- Revenue stable at €1.085 billion;

- EBITDA down 2%1 to €560 million, in line with announced

objectives;

- Strong growth of 20% in consolidated net profit to €159

million2;

- A 14% increase in the dividend will be proposed at the next

AGM on 30 April 2020, to €0.41 per share, bringing the total amount

returned to shareholders, including share-buy-backs, to €1.4

billion since 2008.

Regulatory News:

Getlink (Paris:GET):

Jacques Gounon, Chairman and Chief Executive of the Group

said: “Getlink has achieved its highest net result since 2007 on a

like-for-like basis. The Group performed robustly in 2019, in line

with our forecasts and in line with market expectations, despite a

changing and complex environment.”

- 2020 financial objectives

- 2020 dividend in respect of the 2019

financial year: €0.41 per share subject to approval at the AGM on

30 April 2020, an increase of €0.05 per share;

- EBITDA3: €580million based on taking a

prudent view of the current risk from the COVID-19 virus.

- EBITDA above €735 million;

- Dividend increase of €0.05 per share per

year.

ANNUAL HIGHLIGHTS

- Group

- Settlement with the UK Secretary of State for Transport

totalling £33 million (€38 million) of which £11 million has been

received.

- Change to the governance structure from 1 July 2020, with the

appointment of Yann Leriche as Chief Executive Officer and Jacques

Gounon as Chairman of the Board of Directors.

- Eurotunnel

- In 2019, Eurotunnel Shuttles transported more than 2.6 million

passenger vehicles and nearly 1.6 million trucks;

- Yield increase of 3%, in line with the quality of service

strategy and premium policy;

- The Le Shuttle and Le Shuttle Freight services confirmed their

position as leading market players on the Short Straits, with

market shares of 56.9% for the car activity and 40.4% for the truck

activity;

- A new record for Eurostar which carried more than 11 million

passengers in 2019. This is driven by the development of the London

– Amsterdam service;

- €30 million investment in new infrastructure in preparation for

Brexit (Pit-Stops, French e-gates, customs and Sanitary and

Phytosanitary control centre (SPS), export parking, Fréthun

scanner) and smart border technology.

- Europorte

- Europorte recorded good growth in annual revenue, up 4% to

€126.5 million, despite the difficult end to the year impacted by

SNCF strikes;

- Europorte achieved a substantial EBITDA of €24 million;

- Europorte recorded a positive net profit before tax, confirming

the profitability of this activity.

- ElecLink

- The IGC has announced that it has received the final dossier,

and that it intends to take its final decision on authorising the

installation of the cable in the Tunnel in April 2020.

FINANCIAL RESULTS

The Group’s consolidated revenue for the 2019 financial year

amounts to €1.085 billion, a very slight increase compared to

2018.

Consolidated EBITDA was in line with guidance at €560 million,

down €12 million compared to 2018 at a constant exchange rate.

Operating profit was €409 million, up €13 million.

The Group’s consolidated net profit for the 2019 financial year

was €159 million compared to €132 million in 2018, a strong

increase of 20%.

The cost of net financial debt fell by €14 million to €257

million due mainly to the favourable impact of lower British and

French inflation rates on the cost of the index-linked tranche of

the debt.

Cash held at the end of December 2019 amounted to €525

million.

OBJECTIVES

Confident in the robustness of its economic model and the solid

results in 2019, the Group confirms its intention to pursue its

dividend policy in the service of its shareholders. Accordingly, it

will propose at the AGM to increase the dividend to €0.41 per share

for the 2019 financial year, an increase of 14% compared to

2018.

In an economic context that is still uncertain following the

UK’s exit from the European Union on 31 January 2020 and with

possible consequences of the COVID-19 coronavirus crisis, the Group

has set a financial target for a 2020 EBITDA of €580 million at an

exchange rate of £1=€1.14 and on a like-for-like basis.

The uncertain short-term environment does not diminish the

Group’s confidence in the soundness of its various businesses and

their growth potential in the medium- and long-term. The Group

maintains its objective of exceeding €735 million in EBITDA by 2022

(at £1=€1.14) following the entry into service of the ElecLink

electricity interconnector mid-2021 or shortly thereafter.

