Rights and Issues Investment Trust PLC (RIII)

Rights and Issues Investment Trust PLC: Annual Report

24-Feb-2020 / 15:59 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

RIGHTS AND ISSUES INVESTMENT TRUST PLC

Annual Report & Accounts for the full year to 31 December 2019

A copy of the Company's Annual Report for the year ended 31st December 2019

will shortly be available to view and download from the Company's website

www.rightsandissues.co.uk.

Printed copies of the Annual Report will be sent to shareholders shortly.

Additional copies may be obtained from the Corporate Secretary - Maitland

Administration Services Limited, Hamilton Centre, Rodney Way, Chelmsford,

Essex CM1 3BY.

The Annual General Meeting of the Company will be held at The Gridiron

Building, 8th Floor, Number One Pancras Square, Pancras Road, King's Cross,

London N1C 4AG on 1st April 2020 at 12 noon.

The Directors have proposed the payment of a final dividend of 21.5p per

Ordinary share which, if approved by shareholders at the forthcoming Annual

General Meeting, will be payable on 4th April 2020 to shareholders whose

names appear on the register at the close of business on 13th March 2020

(ex-dividend 12th March 2018).

The following text is copied from the Annual Report & Accounts.

INVESTMENT OBJECTIVE & POLICY

The Board's objective is to exceed the benchmark index over the long term

whilst managing risk.

The Company invests in equities with an emphasis on smaller companies. UK

smaller companies will normally constitute at least 80% of the investment

portfolio. UK smaller companies include both listed securities and those

quoted on the Alternative Investment Market ("AIM").

The investment portfolio will normally lie in the range of 80% to 100% of

shareholders' funds and therefore gearing will normally be between -20% and

0%. As a result of the Alternative Investment Fund Managers Regulations 2013

it has been decided that the Company will not use gearing

CAPITAL STRUCTURE

ISSUED SHARE CAPITAL (at 31st December 2019)

7,540,321 Ordinary shares of 25p each.

INCOME ENTITLEMENT

Equal entitlement to dividends and other distributions.

CAPITAL ENTITLEMENT

Equal entitlement to the surplus assets.

VOTING

One vote per share.

PRICE (mid-market) (at 31st December 2019)

2,225.00p.

DIVID YIELD

1.42%.

DISCOUNT MANAGEMENT POLICY

On 7th December 2016, the Company implemented share buy-back arrangements to

encourage the level of discount to be not more than 10%.

SHARE BUY BACKS

During the year to 31st December 2019, the Company has bought back for

cancellation a total of 465,858 Ordinary shares for a total consideration of

GBP9m, representing 5.8% of the share capital of the Company as at 7th

December 2016, when the ability to buy back shares was introduced.

DISCOUNT

(at 31st December 2019)

2.21%.

RIGHTS AND ISSUES INVESTMENT TRUST PLC ('THE TRUST" or 'THE COMPANY") MAY BE

LIQUIDATED AT ANY TIME, BUT THE BOARD OF DIRECTORS HAS INDICATED THAT IT IS

NOT ITS PRESENT INTENTION TO DO SO PRIOR TO 25TH JULY 2021.

Note: The above is a summary of rights. For full information shareholders

should refer to the Articles of Association.

HISTORIC RECORD

Year to Net asset Net asset Net FTSE All FTSE All

value per value per Share Share

share share Index

(Rebased

31st dividend

December per share Index

(Index

1984 = 1984 =

100) 100)

1984 29.0p 100 3.80p 592.94 100

1990 75.4p 260 7.50p 1032.60 174

1995 175.0p 602 10.50p 1802.56 304

2000 473.9p 1631 25.50p 2983.81 503

2005 732.0p 2520 40.50p 2847.00 480

2010 776.4p 2673 25.50p 3094.41 522

2011 751.2p 2586 25.50p 2857.88 482

2012 962.0p 3312 26.75p 3093.41 522

2013 1382.5p 4759 40.00p* 3609.63 609

2014 1297.1p 4465 36.00p 3532.74 596

2015??? 1595.6p 5492 36.00p 3444.26 581

2016 2002.2p 6892 52.50p* 3873.22 653

2017 2372.3p 8166 30.75p 4221.82 712

2018 2118.1p 7291 31.50p 3675.27 620

2019 2275.2p 7832 32.25p 4196.47 709

* Includes Special Dividend

??? From 2015 onwards the historic record is for the Company only and not the

Group.

Note: Until 2016 net asset value per share is based on the Capital shares

adjusted for the reconstruction (four Ordinary shares for each Capital

share). Thereafter, performance is based on the Ordinary shares, formerly

named the Income shares (the only remaining share class).

DIRECTORS AND ADVISERS

DIRECTORS

Dr D. M. BRAMWELL (Chairman)

D. M. BEST

Dr A. J. HOSTY

S. J. B. KNOTT

J. B. ROPER

REGISTERED OFFICE

Hamilton Centre

Rodney Way

Chelmsford CM1 3BY

WEBSITE

www.maitlandgroup.com/investment-trusts/

[1]rights-and-issues-investment-trust-plc

ADMINISTRATOR/SECRETARY

MAITLAND ADMINISTRATION SERVICES LTD

Hamilton Centre

Rodney Way

Chelmsford CM1 3BY

SOLICITORS

EVERSHEDS SUTHERLAND

One Wood Street

London EC2V 7WS

AUDITOR

BEGBIES

9 Bonhill Street

London EC2A 4DJ

REGISTRARS

LINK MARKET SERVICES LTD

The Registry

34 Beckenham Road

Beckenham

Kent BR3 4TU

BROKERS

SHORE CAPITAL

Cassini House

57 St James's Street

London SW1A 1LD

BANKERS/CUSTODIAN

NORTHERN TRUST COMPANY

50 Bank Street

Canary Wharf

London E14 5NT

REGISTRATION DETAILS

Company Registration Number: 00736898 (Registered in England)

SEDOL number :0739207

ISIN number: GB0007392078

London Stock Exchange (EPIC) Code: RIII

Global Intermediary Identification Number (GIIN): I2ZVNY.99999.SL.826

Legal Entity Identifier (LEI): 2138002AWAM93Z6BP574

NOTICE OF ANNUAL GENERAL MEETING

Notice is hereby given that the fifty-seventh Annual General Meeting of the

members of Rights and Issues Investment Trust Public Limited Company will be

held in the Gridiron Building, 8th Floor, Number One Pancras Square, Pancras

Road, King's Cross, London N1C 4AG, on 1st April 2020, at 12 noon, for the

following purposes:

ORDINARY BUSINESS

1) To receive the audited financial statements and Reports of the

Directors and Auditor for the year ended 31st December 2019.

2) To approve the Annual Report on Directors' Remuneration, set out on

pages 24 to 29 (excluding the Remuneration Policy on pages 27 and 28), for

the financial year ended 31st December 2019.

3) To approve the payment of a final dividend of 21.5 pence per Ordinary

share for the financial year ended 31st December 2019.

4) To re-elect Dr D. M. Bramwell as a Director.

5) To re-elect D. M. Best as a Director.

6) To re-elect Dr A. J. Hosty as a Director.

7) To re-elect S. J. B. Knott as a Director.

8) To re-elect J. B. Roper as a Director.

9) To reappoint Begbies as Auditor and authorise the Directors to

determine the Auditor's remuneration.

SPECIAL BUSINESS

To consider and, if thought fit, pass resolution 10 as an Ordinary

Resolution and resolution 11 as a Special

Resolution:

10. To approve the Directors' Remuneration Policy set out on pages 27 and 28

of the Directors' Remuneration Report, which takes effect immediately after

the end of the Annual General Meeting.

