TIDMATM

RNS Number : 2749D

AfriTin Mining Ltd

18 February 2020

18 February 2020

AfriTin Mining Limited

("AfriTin" or the "Company")

Uis Tin Mine Operational Update

AfriTin Mining Limited (AIM: ATM), a tin mining company with a

portfolio of assets in Namibia and South Africa, is pleased to

provide an operational update relating to its Phase 1 Pilot Plant

project ("Processing Plant") at its flagship asset, the Uis Tin

Mine ("Uis") in Namibia .

Highlights

-- Maiden sale of tin concentrate concluded;

-- Second shipment of tin concentrate has been dispatched from the Uis mine;

-- Processing plant throughput increased by an average of 63%

month-on-month from November 2019 to January 2020;

-- Debottlenecking of and enhancements to the Processing Plant

underway to increase throughput and achieve nameplate production of

60 tonnes of tin concentrate per month; and,

-- Appointment of Mr. Nico Smit as Vice President of Operations and Projects.

The first shipment of tin concentrate (6 tonnes grading more

than 60% Sn metal contained) has now been delivered to Thailand

Smelting and Refining Company ("Thaisarco") according to the terms

of the offtake agreement, as announced in August 2019. The

concentrate was produced by the Company's Phase 1 pilot mining and

processing facility at Uis during October and November 2019.

A second shipment of 20 tonnes of tin concentrate has been

dispatched from the mine. The concentrate is trucked to the port of

Walvis Bay in Namibia, then shipped to Thailand. The offtake

agreement provides for an 80% prepayment for each shipment upon

bill of lading in Walvis Bay.

Following initial production of tin concentrate, processing

plant throughput has increased by an average of 63% month-on-month

from 4,300 tonnes of ore in November 2019, to 5,800 tonnes in

December 2019, and to 11,400 tonnes in January 2020. The Company

expects to continue to ramp-up plant production over the next six

months to nameplate of 45,000 tonnes of ore to the plant and the

production of 60 tonnes of tin concentrate per month.

The ramp-up is supported by a number of operational

commissioning initiatives including:

-- Transition from the current six-day plant roster to a

continuous 24/7 operation, pending the required government

approvals;

-- Debottlenecking of and enhancements to the Processing Plant,

in particular the fines tailings dewatering circuits which require

additional capacity due to a higher than expected fines ratio in

the Run Of Mine feed;

-- Expanding the on-site laboratory to facilitate metal

accounting and increased plant recovery; and,

-- Implementation of computerised maintenance management system

to support targeted plant availability.

The debottlenecking of the Processing Plant focusses on the

dewatering of the grits tailings (less than 630 microns),

dewatering of the slimes tailings (less than 45 microns) and

expanding the feed capacity to the spiral plant. Modifications that

are currently in progress are expected to more than double the

throughput capacity of these circuits.

The Company is also pleased to announce the appointment of Mr.

Nico Smit as Vice President of Operations and Projects. He is a

qualified processing engineer and brings a wealth of operational

experience to the team which includes process plant commissioning

and optimisation, and various executive management roles in the

mining sector. He joins the Company from his current position as

Regional Director Advisory at Hatch.

Anthony Viljoen, CEO of AfriTin Mining Limited commented:

"The first shipment of tin concentrate and first revenues from

the Uis Tin Mine in three decades marks a significant milestone for

the Company and the Erongo region of Namibia.

"We will continue to deliver this operation as we ramp up

production to nameplate of 60 tonnes of tin concentrate per month.

Combined with a JORC-compliant mineral resource estimate of 95,539

tonnes of contained Sn, we are well placed to advance the project

to the goal of establishing an enlarged mining and processing

facility."

Glossary of abbreviations

JORC The Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves

Sn Elemental symbol for Tin

---------------------------------------------------

For further information, please visit www.afritinmining.com or

contact:

AfriTin Limited

Anthony Viljoen, CEO +27 (11) 268 6555

Nominated Adviser and Joint Broker

WH Ireland Limited

Katy Mitchell

Adrian Hadden

James Sinclair-Ford +44 (0) 207 220 1666

Corporate Advisor and Joint Broker

Hannam & Partners

Andrew Chubb

Jay Ashfield

Nilesh Patel +44 (0) 20 7907 8500

Joint Broker

NOVUM Securities Limited

Jon Belliss +44 (0)20 7399 9400

Financial PR (United Kingdom)

Tavistock +44 (0) 207 920 3150

Jos Simson

Barney Hayward

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining is the first pure tin company listed in London

and its vision is to create a portfolio of globally significant,

conflict-free, tin-producing assets. The Company's flagship asset

is the Uis Tin Mine in Namibia, formerly the world's largest

hard-rock tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current two-fold strategy: fast track Uis

Tin Mine in Namibia to commercial production in 2020 as Phase 1,

ramping up to 5,000 tonnes of concentrate in a Phase 2 expansion.

The Company strives to capitalise on the solid supply/demand

fundamentals of tin by developing a critical mass of tin resource

inventory, achieving production in the near term and further

scaling production by consolidating tin assets in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDEAFAXFDDEEAA

(END) Dow Jones Newswires

February 18, 2020 02:00 ET (07:00 GMT)

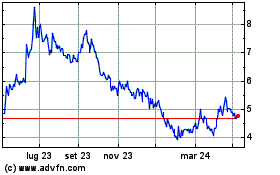

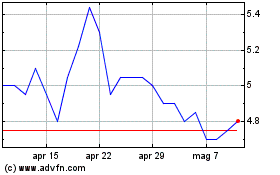

Grafico Azioni Andrada Mining (LSE:ATM)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Andrada Mining (LSE:ATM)

Storico

Da Apr 2023 a Apr 2024