Dates for your 2020

diary:

23 April 2020: 2020 first quarter revenue and traffic 30 April

2020: AGM 23 July 2020: 2020 half-year results

Additional information:

The Board of Directors at its meeting on Wednesday 26 February

2020 under the chairmanship of Jacques Gounon, approved the

financial statements for the year ending 31 December 2019.

The financial analysis of the consolidated financial statements

is available on the Group’s website: www.getlinkgroup.com

Getlink SE’s consolidated and parent company accounts for 2019

have been audited and certified by the statutory auditors.

REVIEW OF THE CONSOLIDATED RESULTS AND

FINANCIAL SITUATION THE FOR THE YEAR ENDED 31 DECEMBER

2019

The following information relating to Getlink SE’s financial

situation and consolidated results must be read in conjunction with

the consolidated financial statements set out in section 2.2.1 of

the 2019 Universal Registration Document.

Accounting standards applied4 and presentation of the

consolidated results

Pursuant to EC Regulation 297/2008 of 11 March 2008 on the

application of international accounting standards, the consolidated

financial statements of Getlink SE for the financial year ended 31

December 2019 have been prepared in accordance with International

Financial Reporting Standards (IFRS) as adopted by the European

Union at 31 December 2019.

1 ANALYSIS OF CONSOLIDATED INCOME STATEMENT

In order to enable a better comparison between the two years,

the 2018 consolidated income statement presented in this section

has been recalculated at the exchange rate used for the 2019 income

statement of £1=€1.140.

Summary

In 2019, the Group’s consolidated revenues amounted to €1,085

million, an increase of €1 million compared to 2018 in a difficult

context. The Group estimates that the strike by French customs

officials in the spring and the strike action against the pension

reform in France in December had a negative impact on the Group's

revenue of approximately €18 million in 2019. Operating costs,

which include non-recurring costs related in particular to the

preparation of Brexit, amounted to €525 million, an increase of €13

million (3%) compared to 2018. EBITDA decreased by €12 million (2%)

to €560 million and the trading profit decreased by €20 million

€378 million. After accounting for an income of €38 million (£33

million) arising from the settlement agreement between the UK

Secretary of State for Transport and Eurotunnel (see note A.3 to

the consolidated financial statements in section 2.2.1 to the 2019

Universal Registration Document), the operating profit for 2019 was

up by €13 million compared to 2018, to €409 million. Net finance

costs decreased by €14 million compared to the previous year mainly

due to the favourable impact of lower British and French inflation

rates on the cost of the index-linked tranche of the debt. The

pre-tax profit for the Group’s continuing operations improved by

€25 million to €156 million for the 2019 financial year (including

€38 million for the settlement agreement referred to above).

After taking into account a tax income of €2 million, the net

result for the continuing activities of the Group was a profit of

€158 million, up €26 million. The Group’s net consolidated result

for 2019 was a profit €159 million, an improvement of €27

million.

€ million

2019

2018

Change

2018

Improvement/(deterioration) of result

restated*

€M

%

published

Exchange rate €/£

1.140

1.140

1.128

Eurotunnel

958

961

(3)

-0%

956

Getlink

1

2

(1)

-50%

2

Europorte

126

121

5

+4%

121

Revenue

1,085

1,084

1

+0%

1,079

Eurotunnel

(406)

(399)

(7)

-2%

(397)

Getlink

(17)

(16)

(1)

-6%

(16)

Europorte

(102)

(96)

(6)

-6%

(96)

ElecLink

–

(1)

1

+100%

(1)

Operating costs

(525)

(512)

(13)

-3%

(510)

Operating margin (EBITDA)

560

572

(12)

-2%

569

Depreciation

(182)

(174)

(8)

-5%

(174)

Trading profit

378

398

(20)

-5%

395

Other net operating income/(charges)

31

(2)

33

(2)

Operating profit (EBIT)

409

396

13

+3%

393

Net finance costs

(257)

(271)

14

+5%

(269)

Other net financial income/(charges)

4

6

(2)

5

Pre-tax profit from continuing

operations

156

131

25

+19%

129

Income tax income/(expense)

2

1

1

1

Net profit from continuing

operations

158

132

26

+20%

130

Net profit from discontinued

operations

1

–

1

–

Net consolidated profit for the

year

159

132

27

+20%

130

* Restated at the rate of exchange used

for the 2019 income statement (£1=€1.140).

