TIDM88E

RNS Number : 1691E

88 Energy Limited

26 February 2020

88 ENERGY LIMITED

ASX LODGEMENT OF ANNUAL REPORT

88 Energy Limited (ASX:88E; AIM:88E) ("88 Energy" or "Company")

advises that a copy of the Company's Annual Report for the year

ended 31 December 2019 has been lodged on the ASX along with the

Company's 2019 year-end Corporate Governance Statement and Appendix

4G.

Each of these documents is available on the Company's website at

www.88energy.com and the Annual Report, which was sent to

shareholders today, can be accessed at the following link -

http://www.rns-pdf.londonstockexchange.com/rns/1691E_1-2020-2-26.pdf

Set out below is the Chairman's Statement as included in the

Company's Annual Report.

Also set out below is a summary of the Company's audited

financial information for the year ended 31 December 2019 as

extracted from the Annual Report, being:

-- Consolidated Statement of Comprehensive Income;

-- Consolidated Statement of Financial Position;

-- Consolidated Statement of Changes in Equity; and

-- Consolidated Statement of Cash Flows.

Media and Investor Relations:

88 Energy Ltd

Dave Wall, Managing Director Tel: +61 8 9485 0990

Email: admin@88energy.com

Finlay Thomson, Investor Relations Tel: +44 7976 248471

Hartleys Ltd

Dale Bryan Tel: + 61 8 9268 2829

Cenkos Securities

Neil McDonald/Derrick Lee Tel: +44 131 220 6939

CHAIRMAN'S STATEMENT

Dear Shareholders

It is with great optimism that I present my Chairman's Report

for the 2019 financial year.

As I write, Nordic Rig#3 is on location and preparing to spud

the Charlie-1 well. The well is testing a conventional oil

prospect, defined by 3D seismic, comprising a sequence of stacked

Brookian sandstones, on the Alaskan north slope with a gross mean

unrisked prospective resource of 1.6 billion barrels (480MMBO net

to 88E). It is arguably one of the most significant wells to be

drilled by an ASX listed entity in 2020 and offers substantial

upside to 88E shareholders in the event of success.

Charlie-1 is effectively a step out of a discovery well drilled

by BP some 3 decades ago. This nearology significantly lowers the

prospect risk and was one of the factors that enabled 88E to

procure a drilling partner to carry the well cost up to US$ 23

million, in what has been a challenging market for farmouts. That

partner, UK based Premier Oil Plc, has a track record of successful

exploration.

As we approach the drilling of the Charlie-1 well, it is worth

reminding ourselves why 88E chose to explore in Alaska. At the

outset, 88E cast the net far and wide in search of a project that

could make a meaningful difference; one which would capture

investor attention with transformational upside. The source rocks

of Alaska have been described as unbelievably rich and prolific,

having sourced the largest conventional oil pool in North America,

the 15 billion barrel Prudhoe Bay field. Earlier this year, the

USGS estimated there was almost 4 billion barrels of oil yet to be

discovered, with most of that potential in the Brookian play that

88E is targeting. Almost all the remaining fields in Alaska are

stratigraphic traps rather than anticlines and require a subtler

exploration approach utilising modern seismic data, which 88E has

spent the last three years acquiring and interpreting.

Our early initiative to target Alaska has been validated by

recent exploration successes and the arrival of new entrants on the

Alaskan exploration scene. Between 2014 and 2019 alone, some 4

billion barrels of new oil was discovered in the State. It is not

surprising the December 2019 lease sale in Alaska by the Bureau of

Land Management was hailed as the most successful in as many as 13

years. S&P Global Platts reported early in January 2020 that

Oil companies could spend up to $24 billion on new production in

the Alaska over the next ten years. Access to existing

infrastructure; a very supportive and stable State Government and

significant exploration upside have long been recognised by

88E.