11. THAT the Company be and is hereby generally and unconditionally

authorised in accordance with section 701 of the Companies Act 2006 to make

market purchases (within the meaning of section 693 of the Companies Act

2006) of Ordinary shares, provided that:

11.1 the maximum aggregate number of Ordinary shares hereby authorised to be

purchased shall be 1,130,294 (representing approximately 14.99% of the

Ordinary shares in issue on 21st February 2020);

11.2 the minimum price (exclusive of expenses) which may be paid for an

Ordinary share is 25 pence;

11.3 the maximum price (exclusive of expenses) which may be paid for an

Ordinary share is not more than the higher of (i) an amount equal to 105% of

the average market value of the Ordinary shares for the five business days

immediately preceding the day on which the Ordinary share is purchased; and

(ii) the higher of the last independent bid and the highest current

independent bid on the London Stock Exchange when the purchase is carried

out, or such other amount as may be specified by the FCA from time to time;

11.4 the authority hereby conferred will expire at the conclusion of the

next Annual General Meeting of the Company unless such authority is renewed

prior to such time; and

11.5 the Company may make a contract to purchase Ordinary shares under the

authority hereby conferred prior to the expiry of such authority which will

or may be executed wholly or partly after the expiration of such authority

and may make a purchase of Ordinary shares pursuant to any such contract;

provided that all Ordinary shares purchased pursuant to this authority shall

be cancelled or transferred into treasury immediately upon completion of the

purchases.

By Order of the Board,

MAITLAND ADMINISTRATION SERVICES LTD

Secretary, 21st February 2020

Notes:

1) Any shareholder entitled to attend and vote at the above meeting is

entitled to appoint one or more proxies (who need not be a shareholder of

the Company) to attend and to vote instead of the shareholder. To appoint

more than one proxy, additional proxy forms may be obtained by contacting

the Company's registrars. Please also indicate by ticking the box provided

if the proxy instructions are one of multiple instructions being given.

All forms must be signed and should be returned together in the same

envelope. Completion and return of a form of proxy will not preclude a

shareholder from attending and voting at the meeting in person, should he

subsequently decide to do so.

2) The right to appoint a proxy does not apply to persons whose Ordinary

shares in the Company (the "Shares") are held on their behalf by another

person and who have been nominated to receive communications from the

Company in accordance with section 146 of the Companies Act 2006

("nominated persons"). Nominated persons may have a right under an

agreement with the registered shareholder who holds the Shares on their

behalf to be appointed (or to have someone else appointed) as a proxy.

Alternatively, if nominated persons do not have such a right, or do not

wish to exercise it, they may have a right under such an agreement to give

instructions to the person holding the Shares as to the exercise of voting

rights.

3) In order to be valid, a form of proxy, which is provided with this

notice, and a power of attorney or other authority under which it is

signed, or certified by a notary or office copy of such power or

authority, must reach the Company's registrars, Link Asset Services, PXS,

34 Beckenham Road, Beckenham BR3 4TU not less than 48 hours (excluding any

part of a day which is a non-working day) before the time of the meeting

or of any adjournment of the meeting. A form of proxy is enclosed with

this notice.

4) CREST members who wish to appoint a proxy or proxies by utilising the

CREST electronic proxy appointment service may do so by utilising the

procedures described in the CREST manual. CREST personal members or other

CREST sponsored members, and those CREST members who have appointed a

voting service provider(s), should refer to their CREST sponsor or voting

service provider(s), who will be able to take the appropriate action on

their behalf.

5) In order for a proxy appointment made by means of CREST to be valid,

the appropriate CREST message must be transmitted so as to be received by

the Company's agent, Link Market Services (whose CREST ID is RA10) by the

specified latest time(s) for receipt of proxy appointments. For this

purpose, the time of receipt will be taken to be the time (as determined

by the timestamp applied to the message by the CREST applications host)

from which the Company's agent is able to retrieve the message by enquiry

to CREST in the manner prescribed.

6) The Company may treat as invalid a CREST proxy instruction in the

circumstances set out in Regulation 35(5)(a) of the Uncertificated

Securities Regulations 2001. A register showing the interests of each

Director and their connected persons, so far as they are aware, in the

Ordinary shares will be available for inspection at the offices of the

Company Secretary, Maitland Administration Services Limited, Hamilton

Centre, Rodney Way, Chelmsford, Essex CM1 3BY, during normal business

hours every weekday except Saturdays, from the above date to the day

preceding that of the general meeting. It will also be available for

inspection at the place of the meeting for 15 minutes prior to the general

meeting and during the meeting. Apart from the Investment Director, there

are no contracts of service existing between the Company and any of the

Directors.7. Any shareholder attending the general meeting is entitled,

pursuant to section 319A of the Companies Act 2006, to ask any question

relating to the business being dealt with at the meeting. The Company will

answer any such questions unless:

i) to do so would interfere unduly with the preparation for the meeting or

involve the disclosure of confidential information;

ii) the answer has already been given on a website in the form of an

answer to a question; or

iii) it is undesirable in the interests of the Company or the good order

of the meeting that the question be answered.

From the date of this notice and for the following two years the following

information will be available on the Company's website and can be accessed

at

www.maitlandgroup.com/investment-trust/rights-and-issues-investment-trust-pl

c: [2]

i) the matters set out in this notice of general meeting;

ii) the total numbers of Shares in respect of which shareholders are

entitled to exercise voting rights at the meeting; and

iii) the totals of the voting rights that shareholders are entitled to

exercise at the meeting in respect of the Shares.

8. Any shareholders' statements, shareholders' resolutions and shareholders'

matters of business received by the Company after the date of this notice

will be added to the information already available on the website as soon as

reasonably practicable and will also be made available for the following two

years.

9. Where a poll is taken at the general meeting, from the date of this

notice and for the following two years the following information will be

available on the Company's website and can be accessed at

www.maitlandgroup.com/investment-trust/rights-and-issues-investment-trust-pl

c: [2]

i) the date of the general meeting;

ii) the text of the resolution or, as the case may be, a description of

the subject matter of the poll;

iii) the number of votes validly cast;

iv) the proportion of the Company's issued share capital represented by

those votes;

v) the number of votes cast in favour;

vi) the number of votes cast against; and

vii) the number of abstentions (if counted).

10. In order to attend and vote at this meeting you must comply with the

procedures set out in notes 1 to 3 by the time specified in note 3.

11. The right of shareholders to vote at the meeting is determined by

reference to the register of shareholders. As permitted by section 360B(3)

of the Companies Act 2006 and Regulation 41 of the Uncertificated Securities

Regulations 2001, shareholders (including those who hold Shares in

uncertificated form) must be entered on the Company's share register at

close of business on 30th March 2020 in order to be entitled to attend and

vote at the meeting. Such shareholders may only cast votes in respect of

Shares held at such time. Changes to entries on the relevant register after

that time shall be disregarded in determining the rights of any person to

attend or vote at the meeting.

12. The total number of Ordinary shares of 25p in issue as at 21st February

2020, the last practicable day before printing this document, was 7,540,321

Shares and the total level of voting rights was 7,540,321.

CHAIRMAN'S STATEMENT

The resolution of Brexit in December's General Election has finally provided

clarity. The removal of uncertainty allowed the FTSE All-Share Index to

increase by 14.2% in 2019.

The UK smaller company market enjoyed a strong finish for the year with FTSE

All Small Index progressing by 13.2%.

Your Company's portfolio had a more mixed year with the net asset value

rising by 7.4% to 2275.2p. The final dividend proposed is 21.5p making

32.25p for the year, a 2.4% increase.

