TIDMPRU

RNS Number : 8926C

Prudential PLC

13 February 2020

13 February 2020

Prudential's Eastspring celebrates official completion of

Thanachart Fund acquisition

Eastspring Investments ("Eastspring"), the Asian asset

management business of Prudential plc ("Prudential"), celebrated at

an event in Bangkok today the official completion of its

acquisition of 50.1 per cent of Thanachart Fund Management Co.,

Ltd. ("Thanachart Fund") from Thanachart Bank Public Company Ltd.

("TBANK") and Government Savings Bank ("GSB")(1) . The firm will be

rebranded to Thanachart Fund Eastspring, reflecting the combined

strength of both companies.

The acquisition that was completed on 27 December 2019 places

Eastspring, through its combined holdings in Thanachart Fund

Eastspring and TMBAM Eastspring, as the 4th largest asset manager

in Thailand with a market share of 12 per cent and combined assets

under management ("AUM") of THB 668 billion(2) (USD 22

billion).

Nic Nicandrou, Chief Executive of Prudential Corporation Asia,

said: "As an Asia-led life insurer and asset manager, Prudential is

committed to helping customers protect their health and grow their

wealth. This acquisition will enable us to provide a wider range of

innovative and bespoke investment opportunities and provides us

with a platform to accelerate our growth in this important

market.

"This acquisition also complements Eastspring's acquisition of

65 per cent of TMB Asset Management (now TMBAM Eastspring) that was

completed in September 2018. We have acquired a highly attractive

business in the growing Thai market and the transaction deepens our

relationship with TMB and TBANK," Mr Nicandrou said.

Piti Tantakasem, Chief Executive Officer of TMB, said: "We are

delighted to grow our partnership with Eastspring. Since we

commenced working with Eastspring in 2018, we have seen TMBAM

Eastspring's AUM grow by more than 20 per cent, significantly

expand its client base and raise substantial new funds through the

TMB Eastspring Global Smart Bond Fund and the Thanachart Eastspring

Global Technology Fund in the largest initial public offerings

("IPO") in the history of our business.

"We look forward to working with TMBAM Eastspring and Thanachart

Fund Eastspring in the future. The complementary investment

capabilities of the two firms, together with the synergies and

scale from the integration of TMB and TBANK with almost 900

outlets, means Thai people will have greater access to investment

tools and more affordable choices. This will enable them to have

better financial well-being" Mr Piti said.

Thanachart Fund's strengths are in active equities, multi-asset,

money market and fixed income, and TMBAM Eastspring has strong

capabilities in passive equities, property, fixed income and

foreign invested funds.

Thailand is one of the largest and fastest growing asset

management markets in the ASEAN region(3) due to an expanding

middle class, rising affluence, strong savings culture and low

mutual fund penetration rate compared to more developed

markets.

TMBAM Eastspring and Thanachart Fund Eastspring recently

completed IPOs for the TMB Eastspring Global Smart Bond Fund and

the Thanachart Eastspring Global Technology Fund, respectively.

Both funds saw record-breaking amounts raised for both asset

management firms, due in a large part to the support and

distribution efforts of TMB and TBANK. In January last year, TMBAM

Eastspring launched its first IPO, the Asia Pacific Property

Flexible Fund, that was recently awarded Fund Launch of the Year in

Thailand by Asia Asset Management.

Enquiries:

Media Investors/Analysts

+44 (0)20 3977

Anneliese Diedrichs +65 8799 9241 Patrick Bowes 9702

+44 (0)20 3977 +44 (0)20 3977

Tom Willetts 9760 William Elderkin 9215

Darwin Lam +852 2918 6348

Note to editors:

Numbers converted at actual exchange rate.

About Eastspring Investments

Eastspring Investments is a leading Asia-based asset manager

that manages over USD 216 billion (as at 30 June 2019) of assets on

behalf of institutional and retail clients. Operating in Asia since

1994, Eastspring Investments is the Asian asset management business

of Prudential plc, an international financial services group, and

has one of the widest footprints across the region*. We provide

investment solutions across a broad range of asset classes

including equities, fixed income, multi asset, quantitative

strategies and alternatives and are committed to delivering high

quality investment outcomes for our clients over the long term.

Eastspring Investments is a signatory to the United

Nations-supported Principles for Responsible Investment, a

voluntary program which encourages best practice in environmental,

social and corporate governance issues. For more information on

Eastspring Investments, please visit: www.eastspring.com

*Eastspring Investments (excluding JV companies) companies are

ultimately wholly-owned / indirect subsidiaries / associates of

Prudential plc of the United Kingdom. Eastspring Investments

companies (including JV's) and Prudential plc are not affiliated in

any manner with Prudential Financial, Inc., a company whose

principal place of business is in the United States of America.

About Prudential plc

Prudential plc is an Asia-led portfolio of businesses focused on

structural growth markets. The business helps individuals to

de-risk their lives and deal with their biggest financial concerns

through life and health insurance, and retirement and asset

management solutions. Prudential plc has 20 million customers and

is listed on stock exchanges in London, Hong Kong, Singapore and

New York. Prudential plc is not affiliated in any manner with

Prudential Financial, Inc., a company whose principal place of

business is in the United States of America, nor with the

Prudential Assurance Company, a subsidiary of M&G plc, a

company incorporated in the United Kingdom.

About Prudential in Thailand

Prudential has operated in Thailand for more than 20 years

through Prudential Life Assurance (Thailand) Public Company

Limited. Prudential serves more than 1.6 million customers in

Thailand and manages more than THB 107 billion of assets on their

behalf(4) .

Footnotes

1 Eastspring will acquire a 25.0 per cent stake in Thanachart

Fund from GSB and a 25.1 per cent stake from TBANK.

2 Mutual fund market shares; Mutual fund assets under management

as at 31 December 2019.

3 Source: Cerulli Asset Management in Southeast Asia 2019

Report, data as of December 2018.

4 As of 30 June 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGPURAPUPUUMW

(END) Dow Jones Newswires

February 13, 2020 03:30 ET (08:30 GMT)

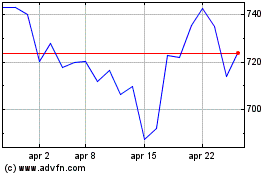

Grafico Azioni Prudential (LSE:PRU)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Prudential (LSE:PRU)

Storico

Da Apr 2023 a Apr 2024