Vela Technologies PLC Update re. Secured Bonds 2020 and Company Update (0656D)

14 Febbraio 2020 - 11:51AM

UK Regulatory

TIDMVELA

RNS Number : 0656D

Vela Technologies PLC

14 February 2020

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 ("MAR"). With the publication of this announcement,

this information is now considered to be in the public domain.

Vela Technologies plc

("Vela" or the "Company")

Update re. Secured Bonds 2020

and Company Update

The Board of Vela (AIM: VELA) today provides an update on its

GBP550,000 10% Secured Bonds 2020 (the "Bonds") and an update on

the future strategy for the Company.

Key points

-- Supported by the Security Trustee and principal Bondholders,

Vela has extended the repayment date on the Bonds by 6 months to

August 2020

-- The Board continues to progress discussions with a view to

effecting a corporate transaction, which may result in a

substantial investment or an acquisition to utilise Vela as a

reverse takeover vehicle

Bond Instrument

In February 2017 the Company completed the issuance of the Bonds

to a number of sophisticated and high net worth Bondholders (the

"Bondholders") via UK Bond Network, now part of Pello Capital. The

Bonds are due for repayment on 17 February 2020. Further details on

the terms of the Bonds are set out in the Company's announcement of

17 February 2017.

Certain Bondholders are also existing shareholders in Vela

including Kevin Sinclair (a substantial shareholder who subscribed

for GBP100,000 of the Bonds), Scott Fletcher (a substantial

shareholder who subscribed for GBP95,000 of the Bonds) and Antony

Laiker (Executive Director of the Company who, as announced on 20

December 2019, inherited GBP50,000 of the Bonds in December 2019

following a grant of probate) (the "Principal Bondholders").

As at 30 September 2019, the Company had cash balances of

GBP120,000 and investments with a total book value of GBP2.14

million. As such, the Company is currently only able to repay the

outstanding principal on the Bonds in full by liquidating certain

of its investments. The Directors do not believe this is in the

best interests of the Company.

On 13 February 2020, Jade State Wealth Limited (the "Security

Trustee") confirmed, in its capacity as Security Trustee to the

Bonds and under the powers granted to it under the terms of the

Bonds, that it had no objection to granting an indulgence of six

months to Vela on the repayment date, being satisfied that it is in

the interests of all parties to grant this period. Other than the

repayment date of the Bonds being extended to 17 August 2020 (the

"Extended Repayment Date"), all other terms of the Bonds (including

Bondholder rights) remain unchanged.

The Bonds continue to be secured by way of a debenture on the

Company's assets and by a fixed charge over certain shares held by

Vela in Portr Limited, one of the Company's unquoted investee

companies. Bondholders will continue to also have the benefit of a

personal guarantee that has been given by Scott Fletcher, which

guarantees in full the payment obligations of Vela in respect of

the Bonds.

The Security Trustee is considered a related party under the AIM

Rules for Companies (the "AIM Rules") by virtue of being classified

as an associate of the Principal Bondholders. Accordingly, the

extension of the repayment date of the Bonds constitutes a related

party transaction pursuant to Rule 13 of the AIM Rules. The

independent director, being Brent Fitzpatrick, having consulted

with the Company's nominated adviser, Allenby Capital Limited,

considers the extension of the repayment date of the Bonds to be

fair and reasonable insofar as the Company's shareholders are

concerned.

Company Update

Further to the Company's previous announcements, most recently

in the Company's interim results announced on 20 December 2019,

Vela continues to focus on progressing discussions with a view to

effecting a corporate transaction, which may result in a

substantial investment or an acquisition to utilise Vela as a

reverse takeover vehicle. In conjunction with this the Company will

continue to actively explore means to repay the Bonds by the

Extended Repayment Date.

Further announcements will be made in due course.

For further information, please contact:

Vela Technologies plc Tel: +44 (0) 7802

262 443

Brent Fitzpatrick, Non-Executive Chairman

Antony Laiker, Director

Allenby Capital Limited Tel: +44 (0) 20 3328

(Nominated Adviser and Broker) 5656

Nick Athanas/Asha Chotai

About Vela Technologies

Vela Technologies (AIM: VELA) is an investing company focused on

early stage and pre-IPO long term disruptive technology

investments. There are currently 12 investments in the portfolio

which either have developed ways of utilising technology or

developing technology with a view to disrupting the businesses or

sector in which they operate. More recently, Vela Technologies has

also started to focus on existing listed companies where valuations

may offer additional opportunities.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBZLFFBLLZBBV

(END) Dow Jones Newswires

February 14, 2020 05:51 ET (10:51 GMT)

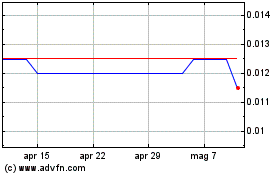

Grafico Azioni Vela Technologies (LSE:VELA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Vela Technologies (LSE:VELA)

Storico

Da Apr 2023 a Apr 2024