The share buy-back programme purchased GBP9.0m of shares in 2019. During the

year, the average discount to net asset value was 7.6%. The programme will

again be extended for a further twelve months to February 2021.

Economic growth looks to be subdued in the forthcoming year. Even before the

emergence of coronavirus in China, prospects for the UK and Europe were

anaemic. The corporate environment appears to be becoming tougher. Still,

good companies prosper in tougher conditions and that, as always, is where

the focus will be.

Dr D. M. BRAMWELL

Chairman

21st February 2020

STRATEGIC REPORT

The Strategic Report is designed to provide information primarily about the

Company's business and results for the year ended 31st December 2019 and

should be read in conjunction with the Chairman's Statement on page 7.

STATUS

The Company is a self-managed investment trust. The Company is registered as

an investment company as defined in section 833 of the Companies Act 2006

and operates as such. The Company is not a close company within the meaning

of the provisions of the Corporation Tax Act 2010.

The Company has been approved by the Financial Conduct Authority to be a

Small Registered Alternative Investment Fund Manager ("AIFM").

In the opinion of the Directors, the Company has conducted its affairs

during the year under review, so as to qualify as an investment trust for

the purposes of Chapter 4 of Part 24 of the Corporation Tax Act 2010 and

continues to meet the eligibility conditions set out in section 1158 of the

Corporation Tax Act 2010.

The Board is directly accountable to its shareholders. The Company is listed

on the London Stock Exchange and is subject to the Listing Rules, Prospectus

Rules and Disclosure Guidance and Transparency Rules published by the

Financial Conduct Authority ("FCA"). The Company is governed by its articles

of association, amendments to which must be approved by shareholders by

special resolution. The Company is a member of the Association of Investment

Companies ("AIC").

The FCA rules in relation to non-mainstream pooled investments do not apply

to the Company.

STRATEGY FOR MEETING THE OBJECTIVES

The Board's objective is to exceed the benchmark index over the long term

whilst managing risk.

To achieve this objective, the Board continues with its long-term strategy

of seeking out undervalued investments that have characteristics consistent

with a matrix of criteria developed by the Investment Director. This is

supported by the five-yearly review that addresses the above objective. The

latest review was conducted in November 2015, which concluded that the

continuation of the Company for the period until July 2021 was in the best

interests of shareholders.

The Board fulfils its investment objective and policy by operating as an

investment company, enabling it to delegate operational matters to

specialised third-party service providers. The close-ended nature of the

Company allows a longer-term view on investments and means liquidity issues

as a result of redemptions are less likely to arise.

In pursuing its strategy, close attention is also paid to the control of

costs. Further information on this is contained in the Key Performance

Indicators on page 11.

INVESTMENT SELECTION

There is a rigorous process of risk analysis at the level of the individual

investment, based on the characteristics of the investee company. This

controls the overall risk profile of the investment portfolio, allowing a

higher level of concentration in the investment portfolio.

The investment portfolio is then managed on a medium-term basis with a low

level of investment turnover. This minimises transaction costs and ensures

medium-term consistency of the investment approach.

The Company's investment activities are subject to the following limitations

and restrictions:

The policy does not envisage hedging either against price or currency

fluctuations. Whilst performance is compared against major UK indices, the

composition of indices has no influence on investment decisions or the

construction of the portfolio. As a result, it is expected that the

Company's investment portfolio and performance will deviate from the

comparator indices.

SUSTAINABILITY OF BUSINESS MODEL AND PROMOTING THE SUCCESS THE COMPANY'S

SUCCESS

The Board is responsible for the overall strategy of the Company and

decisions regarding corporate governance, asset allocation, risk and

control. The day-to-day management of the investments is delegated to the

Investment Director and the management of the operations to specialist

third-party suppliers.

The Directors are conscious of their duties under section 172 of the

Companies Act 2006 and particular the overarching duty to promote the

success of the Company for the benefit of the shareholders, with careful

attention paid to wider stakeholders' interests. The Board is aware of the

importance of ensuring that the Company has a sustainable, well-governed

business model to achieve its strategy and objectives.

As part of discharging its section 172 duties, the Company, through the

Investment Director, uses its influence, where possible, as a shareholder to

encourage the companies in which it invests to adopt best practice on

environmental, social and corporate governance ("ESG") matters. The

Investment Director, during the coming year, will also actively seek to

invest in companies that adopt good ESG practice.

The third-party service providers are a key element of ensuring the success

of the business model. The Board monitors the chosen service providers

closely to ensure that they continue to deliver the expected level of

service. The Board also receives regular reporting from them, evaluates the

control environment and governing contract in place at each service provider

and formally assesses their appointment annually.

CULTURE & VALUES

All the Directors seek to discharge their responsibilities and meet

shareholder expectations in an open and transparent manner. The Board seeks

to recruit Directors who have diverse working experience including managing

the types of companies in which the Company invests. The industry experience

on the Board ensures there is detailed knowledge and constructive challenge

in the decision-making process. This helps the Company achieve its

overarching aim of enhancing shareholder value. The Directors are mindful of

costs and seek to ensure that the best value money is achieved in managing

the Company.

The Company's values of skill, knowledge and integrity are aligned to the

delivery of its investment objective and are monitored closely by the Board.

The Board seeks to employ third-party providers who share the Company's

culture and importantly will work with the Directors openly and

transparently to achieve the Company's aims. As detailed in the Business

Ethics section below, the Board expects and seeks assurance that the

companies with which it works adopt working practices that are of a very

high standard.

The Responsibilities as an Institutional Shareholder section below describes

the Company's approach to managing its investments, including ESG matters.

BUSINESS ETHICS

The Company maintains a zero-tolerance policy towards the provision of

illegal services, bribery and corruption in its business activities,

including the facilitation of tax evasion. As the Company has no employees

other than the Investment Director and the Company's operations are

delegated to third-party service providers, the Board seeks assurances, at

least annually, from its suppliers that they comply with the provisions of

the Modern Slavery Act 2015 and maintain adequate safeguards in keeping with

the provisions of the Bribery Act 2010 and Criminal Finances Act 2017.

As an investment vehicle the Company does not provide goods or services in

the normal course of business, and does not have customers. Accordingly, the

Directors consider that the Company is not within the scope of the Modern

Slavery Act 2015.

BOARD DIVERSITY

The Company's affairs are overseen by a Board currently comprising four

non-executive Directors and one executive Director - all of whom are male.

In terms of progress in achieving diversity, the Company is committed to

ensuring that vacancies arising are filled by the best qualified candidates

and recognises the value of diversity in the composition of the Board. When

the Board goes through its next recruitment process, improving the Board's

gender diversity will be an important criterion.

The Directors have broad experience, bringing knowledge of investment

markets, business, financial services, accounting and regulatory expertise

to discussions on the Company's business. The Directors regularly consider

the leadership needs and specific skills required to achieve the Company's

investment objective. Whilst appointments are based on skills and

experience, the Board is conscious of diversity of gender, social and ethnic

backgrounds, cognitive and personal strengths and experience. All

appointments are based on objective criteria and merit, and are made

following a formal, rigorous and transparent process.

RESPONSIBILITIES AS AN INSTITUTIONAL SHAREHOLDER

The Board has delegated authority to the Investment Director for monitoring

the corporate governance of investee companies. The Board has delegated to

the Investment Director responsibility for selecting the portfolio of

investments within investment guidelines established by the Board and for

monitoring the performance and activities of investee companies. On behalf

of the Company the Investment Director carries out detailed research on

investee companies and possible future investee companies through internally

generated research. The research includes an evaluation of fundamental

details such as financial strength, quality of management, market position

and product differentiation. Other aspects of research include an appraisal

of social, ethical and environmentally responsible investment policies.

