TIDMOSEC

Octopus AIM VCT 2 plc

Final Results

13 February 2020

Octopus AIM VCT 2 plc, managed by Octopus Investments Limited, today

announces the final results for the year ended 30 November 2019.

These results were approved by the Board of Directors on 13 February

2020.

You may view the Annual Report in full at

https://www.globenewswire.com/Tracker?data=pQfvr0fFGNUQNNfmOA0nreHFiefTDexhyfwd07fYPXY-MetV_tmEA7ny2gwmNL7HwLEKlY7vyVWu7b4k7tonD52M_R04dgkh3etSQ-Xzm02A2ne7ozqK-HdAESSRZsGL

www.octopusinvestments.com in due course. All other statutory

information will also be found there.

Financial Summary

30 November 2019 30 November 2018

-------------------------------------- ---------------- ----------------

Net assets (GBP'000s) 80,040 90,630

Loss after tax (GBP'000s) (476) (3,234)

Net asset value ("NAV") per share (p) 72.4 80.8

Dividends paid in year (p) 8.1 4.2

Total return (%) * (0.4) (2.4)

Final dividend proposed (p)** 2.1 2.1

-------------------------------------- ---------------- ----------------

* Total return is an alternative performance measure calculated as

movement in NAV per share in the period plus dividends paid in the

period, divided by the NAV per share at the beginning of the period.

** Subject to shareholder approval at the Annual General Meeting, the

proposed final dividend will be paid on 22 May 2020 to shareholders on

the register on 1 May 2020.

Chairman's Statement

Introduction

I am pleased to present the Annual Report of AIM VCT 2 for the year

ended 30 November 2019. I would like to welcome all new shareholders who

have joined in the year and I do hope that I will see some of you at the

AGM on 30 April 2020.

In the year under review the challenges around international trade,

politics and the visibility of the nature of any Brexit settlement

continued to prey on sentiment, with the result that stock markets

remained vulnerable to bouts of nervousness and volatility throughout

the year. Investors remained cautious about risk, and as a consequence

smaller companies underperformed as an asset class. It was not all bad

news however; despite almost daily negative press, the economy continued

to grow in 2019 and employment levels remained high. At the micro-level

many companies in the portfolio reported good figures in the September

results season. The level of fundraisings on AIM was subdued, with an

emphasis on support for existing companies rather than new issues.

Against this background the VCT made GBP4.3 million of new VCT

qualifying investments in the year, down from GBP8.1 million in the

previous year.

Performance

The NAV on 30 November 2019 was 72.4p per share, a decrease on the NAV

of 80.8p reported at 30 November 2018. Adding back the 8.1p of dividends

paid in the year, to adjust the year end NAV to 80.5p, gives a total

negative return of 0.4%. In the same year, the FTSE All Share Index rose

by 11%, the FTSE SmallCap (excluding investment companies) Index rose by

5.3% and the FTSE AIM All Share Index rose by 0.7%, all on a total

return basis.

Once again stock specific factors had a significant impact on

performance, both positive and negative, and these are covered in more

detail in the Investment Manager's Review. In addition, the

underperformance of smaller companies became more marked as the year

went on and domestic political problems weakened sterling and confidence

in companies exposed to the domestic economy.

In the year under review AIM raised GBP3.6 billion of new capital, a

sharp decrease on the GBP6.2 billion raised in the previous year,

although it still showed itself able to support its existing members,

with the majority of the drop accounted for by a lack of new issues.

Dividends

In November 2019 an interim dividend of 2.1p and a special dividend of

3.9p was paid to all shareholders. The special dividend was made

following from a number of partial and total sales of holdings from the

portfolio in the year. The Board is recommending a final dividend in

respect of the year to 30 November 2019 of 2.1p per share, making 8.1p

in total paid in respect of the year. Subject to the approval of

shareholders at the AGM the dividend will be paid on 22 May 2020 to

shareholders on the register on 1 May 2020.

It remains the Board's intention to maintain a minimum annual dividend

payment of 3.6p per share or a 5% yield based on the year end share

price, whichever is greater. This will usually be paid in two

instalments during each year.

