TIDMBOOM

RNS Number : 6387D

Audioboom Group PLC

20 February 2020

FORM 8 (OPD)

PUBLIC OPENING POSITION DISCLOSURE BY A PARTY TO AN OFFER

Rules 8.1 and 8.2 of the Takeover Code (the "Code")

1. KEY INFORMATION

(a) Full name of discloser: AUDIOBOOM GROUP PLC

(b) Owner or controller of interests and short positions disclosed, if different from 1(a):

The naming of nominee or vehicle companies is insufficient. For a trust, the trustee(s),

settlor and beneficiaries must be named.

--------------------

(c) Name of offeror/offeree in relation to whose relevant securities this form relates: AUDIOBOOM GROUP PLC

Use a separate form for each offeror/offeree

--------------------

(d) Is the discloser the offeror or the offeree? OFFEREE

--------------------

(e) Date position held: 20 February 2020

The latest practicable date prior to the disclosure

--------------------

(f) In addition to the company in 1(c) above, is the discloser making disclosures in respect N/A

of any other party to the offer?

If it is a cash offer or possible cash offer, state "N/A"

--------------------

2. POSITIONS OF THE PARTY TO THE OFFER MAKING THE DISCLOSURE

If there are positions or rights to subscribe to disclose in

more than one class of relevant securities of the offeror or

offeree named in 1(c), copy table 2(a) or (b) (as appropriate) for

each additional class of relevant security.

(a) Interests and short positions in the relevant securities of

the offeror or offeree to which the disclosure relates

Class of relevant security: Ordinary shares of no par value

Interests Short positions

--------------------- ------------------

Number % Number %

------------- ------ ------------- ---

(1) Relevant securities owned and/or controlled: 13,801* 0.1

------------- ------ ------------- ---

(2) Cash-settled derivatives:

------------- ------ ------------- ---

(3) Stock-settled derivatives (including options) and agreements to

purchase/sell:

------------- ------ ------------- ---

TOTAL: 13,801* 0.1

------------- ------ ------------- ---

* See box 3c in relation to ordinary shares held by SONR News

Limited, a 100% owned subsidiary of Audioboom Group plc, where

Audioboom Group plc is able to control the voting of these ordinary

shares.

All interests and all short positions should be disclosed.

Details of any open stock-settled derivative positions

(including traded options), or agreements to purchase or sell

relevant securities, should be given on a Supplemental Form 8 (Open

Positions).

Details of any securities borrowing and lending positions or

financial collateral arrangements should be disclosed on a

Supplemental Form 8 (SBL).

(b) Rights to subscribe for new securities

Class of relevant security in relation to which subscription right exists: N/A

Details, including nature of the rights concerned and relevant percentages: N/A

----

3. POSITIONS OF PERSONS ACTING IN CONCERT WITH THE PARTY TO THE OFFER MAKING THE DISCLOSURE

Details of any interests, short positions and rights to subscribe (including directors' and

other employee options) of any person acting in concert with the party to the offer making

the disclosure:

(a) Beneficial holdings of the Directors of Audioboom Group plc (including their close relatives)

in its ordinary shares of no par value each Name Number of ordinary % of voting share

shares held capital

Michael Tobin 185,476 1.32%

------------------- ------------------

Stuart Last 4,172 0.03%

------------------- ------------------

Brad Clarke - -

------------------- ------------------

Roger Maddock(1) 368,461 2.63%

------------------- ------------------

Steven Smith(2) 4,764 0.03%

------------------- ------------------

(1) Included in Roger Maddock's holding are 40,000 ordinary shares in Audioboom Group plc

held by the Preston Trust. The Preston Trust is a discretionary trust for the benefit of Roger

Maddock's children and grandchildren. Roger Maddock is the settlor, the trustees are Curatus

Trust Company (Mauritius) Limited, the protector is Attendus S.A and the trust structure is

administered by Attendus Trust Company AG.

(2) Steven Smith is a director and 10% shareholder of Candy Ventures sarl which holds 3,682,602

ordinary shares in Audioboom Group plc, which is equivalent to 26.29% of Audioboom Group plc's

current voting share capital. Nicholas Candy, 90% shareholder of Candy Ventures sarl holds

70,000 ordinary shares in Audioboom Group plc in his own name, which is equivalent to 0.50%

of Audioboom Group plc's current voting share capital. Candy Ventures sarl hold warrants exercisable

at a price of GBP3.30 until 13 January 2025 to subscribe for 21,875 ordinary shares in Audioboom

Group plc. Candy Ventures sarl hold warrants exercisable at a price of GBP3.30 until 14 June

2024 to subscribe for 12,500 ordinary shares in Audioboom Group plc. Nicholas Candy holds

warrants exercisable at a price of GBP2.50 until 31 March 2024 to subscribe for 120,000 ordinary

shares in Audioboom Group plc. Steven Smith, Candy Ventures sarl and Nicholas Candy are deemed

to be a Concert Party pursuant to the City Code on Takeover and Mergers.