The Board has delegated authority to the Investment Director to vote on

behalf of the Company in accordance with the Company's best interests. The

primary aim of the use of voting rights is to address any issues which might

impinge on the creation of a satisfactory return from investments. The

Company's policy is, where appropriate, to enter into engagement with an

investee company in order to communicate its views and allow the investee

company an opportunity to respond.

In such circumstances the Company would not normally vote against investee

company management but would seek, through engagement, to achieve its aim.

The Company would vote, however, against resolutions it considers would

damage its shareholder rights or economic interests.

The Company has a procedure in place that where the Investment Director, on

behalf of the Company, has voted against an investee company resolution, it

is reported to the Board.

The Board considers that it is not appropriate for the Company, as a small

self-managed investment trust, formally to adopt the UK Stewardship Code.

However, many of the UK Stewardship Code's principles on good practice on

engagement with investee companies are used by the Company, as described

above.

CORPORATE AND SOCIAL RESPONSIBILITY

When investments are made, the primary objective is to achieve the best

investment return while allowing for an acceptable degree of risk. In

pursuing this objective, various factors that may impact on the performance

are considered and these may include socially responsible investment issues.

As an investment trust, the Company's own direct environmental impact is

minimal. The Company has no greenhouse gas emissions to report from its

operations, nor does it have responsibility for any other

emissions-producing sources under the Companies Act 2006 (Strategic Report

and Directors' Reports) Regulations 2013 for the year to 31st December 2019

(2018: same). All printed material, wherever possible, is on recycled

material. The Investment Director attempts to minimise the Company's carbon

footprint. The Company's indirect impact occurs through the investments it

makes.

The Company does not purchase electricity, heat, steam or cooling for its

own use nor does it have responsibility for any other emissions producing

sources.

Of more importance is the conduct of the companies in the investment

portfolio. The Company does not invest in companies which have significant

adverse effect on the global environment and encourages those companies in

which it has an investment to pursue responsible environmental policies.

The Company contributes to wider society by generating returns to

shareholders whose ownership in shares in the Company affects their savings

and by investing in companies which provide employment and innovation. No

investments are made in tobacco or fossil fuel producing companies.

REVIEW OF THE BUSINESS

A review of the year and commentary on the future outlook is provided in the

Chairman's Statement on page 7.

During the year under review, the assets of the Company were invested in

accordance with the Company's investment policy.

During the year the Company's net assets have increased from GBP169.6m to

GBP171.6m and at 31st December 2019 the net asset value per Ordinary share was

2275.2p.

KEY PERFORMANCE INDICATORS

The Board is provided with detailed information on the Company's performance

at every Board meeting. Key Performance Indicators are:

· Shareholders' funds equity return compared to the FTSE All-Share Index

(the Company's benchmark index).

· Dividends per Ordinary share.

· Ongoing Charge (formerly titled the Total Expense Ratio).

Shareholders' funds equity return

In reviewing the performance of the Company, the Board monitors

shareholders' funds in relation to the FTSE All-Share Index. During the year

shareholders' funds increased by 1.2% compared to an increase of 14.2% by

the FTSE All-Share Index. Over the five years ended 31st December 2019

shareholders' funds increased by 47.5% compared with a rise of 18.8% by the

FTSE All-Share Index.

Dividends per Ordinary share

The total dividend per Ordinary share paid and proposed is 32.25p (2018:

31.50p).

Ongoing Charge

The Ongoing Charge shows the efficiency of control of management costs. The

Ongoing Charge for the

year ended 31st December 2019 was 0.47% (2018: 0.48%).

PRINCIPAL RISKS

The Board of Directors has a process for identifying, evaluating and

managing the key risks of the Company. This process operated during the year

and has continued to the date of this report. The Directors confirm that

they have carried out a robust assessment of the principal risks facing the

Company, including those that would threaten its business model, future

performance, solvency or liquidity. The Directors describe below those risks

and how they are being managed or mitigated.

Investment in an individual smaller company inherently carries a higher risk

than investment in an individual large company. In a diversified portfolio,

the portfolio risk of a smaller company portfolio is only slightly greater

than the portfolio risk of a large company portfolio. The Company manages a

diversified portfolio. Additionally, the Company invests overwhelmingly in

smaller UK listed and AIM traded companies and has no exposure to

derivatives. The principal risks are therefore market price risk and

liquidity risk. Further details on these risks and how they are managed may

be found in Note 18 to the financial statements on page 49.

Additional key risks identified by the Company, together with the Board's

approach in dealing with them are as follows:

Investment performance - The performance of the investment portfolio will

deviate from the performance of the benchmark index. The Board's objective

is to exceed the benchmark index over the long term whilst managing risk.

The Board ensures that the Investment Director is managing the portfolio

within the scope of the investment policy; the Board monitors the Company's

performance against the benchmark; and the Board also receives detailed

portfolio attribution analysis. The Board has a clearly defined investment

philosophy and operates a diversified portfolio.

Share price discount - Investment trust shares often trade at discounts to

their underlying net asset values. The Board monitors the level of the

discount of the Ordinary shares. On 7th December 2016, the Company

implemented share buy-back arrangements to mitigate the risk of the discount

increasing.

Loss of key personnel - The Investment Director is crucial to performance

and the loss of the Investment Director could adversely affect performance

in the medium term. The Board reviews its strategy for this risk annually.

Regulatory risk - The Company must abide by section 1158 of the Corporation

Tax Act 2010 to maintain its investment trust status. This is achieved by

the consistent investment policy and is monitored by the Board. The Board

seeks assurance from the Administrator that the investment trust status is

being maintained. The Board also reviews a schedule of regulatory risk items

at its Board meetings in order to monitor and take action to address any

regulatory changes.

Protection of assets - The Company's assets are protected by the use of an

independent custodian, Northern Trust Company, and the Board monitors the

custodian to ensure assets remain protected. In addition, the Company

operates clear internal controls to safeguard all assets.

Future trading relationships - The risk associated with the decision of a

majority of the UK electorate to leave EU membership could be considerable

for the UK and also for continental European countries. The links between

the UK and the EU are wide-ranging and the future trading relationship

remains unclear, creating conditions that could mean that markets react

unpredictably to the uncertainty created. This risk is challenging to

mitigate but the Investment Director is considering the risk of leaving the

EU for each investment in the portfolio based on its individual

circumstances.

These and other risks facing the Company are reviewed regularly by the Audit

and Compliance Committee and the Board.

SECTION 172 STATEMENT

The Board seeks to promote the success of the Company for the benefit of its

shareholders, giving consideration to the likely long term consequences of

any decision with regard to the interests of its business relationships and

the environment in which it operates. The Company has one employee, the

Investment Director.

Stakeholder Group Engagement in the year and their material

issues

Investors Shareholders play an important role in

monitoring and safeguarding the governance of

the Company and have access to the Board via

the Company Secretary throughout the year and

are encouraged to attend the Annual General

Meeting.

Suppliers Key suppliers are required to report to the

Board on a regular basis. The Company employs

a collaborative approach and looks to build

long term partnerships based on open terms of

business and fair payment terms.

Investee Companies The Investment Director meets with the

management of companies in which the Company

has a significant interest and reports on

findings to the Board on a quarterly basis.

Regulators The Board ensures compliance with the

necessary rules and regulations relevant to

the Company in order to build trust and

reputation in the market.

Factoring Stakeholders into Principal Decisions

The Board defines principal decisions as both those that are material to the

Company but also those that are significant to any of the Company's key

stakeholders as identified above. In making the following principal

decisions, the Board considered the outcome from its stakeholder engagement

as well as the need to maintain a reputation for high standards of business

conduct and the need to act fairly between the members of the Company.