Cancellation of Share Premium Account

At the last General Meeting, shareholders voted to cancel share premium

to create a pool of distributable reserves to the amount of

GBP11,575,000.

Dividend Reinvestment Scheme

In common with a number of other VCTs, the Company has established a

Dividend Reinvestment Scheme (DRIS) following approval at the AGM in

2014. Some shareholders have already taken advantage of this

opportunity. For investors who do not need income, but value the

additional tax relief on their reinvested dividends, this is an

attractive scheme and I hope that more shareholders will find it useful.

In the course of the year 2,086,088 new shares have been issued under

this scheme, returning GBP1.5 million to the Company. The final dividend

referred to above will be eligible for the DRIS.

Share Buybacks

During the year to 30 November 2019 the Company continued to buy back

shares in the market from selling shareholders and purchased 3,838,793

ordinary shares for a total consideration of GBP2,781,484. We have

maintained a discount of approximately 4.5% to NAV (equating to a 5.0%

discount to the selling shareholder after costs), which the Board

monitors and intends to retain as a policy which fairly balances the

interests of both remaining and selling shareholders. Buybacks remain an

essential practice for VCTs, as providing a means of selling is an

important part of the initial investment decision and has enabled the

Company to grow. As such I hope you will all support the appropriate

resolution at the AGM.

Share Issues

An offer to raise up to GBP8 million with an overallotment facility of

up to a further GBP4 million alongside the Octopus AIM VCT plc was

launched on 29 November 2019.

Risks and Uncertainties

In accordance with the Listing Rules and the Companies Act 2006 under

which the Company operates, the Board has to comment on potential risks

and uncertainties, which could have a material impact on the Company's

performance.

Liquidity

There has been much discussion about the issue of liquidity within

investment funds over the past year. Shareholders may be interested to

know that at the year end 27% of the Company's portfolio was held in

cash or collective investment funds providing short-term liquidity, 69%

in individual quoted shares and less than 3% of the company's assets

were held in unquoted single company investments. It should be noted

that a proportion of the quoted securities, which accounts for 69% of

the Company's portfolio, may have limited liquidity owing to the size of

the investee company and proportion held by the Company.

VCT Status

PricewaterhouseCoopers LLP provides the Board and Investment Manager

with advice concerning continuing compliance with HMRC regulations for

VCTs. The Board has been advised that the Company is in compliance with

the conditions laid down by HMRC for maintaining approval as a VCT. From

1st December 2019 a key requirement is to maintain at least an 80%

qualifying investment level, up from the previous level of 70%. As at 30

November 2019, 91% of the Copmany's portfolio were in qualifying

investments.

Annual General Meeting ("AGM")

The AGM will take place on 30 April 2020 at 11:00 a.m. I hope to meet as

many shareholders as possible at this event, which provides an

opportunity for you to meet the Board, Investment Managers and to get an

update on the Company's activities and future plans. At the AGM a

resolution will be proposed to extend the life of the Company until 2025

in order to preserve its VCT status for the benefit of both existing

shareholders and new investors who are participating in the latest

offer. We will do our best to address as many shareholder questions as

possible in this meeting.

Outlook

There was a significant improvement in sentiment after the General

Election in December 2019 and as a result December was a very positive

month for many of the shares in the portfolio resulting in good progress

for the NAV. The subsequent recovery in sterling has favoured some of

those shares that had formerly been held back by their exposure to the

domestic economy which is now expected to be boosted by the government's

spending plans. However, there is still a degree of uncertainty about

the exact nature of the UK's eventual relationship with the EU and

international trade concerns remain. The recent outbreak of Coronavirus

in mainland China is currently dominating the headlines although it is

too early at this stage to assess the scale of any impact on the wider

global economy.

The portfolio now contains 76 holdings across a range of sectors and

many of them have already demonstrated their management's ability to

grow their businesses successfully in difficult economic conditions. The

balance of the portfolio towards profitable companies remains, and the

manager expects to find good opportunities to invest the cash as a

recovery in confidence feeds through to an increased demand from

companies for more growth capital.

