Ariana Resources PLC Director/PDMR Shareholding (8173D)

21 Febbraio 2020 - 7:27PM

UK Regulatory

TIDMAAU

RNS Number : 8173D

Ariana Resources PLC

21 February 2020

21 February 2020

AIM: AAU

Director/PDMR Shareholdings

Ariana Resources plc ("Ariana" or "the Company"), the

exploration and development company operating in Turkey, announces

that it was informed today of the following transactions:

- Michael de Villiers, Chairman, purchased 333,333 ordinary

shares in the Company ("Ordinary Shares") in his SIPP at 3.533

pence per share;

- and at the same time Mr de Villiers, via his wholly owned

company Lucky Villa Holdings Limited, sold 33,333 Ordinary Shares

at 3.435 pence per share; and

- he also sold 300,000 Ordinary Shares at 3.345 pence per share.

Accordingly, the holding of Mr de Villiers remains at 54,845,000

Ordinary Shares in the Company, representing a holding of

5.17%.

The following information relating to the transaction has been

filed with the FCA in accordance with Article 19(1) of the Market

Abuse Regulation,

Michael de Villiers

1 Details of t he p erson disc harging managerial responsib

ilities / p erson closely associated

a) Name Michael de Villiers

-------------------------- --------------------------------------

2 Reason for notification

------------------------------------------------------------------

a) Position / status Chairman

-------------------------- --------------------------------------

b) I nitial notification Initial

/Amendment

-------------------------- --------------------------------------

3 Details of t he issu er, emission allow a n ce m a r

k et participan t, au ct ion plat for m, au ction eer

or auc tion monitor

------------------------------------------------------------------

a) Name Ariana Resources plc

-------------------------- --------------------------------------

b) LEI 213800LVVY7GZY21LH22

-------------------------- --------------------------------------

4 Details of t he t ransact ion (s): section to be re

p eated for ( i) e a ch type of instr u m e n t; (ii)

each type of transac tion; (iii) each date; and ( iv)

each place w h ere transactions have b een condu cted

------------------------------------------------------------------

a) Description of the Ordinary shares of 0.1 pence each

financial instrument, in Ariana Resources plc

t ype of instrument

I d e ntification ISIN GB00B085SD50

code

-------------------------- --------------------------------------

Nature of the transaction Purchase and sales of ordinary shares

-------------------------- --------------------------------------

c) Price(s) and volumes(s)

Price(s) - purchase Volumes(s)

3.533 pence 333,333

-----------

Price(s) - sle Volumes(s)

-----------

3.435 pence 33,333

-----------

Price(s) Volumes(s)

-----------

3.345 pence 300,000

-----------

-------------------------- --------------------------------------

d) Aggregated information n/a

-------------------------- --------------------------------------

e) Date of the transaction 21 February 2020

-------------------------- --------------------------------------

f) Place of the transaction LSE, AIM (XLON) and XOFF

-------------------------- --------------------------------------

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407

3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited Tel: +44 (0) 20 7628

3396

Roland Cornish / Felicity Geidt

Panmure Gordon (UK) Limited Tel: +44 (0) 20 7886

2500

Atholl Tweedie / James Stearns

Yellow Jersey PR Limited Tel: +44 (0) 20 3004

9512

Dom Barretto / Joe Burgess / Henry arianaresources@yellowjerseypr.com

Wilkinson

Editors' Note

About Ariana Resources:

Ariana is an AIM-listed mineral exploration and development

company operating in Europe. It has interests in gold production in

Turkey and copper-gold assets in Cyprus. The Company is developing

a portfolio of prospective licences in Turkey, which contain a

total of 1.6 million ounces of gold and other metals (as at

end-2017).

The Red Rabbit Project is comprised of the Company's flagship

assets, the Kiziltepe and Tavsan gold projects, and is part of a

50:50 Joint Venture with Proccea Construction Co. Both assets are

located in western Turkey, which hosts some of the largest

operating gold mines in the country and remains highly prospective

for new porphyry and epithermal deposits. The Kiziltepe Sector of

the Red Rabbit Project is fully permitted and is currently in

production. The total resource inventory at the Project and its

wider area is c. 605,000 ounces of gold equivalent (as at

end-2017). At Kiziltepe a Net Smelter Return ("NSR") royalty of up

to 2.5% on production is payable to Franco-Nevada Corporation. At

Tavsan an NSR royalty of up to 2% on future production is payable

to Sandstorm Gold.

The 100% owned Salinbas Gold Project is located in north-eastern

Turkey and has a total resource inventory of c. 1 million ounces of

gold equivalent. The project comprises three notable licence areas:

Salinbas, Ardala and Hizarliyayla, all of which are located within

a multi-million ounce Artvin Goldfield. The "Hot Gold Corridor"

contains several significant gold-copper projects including the

4Moz Hot Maden project, which lies 16km to the south of Salinbas

and 7km south of Hizarliyayla. A NSR royalty of up to 2% on future

production is payable to Eldorado Gold Corporation on the Salinbas

Gold Project.

Ariana is also earning-in to 50% of UK-registered Venus Minerals

Ltd ("Venus"). Venus is focused on the exploration and development

of copper-gold assets in Cyprus.

Panmure Gordon (UK) Limited are broker to the Company and

Beaumont Cornish Limited is the Company's Nominated Adviser.

For further information on Ariana you are invited to visit the

Company's website at www.arianaresources.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DSHBIGDDBDDDGGB

(END) Dow Jones Newswires

February 21, 2020 13:27 ET (18:27 GMT)

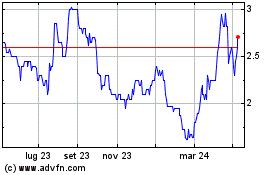

Grafico Azioni Ariana Resources (LSE:AAU)

Storico

Da Mar 2024 a Apr 2024

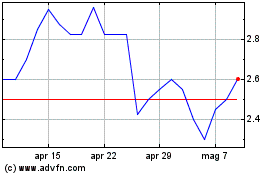

Grafico Azioni Ariana Resources (LSE:AAU)

Storico

Da Apr 2023 a Apr 2024