Principal Decision 1 Dividend Policy

The Board continues to operate a

progressive dividend policy.

Principal Decision 2 Share buy back programme

Since the start of the programme, 16.4% of

the issued share capital has been

repurchased at a cost of approximately

GBP29.5m. The discount on the Company's

shares has reduced which supports the

Company's decision to continue the buyback

policy.

Principal Decision 3 New Investments

The Investor Director is required to report

at each board meeting on the merits of

individual investment opportunities in

accordance with the established risk

analysis.

Principal Decision 4 Remuneration

After reviewing the performance in 2019,

all Directors salaries remain unchanged and

no bonus was awarded to the Investment

Director.

VIABILITY STATEMENT

The Board reviews the performance and progress of the Company over five-year

periods and uses these assessments, regular investment performance updates

from the Investment Director and a continuing programme of monitoring risk

to assess the future viability of the Company. The Directors consider that a

period of five years is a reasonable time horizon to consider the viability

of the Company. The Company also uses this period for its strategic

planning. The following facts support the Directors' view of the viability

of the Company:

· The Company has a liquid investment portfolio invested predominantly in

readily realisable smaller UK-listed and AIM traded securities and has

some short-term cash on deposit.

· The Company does not use gearing.

· Expenses of the Company are covered almost four times by investment

income.

In order to maintain viability, the Company has a robust risk control

framework for the identification and mitigation of risk which is reviewed

regularly by Board. The Directors also seek reassurance from suppliers that

their operations are well managed and that they are taking appropriate

action to monitor and mitigate risk.

SHAREHOLDER COMMUNICATION

The Board is committed to maintaining open channels of communication with

shareholders in a manner which they find most meaningful. It is the

Chairman's role to ensure effective communication with the Company's

shareholders and it is the responsibility of the Board to ensure that

satisfactory dialogue takes place, based on the mutual understanding of

objectives.The Investment Director maintains a regular dialogue with major

shareholders and reports to the Board. In the event shareholders wish to

raise issues or concerns with the Directors, they are welcome to do so at

any time by writing to the Chairman at the registered office. The Annual

Report and half-year results are circulated to shareholders wishing to

receive them and made available on the Company's website. These provide

shareholders with a clear understanding of the Company's portfolio and

financial position. This information is supplemented by the daily

calculation and publication of the NAV per share. The Investment Director

attends the AGM and provides a presentation on the Company's performance and

the future outlook. We encourage shareholders to attend and participate in

the AGM. Shareholders have the opportunity to address questions to the

Chairman of the Board, the Investment Director and all other Directors.

COMPANY'S DIRECTORS AND EMPLOYEES

The number of directors and employees during the year was 5 (2018: 5).

2019 2018

Male Female Male Female

Directors (non-executive) 4 0 4 0

Directors (executive) 1 0 1 0

Employees 0 0 0 0

The Directors have considered the Strategic Report and believe that taken as

a whole it is fair, balanced and understandable and provides the information

necessary for shareholders to assess the Company's performance and strategy.

The Strategic Report was approved by the Board and signed on its behalf by:

S. J. B. Knott, Director

21st February 2020

REPORT OF THE DIRECTORS

The Directors have pleasure in submitting their fifty-seventh Annual Report,

together with audited financial statements in respect of the year ended 31st

December 2019.

DIRECTORS

The Directors who served during the year were as follows:

Dr David Bramwell

David is a Chartered Engineer and during his career has worked in a wide

range of industries in senior executive and management consultancy roles. He

was appointed Chief Executive of Peterhouse Group PLC in 1997 and thereafter

Chairman of Intelek PLC. During his career he has represented several

private equity and investment institutions as chairman and independent

non-executive director of many private companies operating in wide range of

industries. His prime role was the strategic and tactical development in

order to achieve growth in stakeholder value.

David Best

David is a Chartered Accountant and is a director of a number of private

companies. He was previously Group Finance Director of Peterhouse Group PLC

and a Managing Director of YFM Group, a private equity business. He has over

30 years of investment experience across a number of businesses; since 2011

he has been involved with Mercia Asset Managers and its predecessor

operations advising on a number of portfolio companies. His involvement in

operating companies allows him to share insights with the Board on the

issues businesses face across a number of varied sectors.

Dr Andrew Hosty

Andrew is a Chartered Engineer and Fellow of the Royal Academy of Engineers.

He is an international business leader with over 15 years of Non-executive

board experience and 30 years of executive and management experience,

spanning private equity, UK Plc and global blue-chip corporates. From 2016

to 2018 Andrew was the CEO of the Sir Henry Royce Institute, the UK's home

of advanced materials research and innovation. Andrew was Chief Operating

Officer of Morgan Advanced Materials, and served on the Plc Board as an

Executive Director from 2010 to 2016. These experiences and his current work

with other operating companies mean that Andrew can contribute to a range of

business matters over a wide spectrum of end markets.

Jonathan Roper

Jonathan is a solicitor and until his retirement from practice was a partner

in Eversheds Sutherland (formerly Eversheds LLP.) He has more than 35 years'

experience of commercial practice in the City, advising primarily on public

and private company mergers and acquisitions, joint ventures and equity and

other financing arrangements for UK and overseas clients, including many in

the financial services sector, and often at a strategic board level. He is a

member of the Council of the London School of Hygiene & Tropical Medicine

and chair of its Audit & Risk Committee.

Simon Knott

Simon has served as Investment Manager of the Company since 1983 focusing on

UK smaller companies.

DIVIDS

The Board is recommending a final dividend of 21.5p per Ordinary share

(2018: 21.00p). If approved, taken together with the interim dividend of

10.75p per Ordinary share (2018: 10.50p) this will result in a total

dividend to the holders of Ordinary shares for the year of 32.25p per

Ordinary share (2018: 31.50p).

SUBSTANTIAL SHAREHOLDINGS

The Company has received notification to 18th February 2020, in accordance

with Chapter 5 of the Disclosure and Transparency Rules, of the following

voting rights:

Ordinary shares % of voting

rights*

Dartmoor Investment Trust 742,892 9.85%

S. J. B. Knott 488,111 6.47%

J. Knott 482,185 6.39%

Rathbone Brothers PLC 437,361 5.80%

P & J Allen 323,511 4.29%

H. J. D. Knott 314,504 4.17%

* The percentage of voting rights is

as at the time of the notification.

DISCLOSURE OF SECTION 414C (11)

SCHEDULE 7 INFORMATION

The Company has chosen to set out in the Strategic Report all information

relating to the above. SECTION 992 COMPANIES ACT 2006 DISCLOSURES

Details of the Company's capital structure and voting rights are given on

page 1 of this document and in Note 14 on page 47 of the financial

statements.

CORPORATE GOVERNANCE

Full details are given in the Corporate Governance Statement on pages 18 to

20. The Corporate Governance Statement forms part of this Directors' Report.

SPECIAL BUSINESS AT THE ANNUAL GENERAL MEETING

The Notice of the Annual General Meeting to be held on 1st April 2020 is set

out on pages 4 to 6.

Remuneration Policy (resolution 10): The proposed Policy is set out on pages

27 and 28 of the Directors' Remuneration Report, which if approved, shall

take effect immediately after the end of the Annual General Meeting. There

are no substantive changes to the Policy that is already in place.