Keith Mullins

Chairman

13 February 2020

Investment Manager's Review

Introduction

In our interim review we highlighted the effects that international

trade tensions and continuing Brexit uncertainty were having on UK share

prices, with smaller companies in particular having underperformed as

investors sought the comfort of larger more liquid stocks and exposure

to foreign currency earnings. The effect was even more pronounced in the

second half of the year resulting in some very volatile months for the

stock market and declines in both the smaller companies and AIM indices

in the year to 30 November 2019. Sentiment began to recover in November

but only improved decisively in December post the General Election

result. Despite a strong recovery in the NAV in the month of November,

it is disappointing to have to report a small negative total return for

the year of 0.4%, although we are pleased to report the maintenance of

the 5% yield objective and the additional payment of a 3.9p special

dividend in the year. The latest unaudited NAV on 10 February is 76.1p,

5% up from the November year end.

In the year to 30 November 2019 AIM, in common with the wider

stockmarket, saw a sharp decline in the number of new entrants seeking a

listing although it has continued to raise new capital for its existing

members and the Company has deployed existing cash steadily throughout

the period. The decisive General Election result in December has changed

the mood of the market and there are early signs that the supply of new

issues should start to pick up in 2020.

The Alternative Investment Market

AIM trailed larger company indices in 2019, producing a NAV total return

of 0.7% in the twelve months to November, well behind the FTSE All share

return of 11% and behind the Smaller Companies Index (excluding

Investment Trusts) figure of 5.3%. These figures are in part a

consequence of the timing of the VCT's year end which fell just before

the General Election and at the end of a prolonged period of Brexit

uncertainty. With sterling and sentiment weak, investors had sought the

perceived safety of large companies which tend to have a much greater

proportion of their businesses based overseas. Conversely, AIM has the

highest proportion of very small companies in it, something which held

it back in the period.

In the interim report we highlighted the fall in the number of new

companies floating on AIM. This was also the case in the second half of

the financial year with AIM raising a total of only GBP0.4 billion for

new listings, down from a figure of GBP1.7 billion in the previous year.

In the year to 30 November 2019, AIM raised a further GBP3.2 billion of

new capital for existing companies which compares to a figure of GBP4.5

billion the previous year. The shortage of new issues in 2019 was

frustrating and has been attributed to a number of factors including the

popularity of private equity and other alternative financing as a result

of a sustained period of low interest rates as well as volatile markets

exacerbated by the uncertainty around Brexit. It is encouraging that AIM

has continued to raise capital for its existing constituents despite all

of these perceived concerns and we hope that the greater certainty

promised by a majority government helps to restore the flow of new

entrants to the market. VCTs play a significant part in the funding

process and we identify below the companies we have invested in during

the year.

Performance

Adding back the 8.1p of dividends paid in the year, the NAV total return

decreased by 0.4%. This compares with a positive total return for the

FTSE AIM All Share Index of 0.7%, the FTSE SmallCap (excluding

investment companies) of 5.3% and the FTSE All Share Index of 11%. It

was a year characterised by individual months of significant market

volatility, with a tendency for shares to react particularly strongly to

any bad trading news. The market remained wary of smaller companies that

have yet to make a profit (of which there are several in the VCT) and

favoured those exposed to foreign currencies.

Performance as ever was dominated by stock specific factors, with the

market still prepared to reward companies that met or exceeded

expectations with higher share prices and this resulted in some good

contributions to performance from some of the more established and

profitable companies in the portfolio, as well as from some of the

younger companies whose businesses made significant progress in the

year. Where a company is established and has grown in size we will

continue to hold the shares if we still believe it has the capacity to

grow further on a medium term time horizon. This helps to balance the

portfolio as newly raised cash is invested in earlier stage companies

which could take some time to achieve profitability.

Among the larger and more established holdings, GB Group had an

excellent year, successfully integrating the substantial acquisition of

IDology which was followed by upgrades to forecasts and strong interim

results. It was also a beneficiary of weak sterling. Ergomed was another

very good performer in the year. It has increased the profitability of

its business and now has a range of services it can offer large

pharmaceutical companies including the monitoring of drugs for

regulatory purposes and the conducting of drugs trials for very rare

diseases. We expect it to continue to achieve good profitable organic

growth in the coming year. RWS also performed very well, helped by

upgrades to forecasts and we took the opportunity to realise some

profits. Learning Technologies also produced robust trading statements

and was rewarded with a recovery in its share price from depressed

levels at the beginning of the period. Judges Scientific was another

very good performer benefitting from upgrades to forecasts as a result

of good demand for its specialist equipment and currency tail-winds. A

less significant performer was Breedon Group which had been suffering

from fears about its exposure to the UK economy. Its share price started

to recover from recent lows in the period but this has accelerated

since.

