominating headlines, global investors have continued to be net

sellers of Japanese equities, notwithstanding an encouraging

reversal of this trend towards the end of the year. However,

beneath the surface, companies are continuing to improve standards

of corporate governance and increasingly focus on shareholder

returns. This is particularly reflected in rising Returns on Equity

(ROE) and in the strong increase in announced share buybacks this

year. Coupled with fundamental valuation metrics that are far more

attractive than the rest of the developed world, we continue to

believe that Japan represents one of the most attractive equity

market opportunities today.

AJOT invests in strong businesses with high levels of cash flow

generation, attractive valuations, and a potential event to unlock

the value trapped within bloated corporate balance sheets. We find

the greatest number of opportunities in cash-rich, small-cap,

Japanese companies that are unloved and under-researched by the

market. There have been an increasing number of successful

shareholder engagements, which is creating the impetus needed to

focus attention on shareholder value. We believe that changes in

mindset and culture surrounding shareholders are the catalyst to

unlock a tremendous amount of value.

The attributes we look for in our investments can be grouped

into three areas: quality, value, and prospects for improving

corporate governance. Quality companies reduce the risk of earnings

deterioration, which means we can be patient long-term

shareholders; the valuation determines the potential upside of the

investment; and improving corporate governance provides a catalyst

to realise the value, mitigating the risk of value traps.

On the quality front, we try to find companies with stable

earnings which over the medium-term have a good chance of growing.

They are typically domestic-focused and provide services or goods

which are highly valued by their customers, resulting in outsized

margins and returns on equity.

Over the past year, the companies in our portfolio grew

operating profits by a weighted average of +9.3%. This mainly came

from margin expansion, particularly so in the case of Pasona, whose

standalone operating profit margin rose from 0.1% to 0.5%. The

portfolio's profit growth was a satisfactory result when compared

to the +5.2% growth for the companies in the MSCI Japan Small Cap

Total Return Index.

Attractive valuations in Japan are caused by a low overall

valuation for Japanese companies and the market's heavy discounting

of cash and investment securities held on companies' balance

sheets. Adjusted for surplus capital, the companies in AJOT's

portfolio trade on a weighted average EV/EBIT of 3.8x and have net

cash and investment securities that cover 81% of their market

caps.

Despite the +14.3% growth in AJOT's NAV, the overall valuation

of the portfolio remains attractive. While the EV/EBIT of the

portfolio increased from 3.6x at the end of February 2019 (when the

portfolio was fully invested) to 3.8x at the end of December 2019,

and net cash as a percentage of market cap decreased from 48% to

45%, net financial value ("NFV") as a percentage of market cap grew

from 78% to 81%. As our portfolio evolves, we expect fluctuations

in its valuation. The slight increase over the year is not

significant and the still-attractive portfolio valuation highlights

that we continue to find compelling opportunities.

Finally, we turn to corporate governance, the overarching theme

of our portfolio. Since the introduction of the Corporate

Governance Code in 2015, we have witnessed a gradual, but

indisputable, shift in Japanese companies' attitudes towards

shareholders.

Over the period, most of our portfolio companies showed signs of

positive changes in their attitudes towards corporate governance.

These changes have been seen in the form of 'softer' policy changes

such as the introduction of stock-based compensation or independent

directors, as well as in more impactful moves like share buybacks

and takeovers. It is the latter two that have been a particular

boon to performance.

Ten of our portfolio companies announced share buybacks over the

period and three were subject to takeovers at substantial premia to

their prevailing share prices. When one considers that your Company

has a portfolio of just 28 investments, and has only been invested

for 14 months, the pace of change has been quite impressive.

The subsidiary buy-out theme is one we have discussed

extensively in our reporting. The issue of parent-child listings

and inadequate protection for minority shareholders is one that is

receiving more attention from shareholders and the Government. It

has been suggested that listed companies with controlling parent

shareholders should be required to have a majority independent

board to increase minority shareholder protection. The clear

intention is to ultimately reduce the prevalence of parent-child

listings, which are rarely seen in developed markets outside of

Japan.

We benefitted from the subsidiary buy-out theme over the period,

with Toshiba Corp's tender offer for NuFlare Technology and Toshiba

Plant Systems & Services, two significant investments for AJOT.

Both were majority controlled by Toshiba Corp and, with Toshiba's

newly revitalised board and the pressure from regulators

surrounding parent-child listings, we felt it was only a matter of

time before something happened. After weeks of rumours, Toshiba

submitted tender offers to minority shareholders for the shares in

each company that it did not already own. These came at premia of

+46% and +28% to the undisturbed prices for NuFlare and Toshiba

Plant respectively, crystallising returns on investments for AJOT

of +93% and +27%.

While the overall standard of corporate governance in Japan has

improved, we believe the pace of change is accelerated by

shareholder engagement. Often not known to the public, we - and

other shareholders like us - are actively engaging with boards

behind closed doors. It is sometimes difficult to attribute

specific actions to our engagement directly, but we have numerous

examples of our portfolio companies announcing steps broadly in

line with those suggested in our letters and face-to-face

meetings.

Since launching AJOT, we have written 33 letters to 18 of our

portfolio companies and met or called them 95 times. Our

discussions with management cover a variety of topics including

balance sheet efficiency, director compensation, the abolition of

poison pills and board independence.

