AXA 2019 Net Profit, Revenue Rose

20 Febbraio 2020 - 7:36AM

Dow Jones News

By Cristina Roca

AXA SA said Thursday that its earnings rose strongly in 2019

while revenue ticked higher thanks to growth in all business areas,

and it increased its dividend.

Net profit rose to 3.86 billion euros ($4.17 billion) from

EUR2.14 billion the year before, the French insurer said. Analysts

had seen net profit at EUR4.35 billion, according to a consensus

estimate by FactSet. The big jump in net profit is partly due to a

large impairment booked the year before, AXA said.

Revenue for the year rose 1% to EUR103.53 billion thanks to a

revenue increase at all the insurer's business lines. At constant

exchange rates, revenue grew 5%, AXA said.

Annual premium equivalent, known as APE, was stable for 2019 on

a comparable basis. APE measures new business growth by combining

the value of payments on new regular premium policies, and 10% of

the value of payments made on one-time, single-premium

products.

The French insurer's solvency II ratio--a key measure of

financial strength for insurance companies--was 198%, up from 193%

at the end of 2018.

AXA proposed a dividend of EUR1.43 a share, up from EUR1.34 a

share the year previous.

The earnings of the insurer's AXA XL business were hit by

higher-than-normal levels of natural-catastrophe charges in 2019.

The company said it has taken steps to reduce AXA XL's earnings

volatility, and that it expects them to result in a EUR200 million

hit to the unit's earnings in 2020. Underlying earnings for AXA XL

should be around EUR1.2 billion in 2020, the company said.

Write to Cristina Roca at cristina.roca@dowjones.com;

@_cristinaroca

(END) Dow Jones Newswires

February 20, 2020 01:21 ET (06:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

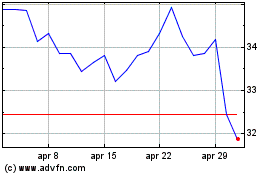

Grafico Azioni Axa (EU:CS)

Storico

Da Mar 2024 a Apr 2024

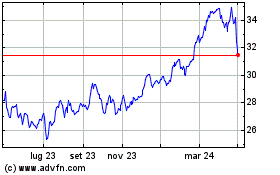

Grafico Azioni Axa (EU:CS)

Storico

Da Apr 2023 a Apr 2024