Vivendi Teases Universal Music IPO

13 Febbraio 2020 - 10:24PM

Dow Jones News

By Anne Steele

Vivendi SA teased an initial public offering of its Universal

Music Group subsidiary, seeking to cash in on a resurgent music

business.

The one-line disclosure was included in Vivendi's quarterly

earnings report Thursday, more than 18 months after the French

media conglomerate said it would seek buyers for up to 50% of

Universal.

Tencent Holdings Ltd. at the end of December struck a EUR3

billion ($3.25 billion) deal for a 10% stake in Universal, valuing

the world's largest music company at $33.4 billion. The deal gives

Tencent the option to buy another 10% by next January. Vivendi said

at the time it announced the Tencent deal that it was in talks with

other investors about selling an additional minority stake at a

valuation that "would at least be identical."

Vivendi said Thursday those negotiations are ongoing and that an

IPO is planned for early 2023 at the latest. An IPO would allow

current and potential investors to cash out as the value of music

assets has skyrocketed.

The music industry, decimated starting in 2001 by online piracy

and the collapse of CD sales, has been on a tear for four years,

with revenue from subscriptions to streaming services like those

offered by Spotify Technology SA and Apple Inc. turning around the

fortunes of record companies. Global recorded music revenue grew

10% to $19.1 billion in 2018, according to the International

Federation of the Phonographic Industry, with streaming revenue

accounting for almost half of overall revenue.

In the U.S., the world's largest music market, the growth has

been even more pronounced. Revenue from recorded music in the U.S.

rose 18% to $5.4 billion in the first half of 2019, according to

the Recording Industry Association of America, with streaming

representing 80% of the industry's total revenue.

Universal's top line rose 14% to EUR7.16 billion in 2019, thanks

to a 22% lift in streaming revenue to EUR3.33 billion, according to

Vivendi's statement on Thursday. Overall recorded music revenue

climbed 12% year-over-year, with even physical sales -- on the

decline industry wide for over a decade -- up 3%.

Vivendi's announcement Thursday is the latest in a series of

flirtations with possible transactions involving its music arm.

In 2017 Vivendi Chief Executive Arnaud de Puyfontaine told The

Wall Street Journal Vivendi could float a minority stake in

Universal -- at the time a departure from its longstanding

opposition to selling any part of the company. Those plans were

abandoned in 2018, with executives saying it was "too complex."

Vivendi had rebuffed earlier offers for Universal, when the

music company was worth significantly less than it is today. Five

years ago, Vivendi brushed off an activist investor's call to sell

some or all of Universal and use the funds to boost cash returns.

In 2013, it rejected an $8.5 billion offer for Universal from

Japan's SoftBank Corp.

Last week, Access Industries Inc.'s Warner Music Group Corp.,

the third-largest music company behind Universal and Sony Corp.'s

Sony Music Entertainment, filed documents to go public.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 13, 2020 16:09 ET (21:09 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

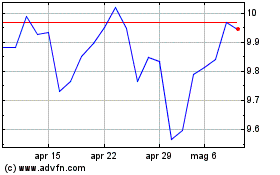

Grafico Azioni Vivendi (EU:VIV)

Storico

Da Mar 2024 a Apr 2024

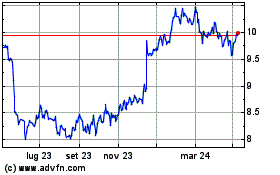

Grafico Azioni Vivendi (EU:VIV)

Storico

Da Apr 2023 a Apr 2024