While our investment horizon, and the time frame for judging our

performance, is longer than the 14 months that AJOT has existed, it

has been an encouraging start. We continue to believe that with

growing shareholder engagement, Japanese boards will focus more on

driving corporate value and increasing share prices. The market

seems to underappreciate this phenomenon, which is why we have been

able to build a portfolio at such astonishingly low valuations. The

mismatch between the fundamental improvements we have witnessed and

continued low valuations presents an exciting opportunity.

AVI Team

The team is led by Joe Bauernfreund with the support of two

dedicated Japan analysts, Daniel Lee and Cameron Dryburgh, and Tom

Treanor, Head of Research. Since launching AJOT we hired Cameron, a

full-time Japanese speaking analyst based in London, added a

part-time analyst based in Tokyo who works with us on research

projects and increased our utilisation of locally based legal and

corporate governance experts. Our increased resource has allowed us

to enhance the quality and pace of engagement while allocating more

time to researching new ideas. There is no shortage of engagement

opportunities or new ideas, and we will continue to invest in the

appropriate infrastructure to support the strategy.

Contributors

NuFlare

Contribution to total

return +4.1%

------------------------ -------

Weight in AJOT net

assets 0.0%

------------------------ -------

EV/EBIT n/a

------------------------ -------

NFV/Market Cap n/a

------------------------ -------

NuFlare added +4.1% to returns, the strongest performer over the

period. While our thesis was for a trade sale of the business, it

was still pleasing to see Toshiba Corp make an offer to buyout

minorities at a +46% premium to the undisturbed price. With the

offer coming after an already strong period in the share price, we

realised a return on investment of +93% and an IRR of +110%.

Toshiba Corp's offer is a vindication of the parent-child theme

within AJOT's portfolio. We have argued that listed subsidiaries

should be either bought in or sold off by the parent company, given

that the potential for the abuse of minority shareholders' rights

depresses the share price. With the Abe administration having been

critical of these sorts of arrangements, and Toshiba Corp's

recently refreshed board, it felt like simply a matter of time

before the company would be required to either acquire or sell off

its stake in NuFlare.

Our confidence in a premium offer being made for NuFlare was

underpinned by our analysis of the business. At the end of March

NuFlare was trading on a 10% free cash flow yield, an EV/EBIT of

1.7x with net cash covering 68% of its market cap. Putting the

issues of governance and liquidity to one side, as a strategic

buyer would, the valuations the market was subscribing did not

correspond to a business with highly valuable technology and a

near-monopolistic market share. The lack of NuFlare's sell-side

coverage and the market's lack of interest in small-cap Japanese

companies allowed us to take advantage of the situation and exploit

the inefficiency.

Digital Garage

Contribution to total

return +2.6%

------------------------ -------

Weight in AJOT net

assets 5.8%

------------------------ -------

EV/EBIT 9.3

------------------------ -------

NFV/Market Cap 62.3%

------------------------ -------

Digital Garage was the second strongest contributor over the

period, adding +2.6% to performance. The returns were driven

equally by an increase in our estimated fundamental value for the

company and a narrowing of the discount at which it trades to that

value.

Digital Garage has a 20% stake in Kakaku.com, which operates

online price comparison and restaurant reservation sites. This

investment accounts for 55% of Digital Garage's market cap and

obscures the hidden value of Digital Garage's two main businesses,

online marketing and credit card payment processing.

We did not acquire shares in Digital Garage until almost two

months after launching on valuation grounds. This proved to be a

wise decision as we were able to purchase our stake two months

later at a price -18% lower than if we had purchased at launch. We

then trimmed our position in May as the share price had risen +41%

from our initial purchase, before opportunistically adding to our

position in August after a -10% fall in the price, bringing our

total average buy in price to Yen3,028 vs an end of year price of

Yen4,585.

For the first half of Digital Garage's financial year (six

months from March to September), Digital Garage's marketing and

credit card processing businesses grew profits by +50% and +28%

respectively. Being able to purchase these businesses on only a

9.3x EV/EBIT multiple despite such impressive growth rates make for

an attractive investment.

Fujitec

Contribution to total

return +1.9%

------------------------ -------

Weight in AJOT net

assets 5.5%

------------------------ -------

EV/EBIT 8.4

------------------------ -------

NFV/Market Cap 45.5%

------------------------ -------

Fujitec, a global elevator manufacturer, was AJOT's third most

significant contributor, adding +1.9% to returns. While seemingly a

cyclical business tied to construction spending, over half of

Fujitec's business, in fact, comes from maintenance and renewal

work. Elevator manufacturers are usually awarded the maintenance

contract following a new installation. This constitutes a sticky,

stable and high-margin revenue stream and can last for decades.

Additionally, once an elevator has reached the end of its useful

life, the manufacturer who built the lift and then maintained it,

is typically awarded the contract for its replacement.

The appeal of the business model is not lost on investors. Kone

and Schindler, two European-listed global manufacturers trade on

EV/EBIT multiples of 24x and 19x respectively. These valuations far

exceed the 8x that Fujitec trades on.

We attribute Fujitec's lower valuation to several factors. 1)

Poor balance sheet efficiency. One third of Fujitec's balance sheet

is allocated to low yielding cash and investment securities, which

accounts for 46% of Fujitec's market cap. These contribute little

to profits and are valued at a heavy discount by the market. 2)

Poison pill. Fujitec first introduced a poison pill in 2007 to fend

off a proposed buyout. By restricting potential buyers, it removes

the possibility of a takeover, thus leading to a valuation

discount. 3) Weaker margins. Fujitec suffers from lower margins

than peers, 7% vs 12%, driven by lower scale and an overly

diversified exposure to non-core geographies. 4) Lack of sell-side

coverage. No sell-side analysts cover Fujitec while 30 cover Kone

and 21 Schindler.