Share Buy Back Facility (resolution 11): The Board is seeking to renew the

authority granted at the Annual General Meeting held on 2nd April 2019 that

authorises the Company to make market purchases of Ordinary shares for

cancellation. At the forthcoming Annual General Meeting the Directors will

seek to renew this authority to buy back for cancellation up to 14.99% of

Ordinary shares in issue, representing 1,130,294 Ordinary shares as at 21st

February 2020. The authority will expire at the conclusion of the next

Annual General Meeting of the Company in 2021 unless the authority is

renewed. The Board considers this authority an important part of the

Company's discount management policy. Shore Capital, the Company's brokers,

will be asked to continue the facilitation of these buy backs on the

Company's behalf and in accordance with the relevant provisions of the

Companies Act 2006 and Listing Rules.

Recommendation: The Directors recommend that shareholders vote in favour of

the resolutions to be proposed at the Annual General Meeting, as they intend

to do in respect of their own beneficial holdings; all resolutions are

considered to be in the best interests of the Company and its members.

DIRECTORS' REMUNERATION REPORT

The Annual Report on Directors' Remuneration on pages 24 to 29 provides

information on the Directors' remuneration and their interests in the share

capital of the Company, together with details of their letters of

appointment and memoranda of service.

ADMINISTRATION & SECRETARIAL AGREEMENT

The accounting, company secretarial and administrative services are provided

by Maitland Administration Services Limited ("Maitland") under an agreement

terminable by either party on not less than six months' notice. The services

provided by Maitland are reviewed regularly by the Board.

DISCLOSURE OF INFORMATION TO AUDITOR

So far as each Director at the date of approval of this report is aware:

· there is no relevant audit information of which the Company's Auditor is

unaware; and

· the Directors have taken all steps that they ought to have taken to make

themselves aware of any relevant audit information and to establish that

the Auditor is aware of that information.

GOING CONCERN

The Company's assets comprise mainly readily realisable equity securities

and cash and the value of its assets is greater than its liabilities.

Additionally, after reviewing the Company's budget including the current

financial resources and projected expenses for the next 12 months and its

medium-term plans, the Directors believe that the Company's resources are

adequate for continuing in business for the foreseeable future. Accordingly,

it is appropriate to continue to prepare the financial statements on a going

concern basis.

GENERAL

No political contributions have been made during the year.

The Company purchases liability insurance covering the Directors and

Officers of the Company.

In accordance with section 489 of the Companies Act 2006, a resolution

proposing the reappointment of Begbies as Auditor of the Company will be put

to the Annual General Meeting.

The Directors' Report was approved by the Board and signed on its behalf by:

Dr D. M. Bramwell, Chairman

21st February 2020

CORPORATE GOVERNANCE STATEMENT

AIC CODE

The Board has considered the Principles and Provisions of the AIC Code of

Corporate Governance, published in February 2019 (AIC Code). The AIC Code

addresses the Principles and Provisions set out in the UK Corporate

Governance Code (the UK Code), as well as setting out additional provisions

on issues that are of specific relevance to investment companies.

The Board considers that reporting against the Principles and Provisions of

the AIC Code, which has been endorsed by the Financial Reporting Council

provides more relevant information to shareholders.

The Company has complied with the Principles and Provisions of the AIC Code

but the Board has not elected to designate a senior independent

non-executive Director, as it considers that each Director has different

strengths and qualities on which they may provide leadership.

The AIC Code is available on the AIC website (www.theaic.co.uk [3]). It

includes an explanation of how the AIC Code adapts the Principles and

Provisions set out in the UK Code to make them relevant for investment

companies.

OPERATION OF THE BOARD OF DIRECTORS

The Directors of the Company, as shown on page 3, are Dr D. M. Bramwell, Mr

D. M. Best, Dr A. J. Hosty, Mr S. J. B. Knott and Mr J. B. Roper. All

Directors served throughout the year under review. Their biographical

details, also set out on page 15, demonstrate a breadth of investment,

commercial and professional experience.

The Board is collectively responsible for promoting the success of the

Company. It deals with the important aspects of the Company's affairs,

including the setting of parameters for, and the monitoring of investment

strategy and the review of, investment performance. It reviews the share

price and the discount or premium to net asset value. The Board sets limits

on the size and concentration of new investments. The application of these

and other restrictions, including those which govern the Company's tax

status as an investment trust, are reviewed regularly at meetings of the

Board.

The Board delegates all investment matters to the Investment Director but

reserves to itself all decisions concerning unquoted investments. The

Investment Director takes decisions as to the purchase and sale of

individual investments and is responsible for effecting those decisions on

the best available terms in accordance with the investment policy as stated

on page 1.

The Chairman leads the Board and ensures that it deals effectively with all

the aspects of its role. In particular, he ensures that the Administrator

provides the Directors, in a timely manner, with management, regulatory and

financial information that is clear, accurate and relevant. Representatives

of the Administrator attend each Board meeting, enabling the Directors to

seek clarification on specific issues or to probe further on matters of

concern. Matters specifically reserved for decision by the full Board have

been defined and there is an agreed procedure for Directors, in the

furtherance of their duties, to take independent professional advice, if

necessary, at the Company's expense.

The Directors, their roles and attendance records are as follows:

Directors Role Audit and Nominations Board Committee

Compliance and meeti meetings

Committee Remuneratio ngs attended

n Committee atten

ded

Dr D. M. Chairman, Yes Yes 6 5

Bramwell non-executive

S. J. B. Chief No No 6 0

Knott Executive and

Investment

Director

D. M. Best Non-executive Chairman Yes 6 5

Dr A. J. Non-executive Yes Yes 6 5

Hosty

J. B. Non-executive Yes Chairman 5 5

Roper

In the year, there were 6 board meetings and 2 board committee meetings. Mr

Knott is not a member of either committee but does attend meetings when

appropriate.

INDEPENCE OF THE DIRECTORS

The Board of Directors, which includes four non-executive Directors, all of

whom are considered to be independent, normally meets six times a year to

review the affairs of the Company. The Directors have reviewed their

independence by reference to the AIC Code. The Directors have had no

material connection other than as Directors of the Company. The Board is of

the opinion that each of the non-executive Directors is independent in

character and judgment and that there are no relationships or circumstances

that are likely to affect their judgment. Dr D. M. Bramwell has now served

on the Board for more than nine years and (along with the other Directors)

will stand for election by the shareholders each year. The Board is firmly

of the view, however, that length of service does not of itself impair a

Director's ability to act independently. As such, the Board considers Dr D.

M. Bramwell to be independent but, in accordance with the Code, his role and

contribution will be subject to particularly rigorous review.

CONFLICTS OF INTEREST

The Articles of Association reflect the codification of certain Directors'

duties arising from the Companies Act 2006 and in particular the duty for

Directors to avoid conflicts of interest. The Board has put in place a

framework in order for Directors to report conflicts of interest or

potential conflicts of interest.

All Directors are required to notify the Company Secretary of any

situations, or potential situations, where they consider that they have or

may have a direct or indirect interest or duty that conflicts or may

possibly conflict with the interests of the Company. The Board has

considered that the framework worked effectively throughout the period since

its adoption. Directors were also made aware that there remains a continuing

obligation to notify the Company Secretary of any new situation that may

arise, or any change to a situation previously notified. It is the Board's

intention to continue to review all notified situations on a regular basis.

NOMINATIONS AND REMUNERATION COMMITTEE

The Committee oversees a formal review procedure and evaluates the overall

composition of the Board from time to time, taking into account the existing

balance of skills and knowledge. Its chairman is an independent

non-executive Director. There are procedures for a new Director to receive

relevant information on the Company together with appropriate induction. The

Committee is satisfied that the Board and its Committees function

effectively, both collectively and individually, and contain the appropriate

balance of skills and experience to provide effective management. The Board

uses a skills matrix in order to identify any gaps in the current Board's

knowledge and experience which will be used to support future evaluations

and succession planning.