During 2019, 88E continued to leverage its early mover advantage

and is now Operator/Manager on several active Exploration Projects

across 250,000 net acres. Unlike the lower 48 States, Alaskan

leases have an attractive 10-year term with no mandatory

relinquishment and a low base royalty. Our prospective land holding

is now of a size one would normally associate with the big end of

town and provides continued scope to attract partners.

The 2019 Alaskan program, which included the unsuccessful Winx-1

well and the Premier farm-out, has been competently executed by our

Managing Director, David Wall, with the assistance of a small

dedicated team including former senior geologist and Exploration

Manager, Elizabeth Pattillo; petroleum engineer Hassan Fatahi; our

Alaskan based Operations Manager, Erik Opstad and the full support

of my fellow Directors.

88E has prudently raised additional capital in advance of the

2020 program. We all know the process of evaluation is not without

risk; however, we look to the future with considerable optimism as

we unlock both the conventional and unconventional potential of our

Alaskan exploration acreage.

Before closing I would like to thank the Department of Natural

Resources, the Alaska Oil and Gas Conservation Commission; the

North Slope Borough and other regulatory agencies that have

facilitated our exploration effort in the State.

Our mission would not be possible without your support as

shareholders in what has been a challenging yet exciting

environment. Our dual listing on both ASX and AIM has garnered a

wide investor base and we have been ably supported by our brokers

and advisers Hartleys and Cenkos.

We look forward to a successful 2020 year.

Yours faithfully,

Michael Evans

Non-Executive Chairman

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME FOR THE FINANCIAL YEARED 31 DECEMBER 2019

Note 2019 2018

$ $

Revenue from continuing operations

Other income 3(a) 35,931 1,362,745

Administrative expenses 3(b) (1,215,226) (1,524,870)

Occupancy expenses (34,596) (44,958)

Employee benefit expenses 3(c) (1,983,685) (1,879,007)

Share-based payment expense 18 (95,276) (21,750)

Depreciation and amortisation expense (58,110) (50,609)

Finance cost (3,095,466) (4,224,698)

Other expenses 3(d) (30,277,141) (149,010)

Foreign exchange (loss) / gain (56,888) 538,564

-----------

Loss before income tax (36,780,457) (5,993,593)

Income tax expense 4 - -

------------ -----------

Loss after income tax for the year (36,780,457) (5,993,593)

------------ -----------

Other comprehensive income / (loss) for

the year

Items that may be reclassified to profit

or loss

Exchange differences on translation of

foreign operations 854,461 6,961,354

------------ -----------

Other comprehensive income / (loss) for

the year, net of tax 854,461 6,961,354

------------ -----------

Total comprehensive income / (loss) for

the year attributable to members of 88

Energy Limited (35,925,996) 967,761

------------ -----------

Loss per share for the year attributable

to the members of 88 Energy Limited:

Basic and diluted loss per share 5 (0.005) (0.001)

The Consolidated Statement of Profit or Loss and Other

Comprehensive Income should be read in conjunction with the notes

to the financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2019

Note 2019 2018

$ $

ASSETS

Current Assets

Cash and cash equivalents 6 15,903,117 21,722,211

Trade and other receivables 7 1,120,550 2,101,501

------------- -------------

Total Current Assets 17,023,667 23,823,712

------------- -------------

Non-Current Assets

Plant and equipment 8 12,900 11,172

Exploration and evaluation expenditure 9 52,928,315 76,983,981

Other Assets 10 23,615,216 22,977,103

-------------

Total Non-Current Assets 76,556,431 99,972,256

-------------

TOTAL ASSETS 93,580,098 123,795,968

------------- -------------

LIABILITIES

Current Liabilities

Trade and other payables 11 6,026,811 6,001,949

Provisions 12 282,199 255,353

Total Current Liabilities 6,309,010 6,257,302

-------------

Non-Current Liabilities

Borrowings 13 22,672,578 23,424,471

Total Non-Current Liabilities 22,672,578 23,424,471

------------- -------------

TOTAL LIABILITIES 28,981,588 29,681,773

------------- -------------

NET ASSETS 64,598,510 94,114,195

------------- -------------

EQUITY

Contributed equity 14 185,619,885 179,304,850

Reserves 15 23,578,127 22,628,390

Accumulated losses (144,599,502) (107,819,045)

