Fox Looks to Buy Streaming Service Tubi

21 Febbraio 2020 - 10:12PM

Dow Jones News

By Lillian Rizzo and Joe Flint

Tubi or not Tubi.

Fox Corp. has expressed interest in acquiring Tubi, an

advertiser-supported streaming service that carries reruns of

television shows and movies, according to people familiar with the

matter.

The companies are discussing a deal that could be valued at

north of $500 million, the people said.

In pursuing Tubi, Fox is following the same path as other media

giants who believe that free, ad-supported video platforms have a

viable future even as a flurry of new subscription-based streaming

services enter the market, including Walt Disney Co.'s Disney+ and

AT&T Inc.'s HBO Max.

Last year, Viacom Inc, which is now part of ViacomCBS Inc.,

bought Pluto TV, a similar platform to Tubi, for $340 million.

In December, The Wall Street Journal reported that Comcast Corp.

was in exclusive negotiations to acquire Xumo LLC, another

ad-supported streaming platform.

Sony Corp. last year formed a joint venture with media company

Chicken Soup for the Soul Entertainment Inc. to launch a beefed up

version of its ad-supported platform, Crackle. Chicken Soup for the

Soul took a majority stake in the streaming platform, now called

Crackle Plus, while Sony remained an investor.

Tubi would give Fox -- which owns the Fox broadcast network, Fox

News and Fox sports networks, among other assets -- a platform with

significant reach and a large customer base. Tubi said that in

December it notched 25 million monthly active users. Fox could use

the service as another home for content from its broadcast network

as well as a promotional platform.

Based in San Francisco, Tubi streams content from Warner Bros.

Entertainment Inc., Paramount Pictures and Lions Gate Entertainment

Corp. Its most popular titles include "Scooby-Doo," "New Jack City"

and "Daddy Daycare." The service is available on streaming devices

such as the Amazon Fire Stick, Apple TV and Roku, as well as Sony

and Samsung televisions. Tubi is available in the U.S., Canada and

Australia.

Fox Corp. and Wall Street Journal parent News Corp. share common

ownership.

Almost all major entertainment companies have launched or are

preparing subscription streaming service to compete with Netflix

Inc. But several companies also see the need to offer free,

ad-supported tiers to reach other consumers.

ViacomCBS outlined its streaming plans this week, saying its

premium option will be Showtime, a second option will be an

expanded version of its CBS All Access subscription service, and

Pluto TV will be the ad-supported option.

Comcast's Peacock service, which launches widely this summer,

will include an ad-supported version for $4.99 a month and an

ad-free tier for $9.99 a month, as well as a more limited, free

version with ads. If Comcast acquires Xumo, it could provide

technical and business support for Peacock, as well as Comcast's

pay-TV services, the Journal reported. HBO Max, which will launch

later this year, will offer a lower cost, ad-supported version at a

later time.

Besides a potential new advertising revenue stream, Tubi, Pluto

and Xumo can also serve as distribution platforms and a way for

media companies to extend their reach.

Tubi, like some of its peers, doesn't have an agreement with an

outside measurement firm like Nielsen Holdings PLC or Comscore Inc.

to provide independent viewing metrics.

Tubi said on its website that it counts venture-capital firms

Foundation Capital and Cota Capital as its investors, as well as

broadcast station company Tegna Inc.'s venture arm.

Write to Lillian Rizzo at Lillian.Rizzo@wsj.com and Joe Flint at

joe.flint@wsj.com

(END) Dow Jones Newswires

February 21, 2020 15:57 ET (20:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

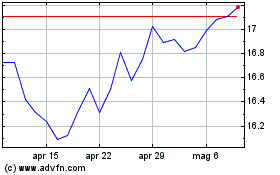

Grafico Azioni AT&T (NYSE:T)

Storico

Da Mar 2024 a Apr 2024

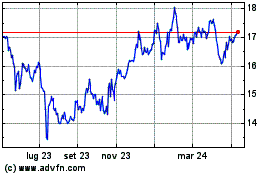

Grafico Azioni AT&T (NYSE:T)

Storico

Da Apr 2023 a Apr 2024