We are working with management and the Board to address these

problems who have so far been receptive to our suggestions.

Considering not only the valuation upside but also margin upside,

Fujitec represents one of the most compelling investments in AJOT's

portfolio.

Toshiba Plant

Contribution to total

return +1.5%

------------------------ -------

Weight in AJOT net

assets 0.0%

------------------------ -------

EV/EBIT n/a

------------------------ -------

NFV/Market Cap n/a

------------------------ -------

Even though Toshiba Plant spent most of the period as a

detractor from performance, after an offer from Toshiba Corp at a

+28% premium, it ended the period as our fourth-largest contributor

adding +1.5% to returns.

Toshiba Plant is an engineering and construction company

offering a full solution to industrial projects, such as power

plants, factories and solar farms. With the know-how acquired from

construction, Toshiba Plant offers maintenance solutions

post-build, which are stable and highly profitable. Since it became

a fully integrated engineering and construction company in 2004,

profits have grown at an annualised rate of 12.3% and in 16 years,

profits declined only once.

Toshiba Plant's business is intertwined with Toshiba Corp's.

Toshiba Plant is given subcontract work from Toshiba, most notably

for the maintenance of Toshiba's nuclear power plants, and as such

it made little sense for Toshiba Plant to operate as a separate

entity with minority shareholders. It has always been our

contention that Toshiba Corp would ultimately buy-in Toshiba Plant,

given the quality of Toshiba Plant's business and the synergies

that would accrue to the combined entity.

Our thesis was vindicated when in November, Toshiba Corp finally

made an offer to minority shareholders at a +28% premium. AJOT made

a +27% return on its investment, which given the short holding

period, crystallised a +35% IRR.

Nitto FC

Contribution to total

return +1.4%

------------------------ -------

Weight in AJOT net

assets 0.0%

------------------------ -------

EV/EBIT n/a

------------------------ -------

NFV/Market Cap n/a

------------------------ -------

Despite a relatively brief holding period, Nitto FC was our

fifth largest contributor. Nitto FC's strong business model and

extreme undervaluation was noticed by a Japanese private equity

firm, who took the company private at a +38% premium in May. Before

the takeover, Nitto FC was trading with 83% of its market cap

covered by net cash, and an EV/EBIT of 3.3x. In a little over six

months, our investment in Nitto FC garnered a profit of +56%,

adding 1.4% to returns.

Nitto FC is a good example of the opportunity for private equity

investors. Given compelling valuations and potential for efficiency

gains, global private equity managers are increasing their exposure

to Japan. George Roberts, of KKR, remarked that Japan is KKR's

highest priority other than the US. With increasing scrutiny from

public shareholders going private is becoming a viable option for

companies. For AJOT, the presence of private equity increases the

chances of our companies being taken over at a large premium,

providing a catalyst for realising the underlying value in the

portfolio.

Detractors

Hi-Lex

Contribution to total

return -0.5%

------------------------ -------

Weight in AJOT net

assets 1.1%

------------------------ -------

EV/EBIT 2.4

------------------------ -------

NFV/Market Cap 81.7%

------------------------ -------

Hi-Lex was our largest detractor over the period, hindering

overall returns by -0.5%. Hi-Lex produces a small range of

essential auto components including window and door opening systems

and control cables. The Company faces a declining market for a

portion of their control cable sales (approximately 10% of total

sales) which, over the coming decades are not needed in electric

vehicles. As a result Hi-Lex has been allocating capital to door

and window products, which are lower margin. This expansionary

capital expenditure and lower margin product mix has led to

declining profitability.

The last twelve months have been tough for Hi-Lex, cutting full

year forecasts midway through the year, with operating profits

falling over -30% for a second year in a row as the auto industry

continues to be surrounded by uncertainty and weak sentiment.

Although the company expects weaker sales in 2020, they also guided

for a big upswing in operating profits, to which the market has

responded favourably. Despite a difficult year Hi-Lex remains

attractive on valuation grounds. Net cash accounts for 58% of

Hi-Lex's market cap which, when including stakes in other listed

companies, rises to 82% of the market cap. Hi-Lex thus trades on an

EV/EBIT of 2.4x.

Although Hi-Lex has fallen -15% from our purchase price, its

small average 1.5% weight over the period reduced its impact on

portfolio returns, detracting only -0.5% overall.

Konishi

Contribution to total

return -0.4%

------------------------ -------

Weight in AJOT net

assets 4.7%

------------------------ -------

EV/EBIT 3.3

------------------------ -------

NFV/Market Cap 56.1%

------------------------ -------

Konishi was a lacklustre performer over the period, more painful

in relative rather than absolute terms. Its share price fell -4%

from our average buy-in price, on weaker than anticipated operating

profits and a lack of corporate governance improvement.

Konishi is a chemical company that manufactures adhesives,

sealants and tape. It is best known for its glue brand in Japan

called "Bondo", the equivalent of "Super Glue" in the UK. It also

sells sealants for DIY home repairs and to professionals in the

construction industry. Through the sale of sealants to

professionals, it has successfully expanded its business into

construction, particularly infrastructure repair work. With Japan's

aging infrastructure, repair work is a useful tailwind for Konishi.

A pure play peer in this area trades on an EV/EBIT of 19x showing

the exciting dynamics of the industry.

