2019 revenue

Activity growth consistent with the

objectives:

+3.5% at current exchange rates and +2.0% at

constant exchange rates

Villepinte, 13 February 2020 -

Guerbet (FR0000032526 GBT), a global specialist in

contrast agents and solutions for medical imaging, is reporting

2019 revenue of €816.9 million, up 3.5% from 2018, including a

favourable forex impact of €11.3 million. Revenue was up 2.0% at

€805.6 million at constant exchange rates1. Fourth quarter

2019 revenue was €211.2 million, up 1.4% at constant exchange

rates.

Excluding the impact of the decrease related to

the subcontracting activities inherited from the CMDS activities,

revenue growth at constant exchange rates was 3.7% over the 2019

financial year and 3.1% in fourth quarter 2019.

Consolidated Group revenue

(IFRS)

| In

millions of euros,at 31 December 2019 |

Change

(%) |

2019at current exchange

rates |

Change

(%) |

2019at constant exchange

rates* |

Reported 2018 |

|

Sales in Europe |

+1.7% |

345.2 |

+1.9% |

346.0 |

339.5 |

|

Sales in Other Markets |

+4.8% |

471.7 |

+2.1% |

459.6 |

450.1 |

|

Total |

+3.5% |

816.9 |

+2.0% |

805.6 |

789.6 |

Growth in all regions

In Europe, growth was around 2% at constant

exchange rates despite slight pressure on Dotarem® prices in

Belgium and Switzerland.

Excluding the impact of the subcontracting

activities inherited from the CMDS activities, sales grew in the

Americas by 3% at constant exchange rates thanks to market shares

increase, in the MRI segment, particularly in North America.

In Asia, the group’s growth was strong at 10.3%

at constant exchange rates with the switch to direct distribution

in Japan and good performance in other countries.

The analysis of activity over the 2019 financial

year shows that:

- Diagnostic Imaging sales grew to €711.0

million at constant exchange rates (+3.0%) and €719.5 million at

current exchange rates.

Sales in the MRI2 segment totalled €271.4

million at constant exchange rates and like-for-like basis

(€275.0 million at current exchange rates) compared with sales

of €272.0 million in 2018. In 2019, activity suffered from the

planned withdrawal of Optimark® from the market. Excluding

Optimark, MRI sales at constant exchange rates were up 1.6%.

CT/Cath Lab2 sales grew 5.2% to

€439.5 million at constant exchange rates thanks to

double-digit sales growth of Optiray® over the period (€444.6

million at current exchange rates). This strong growth, combined

with the stability of Xenetix® sales, illustrates Guerbet’s market

penetration in this segment.

- Interventional Imaging now represents just

over 9% of the Group’s revenue. It showed revenue at constant

exchange rates of €73.5 million, up 12.5% (€75.5 million at current

exchange rates).

Expected 2019 landing

The group expects an EBITDA3 margin of around

13.5% (excluding the positive impact of IFRS16 and excluding the

€7.6 million impact of the final agreement with Mallinckrodt and

Yves L’Epine’s transactional allowance). The group also anticipates

a significant increase in cash flow, resulting especially from its

inventory reduction initiatives and leading to a decrease in net

debt of approximately €30 million for the 2019 financial year

(excluding the effect of IFRS16).

1 At constant exchange rates: amounts and rates

of growth are calculated by cancelling out the exchange rate

effect, which is defined as the difference between the indicator’s

value for period N, converted at the exchange rate for

period N-1, and the indicator’s value for period N-1.

2 As a reminder, the MRI and CT/Cath Lab

divisions now include sales of injection systems and related

consumables.

3 EBITDA: Current operating income + net amortization,

depreciation, and provisions.

Upcoming events:

Publication of 2019 annual results24

March 2020 after trading

About

Guerbet

Guerbet is a leader in medical imaging

worldwide, offering a wide range of pharmaceutical products,

medical devices, software and services for diagnostic and

interventional imaging, to improve the diagnosis and treatment of

patients. A pioneer since more than 90 years in the field of

contrast media, Guerbet is a substantial investor in research and

innovation with more than 8% of revenue dedicated to R&D and

more than 200 employees distributed amongst its four centers in

France, Israel and the United States. Guerbet (GBT) is listed on

Euronext Paris (segment B – mid caps) and generated €817 million in

revenue in 2019. For more information about Guerbet, please visit

www.guerbet.com.

Forward-looking statements

Certain information contained in this press release does not

reflect historical data but constitutes forward-looking statements.

These forward-looking statements are based on estimates, forecasts,

and assumptions, including but not limited to assumptions about the

current and future strategy of the Group and the economic

environment in which the Group operates. They involve known and

unknown risks, uncertainties, and other factors that may result in

a significant difference between the Group’s actual performance and

results and those presented explicitly or implicitly by these

forward-looking statements.

These forward-looking statements are valid only as of the date

of this press release, and the Group expressly disclaims any

obligation or commitment to publish an update or revision of the

forward-looking statements contained in this press release to

reflect changes in their underlying assumptions, events,

conditions, or circumstances. The forward-looking statements

contained in this press release are for illustrative purposes only.

Forward-looking statements and information are not guarantees of

future performance and are subject to risks and uncertainties that

are difficult to predict and are generally beyond the Group’s

control. These risks and uncertainties include but are not limited

to the uncertainties inherent in research and development, future

clinical data and analyses (including after a marketing

authorisation is granted), decisions by regulatory authorities

(such as the US Food and Drug Administration or the European

Medicines Agency) regarding whether and when to approve any

application for a drug, process, or biological product filed for

any such product candidates, as well as their decisions regarding

labelling and other factors that may affect the availability or

commercial potential of such product candidates. A detailed

description of the risks and uncertainties related to the Group’s

businesses can be found in Chapter 4.4 “Risk Factors” of the

Group’s Registration Document filed with the French Financial

Markets Authority (AMF) under number D-18-0387 on 25 April 2018,

available on the Group’s website (www.guerbet.com).

For more information about Guerbet, please visit

www.guerbet.com

Contacts

| Jérôme

EstampesChief Financial

Officer+33 (0)1 45 91 50 00 |

Financial

CommunicationsBenjamin

Lehari+33 (0)1 56 88 11 25blehari@actifin.fr PressJennifer

Jullia+33 (0)1 56 88 11 19jjullia@actifin.fr |

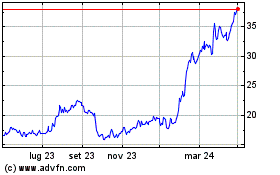

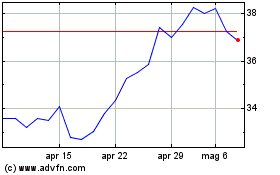

Grafico Azioni Guerbet (EU:GBT)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Guerbet (EU:GBT)

Storico

Da Apr 2023 a Apr 2024