The evolution of the pre-tax result from continuing operations

by segment compared to 2018 is presented below:

€ million

Eurotunnel

**Getlink

Europorte

ElecLink

Total Group

Pre-tax result from continuing

activities: 2018 restated *

133

-

1

(3)

131

Improvement/(deterioration) of result:

Revenue

-3

-1

+5

-

+1

Operating expenses

-7

-1

-6

+1

-13

EBITDA

-10

-2

-1

+1

-12

Depreciation

-6

-1

-

-1

-8

Trading result

-16

-3

-1

-

-20

Other net operating income/charges

+33

-

-

-

+33

Operating result (EBIT)

+17

-3

-1

-

+13

Net financial costs and other

-10

+29

+1

-8

+12

Total changes

+7

+26

-

-8

+25

Pre-tax result from continuing

operations for 2019

140

26

1

(11)

156

* Restated at the rate of exchange used for the 2019 income

statement (£1=€1.140).

** Included in the Getlink segment’s finance line is €27 million

of unrealised intra-Group exchange gains in 2019 compared to €2

million in 2018.

a) Eurotunnel segment

The Group’s core business is the Eurotunnel segment which

operates and directly markets its Shuttle Services and also

provides access, on payment of a toll, for the circulation of

High-Speed Passenger Trains (Eurostar) and the Train Operators’

Rail Freight Trains through its Railway Network.

€ million

Change

Improvement/(deterioration) of result

2019

* 2018

M€

%

Exchange rate €/£

1.140

1.140

Shuttle Services

630

640

(10)

-2 %

Railway Network

315

307

8

+3 %

Other revenue

13

14

(1)

-7 %

Revenue

958

961

(3)

-0 %

External operating costs

(218)

(219)

1

+0 %

Employee benefits expense

(188)

(180)

(8)

-4 %

Operating costs

(406)

(399)

(7)

-2 %

Operating margin (EBITDA)

552

562

(10)

-2 %

EBITDA/revenue

58 %

59 %

-1pt

* Restated at the rate of exchange used for the 2019 income

statement (£1=€1.140).

i) Eurotunnel revenue

Revenue generated by this segment, which in 2019 represented 88%

of the Group’s total revenue, is down by 0.3% compared to 2018, to

€958 million. Labour unrest in France in 2019 has had a significant

negative impact on Eurotunnel's business, with an estimated loss of

revenue of around €14 million, of which €10 million is explained by

the national work-to-rule movement by French customs officials

during the spring which impacted all Eurotunnel traffic (trucks,

cars and Eurostar), and €4 million in revenue from Eurostar arising

from the impact of national strikes in France from 5 December

2019.

Shuttle Services

Traffic (number of vehicles)

2019

2018

Change

Truck Shuttle

1,595,241

1,693,462

-6 %

Passenger Shuttle:

Cars *

2,601,791

2,660,414

-2 %

Coaches

50,268

51,300

-2 %

* Includes motorcycles, vehicles with trailers, caravans and

motor homes.

Despite the decline in cross-Channel markets due to the

uncertainty surrounding the Brexit date and the impact of this

decline on traffic volumes, Shuttle Services’ revenue of €630

million for 2019 was only down by 1.6% compared to the previous

year due to growth in yields which benefit from the strategy of

optimising the profitability of its Shuttle business.

Truck Shuttle

In a year marked by the uncertainties surrounding Brexit, the

French customs officials strike and the downturn in the automobile

market, the Short Straits truck market contracted by approximately

4.9% in 2019 and the Truck Shuttle service’s share of the Short

Straits market was slightly down, to 40.4%. The number of trucks

transported by Eurotunnel decreased by 6% to 1,595,241.

Passenger Shuttle

In spite of the Short Straits car market being impacted by the

uncertainties surrounding Brexit and in decline by 6.2% in 2019,

Eurotunnel’s car traffic was down by only 2% as a result of car

market share up by 2.3 points to 56.9% compared to the previous

year. The Passenger Shuttle’s car activity carried 2,601,791

vehicles.

The Short Straits coach market contracted by approximately 4.0%

in 2019 but the Passenger Shuttle’s coach market share increased

compared to the previous year, to 40.5%.

Railway Network

Traffic

2019

2018

Change

High-Speed Passenger Trains (Eurostar)

Passengers *

11,046,608

10,971,650

1 %

Train Operators' Rail Freight Services

**:

Number of tonnes

1,390,303

1,301,460

7 %

Number of trains

2,144

2,077

3 %

* Only passengers travelling through the

Channel Tunnel are included in this table, excluding those who

travel between continental stations (such as Brussels-Calais,

Brussels-Lille, Brussels-Amsterdam, etc.).

