Anglo American's Cost Performance in Focus at Consensus-Beating Results -- Earnings Review

20 Febbraio 2020 - 11:49AM

Dow Jones News

By Adriano Marchese

Anglo American PLC reported its results for 2019 on Thursday.

Here's what you need to know:

NET PROFIT: The company made a profit of $3.55 billion in 2019,

and though it remained unchanged from the prior year, it beat the

consensus estimate of $3.42 billion, which was compiled from the

forecasts of 14 analysts on FactSet.

UNDERLYING EBITDA: Underlying earnings before interest, taxes,

depreciation and amortization--Anglo American's preferred metric,

which strips out certain one-off items--beat both consensus

forecast and last year's figures with a rise of 9.2% to $10.01

billion. Consensus had this figure pegged at $9.84 billion,

compiled from 19 analysts' forecast on FactSet.

REVENUE: Revenue for the year rose 8.2% to $29.87 billion.

Consensus for revenue was $29.29 billion, taken from FactSet based

on the forecasts of 17 analysts.

WHAT WE WATCHED:

-COST PERFORMANCE: Strong costs performance helped deliver

better Ebitda, says Citi. Anglo delivered strong cost performance

with units costs lower than its guidance for copper, nickel, PGMs

and Minas Rio, the bank added.

-TRADE WITH CHINA: Anglo American's chief executive says the

coronavirus epidemic will be a short-term issue for the diversified

mining company. "We are less reliant on China than our major

competitors," Mark Cutifani says.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

February 20, 2020 05:34 ET (10:34 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

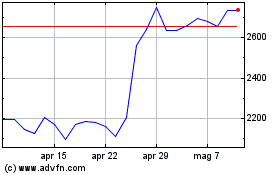

Grafico Azioni Anglo American (LSE:AAL)

Storico

Da Mar 2024 a Apr 2024

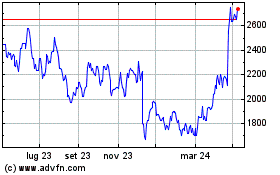

Grafico Azioni Anglo American (LSE:AAL)

Storico

Da Apr 2023 a Apr 2024