By Anna Wilde Mathews

Some of the largest health insurers are capitalizing on recent

massive deals by steering patients toward clinics they now own,

controlling both delivery and payment for health care.

The trend creates worries for rival doctor groups and hospital

companies that have invested deeply in buying up physician

practices, which now increasingly compete against offerings from

insurers.

UnitedHealth Group Inc.'s insurance unit is offering a plan in

the Los Angeles area built around doctors who work for its Optum

arm, which has acquired a sprawling network of doctor practices,

surgery centers and urgent-care clinics. The company says it is

working to offer similar designs in other markets, though they

might also involve non-Optum doctors.

"Health care has got to be more seamless and more integrated,"

said Rob Falkenberg, chief executive of UnitedHealthcare's

California operation.

At Aetna Inc., which was acquired by CVS Health Corp., many

insurance plans this year have dropped co-payments for members if

they go to the drugstore chain's MinuteClinics. Going to other

retail clinics would generally require a co-pay. CVS says the free

MinuteClinic visits are to benefit Aetna members, and not aimed at

bolstering the drugstore chain's customer traffic.

Blue Cross & Blue Shield of Texas launched a plan this year

that includes free primary-care visits at clinics it recently

opened with a partner company in the Houston and Dallas areas. It

priced the coverage 12% to 18% below a different product it offers

statewide. The new plan includes some independent doctors and

clinics, but members who use them would have a co-pay for

primary-care visits.

Blue Cross of Texas expects the clinics will lower costs by

reducing use of emergency rooms and improving preventive care, said

Shara McClure, a senior vice president at the Texas insurer, a unit

of Health Care Service Corp.

Generally, plans built around a health insurer's own clinics

include smaller networks with more limited choices of doctors and

hospitals. That can lower premiums -- but the insurers also can

benefit because they keep revenue inside their own holdings rather

than paying outside companies for the care of their members.

"It's very worrisome for hospitals," said Chas Roades, a

health-care consultant. "Suddenly, the plan you're relying on for

payment is also competing with you at the front end of the delivery

system."

Hospitals' biggest concern may be the power that primary-care

doctors have over where their patients go for care such as imaging

scans and specialist procedures. Hospitals rely on doctors to

direct patients to them for such services -- one reason they have

bought up physician practices. Insurer-owned clinics might refer

patients away from certain hospital systems, cutting off important

revenue.

Referrals are a focus for clinics owned by a joint venture

involving Florida Blue's corporate parent, said Chuck Divita,

executive vice president at the Florida insurer. Florida Blue

offers plans largely built around primary care at clinics where

members don't have a co-pay for those visits. Mr. Divita said the

clinics would aim to refer patients to specialists and other

health-care providers that deliver the best outcomes.

Some companies have offered both insurance and health care,

including Kaiser Permanente, the big California-based health plan

that has its own network of hospitals and doctors. Insurer Highmark

Health took over a Pittsburgh-area hospital system in 2013. And

some hospital operators, such as Virginia's Sentara Healthcare,

have sold their own health plans.

But deals like the CVS-Aetna merger and Optum's provider

acquisitions have created integrated health-care giants on a new

scale. Humana Inc. recently joined with a private-equity firm to

expand its primary-care clinics serving Medicare members, and it

has taken on home-health and hospice assets.

Buying up health-care providers like clinics can create

complications for insurers. Typically, they won't own enough to

offer every health-care service, so they have to keep working with

outside doctors and hospitals. And the health-care providers they

own generally have to continue drawing business from competing

insurers.

"Health plans want to exert pressure on provider systems, but

they don't have a product without providers in it, so they're

moving carefully," said Sam Glick, a partner with consulting firm

Oliver Wyman, a unit of Marsh & McLennan Cos.

UnitedHealthcare's new Harmony plan in the Los Angeles area is

built around Optum doctor groups, which supply all the primary-care

physicians. The insurer says premiums for Harmony cost roughly 20%

less than broader networks, and it is selling well.

But the company doesn't always have that many doctors in a

market. In San Diego, Harmony is using non-Optum doctor groups. As

Harmony potentially rolls out in other locations, including Texas

and Seattle, it may have a mix of Optum and non-Optum doctors, the

company said. Mr. Falkenberg said the Optum health-care providers

don't get special treatment from the insurer.

Many employers are skeptical of health plans with very limited

choices. A survey last year by the Kaiser Family Foundation found

that 39% of employers wouldn't reduce their network sizes for cost

savings. Another quarter said they'd need to see savings of at

least 30%, a high bar.

Individuals have shown more interest, through either the

Affordable Care Act exchanges or Medicare Advantage, said Gary

Claxton, a senior vice president at the Kaiser Family Foundation.

"They're making an individual choice of plan, and they're not

shopping for 5,000 different people in different places," he

said.

Aetna is adding free MinuteClinic visits without trimming its

networks, and it's unclear if the move will save money. A 2016

study in Health Affairs using Aetna data to look at 11 low-risk

health conditions found retail-clinic use was associated with

higher spending.

CVS Health pointed to an earlier study it funded that looked at

a broader array of health costs and tied retail-clinic use to lower

spending.

Troy Brennan, an executive vice president at CVS Health, said

the free MinuteClinic visits would benefit Aetna members and trim

costs. "Aetna is interested in making sure people get the best care

they can, in the most effective way possible," he said.

Write to Anna Wilde Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

February 23, 2020 11:14 ET (16:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

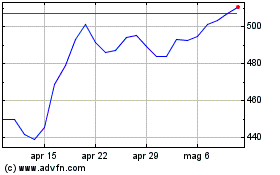

Grafico Azioni UnitedHealth (NYSE:UNH)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni UnitedHealth (NYSE:UNH)

Storico

Da Apr 2023 a Apr 2024