** Rail freight services by train

operators (DB Cargo for BRB, SNCF and its subsidiaries, GB

Railfreight, Rail Operations Group, RailAdventure and Europorte)

using the Tunnel.

The Group earned revenues of €315 million in 2019 from the use

of its Railway Network by Eurostar’s High-Speed Passenger Trains

and by the Train Operators’ Rail Freight Services, an increase of

3% compared to 2018.

The 11,046,608 Eurostar passengers using the Tunnel in 2019

represent an all-time record. The growth of 0.7% compared with 2018

is driven by the continued success of the London-Amsterdam service

launched in April 2018 with the addition of a third frequency in

June 2019, despite the significant impact on Eurostar Paris-London

traffic of the work-to-rule by French customs officials in March,

April and May and the strikes in France in December 2019.

After a first half of 2019 with a 10% increase in traffic,

cross-Channel rail freight was heavily impacted by strikes in

France in December, but nevertheless recorded a 3.2% increase in

the number of cross-Channel rail freight trains in 2019 compared

with the previous year.

ii) Eurotunnel operating costs

In 2019, the Eurotunnel segment’s operating charges increased by

2% (€7 million) compared with 2018 to €406 million.

The impact of inflation, both in France and the United Kingdom,

amounted to €5.5 million, of which €1 million related to the

increase in electricity tariffs over the period. This increase is

partly offset by the reduction in the capacity plan, made possible

by the relative stability of traffic and the improvement in load

factors, for an amount of €2 million.

Continued efforts have been made to improve the quality of

service provided to customers which represented additional

expenditure of €8 million, split between customer relations for €1

million, digital initiatives for €1.5 million and improvement of

service reliability for €5.5 million. The 2019 financial year was

also marked by the intensification of preparations for the United

Kingdom’s exit from the European Union as well as an increase in

personnel costs related to free share incentive plans.

The Group implemented a series of cost reduction and

productivity initiatives aimed at mitigating the financial impact

of external factors (Brexit, the French customs officials strike,

strike action against pension reforms in France) which amounted to

€10 million.

b) Getlink segment

The Getlink segment includes the activities of the Group’s

holding company, Getlink SE, as well as its direct subsidiaries

including the railway training centre CIFFCO.

For the 2019 financial year, the Getlink segment’s operating

charges amounted to €17 million.

c) Europorte segment

The Europorte segment covers the entire rail freight transport

logistics chain in France and includes notably Europorte France and

Socorail.

€ million

Change

Improvement/(deterioration) of result

2019

2018

€M

%

Revenue

126

121

5

+4 %

External operating costs

(51)

(48)

(3)

-6 %

Employee benefits expense

(51)

(48)

(3)

-6 %

Operating costs

(102)

(96)

(6)

-6 %

Operating margin (EBITDA)

24

25

(1)

-4 %

In 2019, Europorte’s revenues increased by 4% despite a

difficult end to the year with activity very strongly impacted by

the SNCF strike action which is estimated to have lost the business

an estimated €4 million in revenues. This increase is the result of

growth in cement and petrochemicals transportation activities and

the winning of new logistics contracts for industrial sites.

Impacted by the strike in December, EBITDA decreased by €1 million

compared to 2018.

d) ElecLink segment

ElecLink’s activity is the construction and operation of a 1GW

electricity interconnector between the UK and France. Construction

works began in the second half of 2016 and the interconnector is

expected to be in commercial operation mid-2021 or shortly

thereafter.

Costs directly attributable to the project are capitalised as

assets under construction. Investment on the project during 2019

amounted to €136 million.

e) Operating margin (EBITDA) and trading profit

EBITDA by business segment evolved as follows:

€ million

Eurotunnel

Getlink

Europorte

ElecLink

Total Group

EBITDA 2018 restated *

562

(14)

25

(1)

572

Improvement/(deterioration):

Revenue

(3)

(1)

5

–

1

Operating costs

(7)

(1)

(6)

1

(13)

Total changes

(10)

(2)

(1)

1

(12)

EBITDA 2019

552

(16)

24

–

560

* Restated at the rate of exchange used

for the 2019 income statement (£1=€1.140).

