TIDMADME

RNS Number : 8251D

ADM Energy PLC

24 February 2020

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED TO

CONSTITUTE INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF THE

MARKET ABUSE REGULATION (EU) NO. 596/2014. UPON THE PUBLICATION OF

THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE

IN THE PUBLIC DOMAIN.

24 February 2020

ADM Energy PLC

("ADM" or the "Company")

ADM to Acquire a Further Interest in OML 113 from EER

ADM Energy PLC (AIM:ADME), an oil and gas investing company

quoted on AIM, is pleased to advise that it has entered into a sale

and purchase agreement ("Agreement") with EER (Colobus) Nigeria

Limited ("EER") to acquire, subject to satisfaction of certain

conditions, a participating interest of 2.25% from EER in oil

mining lease no. 113, which includes the Aje field ("Block"), in

which it already has an interest of 2.7%. Consideration for the

acquisition is $3,000,000, to be satisfied by the issue of

$2,000,000 of new ordinary shares at 7 pence per share

("Consideration Shares") and $1,000,000 in cash at the time of

completion.

Highlights of the Agreement

-- ADM will acquire 25% of the interests, rights and obligations

held by EER in the Block subject to conditions

-- On completion, ADM's participating interest will increase to approximately 4.9%

-- Corresponding revenue and cost bearing interests increasing to 9.2% and 12.3% respectively

-- Upon completion, ADM's net 2P reserves will increase from 8.9

MMboe (as announced on 2 May 2019) to 16.4 MMboe

-- Post completion, net daily production is expected to increase

to approximately 273 bopd from 148 bopd

Background

OML 113 covers an area of 858km(2) in the western Nigeria

offshore Dahomey basin, some 24km south of the coast and 64km from

Lagos, in water depths ranging from 100 to 1,000 metres. The West

African Gas Pipeline (WAGP) intersects the northwest part of the

licence. There are currently five partners in the licence: Yinka

Folawiyo Petroleum Company Limited, New Age Exploration Nigeria

Limited, Pan Petroleum Aje Limited, EER and ADM.

Interest in OML 113

Since 2016, ADM has held a participating interest in the Block

of 2.7% with corresponding revenue interest and cost bearing

interest of 5.0% and 6.7% respectively. EER holds an undivided

participating interest in the Block of 9.0% with a revenue interest

of 16.8% and a cost bearing interest of 22.5%. On completion, ADM's

interest will consolidate to a participating interest of 4.9% with

corresponding revenue and cost bearing interests increasing to 9.2%

and 12.3% respectively.

On 2 May 2019, the Company reported the results of an updated

Competent Person's Report ("CPR") produced by AGR TRACS

International Limited which included production data up to 31

December 2018. The table below updates this information to show the

corresponding estimates for the 2.25% interest being acquired

(subject to completion) for which the net attributable 2P reserves

are approximately 7.5 MMboe. On completion, ADM's net attributable

2P reserves are estimated to increase to 16.4 MMboe. Based on the

current average daily production for 2019 of 2,967 bopd, as

announced on 23 January 2020, ADM's net daily production will

increase from 148 bopd to 273 bopd on completion.

The increase in ADM's net 2P reserves following completion is

based on an extrapolation of reserves data from the latest CPR,

announced on 2 May 2019, and is outlined in the table below. The

information in this table has not been updated since the last

reported CPR and, therefore, does not take into consideration

production from 1 January 2019 onwards.