Among the more recent investments, Ixico made excellent progress,

announcing some meaningful contracts on large drugs trials which involve

the monitoring of the brain using scans. The company is now profitable.

Diaceutics also got off to a good start and has announced better than

expected figures post the period end. Sosandar has also produced higher

than expected sales growth with new product lines being launched at the

beginning of 2020.

Individual companies suffered from specific headwinds which resulted in

poor share price performance. We wrote about Gear4Music and Quixant in

the half-yearly report. Gear4Music has since announced more encouraging

interim results which showed a recovery in its margins. Quixant is still

being held back by the loss of market share of its largest customer. It

has some exciting new products aimed at the broadcasting sector which

have yet to establish themselves. Craneware also saw its shares fall

from a high after the sales growth rate disappointed as a result of a

slower than expected uptake from its new Trisus platform. The company

retains its strong positioning in the US hospital market and stands out

as a cash generative software company with growing annual recurring

revenues.

One of the disappointments of the year was Staffline which we wrote

about in the interim accounts. Having initially been unable to publish

its accounts for the year to December 2018 the consequence was a

significant effect on trading in 2019, a fundraising to bolster the

balance sheet and further downgrades to forecasts. We have subsequently

disposed of the holding post year end.

Two other negative contributors were MyCelx Technologies (MyCelx) and

LoopUp Group. MyCelx had a series of downgrades to forecasts as a result

of lower than expected revenues from its Saudi Arabian based operations.

Other markets have been slower than hoped to open up although the

potential opportunity for its water cleaning technology remains

significant. LoopUp disappointed after the acquisition of Meetingzone

failed to deliver the expected benefits.

Elsewhere, early stage companies yet to reach profitability once again

held back performance of the Company's NAV. Some of these had setbacks

or found themselves in need of cash to achieve the next milestone; DP

Poland, Osirium Technologies, Escape Hunt and Maestrano all fall into

that category. Investing for a VCT involves backing companies when they

are small and still at an early stage of development and share price

progress depends on them being noticed by a wider circle of investors as

they produce results and develop their businesses over time. This quite

often takes longer than expected and they remain potentially vulnerable

until they achieve profitability.

Although the earlier stage companies in the portfolio represent a

relatively small proportion by value we expect them to contribute to

future performance when they start to demonstrate growth in their

businesses. In the year under review there were some examples of

companies that demonstrated that they had started to achieve that in the

period and whose shares outperformed including Ixico, SDI Group,

Sosandar, Diaceutics, and Renalytix. The latter was spun out of the

holding in EKF since when it has made better than expected progress with

its commercialisation strategy for its kidneyintelx test in the US.

Portfolio Activity

Having made two new qualifying investments at a total cost of GBP0.9

million in the first half of the year, we added four further new

qualifying holdings at a cost of GBP2.8 million in the second half, as

well as two further qualifying investments of GBP0.2 million into Popsa

Holdings Ltd and GBP0.4 million into Osirium Technologies, both of which

were follow on investments in existing holdings. This made a total

investment of GBP4.3 million in qualifying investments for the year,

which was considerably lower than last year's GBP8 million, reflecting a

quieter AIM market for fundraisings.

The other four were new investments into existing AIM companies that

were seeking growth capital. They were all companies whose progress we

had been monitoring for some time. Sosandar is a fast-growing on-line

clothing brand aimed at women who have graduated from throwaway fashion

and are seeking a higher quality product. Intelligent Ultrasound has

developed intelligent software installed on simulators to train medical

practitioners in the use of ultrasound machines and to increase their

safety and effectiveness. Cloudcall is another software company

providing communication functionality to companies for their customer

relationship management systems and C4X Discovery has a technology

platform which can help pharmaceutical companies design better molecules

for drugs and hence save time and cost. All of these investments have

significant growth prospects although none of them have yet reached

profitability.