At €560 million in 2019, the Group’s operating margin decreased

by €12 million (-2%) compared to 2018, impacted by social movements

in 2019 as described above.

Depreciation charges increased by €8 million compared to 2018 to

€182 million as a result of the capital investment projects

completed in 2018 and 2019.

The trading profit in 2019 decreased by €20 million (5%)

compared to 2018, to €378 million.

f) Operating profit (EBIT)

At 31 December 2019, net other operating income included €38

million (£33 million) in respect of the settlement agreement

between the UK Secretary of State for Transport and Eurotunnel (see

note A.3 to the Group’s financial statements in section 2.2.1 of

the 2019 Universal Registration Document).

After taking into account this one-off income, the operating

profit for the 2019 financial year was up by €13 million (3%)

compared to 2018, to €409 million.

g) Net financial charges

At €257 million for 2019, net finance costs were down by €14

million compared to 2018 at a constant exchange rate. Lower

inflation rates in the UK and France had a favourable effect on the

cost of the indexed tranche of the debt (€20 million) and the

capitalisation of interest related to the financing of ElecLink

increased by €7 million. These reductions were partially offset by

the full-year impact of the increase in interest expense resulting

from the issuance of the Senior Secured Notes in October 2018 (€12

million).

h) Net result from continuing operations

The Group’s pre-tax result for continuing operations for the

2019 financial year was a profit of €156 million, an improvement of

€25 million compared to 2018 at a constant exchange rate.

In 2019, net income tax was a credit of €2 million (2018: credit

of €1 million).

The Group’s post-tax result for continuing operations for the

2019 financial year was a profit of €158 million, an improvement of

€26 million at a constant exchange rate, including the

non-recurring income of €38 million.

i) Net result from discontinued operations

Information on discontinued activities is set out in note C.2 to

the Group’s consolidated financial statements in section 2.2.1 of

the 2019 Universal Registration Document.

j) Net consolidated result

The net consolidated result for the Group for the 2019 financial

year was a profit of €159 million compared to a profit of €132

million (restated at an equivalent exchange rate) for 2018.

2 ANALYSIS OF CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

€ million

31 December 2019

31 December 2018

Exchange rate €/£

1.175

1.118

Fixed assets

6,734

6,657

Other non-current assets

613

569

Total non-current assets

7,347

7,226

Trade and related receivables

77

97

Other current assets

83

65

Cash and cash equivalents

525

607

Total current assets

685

769

Total assets

8,032

7,995

Total equity

1,639

2,006

Total financial liabilities

4,998

4,907

Interest rate derivatives

1,055

748

Other liabilities

340

334

Total equity and liabilities

8,032

7,995

The table above summarises the Group’s consolidated statement of

financial position as at 31 December 2019 and 31 December 2018. The

main elements and changes between the two dates, presented at the

exchange rate for each period, are as follows:

- At 31 December 2019, fixed assets include property, plant and

equipment and intangible assets amounting to €5,877 million for the

Eurotunnel segment, €747 million for the ElecLink segment and €101

million for the Europorte segment. The increase between 31 December

2018 and 31 December 2019 results mainly from investment in the

ElecLink project (€136 million in 2019).

- Other non-current assets at 31 December 2019 include the G2

inflation-linked notes held by the Group amounting to €348 million

and a deferred tax asset of €205 million.

- At 31 December 2019, cash and cash equivalents amounted to €525

million after payment of the €193 million dividend, net capital

expenditure of €246 million, €255 million in debt service costs

(net interest, repayments and fees).

- Equity decreased by €367 million as a result of the impact of

the dividend payment (€193 million), the recycling to the income

statement of the fair value and the change in the mark-to-market

valuation of the partially terminated hedging contracts (€264

million) and the impact of the evolution of the cumulative

translation reserve (€82 million). These decreases have been

partially offset by the impact of the net profit for the year (€159

million), changes in share-based payments (€11 million) and the

purchase of treasury shares (€6 million).

- Financial liabilities have increased by €91 million compared to

31 December 2018 as a result of the impact of the increase in the

exchange rate on the sterling-denominated debt (€114 million) and

the increase of €38 million arising from of the evolution of

inflation indexation and costs. These increases have been partially

offset by the effect of the €60 million of contractual debt

repayments and by the €4 million decrease in lease liabilities

under IFRS 16.

