Primark Owner ABF Looks for Suppliers Outside of China Amid Coronavirus Outbreak

24 Febbraio 2020 - 9:54PM

Dow Jones News

By Nina Trentmann

U.K. conglomerate Associated British Foods PLC is operating its

food-processing factories in China at reduced capacity and is

looking for alternative suppliers to prepare for a prolonged

slowdown in garment production in the country as the coronavirus

outbreak spreads.

The London-based owner of fast-fashion retail chain Primark

relies on China for a significant portion of its supplies of

clothing and accessories.

Primark, which operates 376 stores around the globe and

represents about half of ABF's earnings before interest and taxes,

has enough inventory for months to come, Chief Financial Officer

John Bason said Monday.

"Even if there is no supply out of China during the coming

months, we have enough supply to get through the summer months," he

said in an interview.

Primark has about 600 suppliers in China, nine of which are in

Hubei, the province where the first coronavirus cases were

recorded. Many of Primark's Chinese suppliers are operating below

capacity because of travel restrictions and local quarantine

requirements, Mr. Bason said.

ABF has considered increasing orders from alternative suppliers

in South and Southeast Asia, including in Bangladesh, Cambodia,

Vietnam, Myanmar and India.

"It's all about knowing where you would go," Mr. Bason said.

Resorting to alternative suppliers would not fully cover the

production gap in China, Mr. Bason said. But the fact that the

group has suppliers in other regions means ABF can offset some of

the production loss in China, which is "a good sign," Sophie

Lund-Yates, an analyst at financial services company Hargreaves

Lansdown PLC, wrote in a note to investors.

ABF also owns food brands such as Twinings tea and Patak's

sauces, and the coronavirus outbreak is affecting its

food-processing business in China. Its bakery ingredients unit AB

Mauri, animal feed unit AB Agri and malt-drink maker Ovaltine have

reduced production because of labor and logistics constraints,

according to Mr. Bason. Those facilities mostly produce for the

Chinese market, he said.

Mr. Bason hasn't altered his profit guidance for the financial

year. The forecast includes strong growth in adjusted operating

profit in the second half of the year.

Analysts at Credit Suisse Group AG said in a note that there is

little reason to change forecasts at this stage.

ABF's management is discussing its contingency plans on a

regular -- though not daily -- basis, according to Mr. Bason.

"The role of the CFO is to communicate during a fast-moving

situation with lots of consequences to external markets," he said.

"You want to give a feel of likely outcomes, even though you can't

know where this is going."

Philip Waller contributed to this article.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

February 24, 2020 15:39 ET (20:39 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

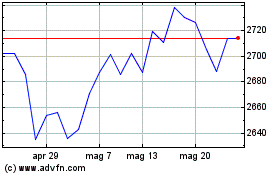

Grafico Azioni Associated British Foods (LSE:ABF)

Storico

Da Mar 2024 a Apr 2024

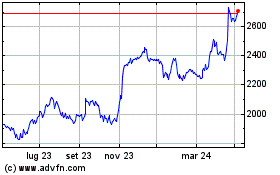

Grafico Azioni Associated British Foods (LSE:ABF)

Storico

Da Apr 2023 a Apr 2024