Non-qualifying investments are used to manage liquidity while awaiting

new qualifying investment opportunities. Although we have continued to

hold existing non-qualifying AIM holdings where we see the opportunity

for further progress we did reduce the size of many of these holdings in

the year under review. We have also invested the funds raised at the end

of the previous year into a mixture of the Octopus managed portfolios

with a small proportion going into the FP Octopus Multi-Cap Income Fund.

This strategy is designed to obtain a better return on funds awaiting

investment than the very low rates available on cash. In the period

under review GBP0.6 million was invested into the FP Octopus Multi-Cap

Income Fund. A net divestment of GBP1.3 million was made in each of the

Octopus Portfolio Manager ("OPM") funds; OPM 3 and OPM 4.

During the year we sold part of the holdings in RWS, Clinigen, Quixant,

Gamma, Restore, Next Fifteen, Advanced Medical Solutions, LoopUp, Ixico,

Creo Medical and VR Education as well as disposing of the entire Abcam

and Iomart holdings, all at a profit. Synnovia, a long-term qualifying

holding, was sold as the result of a takeover bid. In all disposals made

a GBP1.9 million profit over original cost and generated GBP5.3 million

of cash proceeds. A proportion of the proceeds were paid out in a 3.9p

special dividend in November. Post the period end we accepted a cash

offer for the balance of our holding in Brady Group and took profits in

Ixico and Learning Technologies.

VCT Regulations

There have been no further changes to the VCT regulations since

publication of the previous set of audited accounts. As a reminder, the

current requirements are that any funds raised after 6th April 2019

should be 30% invested in qualifying holdings within 12 months of the

end of the accounting period in which the shares were issued, and for

financial years ending after 6 April 2019 the portfolio will also have

to maintain a minimum of 80% invested at cost in qualifying holdings. We

are determined to maintain a threshold of quality and to invest where we

see the potential for returns from growth. However, the emphasis of the

new regulations is definitely to encourage investment into earlier stage

companies and to that extent, it seems likely over a number of years,

that the portfolio will see a rise in the number of smaller companies

receiving our initial investment. We would expect to invest further in

those companies as they demonstrate their ability to grow.

At present there has been little change to the profile of the portfolio,

as we continue to hold the larger market capitalisation companies, in

which we invested several years ago as qualifying companies, or which we

bought in the market prior to the rule changes where we see the

potential for them to continue to grow.

In order to qualify, companies must:

-- have fewer than 250 full time equivalent employees; and

-- have less than GBP15 million of gross assets at the time of

investment and no more than GBP16 million immediately post investment;

and

-- be less than seven years old from the date of its first

commercial sale (or 10 years if a knowledge intensive company) if

raising State Aided (i.e. VCT) funds for the first time; and

-- have raised no more than GBP5 million of State Aided funds in

the previous 12 months and less than the lifetime limit of GBP12 million

(or since 6th April 2018 GBP10 million in 12 months GBP20 million

lifetime limit if a knowledge intensive company); and

-- produce a business plan to show that the funds are being

raised for growth and development.

The latest changes are to encourage VCTs to keep their investment rate

up after raising money. However, allowing knowledge intensive companies

to raise up to GBP10 million of the GBP20 million lifetime limit in a

twelve month period rather than the existing GBP5 million has given the

VCT more flexibility. In addition, the rules around the amount of time

allowed for re-investment of cash from sales of qualifying holdings have

shifted from six to twelve months from April 2019 which has further

created some head room.

Outlook

The new financial year started well for the Company, with share prices

reacting favourably to the General Election result in December, and the

extent of the Government's majority surprising most commentators.

Although the UK left the EU last month, the relationship with the EU

remains similar as the country is now in a transition period until 31

December 2020. As such, the uncertainty remains with regards to the UK's

future relationship with the EU. The threat of an ineffective hung

Parliament has been removed and this feels like a considerable step

forward from the uncertainty which dominated events prior to that. In

contrast to the year to November 2019 it has been the domestically

focused companies that have led the recent market performance,

particularly helped by positive noises from the new administration about

increasing expenditure on infrastructure and the regions. There should

be the potential for UK equities to return to favour and narrow the

valuation discount that they currently trade on and in time we hope that

this will trickle down to smaller companies and increase the flow of new

companies coming to market.