- Interest rate derivatives increased by €307 million as a result

of the impact of the decrease in long-term rates on the market

value of the hedging instruments that were partially terminated in

2017.

- Other liabilities include €242 million of trade and other

payables and provisions, as well as retirement liabilities of €98

million.

3 Analysis of consolidated cash flows

a) Consolidated cash flows

€ million

2019

2018

Exchange rate €/£

1.175

1.118

Continuing activities:

Net cash inflow from trading

589

588

Other operating cash flows and

taxation

8

(14)

Net cash inflow from operating

activities

597

574

Net cash outflow from investing

activities

(246)

(269)

Net cash outflow from financing

activities

(442)

(422)

Net cash inflow from financing

operations

–

115

Decrease in cash in year from

continuing activities

(91)

(2)

Discontinued activities *:

Increase/(decrease) in cash in year from

discontinued activities

1

(1)

Total decrease in cash in year

(90)

(3)

* Maritime segment, see note C.2 to the

consolidated accounts at 31 December 2019.

At €589 million in 2019, net cash generated from trading by

continuing operations improved by €1 million compared to 2018:

- a reduction of €2 million in the Eurotunnel and Getlink

segments to €561 million (2018: €563 million),

- an increase of €2 million in Europorte’s cash flows to €29

million (2018: €27 million), and

- ElecLink’s operating expenditure remained stable.

The positive variance of €22 million in “Other operating cash

and taxation” between the two years is principally due to a change

in tax payments (net receipts of €4 million in 2019 compared to net

payments of €10 million in 2018) and to the receipt of £11 million

(€13 million) in respect of the settlement agreement between the UK

Secretary of State for Transport and Eurotunnel (see note A.3 to

the consolidated financial statements at 31 December 2019).

At €246 million in 2019, net cash payments for investing

activities are down by €23 million compared to 2018. In 2019, these

comprised mainly:

- €104 million relating to Eurotunnel and Getlink (2018: €74

million). The main expenditure was €25 million on preparations for

Brexit (such as the Pit-Stops to regroup the different security

controls and inspections, the SIVEP zone for customs, veterinary

and phytosanitary controls and e-gates with facial recognition for

coach passengers), €26 million on rolling stock (including €15

million on the start of the mid-life maintenance work on the

Passenger Shuttles), €27 million on infrastructure (including €18

million on catenary and power supply) and €16 million on computing

and digital projects, and

- payments of €141 million in the ElecLink project (€194 million

in 2018).

Net financing payments in 2019 amounted to €442 million compared

to €422 million in 2018. During 2019, cash flow from financing

comprised:

- capital transactions with an outflow of €187 million consisting

of:

- €193 million paid in dividends (2018: €160

million), and - €3 million net receipts in respect of the liquidity

contract (€1 million paid in 2018) and receipts of €3 million in

respect of the exercise of stock options (€3 million in 2018);

- net debt service costs of €255 million:

- €189 million of interest paid on the Term

Loan and on other borrowings (€174 million in 2018), the increase

of €15 million being mainly due to interest paid on the Senior

Secured Notes issued by Getlink SE in October 2018 (€20 million in

2019 and €5 million in 2018), - €52 million paid in respect of the

scheduled repayment of the Term Loan and other borrowings (€63

million in 2018), - €5 million received in respect of the

contractual repayment of the G2 notes held by the Group (€7 million

in 2018), - €21 million paid in relation to leasing contracts (€19

million in 2018), - €7 million paid in relation to the operation to

simplify the debt completed in 2015 (€7 million in 2018), and - net

receipts of €10 million from interest received on investments and

on the G2 notes held by the Group (2018: €8 million in 2018).

b) Free Cash Flow

The Group’s Free Cash Flow represents the cash generated by its

current activities in the normal course of its business. It can be

used to distribute dividends to shareholders and to make strategic

investments in the Group’s development in order to add value for

all stakeholders. The Group defines it as net cash flow from its

current activities excluding extraordinary or exceptional cash

movements in respect of the equity-related cash flows, financial

transactions such as the raising of new debt to help finance new

activities, debt refinancing, renegotiation or early repayment as

well as investment in new activities or the divestment of

activities and related assets.