-------------

TOTAL EQUITY 64,598,510 94,114,195

------------- -------------

The Consolidated Statement of Financial Position should be read

in conjunction with the notes to the financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE FINANCIAL

YEAR ENDED 31 DECEMBER 2019

Accumulated

Issued Capital Reserves Losses Total

$ $ $ $

--------------- ----------- -------------- -------------

At 1 January 2019 179,304,850 22,628,390 (107,819,045) 94,114,195

--------------- ----------- -------------- -------------

Loss for the year - - (36,780,457) (36,780,457)

Other comprehensive income - 854,461 - 854,461

--------------- ----------- -------------- -------------

Total comprehensive income/(loss)

for the year after tax - 854,461 (36,780,457) (35,925,996)

Transactions with owners

in their capacity as owners:

Issue of share capital 6,750,000 - - 6,750,000

Share-based payments - 95,276 - 95,276

Share issue costs (434,965) - - (434,965)

--------------- ----------- -------------- -------------

Balance at 31 December

2019 185,619,885 23,578,127 (144,599,502) 64,598,510

--------------- ----------- -------------- -------------

At 1 January 2018 141,711,466 15,645,286 (101,825,452) 55,531,300

--------------- ----------- -------------- -------------

Loss for the year - - (5,993,593) (5,993,593)

Other comprehensive loss - 6,961,354 - 6,961,354

--------------- ----------- -------------- -------------

Total comprehensive income/(loss)

for the year after tax - 6,961,354 (5,993,593) 967,761

Transactions with owners

in their capacity as owners:

Issue of share capital 39,678,216 - - 39,678,216

Share-based payments - 21,750 - 21,750

Share issue costs (2,084,832) - - (2,084,832)

--------------- ----------- -------------- -------------

Balance at 31 December

2018 179,304,850 22,628,390 (107,819,045) 94,114,195

--------------- ----------- -------------- -------------

The Consolidated Statement of Changes in Equity should be read

in conjunction with the notes to the financial statements.

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE FINANICAL YEAR

ENDED 31 DECEMBER 2019

Note 2019 2018

$ $

Cash flows from operating activities

Payment to suppliers and employees (3,465,770) (4,333,868)

Interest received 22,930 16,896

Interest & finance costs (2,395,536) (2,267,612)

Net cash flows used in operating activities 6(b) (5,838,376) (6,584,584)

------------ ------------

Cash flows from investing activities

Payments for exploration and evaluation

activities (29,725,227) (35,110,843)

Contribution from JV Partners in relation

to Exploration 23,860,234 12,156,384

Net cash flows used in investing activities (5,864,993) (22,954,459)

------------ ------------

Cash flows from financing activities

Proceeds from issue of shares 6,530,000 39,677,293

Share issue costs (461,498) (2,124,000)

Payment of borrowing costs - (1,126,456)

Net cash flows from financing activities 6,068,501 36,426,837

------------ ------------

Net increase/(decrease) in cash and cash

equivalents (5,634,867) 6,887,794

Cash and cash equivalents at the beginning

of the year 21,722,211 14,014,422

Effect of exchange rate fluctuations on

cash held (184,227) 819,995

------------ ------------

Cash and cash equivalents at end of year 6(a) 15,903,117 21,722,211

------------ ------------

The Consolidated Statement of Cash Flows should be read in

conjunction with the notes to the financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR GZGZZNVNGGZG

(END) Dow Jones Newswires

February 26, 2020 02:11 ET (07:11 GMT)

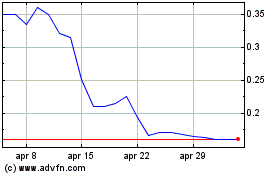

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Apr 2023 a Apr 2024