We have been disappointed with the lack of progress Konishi has

made to improve corporate governance. With a payout ratio of just

20%, only two independent directors on a nine-person board, and 31%

of total assets in cash and investment securities, there is much to

be improved. Collectively with AVI Global Trust, we own 3.6% of

Konishi's voting rights, and given the underwhelming share price

performance, we plan to step up our engagement with the Board over

the coming year.

Tokyo Broadcasting System

Contribution to total

return -0.2%

------------------------ --------

Weight in AJOT net

assets 5.0%

------------------------ --------

EV/EBIT <0.0

------------------------ --------

NFV/Market Cap 113.9%

------------------------ --------

Tokyo Broadcasting System ("TBS") has continued to be a

frustrating holding in the portfolio. Since the launch of AJOT its

share price has fallen -13.7%, even as the share prices of its two

largest cross-shareholdings, Tokyo Electron and Recruit, rose by

+67.1% and +27.6% respectively. TBS's stakes in these two companies

have now swollen to 95% of TBS's market cap.

In their full-year results management gave a weak outlook for

the FY2020 profitability due to reorganisation costs and the

beginning of 4K broadcasting. This was compounded by announcing a

dividend pay-out ratio of only 23% (below the company's stated 30%

policy) and giving no further strategy for reducing

cross-shareholdings. Investors had previously been hopeful for the

prospects of a strategic change in policy, following a sell-side

research note in February which explicitly mentioned the

possibility of a large-scale sale of securities and greater

shareholder returns through buybacks and dividends. The market

reaction to the announcements was distinctly negative, with the

stock falling by -15%.

Further disappointment came when TBS declined to take part in

either Tokyo Electron's buyback or a block offering of Recruit

shares. We were disappointed by this as both represented

opportunities to reduce the extraordinarily large allocation in

TBS's NAV.

Against this, there are some grounds for optimism: in March, TBS

sold down around 8% of one of its largest holdings, Tokyo Electron,

introduced stock-based compensation for directors, and there was a

3% reduction in key allegiant shareholders' stakes.

Despite a difficult year, we believe that the investment case

for TBS remains strong. It has excess cash, listed securities, and

prime Tokyo real estate which cover its market capitalisation

almost two times over. TBS is, in effect, an asset manager with a

small broadcasting business. Whilst thus far TBS has been ambiguous

in its intentions for these assets, we believe that if it were to

announce a clearly defined strategic policy to reduce its

over-capitalised balance sheet, the market would reward the company

with a much higher share price. We remain in regular dialogue with

TBS's board of directors in order to produce a satisfactory outcome

for all stakeholders. We added to our position on share price

weakness during the year.

Environmental, Social & Governance Issues

AVI undertakes detailed research on its existing and candidate

holdings, and environmental, social and governance (ESG) factors

form part of this research process. Our process does not involve

the use of a filter to screen out stocks that score poorly on an

ESG scale, or a filter to only include positive-scoring ESG stocks.

We assess each potential investment on a case-by-case basis to

identify potential strengths and weaknesses in a firm's conduct and

operations. We believe that firms which score highly on ESG metrics

have a beneficial impact on society and, as such, we work hard with

the companies we invest in where we see deficiencies that can be

corrected.

The emphasis in AJOT's portfolio is on governance factors. A

significant amount of AVI's research process is dedicated to

understanding the shortcomings in governance practices that may

occur at your Company's investments. These shortcomings include,

among others: ine cient balance sheets, low dividend payouts and

share buybacks, depressed returns on equity, excessive board tenure

policies, lack of board independence, and outdated corporate

defence tools (such as poison pills). Where our analysis reveals

less-than-ideal corporate governance practices, we engage with the

board and management in a constructive and private manner in order

to provide our expertise on the matter and to suggest solutions

that will benefit all stakeholders. In so doing, we believe that we

can unlock value for shareholders.

AVI respects the protection of the environment. We are

encouraged that the World Business Council for Sustainable

Development (WBCSC) has reported positively on Japan in their 2019

report : 'There is a strong focus on disclosure of corporate

performance on environmental issues. Environmental topics are

covered by 71% of reporting provisions in Japan, compared to 62%

for the rest of the world and 65% for major economies.'

We aim to understand the network of relationships within which

the investee company exists, including relationships with

suppliers, customers, employees and society-at-large. We engage in

dialogue with companies where we see practices that could be

improved; an area of particular focus is employee relationships. In

this regard, we have been pleased to see progress in Japan on

minimum wage laws, greater female participation in the workforce

generally, and a reduction in the levels of overtime required of

employees.

Outlook

Standards of corporate governance in Japan are improving, along

with an increased focus on shareholder returns. Record share

buybacks during 2019 point to a growing acceptance by Japanese

corporates that their ever increasing levels of surplus cash ought

to be put to better use than simply sitting idly on their balance

sheets. With large parts of the Japanese stock market -

particularly the small and midcap segments - trading at low

valuation multiples, there is huge scope for prices to re-rate

upwards. At the heart of the renewed focus on shareholder returns,

lies shareholder engagement. This has not been a particularly

fruitful or popular activity in the past. However, the Stewardship

Code along with the Corporate Governance Code, are encouraging

domestic and foreign investors to engage with the management of the

companies they are invested in. The increased levels of shareholder

engagement are having an impact and we believe they will continue

to do so.

Alongside shareholder engagement and company share buybacks, we

have also seen increased levels of corporate activity. During the

year Japan even experienced a number of contested takeovers-

something that the country has rarely experienced before. This

points to a recognition that some Japanese companies are

under-valued and there is plenty of scope for unlocking this

value.