The remuneration of the Investment Director is recommended to the Board by

the Nomination and Remuneration Committee. The Board considers that the

interests of the Investment Director, who is himself a shareholder (see page

24), are aligned with those of other shareholders. This Committee also

reviews the composition of the Board and manages the recruitment process for

new Directors.

Further details of the work of the Committee are given on page 24.

BOARD AND DIRECTOR EVALUATION

The Board reviews its performance on an annual basis; this does not involve

an external third party. The review covers an assessment of how cohesively

the Board, Audit and Compliance Committee and Nominations and Remuneration

Committee work as a whole, as well as the performance of the individuals

within them.

The Chairman is responsible for performing this review. Mr D. M. Best, Dr A.

J. Hosty and Mr J. B. Roper perform a similar role in respect of the

performance of the Chairman. The evaluation confirmed that all Directors

continue to be effective on behalf of the Company and committed to the role.

The Nominations and Remuneration Committee conducts an annual review of the

Investment Director's performance. The review of the Investment Director's

performance in 2019 was output-based, but had regard to all other relevant

factors.

In order to prevent "overboarding", any significant external commitments

require the prior consent of the Board.

TENURE OF DIRECTORS

As in previous years, all Directors retire at each Annual General Meeting

and, if appropriate, seek re-election. Being eligible, all Directors offer

themselves for re-election. The Board considers that the Directors should be

re-elected because they bring wide, current and relevant business experience

that allows them to contribute effectively to the leadership of the Company.

Following performance evaluation their performance continues to be effective

and committed to the role.

Each non-executive Director has signed a letter of appointment to formalise

the terms of his engagement as a non-executive Director (or there is a

memorandum of such terms), copies of which are available on request and at

the Company's Annual General Meeting. No Director is or was materially

interested in any contract subsisting during or at the end of the year that

was significant in relation to the Company's business.

No Director, apart from the Investment Director, has, or during the

financial year had, a contract of service with the Company. The terms of the

Investment Director's current basis of remuneration are detailed in the

Directors' Annual Remuneration Report on pages 24 to 29.

The Company is committed to ensuring that vacancies arising are filled by

the best qualified candidates and recognises the value of diversity in the

composition of the Board.

RISK MANAGEMENT AND INTERNAL CONTROL

The Board is fully aware of its duty to present a balanced and

understandable assessment of the Company's position. It acknowledges its

responsibility for the Company's system of internal financial controls and

their effectiveness. The Board meets regularly and reviews performance

against approved plans and forecasts. In addition, the day-to-day

administration and accounting functions are carried out by the Administrator

and reports are submitted regularly to the Board.

As part of the system of internal control, there is a process to identify,

evaluate and manage the significant risks faced by the Company, which has

been in place during the year under review and up to the date of approval of

the financial statements. This has been reviewed by the Board, is in

accordance with the guidelines in the AIC Code and is considered by the

Board to be effective and fit for purpose. The system of risk analysis

adopted by the Board is designed to manage rather than eliminate the risk of

failure to achieve the investment objectives of the Company. It must be

stressed that undertaking an acceptable degree of controlled risk is always

necessary in the conduct of any investment trust if above average

performance is to be achieved. For this reason, the process can only provide

reasonable and not absolute assurance against loss.

AUDIT AND COMPLIANCE COMMITTEE

The Audit and Compliance Committee is a formally constituted committee of

the Board with defined terms of reference, which include its role and the

authority delegated to it by the Board, and which are available at the

Company's registered office and on the Company's website. Its specific

responsibilities include reviewing the Company's annual and half yearly

results, together with the supporting documentation.

This Committee also reviews the performance of key suppliers and therefore

the Board has decided not to establish a separate Management Engagement

Committee.

Further details are given in the Report of the Audit and Compliance

Committee on pages 21 to 23. STATEMENT OF COMPLIANCE

The Directors consider that during the year ended 31st December 2019 the

Company has complied with all the relevant provisions set out in the AIC

Code.

This Corporate Governance Statement was approved by the Board and signed on

its behalf:

Dr D. M. Bramwell, Chairman

21st February 2020

REPORT OF THE AUDIT AND COMPLIANCE COMMITTEE

ROLE OF THE AUDIT AND COMPLIANCE COMMITTEE

The Audit and Compliance Committee's main functions are as follows:

* To monitor the internal financial control and risk management systems on

which the Company is reliant.

· To monitor the integrity of the half-year and annual financial

statements of the Company by reviewing and challenging, where necessary,

the actions and judgements of the Investment Director.

· To meet the Auditor to review its proposed audit programme and the

subsequent Audit Report, to review the effectiveness of the audit process

and the levels of fees paid in respect of both audit and non-audit work.

· To make recommendations to the Board in relation to the appointment,

reappointment or removal of the Auditor and to negotiate its remuneration

and terms of engagement on audit and non-audit work.

· To monitor and review annually the Auditor's independence, objectivity,

effectiveness, resources and qualification.

· To monitor the performance of key suppliers.

The Audit and Compliance Committee meets at least twice each year and

operates within defined terms of reference which are available at the

Company's registered office and on the Company's website.

COMPOSITION OF THE AUDIT AND COMPLIANCE COMMITTEE

The Audit and Compliance Committee comprises four independent non-executive

Directors, at least one of whom has recent and relevant financial

experience. The Company's Chairman, David Bramwell is a member of the Audit

and Compliance Committee. This is considered to be appropriate given his

financial and markets' experience and the fact that he was independent on

appointment.

SIGNIFICANT ISSUES AND RISKS

In planning its own work and reviewing the audit plan of the Auditor, the

Audit and Compliance Committee takes account of the most significant issues

and risks, both operational and financial, likely to impact upon the

Company's Financial Statements.

The valuation of the investment portfolio is a significant risk factor;

however, all investments can be verified against daily market prices.

A further significant risk control issue is to ensure that the investment

portfolio accounted for in the financial statements reflects physical

ownership of the relevant securities. The Company uses the services of an

independent custodian, Northern Trust Company, to hold the assets of the

Company. The investment portfolio is regularly reconciled to the custodian's

records and that reconciliation is also reviewed by the Auditor.

The incomplete or inaccurate recognition of income in the financial

statements are risks. Internal control systems, including frequent

reconciliations, are in place to ensure income is fully accounted for. The

Board is provided with information on the Company's income account at each

meeting.

Financial statements issued by the Company need to be fair, balanced and

understandable. The Audit and Compliance Committee reviews the Annual Report

as a whole and makes suitable recommendations to the Board.

The Company's half-yearly report is approved by the Audit and Compliance

Committee prior to publication and is also reviewed by the Auditor.

The Audit and Compliance Committee assesses whether it is appropriate to

prepare the Company's financial statements on a going concern basis and

makes recommendations to the Board. The Board's conclusions are set out in

the Report of the Directors.

INTERNAL CONTROLS

The Audit and Compliance Committee is responsible for ensuring that suitable

internal control systems to prevent and detect fraud and error are designed

and implemented and is also responsible for reviewing the effectiveness of

such controls. The Board confirms that there is an ongoing process for

identifying, evaluating and managing the significant risks faced by the

Company. This process has been in place for the year under review and up to

the date of approval of this Report and is regularly reviewed. In particular

it has reviewed and updated the process for identifying and evaluating the

significant risks affecting the Company and the policies by which these are

managed. The risks of failure of any such controls are identified in a risk

assessment which identifies the likelihood and severity of the impact of

such risks and the controls in place to minimise the probability of such

risks occurring; the risk management process and systems of internal control

are designed to manage rather than eliminate the risk of failure to achieve

the Company's objectives. It should be recognised that such systems can only

provide reasonable, but not absolute, assurance against material

misstatement or loss. Equally, it must be stressed that undertaking an

acceptable degree of controlled risk is always necessary in the conduct of

any investment trust if above average performance is to be achieved.

