ARGO Group Limited Loan to Argo Real Estate Limited Partnership (0845D)

14 Febbraio 2020 - 12:47PM

UK Regulatory

TIDMARGO

RNS Number : 0845D

ARGO Group Limited

14 February 2020

ARGO Group Limited

14 February 2020

Argo Group Limited ("AGL" or "the Company")

Re: Loan to Argo Real Estate Limited Partnership ("ARE LP")

Argo Group Limited, the independent alternative investment

manager focused on global emerging markets, announces a EUR 10.2m

loan ("the Loan") to ARE LP, an Irish Limited Partnership. ARE LP

owns an 85% shareholding in Argo Real Estate Opportunities Fund

Limited ("AREOF") whose key asset is Riviera Shopping City ("RSC")

- an 85,000 sqm retail park in Odessa, Ukraine.

The Loan carries an interest rate of 9% with a final maturity of

July 2027. The proceeds of the Loan have been onward lent by ARE LP

to Novi Biznes Poglyady LLC ("NBP"), the asset holding company in

Ukraine which directly controls the RSC, at similar terms and in

accordance with the established norms of the National Bank of

Ukraine. This loan will enable NBP to refinance the EUR 48.7m

senior debt facility from Bank of Cyprus ("BoC") which currently

supports the RSC development.

The Loan will rank junior to the EUR 40m facility being advanced

by the European Bank for Reconstruction and Development ("EBRD").

In addition to the EUR 40m facility, the EBRD has also undertaken

to provide a further EUR 12m loan to be used to build a 25,000 sqm

extension of the RSC asset. This development, which is subject to

the granting of planning consent from the local authorities, has

the potential to significantly enhance the value of RSC. The

refinancing from the EBRD is at a lower interest rate when compared

to the BoC facility and matures in 10 years, as opposed to a final

maturity of November 2022 for the BoC facility.

The Loan will rank senior to all other borrowings of NBP and the

loan to value ratio of the financing covers the range between 52%

and 67%. As an additional benefit from the Loan, AGL will possibly

benefit from a better recovery on the outstanding EUR 8 m of unpaid

fees due from AREOF. Currently, these fees due to AGL are carried

at zero value. The Company believes the recovery of outstanding

fees is greatly enhanced by the EBRD refinancing and the offered

return is attractive compared to other alternatives.

Enquiries:

Argo Group Limited

Andreas Rialas

020 7016 7660

Panmure Gordon

Dominic Morley

020 7886 2500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

STRKKQBQDBKDQBD

(END) Dow Jones Newswires

February 14, 2020 06:47 ET (11:47 GMT)

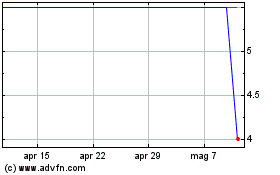

Grafico Azioni Argo (LSE:ARGO)

Storico

Da Mar 2024 a Apr 2024

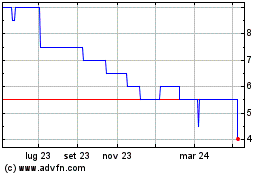

Grafico Azioni Argo (LSE:ARGO)

Storico

Da Apr 2023 a Apr 2024