AJOT will continue to try and identify the best possible

candidates for inclusion in our concentrated portfolio. We will

continue to engage pro-actively with the companies we are invested

in on your behalf. And we are confident that there is plenty of

upside within the existing portfolio.

We thank you for your support.

Joe Bauernfreund

Asset Value Investors Limited

Top 10 investments*

1. SK Kaken (7.1% of portfolio, 5.2 ev/ebit)

SK Kaken specialises in industrial paints, commanding more than

50% domestic market share. It is a stable business with consistent

earnings and margins but a low payout ratio has led to cash

ballooning on the balance sheet. This capital inefficiency masks an

otherwise high-quality business.

2. Teikoku Sen-i (6.9% of portfolio, 4.9 ev/ebit)

Founded as a textile company, Teikoku Sen-i's main business now

is in manufacturing disaster prevention equipment. It has a strong

track record of growth with high operating margins. Despite this it

trades at a 34% discount due to an inefficient balance sheet and

other corporate governance failings.

3. Digital Garage (5.7% of portfolio, 9.3 ev/ebit)

Its three main business interests are in: credit card payment

processing, online market, and venture investments. Digital Garage

has a good track record of incubating young tech businesses in

Japan and being at the front of digital innovation. It also has a

large stake in the online price comparison site Kakaku.com which

accounts for 47% of Digital Garage's NAV.

4. Fujitec (5.5% of portfolio, 8.4 ev/ebit)

A leading manufacturer of lifts and escalators with a global

presence. It trades at a significant discount compared to global

peers due to weak margins outside of Japan, low ROE exacerbated by

a large cash pile on its balance sheet, and the presence of a

poison pill. We believe that with some improvements in corporate

governance and margins Fujitec should be trading at the same

multiples as its global competitors and there is room for

considerable upside.

5. C Uyemura (5.3% of portfolio, 4.9 ev/ebit)

C Uyemura makes plating and surface finishing related chemical

products. Although it has a long history of developing and

manufacturing high-quality products, several years of hoarding

cash, opaque business and capital allocation strategies have

depressed its value. We were very pleased to see C Uyemura conduct

its first buyback in eight years, which the market viewed very

favourably.

6. Pasona (5.3% of portfolio, <0 ev/ebit)

A staffing company providing dispatch workers and recruitment

services throughout Japan. Pasona has a 50% stake in Benefit One, a

provider of welfare agency services. Benefit One has grown rapidly

in recent years and Pasona's stake in the company is worth 277% of

its market cap. The listed subsidiary phenomenon is a problem

particularly acute in Japan and one we have paid close attention to

as it comes under increasing scrutiny and pressure.

7. Secom Joshinetsu (5.2% of portfolio, 2.8 ev/ebit)

Secom Joshinetsu, a regional subsidiary of Secom, is another

example of the problems of parent- subsidiary listings in Japan. It

operates in Niigata, Gunma, and Nagano prefectures providing

security services. Despite having similar business characteristics

to its parent, Secom, Secom Joshinetsu trades at a severe

discount.

8. Kato Sangyo (5.1% of portfolio, 2.8 ev/ebit)

A leading wholesaler of food and drinks, primarily in Japan but

growing fast abroad, particularly in South East Asia. As with many

other companies in AJOT the strength of its core business contrasts

strongly with inefficient deployment of its capital. Alongside a

string of unnecessary cross-shareholdings tying up capital, cash

takes up 36% of balance sheet assets, weighing down heavily on its

ROE.

9. Tokyo Broadcasting System (5.0% of portfolio, <0

ev/ebit)

TBS is a well-known broadcaster in Japan. The bulk of TBS's

value lies in its large real estate holdings and its

cross-shareholdings, most significantly in Tokyo Electron and

Recruit Holdings. The company justifies this misallocation of

capital on the grounds of protecting key business relationships,

but these reasons stand up to little scrutiny and consequently TBS

trades at a 47% discount.

10. Toyota Industries (4.7% of portfolio, 4.6 ev/ebit)

Originally the core of the Toyota Group, the links between

Toyota Industries and the Toyota Motor Group are still strong.

Toyota Industries owns 6.7% of the auto company and in turn is 30%

owned by Toyota Motor. This 6.7% stake is worth 85% of Toyota

Industries' market cap. Toyota Industries itself manufactures

forklifts, compressors for engines and air conditioning units. It

is the largest manufacturer worldwide of forklifts.

*All ev/ebit figures are estimates provided by AVI. Please refer

to the Glossary below.

Portfolio Construction

The objective of AVI's portfolio construction process is to

create a concentrated portfolio of about 20-30 holdings,

facilitating a clear monitoring process of the entire portfolio.

AVI picks stocks that meet our investment criteria and once we

decide to invest a minimum position size of approximately 2% of the

portfolio is initiated. In determining position sizes, AVI is

mindful of liquidity and the likely timing of any catalysts to

unlock value. Often, a key consideration will be the make-up of the

shareholder register, as this will indicate the likely support AVI

could expect in any shareholder proposal it submits to the company.

The portfolio is diverse in the industries within it but we are

sector agnostic and select investments based on quality and

value.