The portfolio now contains 76 holdings with investments across a range

of sectors including both domestic and international exposure. The

balance of the portfolio towards profitable companies remains. The

recent outbreak of Coronavirus in China is of course a concern, and

although it is too early to quantify any impact on individual companies

we are watching the situation closely. The VCT is currently in the

middle of a fundraise which will provide cash for new investments.

The AIM Team

Octopus Investments Limited

13 February 2020

Directors' Responsibility Statement

The Directors are responsible for preparing the Annual Report and the

Accounts in accordance with applicable law and regulations.

Company law requires the Directors to prepare financial statements for

each financial year. Under that law the Directors have elected to

prepare the financial statements in accordance with the Financial

Reporting Standard applicable in the United Kingdom and Republic of

Ireland ("FRS 102"). Under company law the Directors must not approve

the financial statements unless they are satisfied that they give a true

and fair view of the state of affairs of the Company and of the profit

or loss of the Company for that period.

In preparing these financial statements the Directors are required to:

-- select suitable accounting policies and then apply them

consistently;

-- make judgments and accounting estimates that are reasonable and

prudent;

-- state whether applicable UK accounting standards have been

followed, subject to any material departures disclosed and explained in

the financial statements;

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will continue in

business; and

-- prepare a strategic report, a Directors' report and Directors'

remuneration report which comply with the requirements of the Companies

Act 2006.

The Directors are responsible for keeping adequate accounting records

that are sufficient to show and explain the Company's transactions, to

disclose with reasonable accuracy at any time the financial position of

the Company and to enable them to ensure that the financial statements

comply with the Companies Act 2006. They are also responsible for

safeguarding the assets of the Company and hence for taking reasonable

steps for the prevention and detection of fraud and other

irregularities.

The Directors are responsible for ensuring that the Annual Report and

Accounts, taken as a whole, are fair, balanced, and understandable and

provides the information necessary for shareholders to assess the

Company's performance, business model and strategy.

The Directors are responsible for ensuring the Annual Report and

Accounts are made available on a website. Financial statements are

published on the Company's website in accordance with legislation in the

United Kingdom governing the preparation and dissemination of financial

statements, which may vary from legislation in other jurisdictions. The

maintenance and integrity of the Company's website is the responsibility

of the Directors. The Directors' responsibility also extends to the

ongoing integrity of the financial statements contained therein.

Directors' responsibilities pursuant to DTR4

The Directors confirm to the best of their knowledge:

-- the financial statements, prepared in accordance with the

Financial Reporting Standard applicable in the United Kingdom and

Republic of Ireland ("FRS 102"), give a true and fair view of the assets,

liabilities, financial position and profit and loss of the Company; and

-- the Annual Report includes a fair review of the development and

performance of the business and the financial position of the Company,

together with a description or the principal risks and uncertainties

that it faces.

On Behalf of the Board

Keith Mullins

Chairman

13 February 2020

NON-STATUTORY ACCOUNTS

The financial information set out below does not constitute the

Company's statutory accounts for the years ended 30 November 2019 or 30

November 2018 but is derived from those accounts. Statutory accounts for

the year ended 30 November 2018 have been delivered to the Registrar of

Companies and statutory accounts for the year ended 30 November 2019

will be delivered to the Registrar of Companies in due course. The

Auditor has reported on those accounts; their reports were (i)

unqualified, (ii) did not include a reference to any matters to which

the Auditor drew attention by way of emphasis without qualifying their

report and (iii) did not contain a statement under Section 498 (2) or

(3) of the Companies Act 2006. The text of the Auditor's reports can be

found in the Company's full Annual Report and Accounts at

www.octopusinvestments.com

Income Statement

Year to 30 November 2019 Year to 30 November 2018

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- -------- -------- -------- --------

Gain on

disposal of

fixed asset

investments - 315 315 - 1,266 1,266

Gain on

disposal of

current

asset

investments - 61 61 - - -

Loss on

valuation

of fixed

asset

investments - (900) (900) - (3,185) (3,185)