Oil & Gross Net Attributable Net Attributable

Liquids: to ADM from EER Interest

MMbbls Acquisition

Gas: Bscf

1P 2P 3P 1P 2P Proved 3P Proved, 1P 2P Proved 3P Proved,

Proved Proved Proved, Proved & Probable Proved & Probable

& Probable Probable & Possible Probable & Possible

Probable &

Possible

OML 113 Aje

OIL

Developed

Producing

(DP) 2.05 2.25 2.43 0.1 0.11 0.12 0.08 0.09 0.1

Justified

for

Development

(JD) 1.11 2.48 4.17 0.07 0.16 0.25 0.06 0.13 0.21

OML 113 Aje

CONDENSATE

Justified

for

Development

(JD) 10.32 17.41 27.87 0.65 1.12 1.66 0.55 0.94 1.4

OML 113 Aje

LPG

Justified

for

Development

(JD) 20.11 33.86 54.39 1.29 2.2 3.14 1.09 1.85 2.65

OML 113 Aje

DRY GAS

(Bscf)

Justified

for

Development

(JD) 292.7 492.8 791.9 18.8 32.1 45.7 15.84 27.05 38.51

TOTAL, MMboe 82.4 138.2 220.8 5.2 8.9 12.8 4.38 7.5 10.79

Details of the Agreement

Completion of the transaction is conditional upon the consent of

the Nigerian Minister of Petroleum Resources for the transfer of

the interest from EER to ADM. Subject to completion, ADM will

acquire 25% of the interests, rights and obligations held by EER in

the Block such that, on completion, ADM's participating interest

will increase to 4.9% with corresponding revenue and cost bearing

interests increasing to 9.2% and 12.3% respectively. Further, ADM

shall be responsible for a corresponding interest in EER's alleged

outstanding disputed unpaid cash calls with the operator of the

Block which, for ADM as a purchaser of 1/4 of EER's interest in the

Block, represents approximately $1,500,000 plus applicable

interest. Subject to verification through audit, should it be

determined that all or a portion of the outstanding cash calls are

due, it is the intention that any sums deemed outstanding by the

partners will continue to be settled from production revenue at the

project level.

ADM is required to pay a refundable deposit of $250,000 within

90 days of signing the Agreement. Upon completion and following the

issue of the Consideration Shares, EER and any connected person or

other person to whom the Consideration Shares may be issued and

their associates ("Relevant Shareholders") will enter into a

relationship agreement, lock-in agreement and orderly market

agreement with ADM. Under the terms of the relationship agreement,

the Relevant Shareholders will have the right to nominate a

director to be appointed to the Board of ADM from completion,

subject to normal regulatory approval, and such right shall

continue until such time as the Relevant Shareholders cease to hold

20% or more of the entire issued share capital of the Company.

It is expected that the requisite consents and authorisations

may take a number of months to be received such that a long stop

date of 180 days after signing of the Agreement has been agreed,

following which either party is entitled to terminate the

transaction.

Related Party Transaction

Osamede Okhomina, the CEO of the Company, is a non-executive

director of EER. Accordingly, the signing of the Agreement in

respect of the proposed acquisition of the interest from EER and

related documents constitutes a related party transaction pursuant

to Rule 13 of the AIM Rules for Companies. Accordingly, the

independent directors (comprising the Board of ADM other than

Osamede Okhomina), having consulted with the Company's nominated

adviser, consider that the terms of the transaction are fair and

reasonable insofar as the Company's shareholders are concerned.

A further announcement will be made in due course.

Osamede Okhomina, CEO of ADM, said: "In keeping with our

strategic development agenda, I am pleased to announce our first

investment under the Company's new leadership. OML 113 is well

known to us and it is a fantastic asset that covers the spectrum of

field types from current oil production to several appraisal plays.

It is also very wet-gas rich which provides the potential for the

operator to be able to bring into the market, alongside dry gas,

resources like condensate and LPG.

"As envisaged under the intended Strategic Alliance signed

earlier this month, we have proposed this project as one Trafigura

may consider investing in. We look forward to updating the market

further in due course."

Yinka Ogundare, CEO of EER, commented: "We are very pleased with

this transaction that was structured to help further consolidate

our working relationship with ADM. The transaction would result in

deepening our collaborative relationship and help the partners and

the operator develop the asset further."