Geographic Location of Portfolio Company Headquarters

Tokyo 48%

------------ -----

Kansai 41%

------------ -----

Nagoya 5%

------------ -----

Niigata 5%

------------ -----

Hiroshima 1%

Equity Portfolio Value by Market Capitalisation

35.5% GBP250m-GBP500m

------- -----------------

27.5% GBP500m-GBP1bn

------- -----------------

25.0% >GBP1 billion

------- -----------------

12.0% <GBP250m

Portfolio Value by Sector

39.7% Industrials

------- ------------------------

21.1% Materials

------- ------------------------

17.2% Consumer Discretionary

------- ------------------------

7.1% Information Technology

------- ------------------------

5.2% Consumer Staples

------- ------------------------

5.1% Communication Services

------- ------------------------

4.6% Health Care

Investment Portfolio

At 31 December 2020

% of

Stock % of Market AJOT

Exchange investee Cost value net NFV/Market

Company Identifier company GBP'000* GBP'000 assets Capitalisation(1) EV/EBIT(1)

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

SK Kaken JASDAQ: 4628 0.8 8,763 9,110 7.1% 62% 5.2

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Teikoku Sen-i TSE: 3302 2.0 8,513 8,775 6.9% 58% 4.9

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Digital

Garage TSE: 4819 0.5 5,203 7,242 5.7% 62% 9.3

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Fujitec TSE: 6406 0.6 5,460 7,049 5.5% 46% 8.4

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

C. Uyemura TSE: 4966 1.2 5,895 6,760 5.3% 57% 4.9

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Pasona TSE: 2168 1.5 6,228 6,722 5.3% 274% <0

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Secom

Joshinetsu TSE:4342 1.8 5,564 6,565 5.2% 74% 2.8

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Kato Sangyo TSE: 9869 0.7 6,327 6,522 5.1% 77% 2.8

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Tokyo

Broadcasting

System TSE: 9401 0.3 6,624 6,409 5.0% 114% <0

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Toyota

Industries TSE: 6201 0.0 6,051 6,039 4.7% 72% 4.6

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Top ten investments 64,628 71,193 55.8%

------------------------------- ---------- ----------- ----------- ---------- -------------------- -------------

Konishi TSE: 4956 1.3 6,282 5,901 4.6% 56% 3.3

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Fukuda Denshi JASDAQ: 6960 0.5 5,203 5,735 4.5% 65% 3.8

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Daiwa

Industries TSE: 6459 1.1 4,920 4,957 3.9% 90% 1.0

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Seikisui

Jushi TSE: 4212 0.6 4,467 4,897 3.8% 69% 3.4

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Toagosei TSE: 4045 0.4 4,507 4,733 3.7% 58% 4.5

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Kanden TSE: 8081 1.6 3,997 4,282 3.3% 72% 2.9

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Tokyo

Radiator MFG TSE: 7235 3.3 3,105 3,028 2.4% 91% 1.1

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Alps

Logistics TSE: 9055 1.4 2,989 2,976 2.3% 38% 4.8

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

King TSE: 8118 2.8 2,638 2,652 2.1% 108% <0

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Nishimatsuya

Chain TSE: 7545 0.6 2,605 2,502 2.0% 97% 4.6

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Top twenty investments 105,341 112,856 88.4%

------------------------------- ---------- ----------- ----------- ---------- -------------------- -------------

Tachi-S TSE: 7239 0.7 2,523 2,298 1.8% 65% 5.1

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

A-One

Seimitsu JASDAQ: 6156 4.0 2,339 2,295 1.8% 96% 0.5

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Soft99 TSE: 4464 1.3 1,988 2,071 1.6% 94% 0.6

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

CAC Holdings TSE: 4725 0.8 1,541 1,719 1.4% 50% 5.4

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Nishikawa

Rubber TSE: 5161 0.6 1,594 1,466 1.2% 71% 1.4

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Hi-Lex TSE: 7279 0.3 1,658 1,416 1.1% 82% 2.4

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Aichi TSE: 6345 0.3 1,186 1,242 1.0% 57% 3.2

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Techno

Associe TSE: 8249 0.1 150 168 0.1% 80% 1.8

--------------- -------------- ---------- ----------- ----------- ---------- -------------------- -------------

Total investments 118,320 125,531 98.4%

------------------------------- ---------- ----------- ----------- ---------- -------------------- -------------

Other net assets and

liabilities 2,079 1.6%(2)

------------------------------- ---------- ----------- ----------- ---------- -------------------- -------------

Net assets 127,610 100.0%

* Please refer to Glossary below.

(1) Estimates provided by AVI. Refer to Glossary below.

(2) Gearing. Please refer to Glossary below.

Business Model

Company Status

The Company is registered as a public limited company under the

Companies Act 2006 and is an investment company under Section 833

of the Companies Act 2006. It is a member of The AIC.

The Company was incorporated on 27 July 2018 and listed on the

London Stock Exchange on 23 October 2018.

The Company has been approved as an investment trust under

Sections 1158/1159 of the Corporation Tax Act 2010. The Directors

are of the opinion, under advice, that the Company continues to

conduct its affairs as an Approved Investment Trust under the

Investment Trust (Approved Company) (Tax) Regulations 2011.

The Company qualifies as an Alternative Investment Fund in

accordance with the Alternative Investment Fund Managers Directive

("AIFMD").

Investment Objective

The Company's investment objective is to provide Shareholders

with capital growth in excess of the MSCI Japan Small Cap Total

Return Index, through the active management of a focused portfolio

of equity investments listed or quoted in Japan which have been

identified by AVI as undervalued and having a significant

proportion of their market capitalisation held in cash, listed

securities and/or realisable assets.

Investment Policy

The Company invests in a diversified portfolio of equities

listed or quoted in Japan which are considered by the Investment

Manager to be undervalued and where cash, listed securities and/or

realisable assets make up a significant proportion of the market

capitalisation. AVI seeks to unlock this value through proactive

engagement with management and taking advantage of the increased

focus on corporate governance and returns to shareholders in Japan.