Gain/(loss)

on

valuation

of current

asset

investments - 1,390 1,390 - (155) (155)

Investment

Income 539 - 539 510 245 755

Investment

management

fees (353) (1,058) (1,411) (364) (1,093) (1,457)

Other

expenses (470) - (470) (458) - (458)

---------------- -------- -------- -------- -------- -------- --------

Loss on

ordinary

activities

before tax (284) (192) (476) (312) (2,922) (3,234)

Tax - - - - - -

---------------- -------- -------- -------- -------- -------- --------

Return on

ordinary

activities

after tax (284) (192) (476) (312) (2,922) (3,234)

---------------- -------- -------- -------- -------- -------- --------

Earnings per

share --

basic and

diluted (0.3)p (0.1)p (0.4)p (0.3)p (2.9)p (3.2)p

There is no other comprehensive income for the period.

-- the 'Total' column of this statement represents the statutory income

statement of the Company; the supplementary revenue return and capital

return columns have been prepared in accordance with the AIC Statement of

Recommended Practice

-- all revenue and capital items in the above statement derive from

continuing operations

-- the Company has only one class of business and derives its income from

investments made in shares and securities and from bank and money market

funds, as well as OEIC funds.

Balance Sheet

As at 30 November 2019 As at 30 November 2018

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ----------- ----------- ----------- -----------

Fixed asset

investments 58,246 59,871

Current assets:

Investments 16,458 16,891

Money Market Funds 3,474 3,449

Debtors 134 65

Cash at bank 1,881 11,546

-------------------------- ----------- ----------- ----------- -----------

21,947 31,951

Creditors: amounts

falling due within

one year (153) (1,192)

-------------------------- ----------- ----------- ----------- -----------

Net current assets 21,794 30,759

-------------------------- ----------- ----------- ----------- -----------

Net assets 80,040 90,630

-------------------------- ----------- ----------- ----------- -----------

Called up equity share

capital 11 11

Share premium 47,044 57,045

Capital redemption

reserve 1 1

Special distributable

reserve 19,423 19,536

Capital reserve

realised (8,641) (9,898)

Capital reserve

unrealised 23,146 24,595

Revenue reserve (944) (660)

-------------------------- ----------- ----------- ----------- -----------

Total equity

shareholders' funds 80,040 90,630

-------------------------- ----------- ----------- ----------- -----------

Net asset value per 72.4p 80.8p

share

The statements were approved by the Directors and authorised for issue

on 13 February 2020 and are signed on their behalf by:

Keith Mullins

Chairman

Company No: 05528235

Statement of changes in Equity

Share capital Share premium Special distributable reserves* Capital reserve -- realised* Capital reserve -- unrealised Capital redemption reserve Revenue reserve* Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

As at 1 December 2018 11 57,045 19,536 (9,898) 24,595 1 (660) 90,630

----------------------------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

Comprehensive income for the year:

Management fee allocated as capital

expenditure -- -- -- (1,058) -- -- -- (1,058)

Current year gains on disposal -- -- -- 376 -- -- -- 376

Current period gains on fair value

of investments -- -- -- -- 490 -- -- 490

Loss after tax -- -- -- -- -- -- (284) (284)

----------------------------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

Total comprehensive income for the

year -- -- -- (682) 490 -- (284) (476)

Contributions by and distributions

to owners:

Repurchase and cancellation of own

shares -- -- (2,782) -- -- -- -- (2,782)

Issue of shares -- 1,576 -- -- -- -- -- 1,576

Share issue costs -- (2) -- -- -- -- -- (2)

Dividends -- -- (8,906) -- -- -- -- (8,906)

----------------------------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

Total contributions by and

distributions to owners -- 1,574 (11,688) -- -- -- -- (10,114)

Other movements:

Cancellation of share premium -- (11,575) 11,575 -- -- -- -- --

Prior years' holding gains now

realised -- -- -- 1,939 (1,939) -- -- --

----------------------------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

Total other movements -- (11,575) 11,575 1,939 (1,939) -- -- --

----------------------------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