Enquiries:

ADM Energy plc +44 20 7786 3555

Osamede Okhomina, CEO

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Fox-Davies Capital Ltd +44 20 3884 8450

(Lead Broker)

Daniel Fox-Davies, Lionel Therond

Pello Capital Limited +44 20 3700 2500

(Joint Broker)

Dan Gee

Luther Pendragon +44 20 7618 9100

(Financial PR)

Harry Chathli, Alexis Gore, Joe Quinlan

About ADM Energy PLC

ADM Energy (AIM:ADME) is a natural resources investment company

with an existing asset base in Nigeria. ADM Energy holds a 5%

profit interest in the Aje Field, part of OML 113, which covers an

area of 858km(2) offshore Nigeria. Aje has multiple oil, gas and

gas condensate reservoirs in the Turonian, Cenomanian and Albian

sandstones with five wells drilled to date.

ADM Energy is seeking to build on its existing asset base in

Nigeria and target other investment opportunities across the West

African region in the oil and gas sector with attractive risk

reward profiles such as proven nature of reserves, level of

historic investment, established infrastructure, route to early

cash flow and exploration upside.

Forward-Looking Statements

Certain statements made in this announcement are forward-looking

statements. These forward-looking statements are not historical

facts but rather are based on the Company's current expectations,

estimates, and projections about its industry; its beliefs; and

assumptions. Words such as 'anticipates,' 'expects,' 'intends,'

'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties, and other factors, some

of which are beyond the Company's control, are difficult to

predict, and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

The Company cautions security holders and prospective security

holders not to place undue reliance on these forward-looking

statements, which reflect the view of the Company only as of the

date of this announcement. The forward-looking statements made in

this announcement relate only to events as of the date on which the

statements are made. The Company will not undertake any obligation

to release publicly any revisions or updates to these

forward-looking statements to reflect events, circumstances, or

unanticipated events occurring after the date of this announcement

except as required by law or by any appropriate regulatory

authority.

Notes

The announcement has been reviewed by Wim Burgers, technical

consultant for ADM, a qualified production geologist with more than

40 years' experience in the oil and gas industry, who has also

reviewed the AGR TRACS report to which it relates.

In estimating reserves, contingent and prospective resources AGR

TRACS has used the standard petroleum engineering techniques. These

estimates are based on the joint definitions of the Society of

Petroleum Engineers, the World Petroleum Congress, the American

Association of Petroleum Geologists and the 2007 PRMS (Petroleum

Resources Management System).

It should also be noted that in producing the figures of the net

attributable reserves extracted from the CPR, the CPR calculations

use both the cost and revenue interests to derive the numbers.

Glossary of Key Terms

1P Proved reserves; represent volumes that will be recovered

with 90% probability

2P Proved + Probable; represent volumes that will be recovered

with 50% probability

3P Proved + Probable + Possible; represent volumes that

will be recovered with 10% probability

bbls barrels

boe barrels of oil equivalent

bopd barrels of oil per day

Bscf Billion standard cubic feet

condensate A mixture of hydrocarbons in either gas or liquid form

gross 100% of the resources attributable to the licence

MMbbls Million barrels

MMboe Million barrels of oil equivalent

Reserves Those quantities of petroleum anticipated to be commercially

recoverable by application of development projects to

known accumulations from a given date forward under

defined conditions on production, approved for development

or justified for development. Reserves are also classified

according to the associated risks and probabilities

(1P, 2P and 3P)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQPPUUCPUPUPGW

(END) Dow Jones Newswires

February 24, 2020 02:00 ET (07:00 GMT)

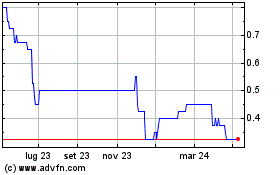

Grafico Azioni Adm Energy (LSE:ADME)

Storico

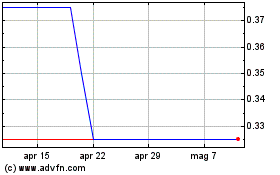

Da Mar 2024 a Apr 2024

Grafico Azioni Adm Energy (LSE:ADME)

Storico

Da Apr 2023 a Apr 2024