By Benjamin Katz

TOULOUSE, France -- Airbus SE is ramping up production of its

bestselling single-aisle jet, moving to fill a hole in the market

created by the prolonged grounding of rival Boeing Co.'s 737

MAX.

The increase comes as airlines are planning for a second summer

travel season without their MAX jets. Southwest Airlines Co., the

world's largest MAX operator, said Thursday that it has cut the

plane from its schedule through Aug. 10, two months longer than

planned.

Airbus on Thursday outlined plans to raise production of its

A320neo to as many as 67 a month by 2023, from the current target

of 63 a month in 2021. The A320neo competes directly with the

MAX.

Both jetliners have become the workhorses of many airlines'

commercial fleets. The fuel-efficient jets, with their extended

ranges and low-passenger load, have been popular with airlines for

their flexibility.

Airbus hasn't yet materially benefited from the grounding of the

MAX, however. That is because both jets have been so popular that

their order books stretch out for years. Airbus has struggled with

production issues for many of its jets, making it difficult to ramp

up output of the A320neo.

Underscoring the new pressure on Boeing, Nigeria's Green Africa

Airways on Thursday placed a major order for Airbus's smaller A220

narrow-body jets. The airline had previously placed a commitment

for as many as 100 Boeing MAX jets, an order that is now in

jeopardy, according to people familiar with the matter.

The Nigerian startup turned to Airbus amid uncertainty about

when it would start receiving its MAX jets, after having to

postpone the airline's launch, according to a company

executive.

Airlines managed through last summer by trimming service from

routes with multiple flights and rerouting passengers. Some kept

older planes flying longer, with others renting alternative jets to

fill the gap.

Panama-based Copa Holdings SA on Thursday also pushed back the

MAX from its schedules until September. And Norwegian Air Shuttle

ASA said Thursday that it doesn't expect any of its 18 MAX jets to

fly before September, having planned previously to fly them this

summer. The airline is due to receive an additional 16 MAX jets

this year, 14 of which have already been built.

Chief Financial Officer Geir Karlsen said on an investor call

that it is "completely unrealistic" all these will arrive as

scheduled. He said Norwegian is renting alternative jets and might

not need all the planes it has ordered for the winter schedule.

Airlines typically receive some cancellation options when a

plane is more than a year late, which he said he expected some

carriers to exercise. "I think Boeing is sitting there today

expecting that at least some of the customers will cancel," Mr.

Karlsen said.

American Airlines Group Inc. and United Airlines Holdings Inc.

have also indicated that further schedule adjustments are likely.

Both carriers currently have the MAX on their schedules again from

early June.

Boeing grounded its latest version of the 737 last year after

two crashes of the jet, which were blamed partly on a faulty

flight-control system. The grounding has been extended to the

middle of this year.

Boeing halted production of the plane late last year and has

been forced to cut back planned deliveries of the aircraft. It has

struggled to win deals for its planes amid the MAX crisis. Its

order intake last year fell to a 16-year low. The company booked no

new orders last month.

Airbus said, overall, its deliveries this year will reach 880

aircraft, topping last year's 863. Still, that represents a slower

rate of growth as the company reins in deliveries of its wide-body

jets.

Demand for those bigger planes has fallen as airliners gravitate

toward the smaller, nimbler jets such as the A320neo. Airbus said

it would hand over 40 of its bigger A330s this year, 13 shy of

2019's total. Production of its A350 twin-aisle will be kept just

shy of its prior 10-a-month target.

Those moves follow two separate cuts made by Boeing to its 787

Dreamliner. That program has struggled with lower demand from

Chinese airlines amid the U.S.-China trade war.

Airbus is also still running about six months behind schedule on

narrow-body deliveries, Chief Executive Guillaume Faury said on a

call with analysts. The delays are expected to continue for a

further 12 to 18 months, he said.

The company has been battling to deliver its customizable,

larger and longer-range variant, the A321neo, which has made it

more difficult to manufacture the jets using a cookie-cutter

approach. Engine glitches are also holding back deliveries. Airbus

has had to ship replacement engines to existing operators ahead of

handing over new jets, Mr. Faury said.

Airbus said it swung to a loss in 2019 after taking a large

charge to settle U.S., U.K. and French allegations of bribery.

Airbus reported a full-year net loss of EUR1.36 billion ($1.48

billion), compared with a net profit of EUR3.05 billion in

2018.

The plane maker agreed last month to a EUR3.6 billion settlement

with prosecutors, who alleged Airbus used middlemen to make

payments to government and airline officials to win orders. Airbus,

by settling, wasn't required to admit or deny the charges and

avoided possible prosecution in the U.S. and the European Union. It

has said it reported the payments to investigators, cooperated with

them, and has changed its business practices to prevent further

inappropriate payments.

Airbus said it also took a EUR1.2 billion charge related to its

A400M military aircraft. Part of that was because of lower

expectations for future sales, including from a ban by Germany on

exports to Saudi Arabia.

The company said its full-year sales rose 11% to EUR70.48

billion.

Airbus also said Thursday that it had agreed to buy out its

partner in the A220. The Wall Street Journal previously reported

Airbus was nearing a deal that would allow Bombardier Inc. to exit

from the program, previously called the CSeries. Airbus said it

would pay $591 million to lift its stake to 75%, with the

government of Quebec increasing its ownership to 25%.

--Alison Sider and Doug Cameron contributed to this article.

Write to Benjamin Katz at ben.katz@wsj.com

(END) Dow Jones Newswires

February 13, 2020 15:49 ET (20:49 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

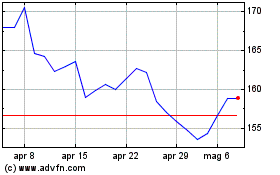

Grafico Azioni Airbus (EU:AIR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Airbus (EU:AIR)

Storico

Da Apr 2023 a Apr 2024