€ million

2019

2018

Exchange rate €/£

1.175

1.118

Net cash inflow from operating

activities

598

573

Net cash outflow from investing

activities

(105)

(75)

Net debt service costs (interest

paid/received, fees and repayments)

(255)

(249)

Other receipts

3

3

Free Cash Flow

241

252

Dividend paid

(193)

(160)

Purchase of treasury shares and net

movement on liquidity contract

3

(16)

ElecLink: project expenditure

(141)

(194)

Refinancing operations

–

115

Use of Free Cash Flow

(331)

(255)

Decrease in cash in the year

(90)

(3)

At €241 million in 2019, Free Cash Flow has decreased by €11

million compared to 2018 for the reasons out in section a)

above.

4 DEBT COVER RATIOS

a) Getlink ratios

EBITDA to finance cost ratio

The ratio of the Group’s consolidated EBITDA to its finance

costs (excluding interest received and indexation) is 2.4 at 31

December 2019 (2018 restated: 2.5).

€ million

2019

2018 * restated

Exchange rate €/£

1.140

1.140

EBITDA

560

572

Finance cost

259

273

Indexation

(26)

(46)

Finance cost excluding

indexation

233

227

EBITDA / finance cost excluding

indexation

2.4

2.5

* Restated at the rate of exchange used

for the 2019 income statement (£1=€1.140).

Net debt to EBITDA ratio

The Group defines its net debt to EBITDA ratio as the ratio

between financial liabilities less the indexed nominal value of the

G2 notes held by the Group and cash and cash equivalents, and

consolidated EBITDA. At 31 December 2019, the ratio was 7.6

compared to 7.2 at 31 December 2018.

€ million

31 December 2019

31 December 2018

Non-current financial liabilities

4,853

4,759

Current financial liabilities

61

55

Other non-current liabilities

50

57

Other current liabilities

34

36

Total financial liabilities

4,998

4,907

Inflation-indexed notes (G2)

(232)

(222)

Cash and cash equivalents

(525)

(607)

Net debt

4,241

4,078

EBITDA

560

569

Net debt / EBITDA

7.6

7.2

Statement of financial position exchange

rate €/£

1.175

1.118

Income statement exchange rate €/£

1.140

1.128

b) Eurotunnel ratios

Financial covenants in respect of the Term Loan

The debt service cover ratio and the synthetic service cover

ratio on the Term Loan apply to the Eurotunnel Holding SAS

sub-group. These ratios are described in note G.1.2.b) to the

consolidated financial statements contained in section 2.2.1 of the

2019 Universal Registration Document.

At 31 December 2019, Eurotunnel has respected its financial

covenants under the Term Loan with a debt service cover ratio and a

synthetic service cover ratio of approximately 2.

1 All comparisons with the 2018 income statement are based on

the average exchange rate for 2019 of £1 = € 1.14. 2 Of which €38

million (£33 million) in respect of the settlement agreement

between the UK Secretary of State for Transport and Eurotunnel. 3

At the rate of £1 = €1.14 and current scope. 4 The Group has

applied IFRS 5 “Non-current Assets Held for Sale and Discontinued

Operations” to its maritime segment since the cessation of

MyFerryLink’s operations in the second half of 2015. Accordingly,

the net results of these activities for the current and previous

financial years are presented as a single line in the income

statement called “Net profit from discontinued operations”. More

information on these transactions is given in note C.2 to the

consolidated financial statements in section 2.2.1 to the 2019

Universal Registration Document.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200226006095/en/

Getlink Contacts: For UK

media enquiries contact John Keefe on + 44 (0) 1303

284491 Email: press@getlinkgroup.com

For other media enquiries contact Anne-Laure Desclèves on

+33(0)1 4098 0467 For investor enquiries contact:

Jean-Baptiste Roussille on +33 (0)1 40 98 04 81 Email: jean-baptiste.roussille@getlinkgroup.com

Michael Schuller on +44 (0) 1303 288749 Email: Michael.schuller@getlinkgroup.com

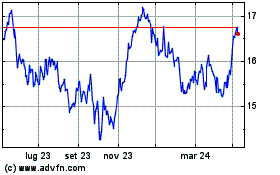

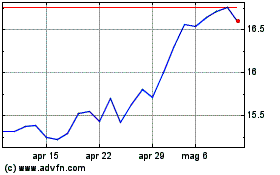

Grafico Azioni Getlink (EU:GET)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Getlink (EU:GET)

Storico

Da Apr 2023 a Apr 2024