(b) Beneficial holdings of the directors of Audioboom Group plc in rights to subscribe for

shares in Audioboom Group plc

Warrants to subscribe for ordinary shares in Audioboom Group plc: Name Date of grant Exercise Expiry Date Number

price (p) outstanding

1 September 1 September

Michael Tobin 2018 GBP1.30 2023 100,000

1 September

2018 GBP3.30 To be determined** 100,000

1 September

2018 GBP5.30 To be determined*** 100,000

14 June 2019 GBP3.30 14 June 2024 12,500

13 January 2020 GBP3.30 13 January 2025 21,875

------------------ ----------- ------------------------------------- ---------------

** These 100,000 warrants will vest if the Company's share price exceeds GBP3.30 for 60 days

from 1 September 2018 within any rolling six-month period. These warrants are exercisable

during a period from six months from vesting to five years from vesting. They also vest and

are exercisable on a change of control.

*** These 100,000 warrants will vest if the Company's share price exceeds GBP5.30 for 60 days

from 1 September 2018 within any rolling six-month period. These warrants are exercisable

during a period from six months from vesting to five years from vesting. They also vest and

are exercisable on a change of control.

Options over ordinary shares in Audioboom Group plc: Name Plan Date of grant Option Expiry Date Number

price outstanding

(p)

Employee

Stuart Share Option 24 September 24 September

Last Plan**** 2015 GBP4.125 2025 10,660

9 March 2016 GBP3.125 9 March 2026 7,000

8 May 2017 GBP2.185 8 May 2027 52,340

20 March 2019 GBP1.30 20 March 2029 90,000

20 December 20 December

2019 GBP2.075 2029 90,000

---------------- ---------- -------------------------------------------- -----------

Employee

Share Option 1 September 1 September

Brad Clarke Plan**** 2018 GBP2.40 2028 65,000

20 March 2019 GBP1.30 20 March 2029 120,000

---------------- ---------- -------------------------------------------- -----------

**** The vesting of certain of these options is subject to performance conditions relating

to the Company's performance in terms of revenue and EBITDA metrics against budget. These

options vest and are exercisable on a change of control.

(c) Interests of persons acting in concert with Audioboom Group plc (in addition to those

set out in (a) above) in the ordinary shares of no par value each in Audioboom Group plcName Number of ordinary % of voting share

shares held capital

SONR News Limited(3) 13,801 0.10%

------------------ -----------------

(3) SONR News Limited, a 100% owned subsidiary of Audioboom Group plc, holds 13,801 ordinary

shares in Audioboom Group plc on behalf of certain persons whose shares in SONR News Limited

were compulsorily acquired via statutory process by Audioboom Group plc (as part of the acquisition

by Audioboom Group plc of 100% of the ordinary shares in SONR News Limited in 2017) and who

have not as of today's date completed the necessary formalities for those shares to be transferred

into their own names. Audioboom Group plc is able to control the voting of these 13,801 ordinary

shares.

(d) Interest of total Concert Party in ordinary shares of no par value each in Audioboom

Group plc Number of ordinary % of voting share

Holder shares held capital

Total Concert Party 576,674 4.12%

------------------- ------------------

(d) Interests of connected advisers

Allenby Capital Limited - Nil

Details of any open stock-settled derivative positions

(including traded options), or agreements to purchase or sell

relevant securities, should be given on a Supplemental Form 8 (Open

Positions).

Details of any securities borrowing and lending positions or

financial collateral arrangements should be disclosed on a

Supplemental Form 8 (SBL).

4. OTHER INFORMATION

(a) Indemnity and other dealing arrangements

Details of any indemnity or option arrangement, or any agreement or understanding, formal

or informal, relating to relevant securities which may be an inducement to deal or refrain

from dealing entered into by the party to the offer making the disclosure or any person acting

in concert with it:

Irrevocable commitments and letters of intent should not be included. If there are no such

agreements, arrangements or understandings, state "none"

None

(b) Agreements, arrangements or understandings relating to options or derivatives

Details of any agreement, arrangement or understanding, formal or informal, between the party

to the offer making the disclosure, or any person acting in concert with it, and any other

person relating to:

(i) the voting rights of any relevant securities under any option; or

(ii) the voting rights or future acquisition or disposal of any relevant securities to which

any derivative is referenced:

If there are no such agreements, arrangements or understandings, state "none"

None

(c) Attachments

Are any Supplemental Forms attached?

Supplemental Form 8 (Open Positions) NO

Supplemental Form 8 (SBL) NO

---

Date of disclosure: 20 February 2020

Contact name: Brad Clarke

--------------------

Telephone number: +44 (0)20 7403 6688

--------------------

Public disclosures under Rule 8 of the Code must be made to a

Regulatory Information Service.

The Panel's Market Surveillance Unit is available for

consultation in relation to the Code's disclosure requirements on

+44 (0)20 7638 0129.

The Code can be viewed on the Panel's website at

www.thetakeoverpanel.org.uk .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FEESEWFESESSELE

(END) Dow Jones Newswires

February 20, 2020 08:00 ET (13:00 GMT)

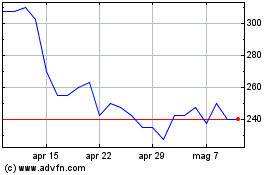

Grafico Azioni Audioboom (LSE:BOOM)

Storico

Da Mar 2024 a Apr 2024

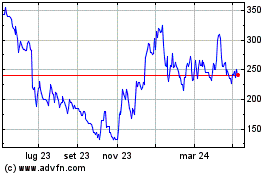

Grafico Azioni Audioboom (LSE:BOOM)

Storico

Da Apr 2023 a Apr 2024