The Board has not set any limits on sector weightings or stock

selection within the portfolio. Whereas it is not expected that a

single holding (including any derivative instrument) will represent

more than 10% of the Company's gross assets at the time of

investment, the Company has discretion to invest up to 15% of its

gross assets in a single holding, if a suitable opportunity

arises.

No restrictions are placed on the market capitalisation of

investee companies, but the portfolio is weighted towards small and

mid-cap companies. The portfolio normally exists of between 20 and

30 holdings although it may contain a lesser or greater number of

holdings at any time.

The Company may invest in exchange traded funds, listed anywhere

in the world, in order to gain exposure to equities listed or

quoted in Japan. On acquisition, no more than 15% of the Company's

gross assets will be invested in other UK listed investment

companies.

The Company may also use derivatives for gearing and efficient

portfolio management purposes.

The Company will not be constrained by any index benchmark in

its asset allocation.

Borrowing Policy

The Company may use borrowings for settlement of transactions,

to meet on-going expenses and may be geared through borrowings

and/or by entering into long-only contracts for difference or

equity swaps that have the effect of gearing the Company's

portfolio to seek to enhance performance.

The aggregate of borrowings and long-only contracts for

difference and equity swap exposure will not exceed 25% of NAV at

the time of drawdown of the relevant borrowings or entering into

the relevant transaction, as appropriate. It is expected that any

borrowings entered into will principally be denominated in JPY.

Hedging Policy

The Company does not currently intend to enter into any

arrangements to hedge its underlying currency exposure to

investments denominated in JPY, although the Investment Manager and

the Board may review this from time to time.

Material Changes to the Investment Policy

No material change will be made to the Company's investment

policy without Shareholder approval. In the event of a breach of

the Company's investment policy, the Directors will announce

through a Regulatory Information Service the actions which have

been taken to rectify the breach.

Management Arrangements

The Company has an independent Board of Directors which has

appointed AVI, the Company's Investment Manager, as Alternative

Investment Fund Manager ("AIFM") under the terms of an Investment

Management Agreement ("IMA") dated 6 September 2018. The IMA is

reviewed annually by Board and may be terminated by one year's

notice from either party subject to the provisions for earlier

termination as stipulated therein.

The portfolio is managed by Joe Bauernfreund, the Chief

Executive Officer and Chief Investment Officer of AVI. He also

manages AVI Global Trust Plc and is responsible for all investment

decisions across the Investment Manager's strategies. He conducts

regular visits to Japan, engaging with prospective and current

investments, which he has done for over 15 years.

Management fees are charged in accordance with the terms of the

management agreement, and provided for when due. The Investment

Manager is entitled to an annual fee of 1% per annum of the lesser

of the Company's Net Asset Value or the Company's Market

Capitalisation, invoiced monthly in arrears. The IMA requires AVI

to invest not less than 25% of the management fee in shares in the

Company. Management fees paid during the period were GBP1,060,000

and the number of shares held by AVI is set out in note 14.

J.P. Morgan Europe Limited was appointed as Depositary under an

agreement with the Company and AVI dated 6 September 2018 (the

"Depositary Agreement"). The Depositary Agreement is terminable on

90 calendar days' notice from either party.

JPMorgan Chase Bank, London Branch, has been appointed as the

Company's Custodian under an agreement dated 6 September 2018 (the

"Custodian Agreement"). The Custodian Agreement is terminable on 90

calendar days' notice from the Company or 180 calendar days' notice

from the Custodian.

Link Company Matters Limited was appointed as corporate Company

Secretary on 27 July 2018. The current annual fee is GBP60,000,

which is subject to an annual RPI increase. The agreement may be

terminated by either party on six months' written notice.

Link Alternative Fund Administrators Limited has been appointed

to provide general administrative functions to the Company. The

Administrator receives an annual fee of GBP90,000. The agreement

can be terminated by either the Administrator or the Company on six

months' written notice, subject to an initial term of one year.

Directors' Duties

Overview

The Directors' overarching duty is to act in good faith and in a

way that is the most likely to promote the success of the Company

as set out in Section 172 of the Companies Act 2006 ("Section

172"). In doing so, Directors must take into consideration the

interests of the various stakeholders of the Company, the impact

the Company has on the community and the environment, take a

long-term view on consequences of the decisions they make as well

as aim to maintaining a reputation for high standards of business

conduct and fair treatment between the members of the Company.

Fulfilling this duty naturally supports the Company in achieving

its investment objective and helps to ensure that all decisions are

made in a responsible and sustainable way. In accordance with the

requirements of the Companies (Miscellaneous Reporting) Regulations

2018, the Company explains how the Directors have discharged their

duty under Section 172 below.

To ensure that the Directors are aware of, and understand, their

duties they are provided with the pertinent information when they

first join the Board as well as receive regular and ongoing updates

and training on the relevant matters. They also have continued

access to the advice and services of the Company Secretary, and

when deemed necessary, the Directors can seek independent

professional advice. The schedule of matters reserved for the

Board, as well as the terms of reference of its committees are

reviewed on at least an annual basis and further describe

Directors' responsibilities and obligations, and include any

statutory and regulatory duties. The Audit Committee has the

responsibility for the ongoing review of the Company's risk

management systems and internal controls and, to the extent that

they are applicable, risks related to the matters set out in

Section 172 are included in the Company's risk register and are

subject to periodic and regular reviews and monitoring.

Decision-making

The importance of the stakeholder considerations, in particular

in the context of decision-making, is taken into account at every

Board meeting. All discussions involve careful considerations of

the longer-term consequences of any decisions and their

implications for stakeholders.

