Active Energy Group PLC Bondholders Agreement to Revise Existing Terms (9804C)

14 Febbraio 2020 - 8:00AM

UK Regulatory

TIDMAEG

RNS Number : 9804C

Active Energy Group PLC

14 February 2020

Active Energy Group Plc / EPIC: AEG / Sector: Alternative

Energy

14 February 2020

Active Energy Group Plc

('Active Energy', 'AEG' or the 'Company')

Convertible Loan Note - Bondholders Agreement to Revise Existing

Terms

Active Energy, the London quoted international biomass based

renewable energy business, is pleased to announce that it has

reached an agreement with all of its bondholders (the

"Bondholders") to revise the terms and conditions of the

outstanding convertible bond, which was first announced by the

Company on 15 March 2017 (the "Convertible Bond' or "Bonds").

The Convertible Bond was issued in 2017 with a maturity date of

14 March 2022 and an interest coupon of 8% per annum, payable

quarterly in arrears. All of the Bondholders have now agreed that

payment of these cash coupon payments will not be required for the

12-month period ending 30 September 2020 (the "Deferral Period").

It has been agreed that the Company has the option to decide that

the coupon payment maybe by either (1) in cash or (2) via the

issuance of additional Bonds in regard to each relevant quarter

during the Deferral Period.

The deferral of coupon payments by the Bondholders will allow

the Company to focus its capital on current activities at the

Company's Lumberton site in North Carolina ("Lumberton" or the

"Lumberton Site") which will include the construction of a 5 tonne

per hour CoalSwitch(TM) plant to facilitate the production of

CoalSwitch(TM) and second-generation biomass pellets coupled with

various lumber production initiatives. The Company's Directors

estimate the deferral of cash coupon payments by the Bondholders

will enable Active Energy to conserve approximately GBP1.2 million

of cash throughout the Deferral Period

In addition, certain Bondholders have elected to convert a total

of 67,687 Bonds into new ordinary shares of 1p each in the capital

of the Company ( the "Ordinary Shares") at a price of 1p per share,

pursuant to the terms of the Convertible Bond. Accordingly,

6,768,700 new Ordinary Shares will be issued to the Bondholder in

accordance with the terms of the Convertible Bond (the "Conversion

Shares").

Total Voting Rights

Application has been made for the Conversion Shares, which will

rank pari passu with the existing Ordinary Shares, to be admitted

to trading on AIM ("Admission"). It is expected that Admission will

become effective and dealings will commence at 8:00am on or around

19 February 2020.

Following Admission, the Company's enlarged issued share capital

will comprise 1,208,675,651 Ordinary Shares with voting rights.

This figure may therefore be used by shareholders in the Company as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or a change in

their interest in, the share capital of the Company under the FCA's

Disclosure and Transparency Rules.

AEG, CEO, Michael Rowan said, "The Board of AEG has worked hard

in recent weeks to secure these revised financial arrangements for

the Company and is grateful for the demonstrable support from the

Bondholders. At this stage of our development plans, we are fully

focused on optimising the use of capital to develop all the revenue

generating opportunities at Lumberton and the development of

CoalSwitch(TM) and the next generation of biomass pellets. We look

forward to providing all stakeholders with further updates

regarding our development programme for Lumberton, including the

anticipated air and construction permit approvals, in the coming

weeks."

Related Party Transaction

Gravendonck Private Foundation ("Gravendonck") is a substantial

shareholder in the Company and also a Bondholder, having subscribed

for circa GBP1.4 million of loan notes in March 2017 pursuant to

the Convertible Bond. As a Bondholder, Gravendonck is now agreeing

to defer approximately GBP109,000 of coupon payments throughout

2020 (the "Gravendonck Deferral").

The Gravendonck Deferral constitutes a related party transaction

in accordance with AIM Rule 13. The Company's Directors consider,

after consultation with the Company's Nominated Adviser, that the

terms of the Gravendonck Deferral are fair and reasonable, in so

far as its shareholders are concerned.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

ENDS

Enquiries:

Website LinkedIn

www.aegplc.com www.linkedin.com/company/activeenergy

--------------------------------------

Enquiries

Active Energy Michael Rowan

Group Plc Chief Executive Officer

Antonio Esposito

Chief Operations Officer

------------------------------ ------------------

SP Angel Corporate David Hignell / Caroline Rowe Office: +44

Finance LLP (0)20 3470 0470

Nominated Adviser

and Broker

------------------------------ ------------------

Camarco Gordon Poole / Tom Huddart aeg@camarco.co.uk

Financial PR Adviser / Emily Hall Office: +44

(0) 20 3757

4980

------------------------------ ------------------

About Active Energy Group:

Active Energy Group plc is a London listed (AIM: AEG) renewable

energy company that has developed a proprietary technology which

transforms low-cost biomass material into high-value green fuels.

Its patented product CoalSwitch(TM) is the world's only drop-in

biomass fuel that can be mixed at any ratio with coal or completely

replace coal in existing coal-fired power stations without

requiring plant modification. Active Energy Group's immediate

strategic focus is the production and commercialisation of

CoalSwitch(TM) and a low emission CoalSwitch(TM) blend that

utilises other waste materials.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGZGMZRFVGGZM

(END) Dow Jones Newswires

February 14, 2020 02:00 ET (07:00 GMT)

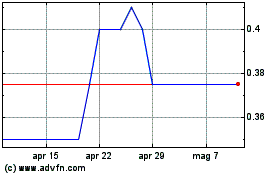

Grafico Azioni Active Energy (LSE:AEG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Active Energy (LSE:AEG)

Storico

Da Apr 2023 a Apr 2024