TIDMACP

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

21 February 2020

Armadale Capital Plc ('Armadale' or 'the Company')

Project Update

Armadale Capital plc (LON: ACP), the AIM quoted investment group

focused on natural resource projects in Africa, is pleased to

provide an update on the Mahenge Liandu graphite project ('Mahenge'

or 'the Project') in south-east Tanzania as it progresses towards

commercialisation in line with the group's transformation from

explorer to emerging producer.

Highlights

-- Definitive feasibility study ('DFS') is on track to be completed in this

quarter (Q1 2020) following inclusion of results from the following work

studies:

-- A detailed mine plan that will target high-grade, near surface

graphite mineralisation for the first 3-5 years of production.

This aims to maximise the returns in the early years of operations

and is nearing completion

-- The study will include a ramp up from 400ktpa to 1mtpa throughput

after 4 years which will maximise the value of the project as

demand for graphite continuing to increase

-- A final round of metallurgical test-work is being completed at

Bureau Veritas, in Perth, on high-grade composites of the diamond

core with average grades of 14.9% and 15.6% Total Graphitic Carbon

('TGC'). This is to confirm the flowsheet is suited to high grade

ore

-- Site locations for the ROM pad, crushing circuit, process plant

and tailing storage facilities have been finalised and a new

access road has been marked out from site to the town of Mahenge

to facilitate mine construction as well as mine production

-- Logistics for the operation have been costed with a local

well-established Tanzanian contractor to truck the product from

site to Dar es Salaam, where it will then be containerised for

shipping

-- The results of the work programme will be the final part of the

definitive feasibility study which is on track to be completed in

March

-- ACP director, Steve Mahede, recently met with senior Tanzanian officials

and was confident that developing the mining projects through to

production was a major priority to generate export earnings as well as

positive economic multiplier benefits

-- Commencing post-DFS era work programmes, with teams working on road

access, production bores, ongoing commercialisation and project funding

discussions with funding partners

Armadale Chairman, Nick Johansen, said: "With one of the largest

high-grade resources in Tanzania this dovetails perfectly with our

ongoing commitment to push the envelope to transform into an

emerging producer by H1 2021.

"In support of this, refinements to our resource modelling and

mine plan from the scoping study have increased our confidence that

the project is going to be a low cost, long life operation.

"We look forward to sharing these key value metrics within the

next month as we finalise the DFS, results for which we know are

eagerly anticipated. I would like to thank shareholders for their

patience in this regard and give my assurance that finalising this

study is our primary objective. We will then look to accelerate

commercialisation and funding initiatives with our partners to

ensure we remain on track with our fast-paced growth plans."

Mahenge Liandu Graphite Project, Tanzania

Armadale's wholly-owned Mahenge Liandu Graphite Project is

located in a highly prospective region, with a high-grade JORC

compliant indicated and inferred mineral resource estimate

announced October 2019 -- 59.5Mt at 9.8% TGC. This includes 11.5Mt

@ 10.5% Measured 32.1Mt Indicted at 9.6% and 15.9Mt at 9.8% TGC,

making it one of the largest high-grade resources in Tanzania.

The work to date has demonstrated the Project's potential as a

commercially viable deposit, with significant tonnage, high-grade

coarse flake and near surface mineralisation (implying a low strip

ratio) contained within one contiguous ore body.

Currently, Armadale Capital is completing a Definitive

Feasibility Study based on the results of a Scoping Study that was

completed in March 2018. The study was based on a throughput of

400,000tpa over a 32-year mine life and showed the project has

robust economics and warrants further development.

The Scoping Study verified the Mahenge Liandu Project could

produce a coarse flake, high-purity graphite product underpinning a

compelling business case to progress commercialisation plans.

The Scoping Study, based on a 400,000tpa throughput, highlighted

the following key positive metrics:

-- Producing an average of 49,000tpa of high-quality graphite products for a

32-year mine life;

-- The near surface nature of the deposit produced a low 1:1 strip ratio for

the life of the mine;

-- The Project has a low operating cost of US$408/t, based on an average

12.5% TGC life of mine grade;

-- The Project has a pre-tax IRR of 122% and NPV of US$349m, with a low

development capex of US$35m; and

-- The maximum draw-down during the construction of the project is US$34.9m

and the after-tax payback period is 1.2 years.

There remains significant scope to further improve returns, with

staged expansions as the current mine plan is based on circa 25% of

the total resource.

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

**ENDS**

Enquiries:

Armadale Capital Plc

Nick Johansen, Non-Executive Director

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and broker: FinnCap Ltd

Christopher Raggett / Simon Hicks +44 (0) 20 7220 0500

Joint Broker: SI Capital Ltd

Nick Emerson +44 (0) 1483 413500

Press Relations: St Brides Partners Ltd

Charlotte Page / Beth Melluish +44 (0) 20 7236 1177

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant Indicated and inferred mineral resource estimate of

59.48Mt @ 9.8% TGC, making it one of the largest high-grade

resources in Tanzania, and work to date has demonstrated Mahenge

Liandu's potential as a commercially viable deposit with

significant tonnage, high-grade coarse flake and near surface

mineralisation (implying a low strip ratio) contained within one

contiguous ore body.

Other assets Armadale has an interest in, include the Mpokoto

Gold project in the Democratic Republic of Congo and a portfolio of

quoted investments.

More information can be found on the website

www.armadalecapitalplc.com.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20200220005513/en/

CONTACT:

Armadale Capital Plc

SOURCE: Armadale Capital Plc

Copyright Business Wire 2020

(END) Dow Jones Newswires

February 21, 2020 02:00 ET (07:00 GMT)

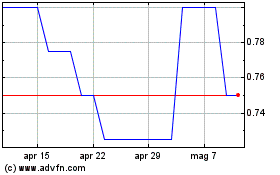

Grafico Azioni Armadale Capital (LSE:ACP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Armadale Capital (LSE:ACP)

Storico

Da Apr 2023 a Apr 2024