Balance as at 30 November 2019 11 47,044 19,423 (8,641) 23,146 1 (944) 80,040

----------------------------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

Share capital Share premium Special distributable reserves* Capital reserve -- realised* Capital reserve -- unrealised Capital redemption reserve Revenue reserve* Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

As at 1

December

2017 10 44,186 25,444 (11,071) 28,690 -- (348) 86,911

-------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

Comprehensive

income for the

year:

Management fee

allocated as

capital

expenditure -- -- -- (1,093) -- -- -- (1,093)

Current year

gains on

disposal -- -- -- 1,266 -- -- -- 1,266

Current period

gains on fair

value of

investments -- -- -- -- (3,340) -- -- (3,340)

Capital

investment

income -- -- -- 245 -- -- -- --

Loss after tax -- -- -- -- -- -- (312) (312)

-------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

Total

comprehensive

income for

the year -- -- -- 418 (3,340) -- (312) (3,234)

Contributions

by and

distributions

to owners:

Repurchase and

cancellation

of own

shares (1) -- (1,579) -- -- 1 -- (1,579)

Issue of

shares 2 13,662 -- -- -- -- -- 13,664

Share issue

costs -- (803) -- -- -- -- -- (803)

Dividends -- -- (4,329) -- -- -- -- (4,329)

-------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

Total

contributions

by and

distributions

to owners 12,859 (5,908) -- -- 1 -- 6,953

Other

Movements:

Prior years'

holding gains

now realised -- -- -- 755 (755) -- -- --

-------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

Total other

movements -- -- -- -- -- -- -- --

-------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

Balance as at

30 November

2018 11 57,045 19,536 (9,898) 24,595 1 (660) 90,630

-------------- ------------- ------------- ------------------------------- ---------------------------- ------------------------------ -------------------------- ---------------- --------

*Included within these reserves is an amount of GBP9,838,000 (2018:

GBP8,978,000) which is considered distributable to shareholders.

Cash Flow Statement

Year to 30 November 2019 Year to 30 November 2018

GBP'000 GBP'000

-------------------------- ------------------------ ------------------------

Cash flows from operating

activities

Loss on ordinary

activitites before tax (476) (3,234)

Adjustments for:

(Increase)/decrease in

debtors (69) 33

(Decrease)/increase in

creditors (386) 35

Gains on disposal of fixed

assets (315) (1,266)

Gains on disposal of

current asset

investments (61) -

Loss on valuation of fixed

asset investments 900 3,185

(Gains)/loss on valuation

of current asset

investments (1,390) 155

EKF In-specie dividend

Renaltyx - (245)

Cash from operations (1,797) (1,337)

Income taxes paid - -

-------------------------- ------------------------ ------------------------

Net cash generated from

operating activities (1,797) (1,337)

-------------------------- ------------------------ ------------------------

Cash flows from investing

activities

Purchase of fixed asset

investments (4,959) (7,413)

Sale of fixed asset

investments 5,346 6,155

Purchase of current asset

investments (3,116) (300)

Sale of current asset

investments 5,000 -

Total cash flows from

investing activities 2,271 (1,558)

Cash flows from financing

activities

Purchase of own shares (2,782) (1,579)

Issue of shares net of

issue costs 90 12,183

Dividends paid (7,422) (3,651)

Total cash flows from

financing activities (10,114) 6,953

-------------------------- ------------------------ ------------------------

(Decrease)/Increase in

cash and cash

equivalents (9,640) 4,058

Opening cash and cash

equivalents 14,995 10,937

Closing cash and cash

equivalents 5,355 14,995

--------------------------

Cash and cash equivalents

comprise

Cash at bank 1,881 11,546

Money Market Funds 3,474 3,449

5,355 14,995

(END) Dow Jones Newswires

February 13, 2020 12:03 ET (17:03 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

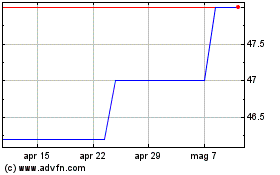

Grafico Azioni Octopus Aim Vct 2 (LSE:OSEC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Octopus Aim Vct 2 (LSE:OSEC)

Storico

Da Apr 2023 a Apr 2024