The following are the key components which the Company has in place to

provide effective internal control:

· The Board has agreed clearly defined investment criteria; reports on

compliance therewith are regularly reviewed by the Board.

· The Board has a procedure to ensure that the Company can continue to be

approved as an investment company by complying with section 1158 of the

Corporation Tax Act 2010.

· The Administrator prepares forecasts and management accounts which allow

the Board to assess the Company's activities and review its performance.

· The performance of the Investment Director and any contractual

agreements with other third party service providers, and adherence to

them, are regularly reviewed.

· The Company does not itself have a whistleblowing policy in place. The

Company delegates its administration to third party providers who have

such policies in place.

The Audit and Compliance Committee has reviewed the need for an internal

audit function, but has concluded that, given the size of the organisation

and the clear segregation of investment management and control of the

assets, there is no need for such a function at the current time. The Audit

and Compliance Committee has also agreed to keep such a requirement under

review.

EXTERNAL AUDIT PROCESS

The Audit and Compliance Committee meets at least twice a year with the

Auditor. The Auditor provides a planning report in advance of the annual

audit, a report on the annual audit, and a report of its review of the

half-year financial statements. The Committee has an opportunity to question

and challenge the Auditor in respect of each of these reports; it also

agrees the level and scope of materiality to be adopted in respect of the

annual audit.

In addition, at least once a year, the Audit and Compliance Committee has an

opportunity to discuss any aspect of the Auditor's work with the Auditor in

the absence of the Investment Director.

After each audit, the Audit and Compliance Committee will review the audit

process and consider its effectiveness.

AUDITOR ASSESSMENT AND INDEPENCE

The Company's Auditor is Begbies, which has been the Company's Auditor since

2006. Rotation of the Audit Partner takes place in accordance with Ethical

Standard 3; "Long Association with the Audit Engagement" of the Auditing

Practices Board ("APB").

The fees for audit purposes were GBP16,500 (2018: GBP16,500).

The Audit Committee has approved and implemented a policy on the engagement

of the Auditor to supply non-audit services, taking into account the

recommendations of the APB, and does not believe there is any impediment to

the Auditor's objectivity and independence. All non-audit work to be carried

out by the Auditor must be approved by the Audit Committee in advance.

The cost of non-audit services provided by the Auditor for the financial

year ended 31st December 2019 was GBP5,400 (2018: GBP5,400). These non-audit

services are related to the review of the interim accounts and tax

compliance. The Committee believes Begbies is best placed to provide them on

a cost-effective basis. The fees for non-audit services are not considered

material in the context of the financial statements as a whole.

INDEPENCE

During the year the Committee reviewed the independence policies and

procedures of Begbies, including quality assurance procedures. It was

considered that those policies and procedures remained fit for purpose.

DISCLOSURE OF INFORMATION TO THE AUDITOR

It is the Company's policy to allow the Auditor unlimited access to its

records. The Directors confirm that, so far as each of them is aware, there

is no relevant audit information of which the Company's Auditor is unaware

and they have taken all the steps which they should have taken as Directors

in order to make themselves aware of any relevant audit information and to

establish that the Auditor is aware of that information. This confirmation

is given and should be interpreted in accordance with the provisions of

section 418 of the Companies Act 2006.

CONCLUSION

The Audit Committee has reviewed the matters within its terms of reference

and reports as follows:

· it has approved the financial statements for the year ended 31st

December 2019;

· it has reviewed the effectiveness of the Company's internal controls and

risk management;

· it has reviewed the need for a separate internal audit function;

· it has recommended to the Board that a resolution be proposed at the

Annual General Meeting for the reappointment of the Auditor and it has

considered the proposed terms of its engagement;

· it has satisfied itself as to the independence of the Auditor; and

· it has satisfied itself that the contents of the Annual Report are

consistent with the financial statements.

D. M. Best, Director

Chairman, Audit and Compliance Committee

21st February 2020

DIRECTORS' ANNUAL REMUNERATION REPORT

INTRODUCTION

This Report is submitted in accordance with the requirements of sections 420

to 422 of the Companies Act 2006 in respect of the year ended 31st December

2019. An ordinary resolution to approve this Report will be put to members

at the forthcoming Annual General Meeting, but the Directors' remuneration

is not conditional upon the resolution being passed.

The Company has a Nominations and Remuneration Committee, the terms of

reference of which include annually reviewing and recommending to the Board

the level of Directors' fees and remuneration. The full terms of reference

are available at the Company's registered office and on the Company's

website. The Committee is chaired by J. B. Roper and the other members are

Dr D. M. Bramwell, D. M. Best and Dr A. J. Hosty.

DIRECTORS' REMUNERATION AS A SINGLE FIGURE (AUDITED)

Director Salary and Annual Salary and Annual

fees 2019 GBP fees 2018 GBP

bonuses Total bonuses

for Total for

2019 2019 2018 2018

GBP GBP GBP GBP

D. M. Best 22,000 - 22,000 21,000 - 21,000

Dr D. M. 28,000 - 28,000 27,000 - 27,000

Bramwell

(Chairman)

Dr A. J. 22,000 - 22,000 21,000 - 21,000

Hosty

S. J. B. 319,500 - 319,500 319,500 - 319,500

Knott

(Executive)

J. B. Roper 22,000 - 22,000 21,000 - 21,000

Total 413,500 - 413,500 409,500 - 409,500

No payments of other types prescribed in the relevant regulations such as

Long-term Incentive Plans ("LTIPs") or pensions and pension-related benefits

were made.

No other remuneration or compensation was paid or payable by the Company

during the year to any current or former Directors.

With effect from 1st January 2020 the fees payable to the Directors are as

follows (previous rates are shown in brackets): Chairman GBP28,000 (GBP28,000),

other non-executive Directors GBP22,000 (GBP22,000) and Investment Director/CEO

(base salary excluding discretionary bonus) GBP319,500 (GBP319,500).

STATEMENT OF DIRECTORS' SHAREHOLDINGS AND SHARE INTERESTS (AUDITED)

The Company has not set any requirements or guidelines for the Directors to

own Ordinary shares in the Company. The beneficial interests of the

Directors and their connected persons in the Ordinary shares of the Company

are shown in the table below.

31st December 2019 31 December 2018

D. M. Best 480 -

Dr D. M. Bramwell (Chairman) 22,625 22,625

Dr A. J. Hosty - -

S. J. B. Knott (Executive) 488,111 488,111

J. B. Roper - -

No changes in the Directors' interests shown above have occurred since 31st

December 2019.

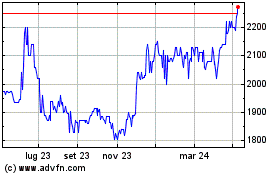

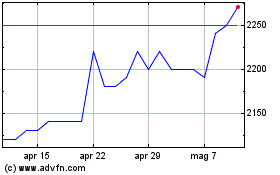

PERFORMANCE GRAPH AND CEO REMUNERATION TABLE

The graph below illustrates the total shareholder return for the Ordinary

shares relative to the FTSE All-Share Index. This has been used as the

appropriate index as it is the Company's benchmark index.

CEO REMUNERATION TABLE

CEO Single Figure of Total Annual Bonus Paid Out GBP

Remuneration GBP

2015 184,000 30,000

2016 213,000 40,000

2017 268,500 45,000

2018 319,500 -

2019 319,500 -

Total 1,304,500 115,000

The above bonuses were of a discretionary nature and so no percentage

against a maximum payable has been shown.

The table below shows the percentage change in the remuneration of the