Stakeholders

The Board seeks to understand the needs and priorities of the

Company's stakeholders and these are taken into account during all

its discussions and as part of its decision-making. During the

period under review, the Board has discussed which parties should

be considered as stakeholders of the Company. Following thorough

review, it was concluded that, as the Company is an externally

managed investment company and does not have any employees or

customers, its key stakeholders comprise its Shareholders and

service providers. The section below discusses why these

stakeholders are considered of importance to the Company and the

actions taken to ensure that their interests are taken into

account.

Importance Board Engagement

------------------------------ --------------------------------------------------------------

Shareholders

------------------------------ --------------------------------------------------------------

Continued shareholder The Company has over 200 shareholders,

support and engagement including institutional and retail investors.

are critical to existence The Board is committed to maintaining

of the business and open channels of communication and to

the delivery of the engage with Shareholders in a manner which

long-term strategy they find most meaningful, in order to

of the business. gain an understanding of the views of

Shareholders. These include:

The Directors intend

to offer shareholders * Annual General Meeting ("AGM") - The Company welcomes

the opportunity to and encourages attendance and participation from

exit the Company at shareholders at the AGM. Shareholders have the

close to NAV in October opportunity to meet the Directors and Investment

2022 and every two Manager and to address questions to them directly.

years thereafter. The Investment Manager attends the AGM and will

The Board and Corporate provide a presentation on the Company's performance

Broker will canvass and the future outlook. The Company values any

opinion from Shareholders feedback and questions it may receive from

in the months leading Shareholders ahead of and during the AGM and will

up to October 2022 take action or make changes, when and as appropriate;

(and at each appropriate

interval thereafter)

when making any decision * Publications - The Annual Report and Half-Year

in respect of any results are made available on the Company's website

potential Exit Opportunity. and the Annual Report is circulated to Shareholders.

These reports provide Shareholders with a clear

understanding of the Company's portfolio and

financial position. This information is supplemented

by the daily calculation and publication of the NAV

per share and a monthly factsheet and quarterly

reports which are available on the Company's website

and the publication of which is announced via a

Regulatory Information Service. Feedback and/or

questions the Company receives from the Shareholders

help the Company evolve its reporting, aiming to

render the reports and updates transparent and

understandable;

* Shareholder meetings - Unlike trading companies,

Shareholder meetings often take the form of meeting

with the Investment Manager rather than members of

the Board. Shareholders are able to meet with the

Investment Manager throughout the period and the

Manager provides information on the Company and

videos of the Investment Manager on the Company's

website and via various social medial channels.

Feedback from all meetings between the Investment

Manager and Shareholders is shared with the Board.

The Chairman, the Chairman of the Audit Committee or

other members of the Board are available to meet with

shareholders to understand their views on governance

and the Company's performance where they wish to do

so. With assistance from the Manager, the Chairman

seeks meetings with Shareholders who might wish to

meet with him;

* Shareholder concerns - In the event Shareholders wish

to raise issues or concerns with the Directors, they

are welcome to do so at any time by writing to the

Chairman at the registered office. Other members of

the Board are also available to Shareholders if they

have concerns that have not been addressed through

the normal channels; and

* Investor Relations updates - at every Board meeting,

the Directors receive updates from the Company's

broker on the share trading activity, share price

performance and any Shareholders' feedback, as well

as an update from the Investment Manager on any

publications or comments by press. To gain a deeper

understanding of the views of its Shareholders and

potential investors, the Investment Manager will also

undertake regular Investor Roadshows. Any pertinent

feedback is taken into account when Directors discuss

the share capital, any possible fundraisings or the

dividend policy and actioned as and when appropriate.

The willingness of the shareholders, including the

partners and staff of the Investment Manager, to

maintain their holdings over the long term period is

another way for the Board to gauge how the Company is

meeting its objectives and suggests a presence of a

healthy corporate culture.

------------------------------ --------------------------------------------------------------

Other stakeholders

------------------------------ --------------------------------------------------------------

The Investment Manager

------------------------------ --------------------------------------------------------------

Holding the Company's Maintaining a close and constructive working

shares offers investors relationship with the Investment Manager

an investment vehicle is crucial as the Board and the Investment

through which they Manager both aim to continue to achieve

can obtain exposure consistent, long-term returns in line

to AJOT's diversified with its investment objective. Important

portfolio of Japanese components in the collaboration with the

equities. The Investment Investment Manager, representative of

Manager's performance the Company's culture are:

is critical for the

Company to successfully * Encouraging open discussion with the Manager,

deliver its investment allowing time and space for original and innovative

strategy and meet thinking;

its objective to provide

Shareholders with

capital growth in * The IMA requires AVI to invest not less than 25% of

excess of the MSCI the management fee in shares in the Company and to

Japan Small Cap Index hold these for a minimum of two years, which ensures

through active management that that the interests of Shareholders and the

of the portfolio and Investment Manager are well aligned;

engagement with portfolio

companies.

* Recognising the alignment of interests mentioned

above, adopting a tone of constructive challenge,

balanced with robust negotiation of the Manager's

terms of engagement if those interests should not be

fully congruent;

* Drawing on Board Members' individual experience and

knowledge to support the Manager in its monitoring of

and engagement with portfolio companies; and

* Willingness to make the Board Members' experience

available to support the Manager in the sound

long-term development of its business and resources,

recognising that the long-term health of the

Investment Manager is in the interests of

Shareholders in the Company.